Hurricane Ida hits energy resources

In the USA, gasoline stocks are significantly decreasing, while gasoline prices are rising. The same is true of natural gas, except that the situation here applies not only to the United States, but also to almost all of Europe. US gasoline futures jumped above $ 2,3 a gallon, approaching levels the highest since October 2014..

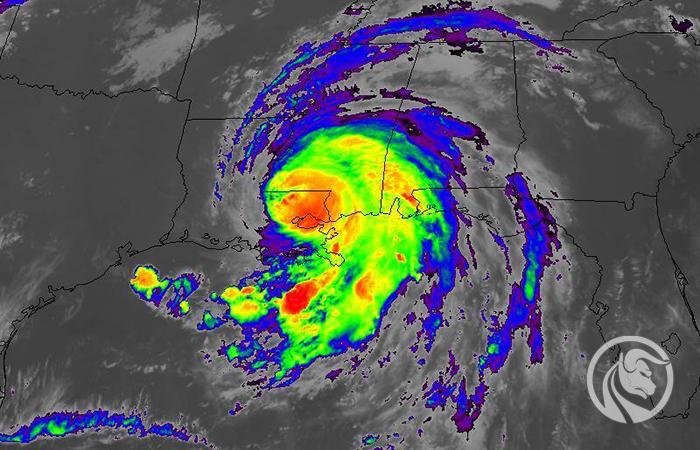

The increases appear to be a consequence of supply constraints and dwindling inventories. These, in turn, arose because the United States first struggled with drought, and now Hurricane Ida has hit the mainland near Port Fourchon, Louisiana, a hub for the offshore energy industry in the Gulf of Mexico, disrupting processing plants.

Ida inhibits oil production

The devastation in the Gulf of Mexico resulted in the suspension of production of 1,72 million barrels of oil daily. Fortunately, the works are to gradually return to normal there. However, the entire decline in fuel stocks in the US cannot be linked to the element. The official data of the Energy Information Administration showed that US gasoline reserves fell by 2,242m barrels last week, which is much more than forecasted for a decline of 1,557m.

Exceeding demand tends to push up prices, and in the case of gasoline, an important factor in inflation, these have already risen in the wake of the outlook for economic recovery after the pandemic. This, in turn, means that inflation in the US may still remain at high levels and Americans' disposable income is declining.

Natural gas is more expensive in the US and Europe

In the energy commodity market, not only crude oil attracts attention, but also natural gas. In the US, futures contracts for this commodity rose above $ 4,4 per million British thermal units (mmBtu) at the start of the week for the first time since December 2018. This was driven by the hurricane Ida threat, stronger demand, but also as a result of this , that Energy Information Administration announced a much smaller volume of inventories last week.

In fact, the EIA said companies had added 20bn cubic feet of gas to storage in the week ending August 29, while market forecasts said they were gaining 40bn feet.

Natural gas prices have also increased in Europe. In the Old Continent, this fuel is much more expensive than in the US, currently the price is above $ 15 per million British thermal units (mmBtu). Europe faces a natural gas shortage as Russia, the largest supplier in Europe, refused to reserve large additional flows through Ukraine's pipelines before completing the construction of the controversial Nord Stream 2 pipeline to German.

Oil keeps a high level

Crude oil also remains relatively expensive - around $ 69 per barrel, which is close to the two-week high. Here investors are waiting for tomorrow's meeting OPEC +where the issue of extraction will be discussed.

The dominant belief is that the cartel will continue its plans to increase deliveries by another 400 until December. barrels a day each month. This week, WTI's oil futures seem to reflect back gains that came after the market opened. It is worth recalling, however, that last week, black gold prices jumped by more than 10%, which was the largest weekly increase since June 2020.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)