Inflation up, EUR/USD down

Consumer inflation in the euro zone slowed down. However, this slowdown was expected, so it has no impact on EUR/USD behavior, nor should it affect Thursday's ECB decision.

Inflation in the Eurozone up

HICP inflation in the euro area rose to 7% in April. from 6,9 percent year-on-year in March, according to preliminary estimates published today by Eurostat. And although this means a break in the 5-month series of inflation declines in Europe (from 10,6% y/y in October 2022), the data themselves were not a surprise. This is exactly what the market expected.

Of course, the increase in HICP inflation may be a little worrying. Especially that month-on-month inflation increased by 0,7 percent in April. This shows that the recent declines are largely due to the base effect. On the plus side, April's decline in the annual core HICP inflation rate should be noted. This fell to 5,6 percent. from 5,7 percent in March. This is likely the beginning of future declines in this measure of inflation.

HICP inflation in the euro area in April 2023 (preliminary data). Source: macronext.pl

Inflation data published today do not change much in the assessment of what decision he will take next Thursday European Central Bank (ECB). Similarly to market expectations, the industrial PMI indices for France, Germany and the euro zone, released in the morning, did not change.

Taking into account the inflation processes in Europe on the one hand, and the slowdown of the European economy and the observed decline in lending on the other, it can be said with certainty that the ECB will raise interest rates by 25 basis points on Thursday. This is also the market consensus. This will mean that the deposit rate in Euroland will increase to 3,25 percent. from 3 percent currently, and the refinancing rate to 3,75 percent. from 3,50 percent

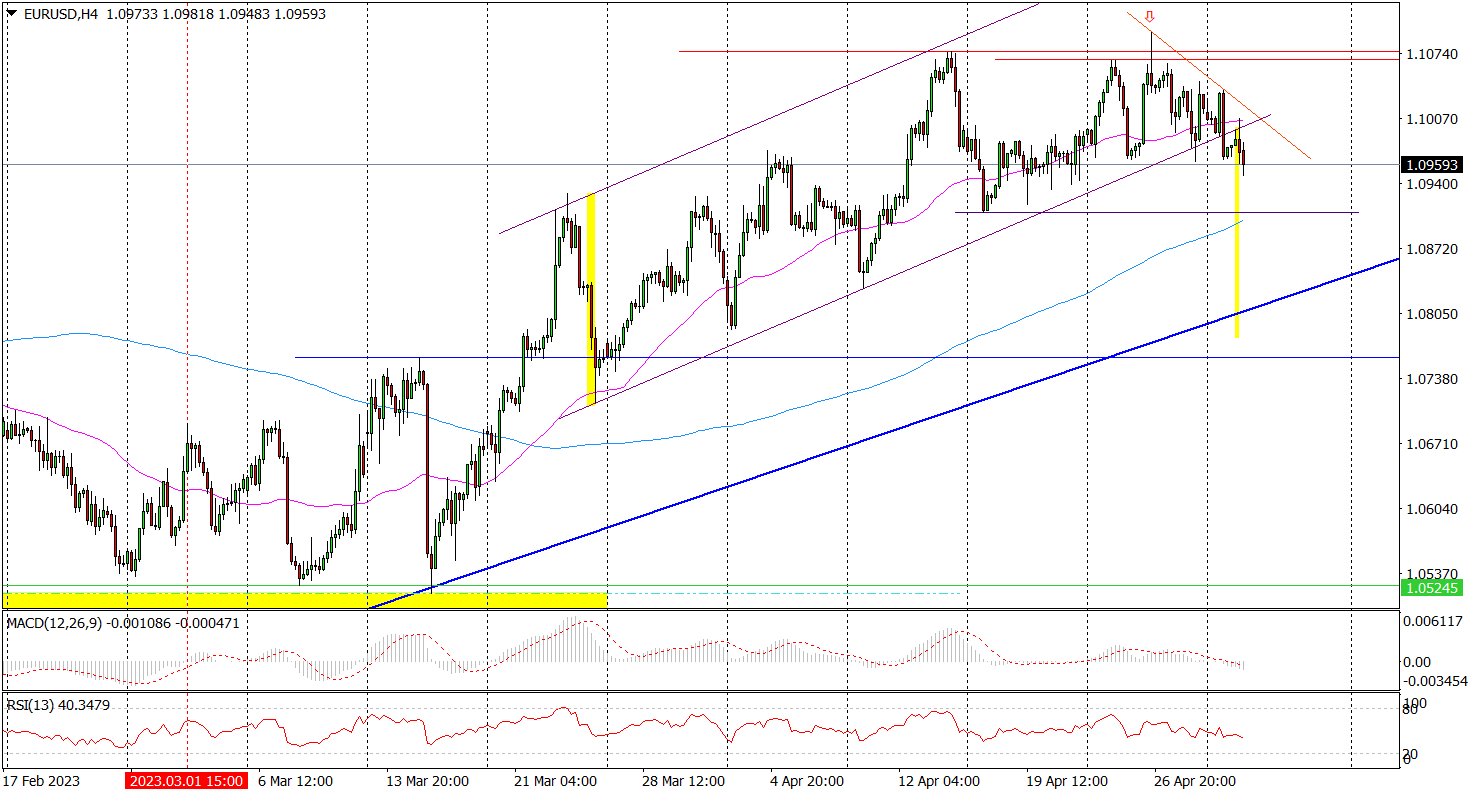

The dollar is recovering

EUR / USD exchange rate neither reacted to the morning retail sales data in Germany, nor to the subsequent PMI indices, nor to the above-mentioned inflation data for the euro zone. The pair fell to around $1,0950 today, the lowest since April 21. However, this drop changes a lot on the EUR/USD chart (H4). Mainly because there was a downward breakout from the upward channel drawn since March 24, which was preceded by a drop below the 50-period average and several failed attacks to levels above 1,1050. The structure of increasingly higher local lows has also been negated. All these technical signals make you prepare for a deeper EUR/USD pullback. The first significant support is 1,09-1,0909, where the demand barrier is created by the local low of April 17 and the 200-period average. It's just that if you take seriously the sell signal in the form of a downward breakout from the upward channel, you have to take into account a fall of more than 100 pips deeper and an attack on levels below 1,08.

EUR / USD chart, daily interval. Source: Tickmill

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)