How to invest in toy producing companies? [Guide]

The holiday season is approaching, which means that toy sellers are having their golden time. Currently, manufacturers are competing with each other in new ideas to attract customers. This is understandable because there is a lot of competition and the toy market itself is very mature. The sector is growing by only 2-3% per year and its value according to Statista was approximately $2022 billion in 123. The most important toy markets are United States ($38,5 billion) and China ($17,3 billion).

The toy market has been changing rapidly in recent years. Toys must keep up with the changing tastes of children, who are the first generation to grow up in the era of social media and mobile games. Another challenge is the transition of sales to the online channel, which accounts for 20% of the total. It seems that the toy sector is resistant to crises and should provide high rates of return. Is this really the case? You will find out from this article.

LEGO – ordinary bricks or a wise investment?

LEGO has been one of the synonyms of good quality play bricks for decades. Interestingly, the Danish company that produces them previously made wooden toys. The invention of plastic blocks was not very well received at first. Even though this type of blocks was created in 1949, in the 50s their share in sales did not exceed 8%. Only in the following decades did LEGO gain popularity. However, at the beginning they were just ordinary blocks, without the various sets we know today. Innovations were slow, suffice it to say that it was not until 1978 that the famous ones were created “LEGO people”.

Even though LEGO is now considered to be “indestructible” enterprise, it wasn't always like this. The company struggled at the turn of the XNUMXth and XNUMXst centuries as the business model seemed to have worn thin as children looked for more interactive toys. As a result, stocks of unsold goods piled up. The Danes responded with deep restructuring. The number of available components has been reduced, improving performance. Another idea was creating models that follow popular trends. A great example is the Star Wars lines that appear in stores right after the movie premieres. Currently, LEGO is the undisputed leader on the market.

LEGO is also known in the media world for its investment opportunities. A few years ago, a study by Wiktoria Dobrynskaja and Yulia Kishilova entered the mainstream in an analysis “LEGO – The Toy of Smart Investors”. According to the authors, investing in specific LEGO models could provide a rate of return higher than the stock market. And indeed, some sets can bring handsome profits. One of the most amazing examples is the figurine Mr Gold, which went on sale for $2,99. Its current price is around $7000. The reason was the uniqueness of the element (only 5000 pieces) and its unusual appearance. The uniqueness has resulted in a dynamic price increase over the years.

However, investing in LEGO is not easy. It is necessary to identify the factors that will influence the demand for a given model in the future. These include: interesting theme of the set, unique elements, small edition or sets consisting of over 1000 elements. The problem, however, is that you need to know the market thoroughly, it is not enough to buy just any set. Another problem is low market liquidity. Therefore, an investment in LEGO should be treated as a curiosity and not a good idea for investing capital.

Other toys as investment assets

There are also other collectible toys that can provide high rates of return. One such toy is famous Star Wars figures, which were produced at the turn of the 70s and 80s by the American company Kenner. The most desirable are figures with missing or factory defects. This makes a given figurine unique, which affects its market price. Some of them, such as Obi-Wan Kenobi with an evil lightsaber, can fetch prices of up to several tens of thousands of dollars.

Other toys that can achieve high rates of return are: Barbie dolls. This is because these are iconic dolls that were played with by both grandmothers and granddaughters. Originally packaged toys can sell for thousands of dollars, which may seem like a staggering amount considering the low prices in stores. Of course, this is again for the same reason - some doll models are very rare.

In Poland, on the other hand, unique toys from the Polish People's Republic have high prices. The buyers are usually collectors and people who are sentimental about their childhood and are willing to spend up to several thousand zlotys for a toy from several decades ago. However, it must be remembered that toys from the Polish People's Republic are a niche within a niche, so the liquidity is even lower than in the case of the previously mentioned products.

Toy market – trends

For many years, toys were a quiet business where the brand mattered most. Thanks to economies of scale, the largest toy manufacturers produced cheaper than smaller competitors. In addition, the most famous brands had easier access to the largest sales networks. As a result, people bought products from the most famous brands. Currently Social media has an increasing influence on purchasing decisions. Toys that go viral can achieve high sales without the need to expand the distribution network to the standards of the XNUMXth century. This poses a significant threat to the largest players on the market. On the other hand the largest brands have large budgets that allow them to develop innovative toys. Another advantage is large marketing budgets, which can help generate more sales. Their patents and signed contracts for the production of e.g. Star Wars figurines or toys related to superheroes (Spider-Man or Batman) are also a big advantage.

It is also worth remembering that currently increasingly younger children use electronic devices (smartphones, tablets, computers). This makes them accustomed to more exciting games. For this reason, "ordinary" blocks, toy soldiers or toy cars are no longer as interesting as they were three decades ago.

Are there ETFs giving exposure to the toy sector?

Nistety nie ma ETF, which allow for exposure to toy manufacturers. Company shares "toys", such as Mattel or Hasbro, do not have large holdings in any ETF. For this reason, you cannot gain exposure to this sector in "synthetic" way with funds. For this reason, you can only invest in this type of entities through individual listed companies. What possibilities do we have here? More on that in a moment.

It is worth remembering that the toy market is very competitive, therefore it is worth noting that not every company listed on the stock exchange will provide a good rate of return. Before making an investment decision, you should carefully analyze the financial statements. It's worth checking out how revenues, profits and free cash flow have changed over the last few years. You should also consider what prospects await the company in the coming years.

Hasbro

It is one of the most famous toy companies. Hasbro is primarily known for gaming Monopoly, but the number of brands we have is much larger. Among the most famous can be mentioned Transformers, Nerf, My Little Pony, Dungeons & Dragons or Magic. Thanks to product diversification, the company has no problem generating hundreds of millions in revenue. The American company is therefore one of the largest toy companies in the world. However, this is not a guarantee of achieving high rates of return on this company's shares. The reason is that children are slowly moving away from traditional toys, which affects the traditional and profitable market. Hasbro is trying to adapt to the changing rules. Suffice it to say that currently the main factor supporting growth is the segment of digital games for children (e.g. Monopoly for smartphones). The company announced the so-called OEP (Operational Excellence Program), which is expected to bring from $250 million to $300 million in annual savings.. The plan covers, among others: reduction of some part-time positions and greater emphasis on controlling sales costs. In addition, the company decided to write off old toy stocks in the quarter before Christmas. Despite temporary difficulties, the company continues to pay dividends and has no problems generating $200-300 million in positive cash flows from operating activities.

| million USD | 2019 | 2020 | 2021 | 2022 |

| revenues | 4 720 | 5 465 | 6 420 | 5 857 |

| Operational profit | 652 | 720 | 872 | 430 |

| Operating margin | 13,8% | 13,2% | 13,6% | 7,3% |

| Net profit | 520 | 223 | 429 | 204 |

Source: own study

Hasbro chart, W1 interval. Source: xNUMX XTB.

Mattel

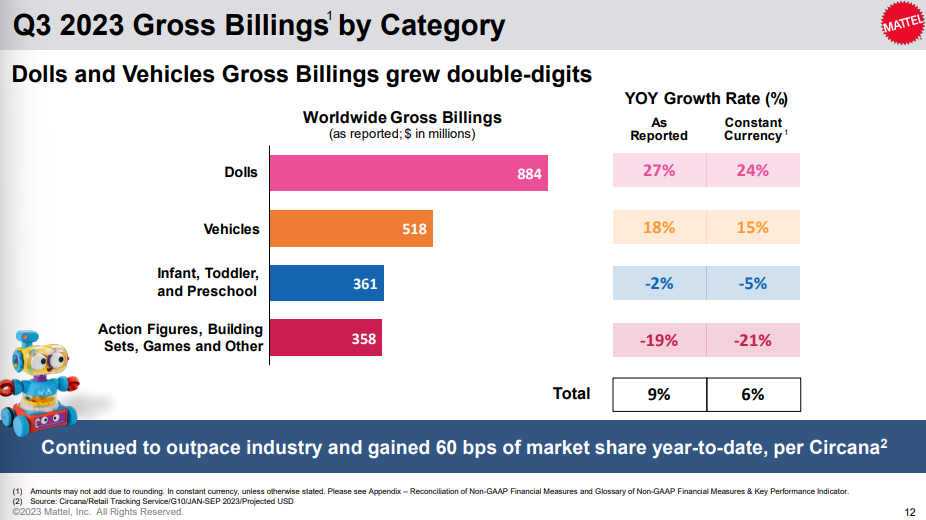

This is another American company that is one of the largest players on the toy market. Mattel sells its products to over 150 countries around the world. Importantly, the products are available in both online and stationary stores. The company has a very strong portfolio of brands, including: Barbie, Monster High, Hot Wheels or Fisher-Price. The most important thing for the company is the sale of dolls and vehicles. This can be seen in the chart below, which shows orders for individual product categories.

The most important region for the company is North America. No wonder, because The United States is the largest toy market in the world. The next region is EMEA. The Asian market generates approximately 10% of Mattel's revenues. This is interesting because this market has huge prospects, especially in China and India. Like Hasbro, Mattel is also introducing a savings program to reduce expenses. The savings program lasts from 2021. Within three years, the accumulated capital in this respect amounted to over $300 million. The greatest impact had optimizations in production costs, which were responsible for a decrease in costs by $180 million over 3 years. Last year was very good because the company was the beneficiary of the success of the Barbie movie. The huge advertising caused the dolls to sell very well and many stores placed orders for many of the dolls during the holiday season. In 2024, there may be good results from the car and license fee segments. The reason is the planned debut of the series Hot Wheels Let's Race.

| million USD | 2019 | 2020 | 2021 | 2022 |

| revenues | 4 505 | 4 584 | 5 458 | 5 435 |

| Operational profit | 39 | 381 | 730 | 676 |

| Operating margin | 0,9% | 8,3% | 13,4% | 12,4% |

| Net profit | -214 | 127 | 903 | 394 |

Mattel chart, W1 interval. Source: xNUMX XTB.

Spin Master

This is another company from North America, but this time not from the USA, but from Canada. The largest brand that the company has is PAW Patrol. Spin Master has contracts to produce and sell Paw Patrol-related toys. Except that, the Canadian company also has contracts for the production of Monster Jam toys. It's not everything. Spin Master also produces toys using licenses granted by the owners of such cult films as Star Wars or Harry Potter.

The company's operations are divided into three segments. The first is the production of toys, which is a core business characterized by stable revenues, profits and FCF. The second segment is entertainment, which concerns films, series, cartoons and other content that engages children. The jewel in the crown is Paw Patrol, which is loved by young children. Spin Master is also expanding into digital games as children increasingly want something more exciting than traditional toys. The company tries to develop games in the play-to-learn model to meet the expectations of both parents and children.

| million USD | 2019 | 2020 | 2021 | 2022 |

| revenues | 1 582 | 1 571 | 2 042 | 2 020 |

| Operational profit | 112 | 61 | 281 | 298 |

| Operating margin | 7,1% | 3,9% | 13,8% | 14,8% |

| Net profit | 64 | 46 | 199 | 261 |

Source: own study

JAKKS Pacific

JAKKS is a relatively small company operating on the toy market. It provides its customers with toys and houses for children. The company divides its operations into two segments. The first of them are toys/consumer products, and the second… costumes. In the case of the first segment, the company has licenses to produce toys, e.g. Apex Legends, Nintendo or Sonic the Hedgehog. It is also worth mentioning that the company has its own brand called Creepy Crawlers or Perfectly Cute. In the case of dolls, the company produces, for example, dolls under license Disney Frozen, Disney Princess or Minnie Mouse. The costumes, in turn, refer to superheroes, and are sold in both children's and adult sizes. The company sells all products mainly to supermarkets. The company's two largest customers are Walmart and Target stores. In 2022, the Walmart chain generated 28,4% of the company's turnover, while the Target chain accounted for 25,5% of sales.

| million USD | 2019 | 2020 | 2021 | 2022 |

| revenues | 599 | 516 | 621 | 796 |

| Operational profit | -2 | 15 | 39 | 61 |

| Operating margin | -0,3% | 2,9% | 6,3% | 7,7% |

| Net profit | -56 | -16 | -7 | 91 |

Source: own study

Volumes Ltd.

Japan is one of the 10 largest toy markets in the world. It is therefore not surprising that this country also has large companies in this sector. The most famous one is Tomy Ltd, which owns the Tomica brand. Except that, the company owns the Licca brand, which is the so-called “Japanese Barbie”. Of course, the appearance of the doll was adapted to the preferences of Japanese girls, which is why visually the Licca doll and Barbie differ significantly. The Japanese doll turned out to be a sales hit. Suffice it to say that over 60 million pieces of this toy have been sold in less than 60 years. Additionally, the Japanese company also owns the Tomix brand, which produces electric trains. Tomy Ltd sells its products mainly in Japan and other Asian countries. However, in terms of generated operating profit, only one market counts - Japan.

| million JPY | 2019 | 2020 | 2021 | 2022 |

| revenues | 164 837 | 141 218 | 165 448 | 187 297 |

| Operational profit | 10 683 | 7 079 | 12 345 | 13 119 |

| Operating margin | 6,5% | 5,0% | 7,5% | 7,0% |

| Net profit | 4 507 | 5 374 | 9 114 | 8 314 |

Source: own study

Funko

Funko is another publicly traded toy company. The company's most famous products include: Pop! Vinyl. The mentioned figurines refer to popular characters from movies, cartoons and the world of sports (including Mayor League Baseball). In addition, the company produces games, toys and gadgets using license agreements from brands such as Disney, Marvel or Warner Bros. The gadgets the company offers include: backpacks, wallets and posters. The company has diversified distribution channels. It has two of its own stationary stores, its own website and distributes its toys to its trading partners (supermarkets, toy stores).

| million USD | 2019 | 2020 | 2021 | 2022 |

| revenues | 795 | 653 | 1 029 | 1 323 |

| Operational profit | 47 | 24 | 95 | -12 |

| Operating margin | 5,9% | 3,7% | 9,2% | -0,9% |

| Net profit | 12 | 4 | 44 | -8 |

Source: own study

Forex brokers offering ETFs and stocks

How to invest in toy producing companies? As we mentioned earlier, there is practically only one option left, which is to individually build a portfolio based on selected companies from the industry. Unfortunately, no ETF related to this industry has been created yet.

An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 21 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

3 - shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

323 - ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | 0% commission* |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 | 100 USD |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

EToro platform |

*Zero commission means no brokerage/transaction fee was charged during the activity. However, they may still incur general fees, such as currency conversion fees for deposits and effects in non-USD currencies, fees for fees, and (if applicable) inactivity fees. Market spread also applies, although this is not a "fee" charged by eToro.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

Summation

Even though the toy market seems to be very profitable and stable, there have been changes in recent years that have forced companies to change their operating model. Nowadays, children have become accustomed to smartphones and tablets, which means that the toy market for children over 5 years old has changed compared to what it was 2-3 decades ago. Now companies must somehow encourage parents and children to buy "analog" products. Another problem is the slow change in consumer habits. The trend of moving the toy trade to e-commerce is a fact, and this somewhat undermines the strength of well-known brands, which often had privileged places in thematic stores or toy departments in supermarkets. It is therefore not surprising that many well-known players have moved towards the "digital world" and introduced savings programs. As can be seen from the financial data and the behavior of the charts, toy manufacturers have not been the best investment idea in recent years. Will this still be the case? We'll see.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in toy producing companies? [Guide] toy producing companies](https://forexclub.pl/wp-content/uploads/2023/12/spolki-produkujace-zabawki.jpg?v=1701774723)

![How to invest in toy producing companies? [Guide] the anatomy of global debt](https://forexclub.pl/wp-content/uploads/2023/12/anatomia-swiatowego-zadluzenia-102x65.jpg?v=1703167279)

![How to invest in toy producing companies? [Guide] fed](https://forexclub.pl/wp-content/uploads/2021/05/polityka-fed-102x65.jpg?v=1620232954)