Historical volatility and great emotions. Summary of the TMS competition

Risk-free competition on virtual accounts, real money prizes and historical volatility during the first recession in three decades. The game was exciting and the competition was fierce until the last session hour.

V edition of the #Forex mobile competition

This edition was unique because it took place at the very beginning of a progressive global recession, which would cover the crisis of 2007-2009. This time we are dealing with a lockdown - i.e. a sudden collapse of economic activity that affects or soon affects almost all the world's economies. This crisis is special because its source is not in a specific sector of the state economy. It is a public health crisis whose solution is to find a vaccine for a dangerous virus.

At the end of the month - and at the end of the competition - the number of infections in the world has exceeded 800 The epicenter of disease has moved from Italy to the United States, specifically to New York. Big companies are coming to the rescue. Private companies are joining the fight. For example, Ford has declared the production of respirators, which are the last chance for people in the most severe condition.

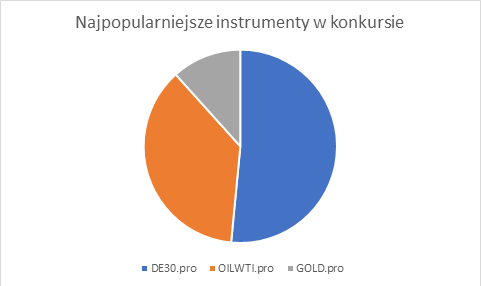

The effects of the COVID-19 pandemic on the financial market are enormous. During the competition, American indexes "dropped" from historical peaks, and their discount exceeded 20 percent. The most, however, happened on the oil market, the sell-off of which was compounded by two main factors: decreasing demand for raw material caused by the global recession and the price war initiated by Saudi Arabia.

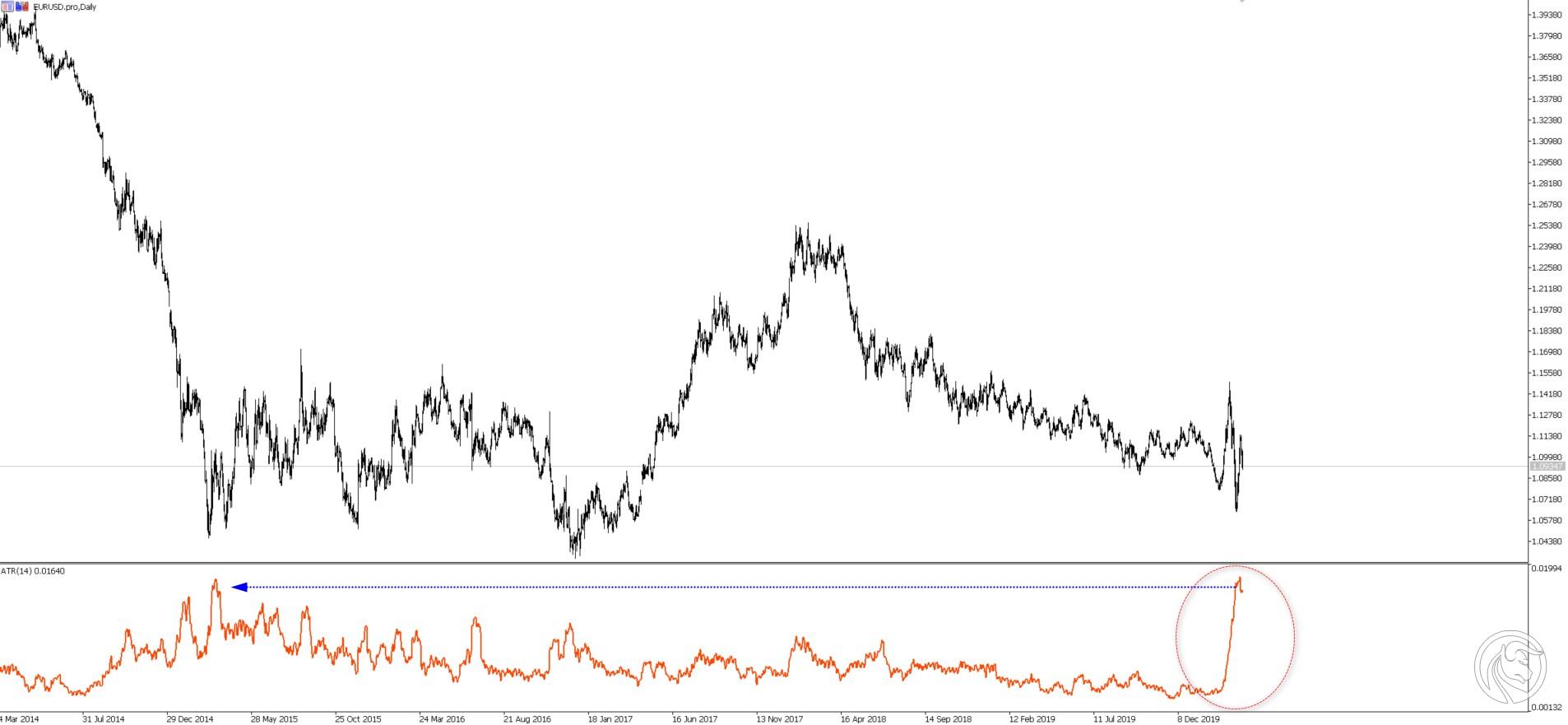

A lot has happened in the gold market as well. The king of metals - in the first two weeks of competition - dropped in the quotation from $ 1700 to $ 1450 per ounce (which was caused, among others, by the reduction of long positions and profit taking on speculative transactions), and then in the last round it increased dynamically, leveling about 70 percent of this discount. The Eurodollar market is also noteworthy, as due to the large flow of capital in global markets, it is again characterized by high volatility. The average daily ATR (indicator showing the volatility of the instrument) is the highest since 2015 and is currently 170 pips. Therefore, trading, despite the financial leverage reduced by ESMA, can currently bring above-average rates of return. The results of the contestants are proof of this.

What did you have to do to win the competition?

During the 3-week competition, two rankings were conducted: weekly and general. The contest earned points, which were due for places from 1 to 50. And so the person who had the best result on the portfolio in a given week received 50 points, the second in the weekly ranking got 49 points, and so analogously to the 50th place. Points from 3 rounds counted in the general ranking. In addition, you could earn "extra" points for the contest instructions friends. There was a maximum of 30 to win.

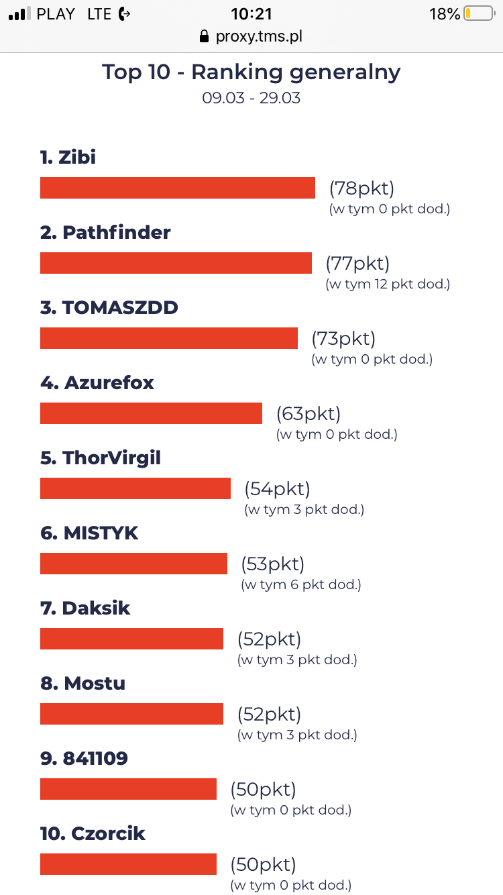

The winner is a trader with a nickname "Zibi". He regularly placed relatively good positions (he was best in the first week when he was 6th), but he didn't win any rounds. He scored 78 points, and in the best for himself - the first round - his rate of return oscillated around 473 percent. In trading, he mainly chose the DE30 instrument (CFD on DAX) and US100 (CFD on NASDAQ100). It is also noteworthy that each of the people who were in the top three in the classification of individual rounds was outside the podium in the general classification. The silver medal went to the "Pathfinder" investor, who recorded his best result in the first week, achieving a rate of return of over 440 percent. The podium was closed by the player "TOMASZDD", who gave a good, 3rd place in the general classification, among others 8 result in the first round: 438.63%.

Another interesting fact is that the winner of the first round finally took 10th place in the general classification, the best contestant of the second week was 9th, and the winner of the third round was not in the top ten of the general classification.

This shows that a single "wringing" a very good result is not enough for the final victory. Regularity was important every week, it had to be confirmed that a good result in a single period is not an accident. These conditions to some extent reflect trading in real conditions when it is awarded consistency, risk management capability, not single play.

Competition statistics

Below are some competition statistics:

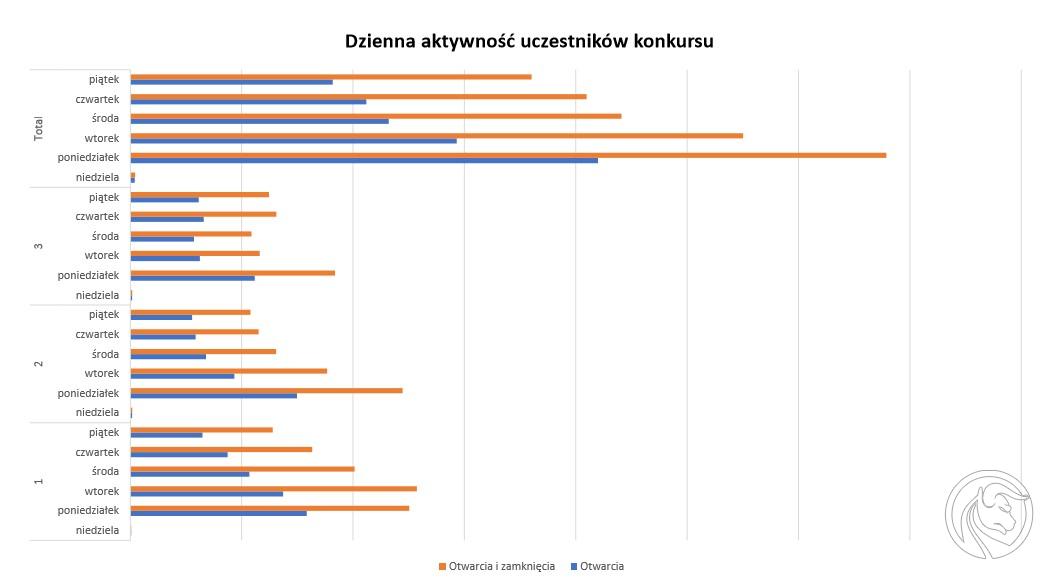

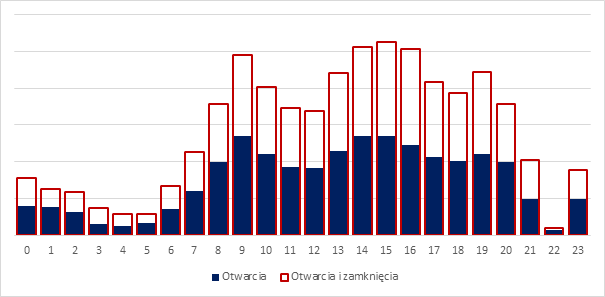

- In the entire competition, the highest activity was normally on Monday, when each trader returned to the market after a two-day rest.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response