Inflation in Poland still plays the first fiddle

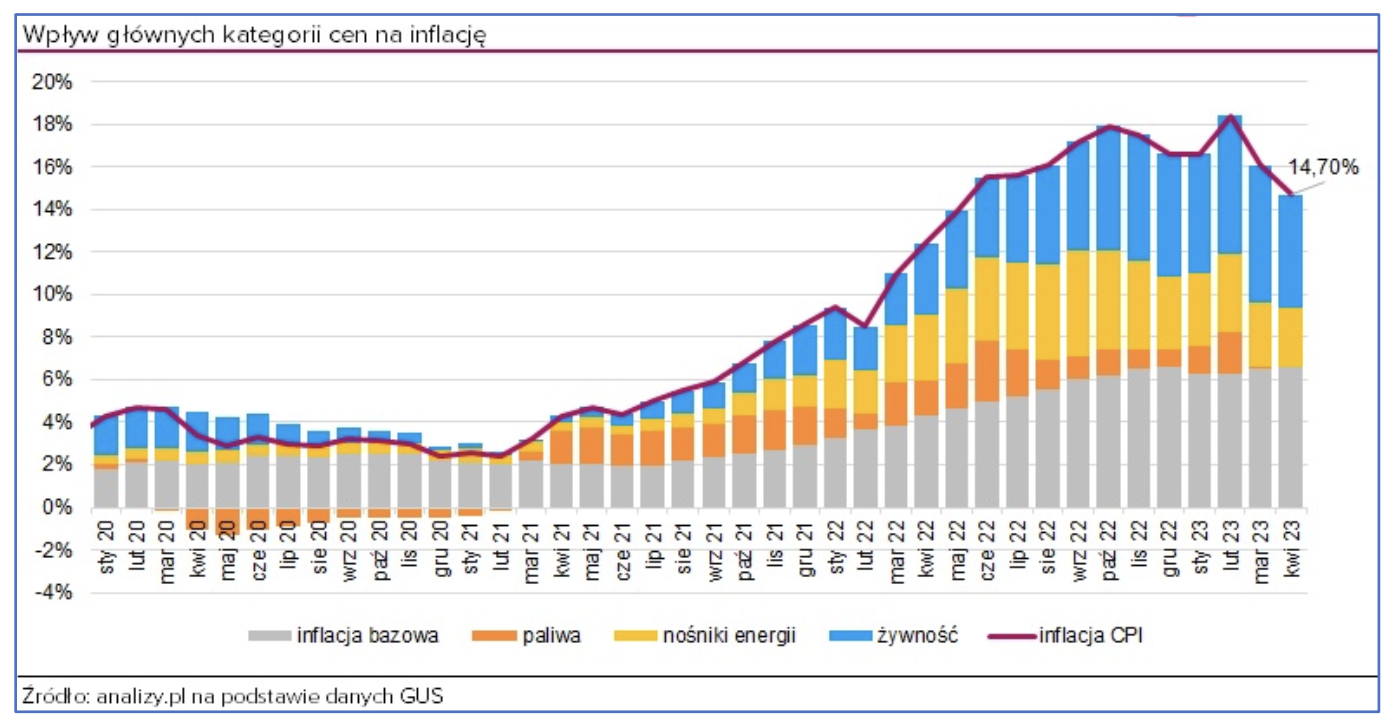

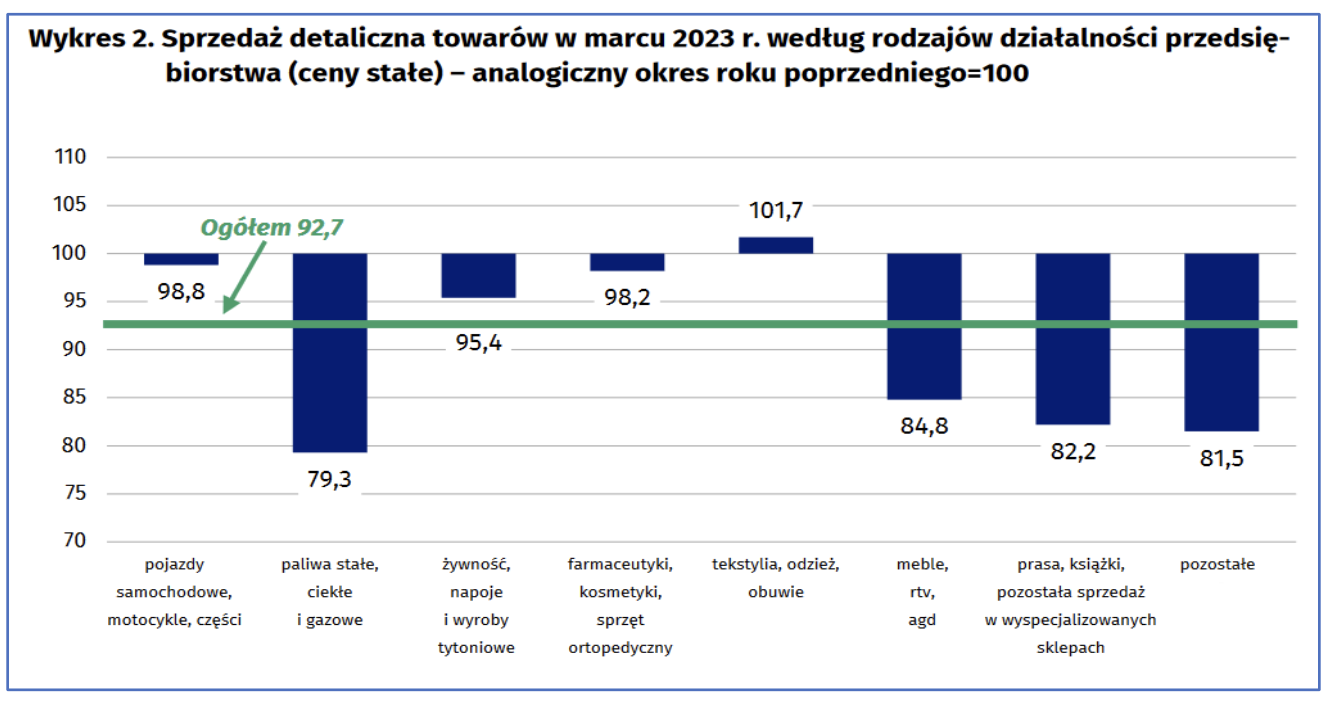

CPI inflation increased by 1,1% in March. compared to February. In turn, the preliminary reading for April suggests a price increase of 0,7 percent. on a monthly basis and 14,7 percent. y/y In the case of core inflation, the monthly dynamics for March amounted to as much as 1,3 percent. which after the "anniversary" translates into an increase of 16,8 percent. Despite dynamically rising prices, base interest rates NBP remained unchanged at 6,75 percent. Also in the case of industrial production or retail sales, we observed unfavorable readings. VIG/C-QUADRAT TFI experts recorded a decrease in industrial production by 2,9 percent. year-on-year, while retail sales shrank by 7,3 percent.

The fight against inflation is also a major challenge in the euro area

While annual dynamics are not as high as in Poland, the increase in core inflation on a monthly basis - as in Poland - reached 1,3 percent. In case of HICP inflation, the monthly increase was 0,9 percent, and for the past 12 months prices have increased by 6,9 percent. For example, in Germany, March HICP inflation was 1,1 percent. and 7,8 percent. respectively on a monthly and annual basis, and preliminary data for April indicate an increase of 0,6 percent. m/m and 7,6 percent. y/y Preliminary data on GDP in the euro area in the first quarter of 1 indicate an increase of 2023%. y/y (seasonally adjusted). In early May, the European Central Bank raised interest rates by 1,3 percentage points. to 0,25 percent, while the three previous increases were 3,75 percentage points each, which mitigates expectations regarding further increases.

The Americans are the closest to victory in the fight against inflation

CPI inflation rose 0,1% in March. on a monthly basis and 5,0 percent. per year. In turn, the core index of consumer spending prices (PCE core) recorded an increase of 0,3% and 4,6%, respectively. and 145 percent. March brought bad data from the labor market. The ADP report indicated an increase of 200. new jobs against market expectations of 1. Weekly jobless claim numbers also highlighted a weakening labor market. In turn, preliminary data on GDP growth in the first quarter of this year. suggest an increase of 1,1 percent. per annum, while market expectations were 0,9 percentage points higher. higher. At the beginning of May FED for the third time in a row, it raised interest rates by 0,25 percentage points, to the level of 5,00-5,25 percent, which equaled inflation. Announcement FOMC after the decision it was more dovish than before, which the markets perceived as a pause in this cycle of interest rate hikes in the US.

GLOBAL MARKETS - STOCKS

Over the past month, investors' attention has shifted back to geopolitical risks, and in particular the impact of deteriorating US-China relations on key sectors - semiconductor manufacturing and semiconductor machinery and tools.

The interest of VIG/C-QUADRAT TFI experts was aroused by data showing that companies are starting to save on IT expenses - both for basic services, but also cyber security i cloud solutions. They see this as a serious signal that the economy is beginning to show symptoms of an economic slowdown.

It can also be seen that investors prefer the largest companies and leaders in their industries, especially those with a strong market position and a solid balance sheet. Experts share the belief that industry leaders will emerge unscathed from the period of increased inflation and economic slowdown.

In such a volatile environment, it is worth paying attention to the slightly higher level of cash in the portfolio - the valuations of European and American equities are clearly above their long-term averages. It is also possible that the strategy "Sell in May and Go Away" may be reasonable this year. experts conclude.

DOMESTIC MARKET - SHARES

Last month, experts pointed out that the disproportion in valuation levels between large, medium and small companies had become too large. After a very good April, they believe that large companies have noticeably reduced this discount in valuation.

The managers of VIG/C-QUADRAT TFI also point to the fact that double-digit inflation continues to "overflow" into the results of companies in many industries, which, in the absence of a more restrictive monetary policy - paradoxically - has a positive effect on the stock market as a tool of "inflation protection". .

The weakening US dollar also has a positive impact on the domestic stock market. On the other hand, domestic companies closed the valuation gap in April and the current valuation level is at the level of its long-term average, which naturally limits further increases. According to the Management, it is much easier to grow from low to medium valuations, and much more difficult from medium to high valuations. For such a scenario to happen, additional growth catalysts are needed, and these - at least temporarily - are running out.

CORPORATE BONDS

The corporate bond market in Poland was booming. On the secondary market, prices recorded slight increases, and there were several issues on the primary market. New bonds were purchased by both individual and institutional customers. Noteworthy is the fact that Kruk SA issued bonds worth EUR 150 million on the international market.

TREASURY BONDS

April was another positive month on the treasury bond market. On the one hand, concerns about the stability of the banking sector and the recession support the demand for safe assets. On the other hand, the 6% level on long-term bonds is where the market is trying to "catch" the equilibrium point in the short term. In the opinion of the Managers, a permanent overcoming of this level (further strong increase in bond prices) will require confirmation of the solidity of the disinflation trend or further weaker readings from the real economy. This may cause investors to worry about the possibility of a recession.

Author: VIG/C-QUADRAT TFI experts

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)