Infrastructural investment gap and hidden inflation

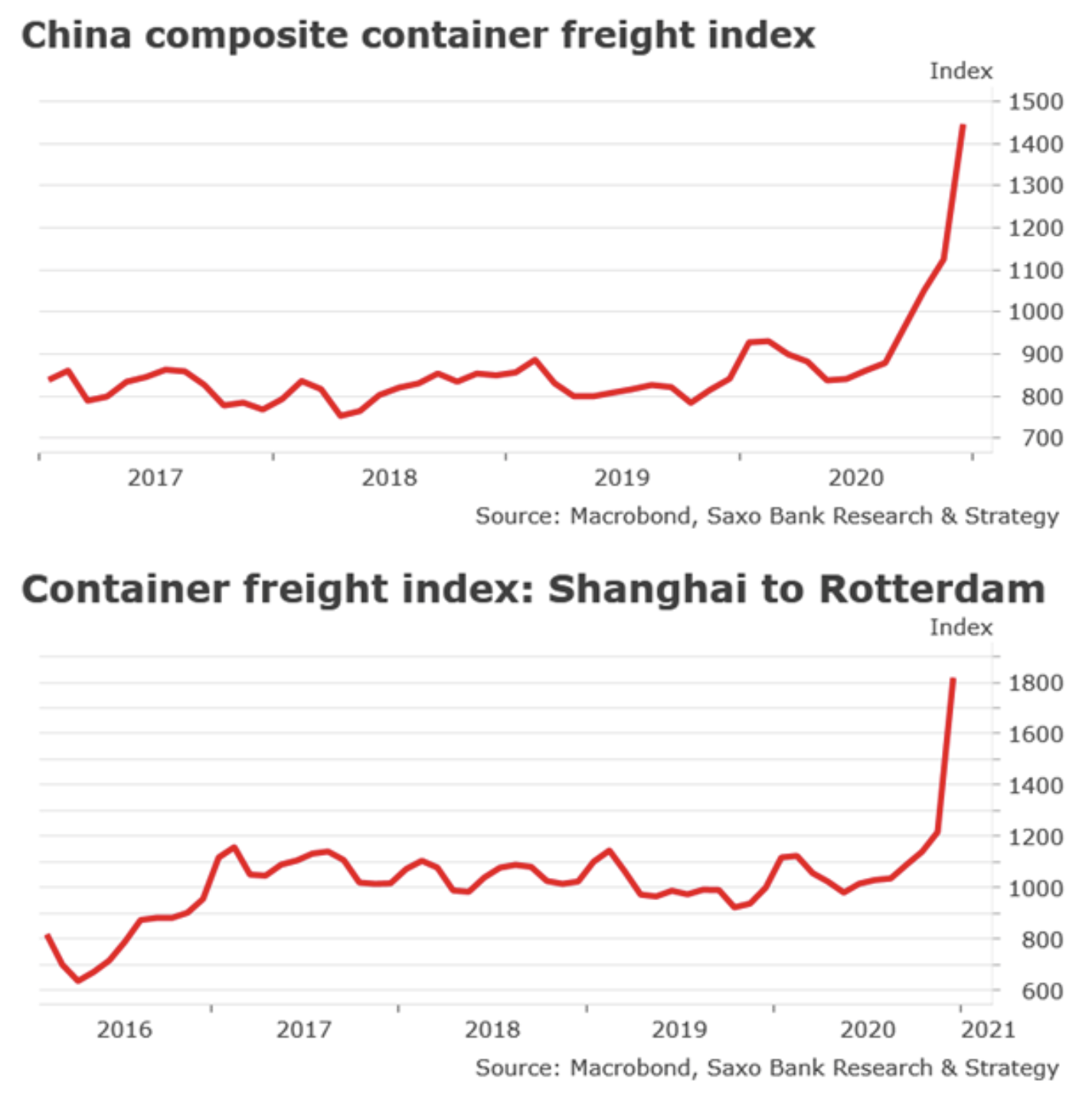

Our first assumption for this year is much higher growth due to the release of cumulative demand after the lifting of most restrictions and lockdowns, in the case of Great Britain and Israel - possibly already in spring, and the implementation of the vaccination program. Our second assumption is the arrival of inflation this year due to physical shortages in the logistics area after many years of underinvestment.

About the Author

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Covid-19 as a trend accelerator

In many respects, the pandemic has accelerated broadly understood trends, in particular with regard to digitization. It has contributed in earnest to transforming consumer spending behavior - consumers have more than ever opted to shop online over checkout queues, significantly increasing e-commerce's share of total sales. In the case of the United States alone, the share of e-commerce in total sales increased from 11,8% in Q2020 16,1 to 2020% in QXNUMX XNUMX. During the pandemic period, only digital companies, or those that were able to take advantage of digitization, managed to secure or - in some cases - even increase revenue streams; meanwhile, the rest, usually brick-and-mortar stores, recorded huge lost revenues. To address the pandemic, companies have focused heavily on creating and investing in online advertising, internet systems and delivery, particularly in sectors that have lagged so far. All this is unlikely to go away when the stores open again.

The process of digitization and online shopping will accelerate in the coming years, highlighting problems that have been ignored so far. One of them will be the underinvestment in infrastructure and logistics focused on the digital world. You may believe that the digital world can exist on its own, but this is a wrong assumption - the digital world cannot exist independently of the real world. It needs all the infrastructure and logistics of the real world to be able to grow and function properly. If we assume that digitization will become the backbone of any business and digital platforms dominate the market, be aware that we have reached a point where the lack of investment in infrastructure to fulfill orders as well as in logistics to enable product delivery is a major constraint translating into growth cost inflation.

Physical restrictions as a source of inflation increase

It is already happening. Physical structures are unable to cope with the unexpected and massive surge in demand. Closed-back consumers with enormous cash reserves rushed to buy Asian-made consumer goods. The transport infrastructure is unable to respond to such a sharp spike in demand, leading to congestion where empty containers are stuck in the wrong locations and freight costs on major routes go up. We are currently in a unique situation where freight costs between China and Europe and between China and the United States are at their highest ever. This signals a revival in world trade, but also under-investment and inadequate investment in logistics, which is nothing new.

Physical constraints are likely to be the main driver of inflation growth in the coming months and quarters, however, this risk has not yet been captured in capital markets and traditional models such as the T5YIFR (measuring the average projected inflation rate over a five-year period five years from today) because the price discovery process is no longer working. Capital markets do not reflect the real structure of the economy and are no longer influenced by free market forces. Capital markets have become part of the price system shaped as a result of government actions through regulation or the direct impact of ultra-accommodative monetary policy. This explains why inflation expectations are still below the 2% threshold set by the central bank, but it does not mean that inflation is absent in the real world.

In the years following the financial crisis, public investment has become a major victim of fiscal consolidation efforts, particularly in Europe. Policymakers are unlikely to repeat this mistake and cut investment once the Covid-19 pandemic is over. In terms of forecasts, there is a consensus that there will be an explosion in demand for infrastructure spending in 2021 and beyond. In the United States, the Biden administration is expected to launch a multi-trillion-dollar comprehensive infrastructure plan by the end of spring under the Build Back Better program, and many countries, both developed and emerging, are taking consider taking similar steps. Although infrastructure investments have been part of the government's economic recovery program since JM Keynes, this time it is possible to adopt a new approach, focusing more on the implementation of new infrastructure technologies, such as hybrid refrigerated transport equipment and automation solutions. This can affect all industries and turn existing solutions into an intelligent infrastructure.

According to a survey conducted a few months ago by IJGlobal and M&E Global, 63% of respondents, all of whom were actively involved in financing and implementing infrastructure projects, predicted that the post-pandemic period would provide a huge boost to the implementation of new infrastructure technologies. 50,7% of respondents believed that this would be a key element in efforts to recover economies after the pandemic. Governments will be instrumental in reducing the infrastructure investment gap and putting pressure on the deployment of digital infrastructure, not only by introducing new regulations and policies, but also by acting as a direct investor. Interest among investors is already noticeable, and equity investors are focusing on infrastructure that is sustainable and resilient.

This period will offer new interesting opportunities, in particular in the area of logistics, which are usually characterized by very low margins. We are already seeing opportunities in healthcare logistics in the context of vaccine delivery - entrepreneurs and investors are focusing on more specialized supply and areas with much higher margins, such as the cold chain.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)