Inflation or speculation? What interest rates can the Fed use? NS. II

All the markets' attention is focused on the most important event of the week, i.e. the FOMC minutes. For now, what he will say is one great unknown, although a number of speculations have already arisen on this topic. The truth is that Federal Reserve (despite the last, quite optimistic dot plot) it does not have to raise or lower the main one at all interest rate. Moreover, perhaps just maneuvering your own "internal" interest rates is enough to get the desired effect. Markets are focusing is still on inflation, but from the perspective of the opportunities, tools and risks that currently weigh on the Federal Reserve, inflation topics are largely a temporary problem. I am looking forward to the first, worse (better for the economy and money) CPI and core readings, to see Bloomberg's headlines stating that the Fed was right about the temporary nature of inflation. Anyway, I invite you to the article in which I want to objectively present the possibilities that the Fed faces.

Be sure to read: How the policy of central banks works [part AND]

The devil is in the details

When talking about the Federal Reserve, what comes to our mind mainly is what is happening now - that is, the silent fight for the interest rate. Before we get into the details and discuss how the Fed can help itself “behind the scenes”, it's worth identifying the main problem. In my opinion, many people, not even related to the investment world, see problems related to inflation. The increase in prices, whether they like it or not, affects households, which are the main recipients of manufactured goods. Inflation itself - with the rest, like other economic indicators, harms some, gains others. At this point, the proverbial "profits" and recipients of profits from the high rate of price increases are government budgets, whose debt has recently increased exponentially.

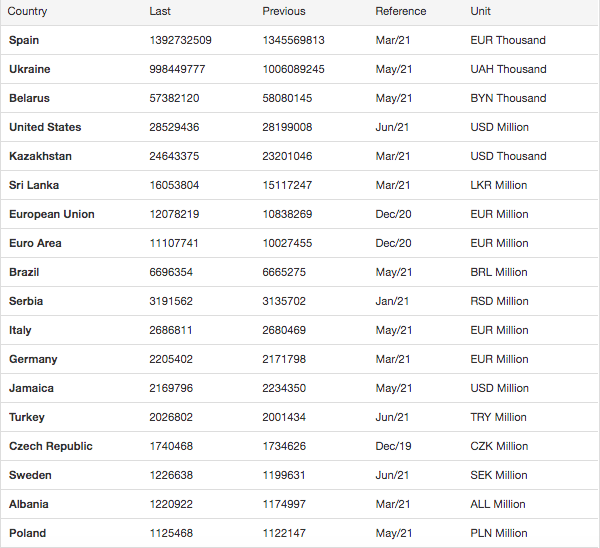

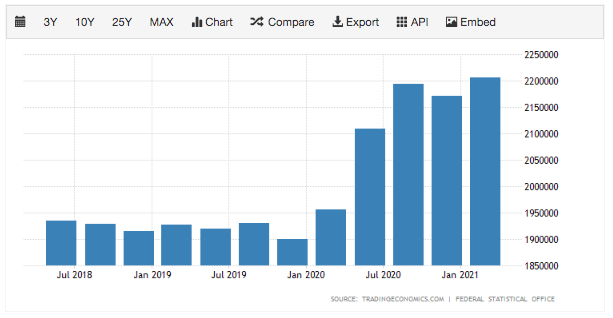

Above, to understand the scale of the problem, are government debts. As you can see, not all data is updated, so you could say that we don't know exactly what it looks like. However, when entering the debt dynamics over several quarters, a tendency towards increasing indebtedness is clearly visible. Leaving aside the example of the USA that best illustrates this situation, let's take a look at our backyard. Below you will find a graphic showing the debt dynamics in Germany and in the Euro Zone. Similar looking bars can be found in practically every country.

Two factors made it possible for governments to take out relatively cheap loans. Low interest rates, which were lowered with the outbreak of the greatest covid panic, and rising inflation, which will allow you to pay off your liabilities with cheaper money. All this is supported by low debt servicing costs. Another question arises in this field. How long will countries incur new and larger debt packages? Well, a lot in this matter can be explained by the attitudes of people associated with monetary policy. Ex-Federal Reserve leader Janet Yellen not long ago talked about the massive debt generated by fiscal packages supporting the economy as an investment in the future. The cost of this investment is high inflation, with which the United States (and not only) must grapple in the near future.

Of course, where some are losing, others are gaining. The increase in the price index is largely an indicator of the increase in the cost of living that households bear with the current monetary policy and its impact on the economic situation. On the other hand, this and no other economic environment is conducive to large-scale lending, making it relatively cheap and more accessible to the general public.

Divorce changed politics

The interest rate struggle we are witnessing today is largely being resolved in the field of the "rationality" of individual bankers. On the other hand, the Fed still has many interest rates that it can use indirectly to achieve the desired effect in the economy. The unconventional monetary policy of the Federal Reserve, it can be argued, came with the purchase of massive asset packages including MBS (Mortgage Covered Bonds). However, it largely began with the divorce of the Federal Reserve which began 12 years ago and which was heavily accelerated by the crisis. This divorce involved a transition from the corridor system to the floor system. Exactly about the system of action in terms of interest rates and the importance of the reserves that banks deposit with the FED. The changes that were introduced were irreversible. The crisis of 2008 only accelerated them. The initial deadline was 2011, and the reserve was already considering the plans to switch to another system in 2006.

What interest rates does the Fed have at its disposal?

In addition to the "standard" interest rate (interest rate) we have at least 4 others that are worth discussing. Belong to them:

- IOER,

- ON RRP,

- ERDF,

- SOFR.

Before I go on to a very general saying of what they can help make, there is one more important thing I should say, and that is the structure of the US money market itself. Given the periods of the pandemic, this market is very concentrated. By concentration, I mean more precisely the deposits that are in the reserves of the FED and which are deposited by banks. Most of these deposits are held mostly in the hands of 5 banks (their deposits account for 99% of the reserves). We are talking about the largest "banking powers" such as Wells Fargo, JP Morgan, Bank of America or Citi.

Until the "divorce", ie the change of the system (which I wrote about in the paragraph above), even small steps taken by the FED in terms of the reserves offered, had a huge impact on the demand for reserves. So it was extremely flexible. By using the word reserves, I mean those that the institutional banks keep at the central bank. In this solution, therefore, there was a very large relationship between interest rates and the reserves in the Fed. The interest rates on these provisions can now be taken into account. For now, however, we will leave them aside. As a rule, they were primarily about creating lending. How is it now? Well, with the departure from the old system, it is considered by many to be the formal beginning of an unconventional monetary policy. The relationship between the amount of free resources and the effectiveness of monetary policy has been broken. A new flooring system was born that was led irreversibly. It is based on the IOER rate, which is the interest on excess reserves. At present, it may seem quite incomprehensible for now, but I will outline further what can be achieved with IOER.

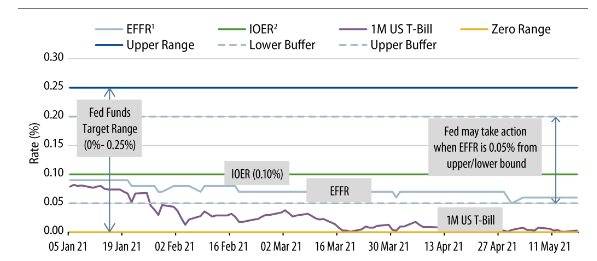

IOER and the ceiling

The IOER is the fixed rate that the Fed pays to the banks that leave reserve balances with the Fed (surpluses). Taking into account the current system, IOER is such a factor that determines the upper ceiling of market interest. Why? This rate sets a certain ceiling below which it is profitable for banks to deposit funds with the central bank than, for example, to lend them to another institution. This solution makes the asset purchases run by the Federal Reserve much more effective. So the Fed's generosity comes from banks being reluctant to get rid of assets to transfer money into much less-interest-bearing reserves. Therefore, they would be a loss on such a transaction.

These processes are well explained and illustrated in the graphic below, which we will discuss over time in the following sections.

Source: Bloomberg.com

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)