Investment Plans at XTB are now available. We check how they work in practice!

To the offer XTB have been added Investment Plans – a new service focusing on investing funds in ETFs in the long term. Initially, it launched only in Romania, which took place exactly in mid-September 2023., but from November 13 it is also available to other customers. We decided to immediately check how it works in practice. What are our observations? There are pluses, there are minuses. But from the beginning.

What are XTB Investment Plans?

On the xStation platform, right next to the tab Market Watch with instrument quotations, appeared Investment Plans. This is a product that allows you to create portfolios composed of one or many ETFs. We cannot add individual shares or other instruments from the broker's offer. Only ETFs, that's it, period.

Installing this product is simple - we invest funds for the long term, without active management of the "position". We can pay extra or withdraw capital at any time, but more on that in a moment. In short, I think you could call this function as "long-term saving product", and "investing".

First, one important note - investment plans are available only for mobile platform xStation. Even when entering this tab on a stationary platform, information appears about where we can download the mobile application. However, this is not a huge problem, because practically everyone has a smartphone, and the operation itself is very convenient and simple. I also think that this is a solution that will change over time and eventually we will see plans supported also from the traditional platform.

The investment starts from the price of 2 Drwal sandwiches

The minimum investment amount for Polish customers was set at 2 times the price of the Drwal sandwich, i.e only PLN 50. A good move that should also encourage young people to invest. Currently, we can choose from approximately 360 ETFs, which are divided into 5 categories:

- The most popular,

- Equity,

- Raw materials,

- Fixed income (bond ETF),

- Others (e.g. VIX-based ETF).

The sheer number of ETFs is not overwhelming, but it should certainly be sufficient for most users. The only thing you need to pay attention to is the way they are placed in the application (more on that in a moment) and inability to group/filter them by the most important statistics (option added in January 2024).

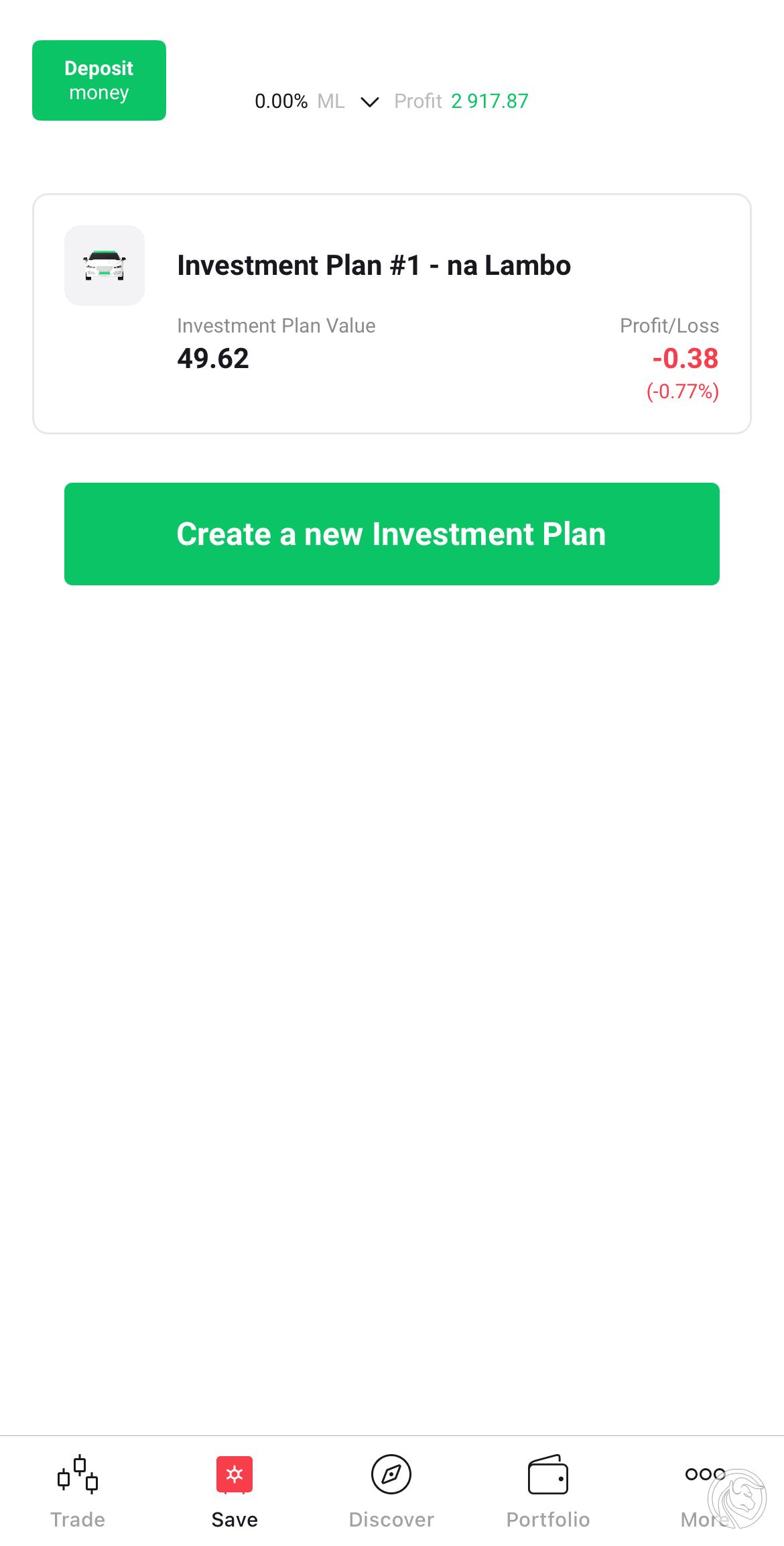

SAVE tab [Novelty]

So let's go to the mobile application. This is the tab [SAVE], right next door [TRADE], there is a new product. Its operation is as simple as possible and it only takes a moment to get used to it "what, where and how".

How it works in practice:

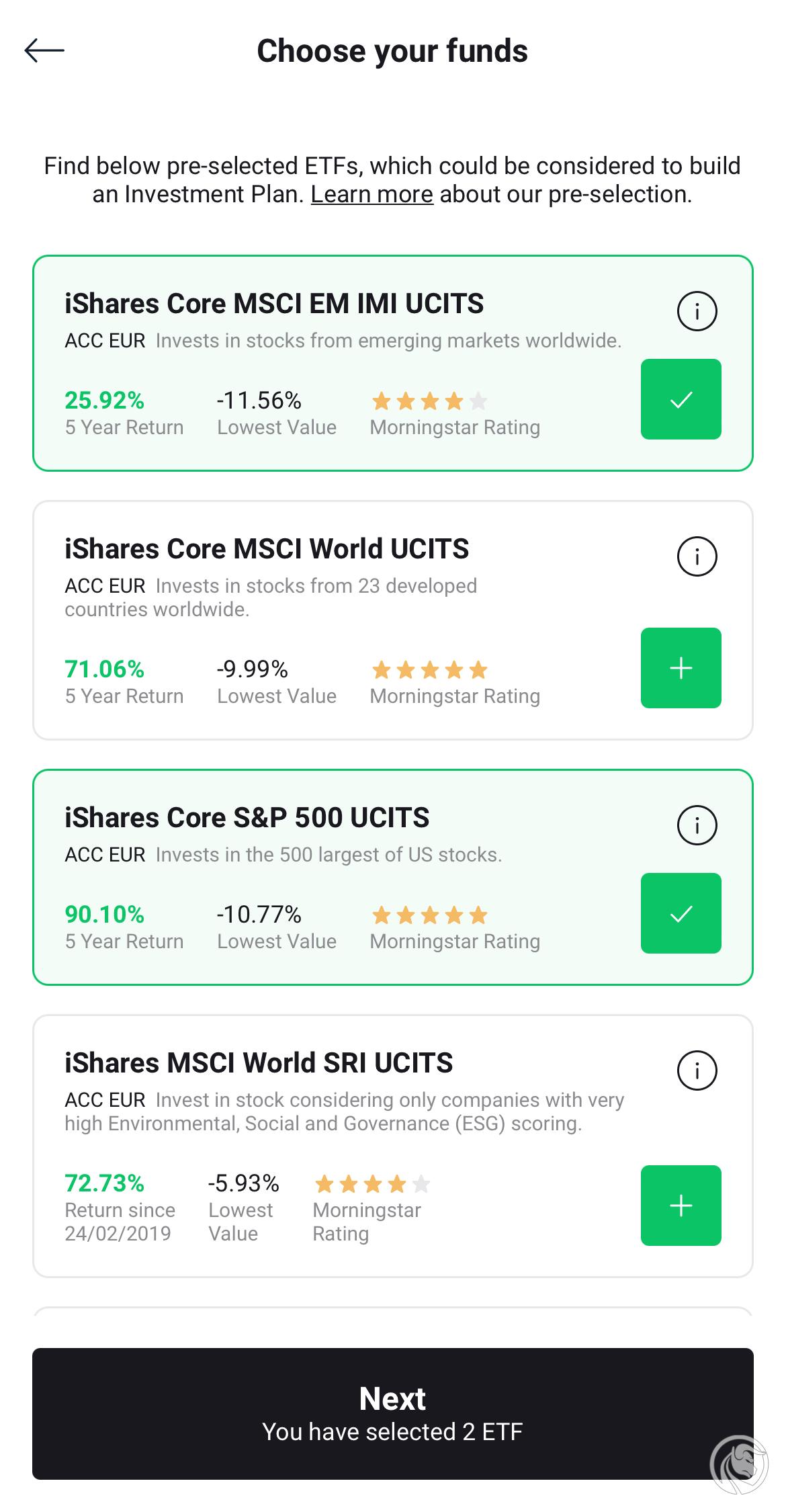

- We are creating a new investment plan.

- We choose one or more ETFs for our plan -> we can first read the details under the symbol about each product (I).

- In the next step, we choose how much percentage of our entire deposit we want to allocate to each ETF (in our picture it is 50% - you can also quickly divide the capital into each ETF equally using the function "Equal allocation"). We also see here how the portfolio we selected has performed over the last 5 years (chart at the top). We can also add another ETF here if we decide that we want greater diversification (option at the very bottom -> "Add a new ETF to the Plan").

- We create an investment plan.

|

|

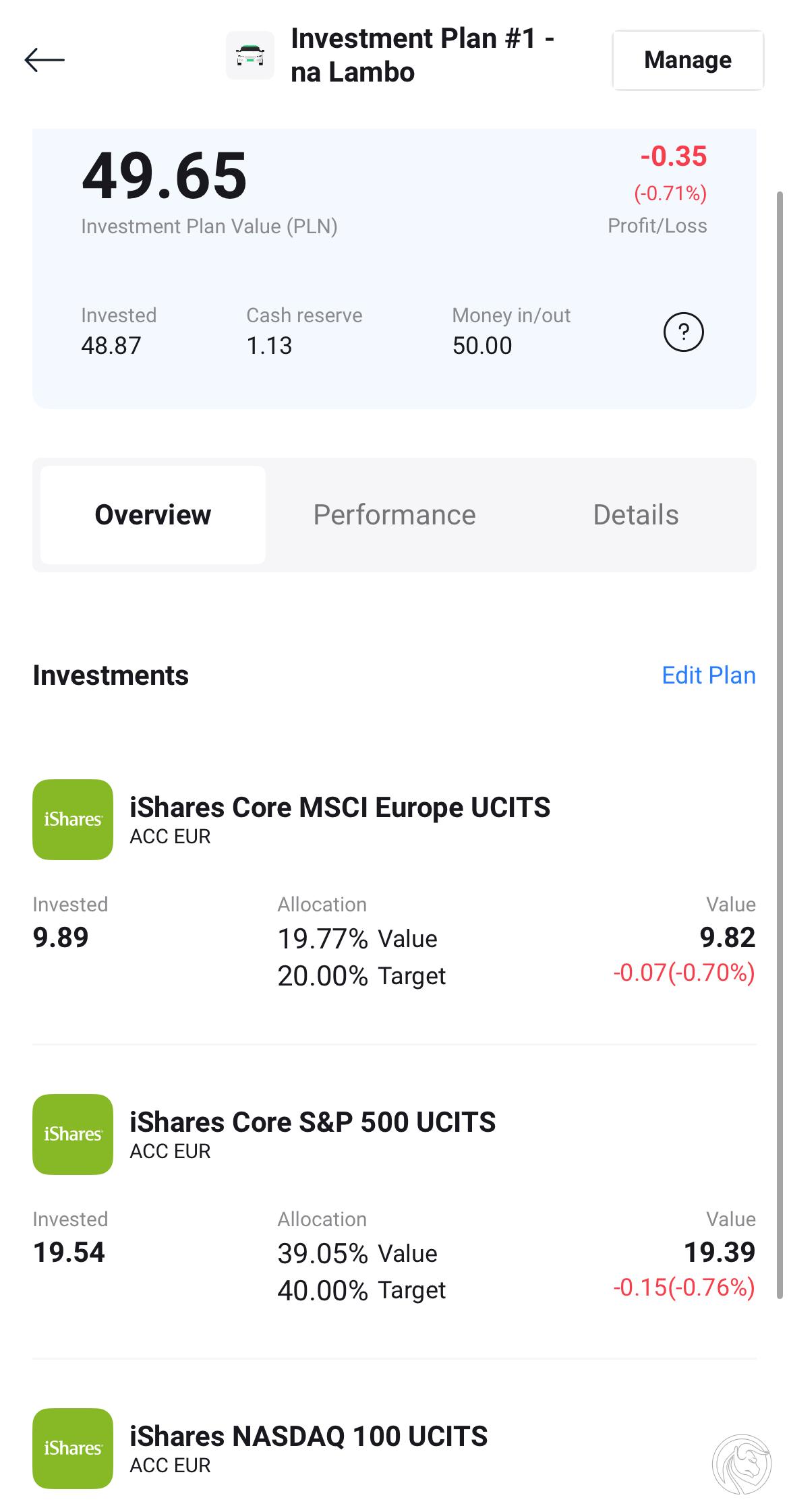

And it's done. Our investment plan ends up on the list, from where we can then freely manage it via the tab [Manage] in the upper right corner (visible after entering a given plan). This is where we can add or withdraw funds, edit proportions or liquidate the wallet.

We can also set the name of our wallet and even choose an icon "visualizing" our investment goal (car, house, vacation, etc.), which further emphasizes that this is a typically long-term product. Our example shows that we have added a third ETF and selected a target "on Lambo" and we paid the entire PLN 50 :).

Changing the proportions of portfolio components, rebalancing

The functionality mentioned above deserves a separate paragraph. When adding a new ETF, all we need to do is set new proportions, the sum of which will be 100%, and then the application will balance the funds allocated for investment between individual instruments. In short: we change the proportions when adding another ETF, and the broker does the rest. We don't calculate anything, we don't order anything, we don't play with Excel. Simple and convenient.

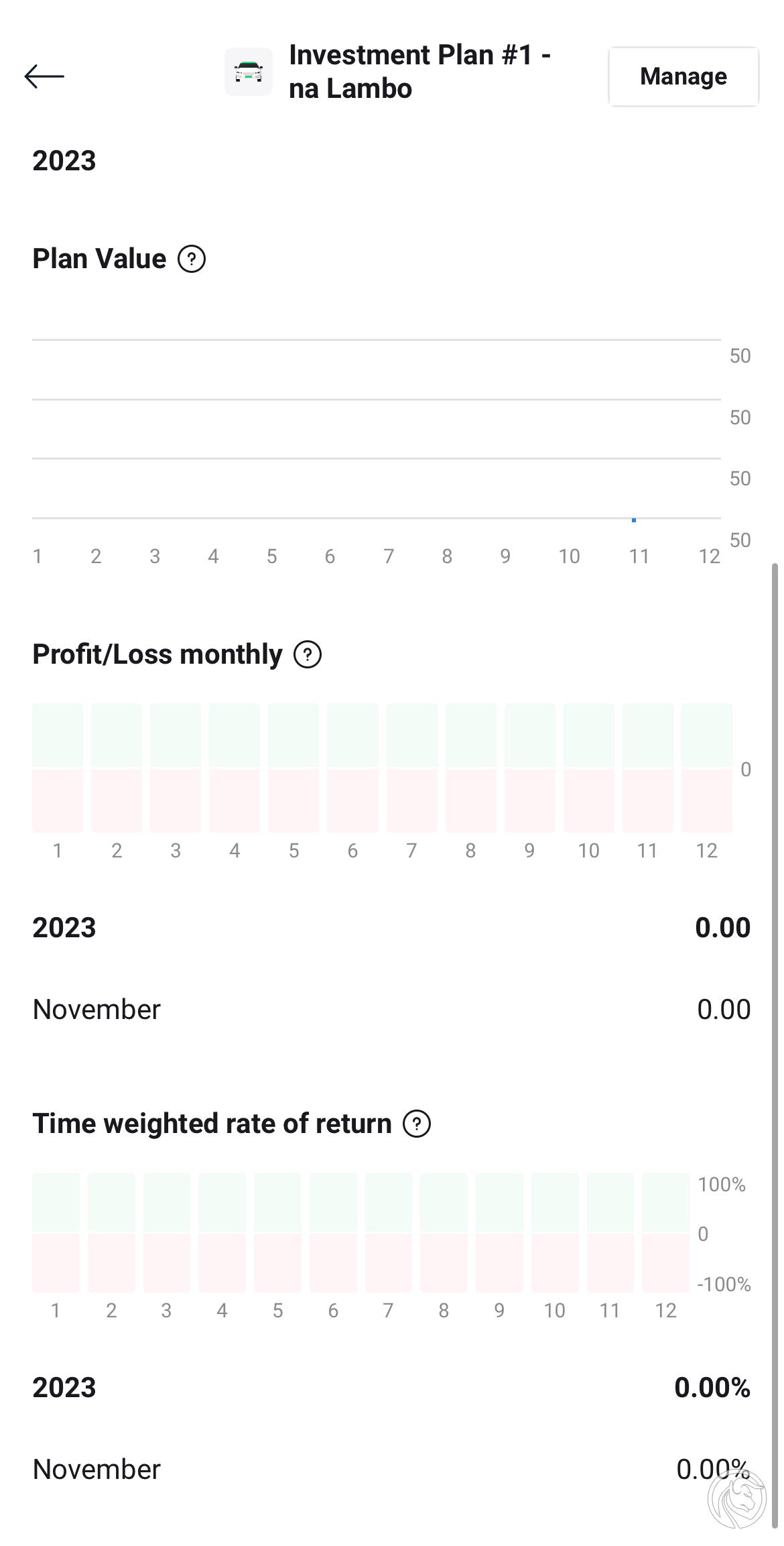

Statistics and portfolio performance

In addition to simplicity in management, we also receive a number of statistics that allow us to monitor the progress of our portfolio. After entering our investment plan in the tabs Performance we will find detailed results of our portfolio broken down by month.

In the bookmark Details details such as share in particular sectors, countries, etc. This is where we can measure both our progress and assess the degree of diversification.

Investing with zero commission up to PLN 100. EUR

Finally, it is worth mentioning that Investment Plans at XTB are included in the offer zero commission on the purchase of shares and ETFs up to the turnover amount of PLN 100 euro per month. This means that until the mentioned threshold is reached (and on a monthly basis!) we do not pay a penny for transactions using the service and all operations performed on the portfolio - both when increasing exposure, reducing it, and changing the proportions when adding another ETF -and.

This item, combined with recently introduced interest rate on free funds on the investment account, creates a truly favorable environment for long-term saving.

Summation

XTB Investment Plans is a very strong competitor to popular robo-advisors such as finax or Fondee. In my opinion, if we take into account that we have greater freedom in selecting components, zero commission, a transparent and easy-to-use platform, this is their tamer. After all, we get free withdrawals, quick deposits using many different payment methods (from transfer, through BLIK and card, to PayPal), PIT-8c and the ability to run an account in various currencies.

The only key element that is weaker than its competitors is deposit guarantee – in Finax it covers 100% of funds up to PLN 50. EUR. In XTB, according to the regulations, it is 90% up to EUR 22 and 500% up to EUR 100. However, considering that we are dealing with a powerful capital group listed on the Warsaw Stock Exchange, which has continuously improved its results and its shares have gone up significantly over the years, the threat of possible bankruptcy seems extremely unlikely.

[Update – January 4, 2024]

With the New Year, quite a large number appeared update of the Investment Plans service on the XTB platform. It brought a few things that we missed when writing the above review. These include the option to filter ETFs when creating a portfolio. The user can choose, for example, the Risk Rating on a scale from 1 to 7, the ETF's quoted currency, the Morningstar rating, industry sectors or the choice between ETFs accumulating or distributing dividends. Another important novelty is automatic investments, i.e. the ability to configure regular payments to selected portfolios based on a set allocation. The options are also interesting here, because we can choose how the portfolio should be funded, with what amount, how often (daily, weekly, every 2 weeks, monthly, every 3 and 6 months) and when the auto-investment should start.

Investment Plans in XTB

| Advantages | Disadvantages |

| Investment from PLN 50 | The service is only available on the mobile application |

| 0% commission up to PLN 100 EUR turnover per month | Relatively few ETFs on offer |

| We can run several independent portfolios | Low level of deposit guarantee |

| PIT-8c available | |

| Multiple deposit methods | |

| Very convenient rebalancing and division of funds between ETFs |

CFDs are complex instruments and involve a high risk of a quick loss of cash due to leverage. 76% of retail investor accounts record monetary losses as a result of trading CFDs with this CFD provider. Consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

This article does not constitute a recommendation or encouragement to undertake any investment. This is solely the author's subjective opinion on the presented external service.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response