Individual investors in the third quarter buy mining and oil shares of the "old economy"

Individual investors bought shares of the "old economy" such as mining and oil companies in QXNUMX, while maintaining faith in great technological powers such as Amazon and Microsoft - Based on the latest quarterly stock data from the eToro Social Investing Network.

- 'Meme stock' Bed Bath & Beyond recorded the largest proportional increase in the number of users in Q182 (+ XNUMX%)

- Twitter recorded the largest proportional drop (-14 percent) after Elon Musk acquired the platform

- Tesla, Amazon and Apple remain the platform's most-held stocks

What do the statistics show?

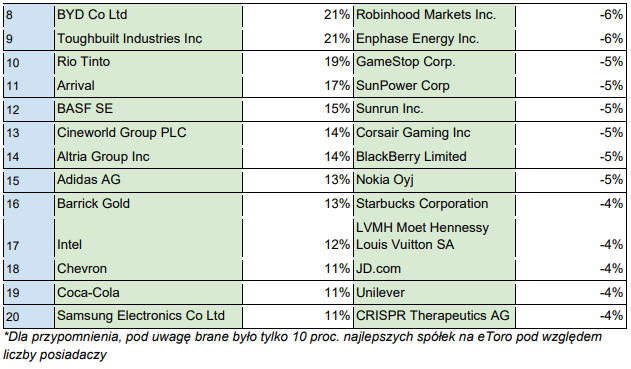

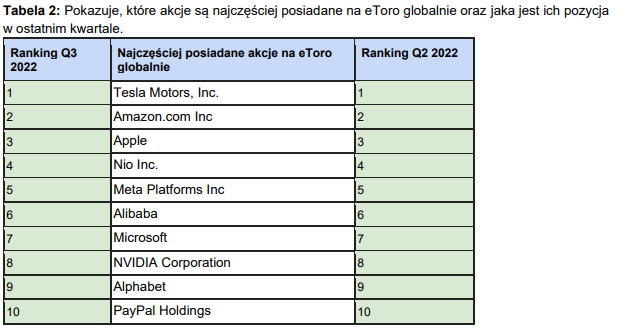

eToro analyzed which companies saw the largest proportional increase and decrease in holders at the end of QXNUMX compared to the end of QXNUMX. The most common shares held on the platform were also looked at. This list, despite this year's sale, remains dominated by big tech.

The company that saw the largest proportional increase in the number of owners was "meme stock" Bed Bath & Beyond, rising 182% after its share price soared in August before plunging again. The company was also the second most sold-out stock on eToro this year, pointing to common sense disagreement with investors for the latest meme stock favorite.

The remainder of the "biggest gains" list included several oil and mining stocks, with oil companies Occidental Petroleum Corp and TotalEnergies SE recording 30 percent. and 23 percent growth (respectively) of holders, while the US oil giant Chevron (+11%), Rio Tinto (+19%) and Barrick Gold (+13%) attracted more investors.

Buy the dip

In the third quarter, retail investors also looked for opportunities to buy shares using the buy the dip strategy, ie buying financial instruments every time their price falls. FedEx (+25%), Chinese company XPeng (+23%) and Cineworld (+14%) were on the list of the biggest gains. All three companies saw huge drops in their share prices this year.

The biggest drop in the third quarter was marked by Twitter, which recorded a 14% drop after the platform was taken over by Elon Musk. Companies focused on breakthrough technologies such as Netflix (-10%), Draftkings (-6%) and Roblox (-7%) were also declining, as well as solar companies: Canadian Solar (-10%). , Enphase Energy (-6%) and SunPower (-5%).

Commenting on the data, Pawel Majtkowski, eToro market analyst said: Retail investors, clearly looking to buy at the lowest price in QXNUMX, also took a more defensive stance, diversifying in "old economy" industries such as energy and mining. This came at the expense of "riskier" stocks related to breakthrough technologies, in particular solar companies, four of which were on the list of the biggest drops. Faced with the cost of living crisis and rising interest rates, some retail investors today seem to be putting income and growth over sustainability.

meme stocks

In the last quarter, several "meme stocks" also entered the top relegation list. Gamestop (-5%), Blackberry (-5%) and Nokia (-5%) all lost favor among eToro users. The list of the most popular stocks among eToro investors (see Table 2 below) remains dominated by tech companies and has not changed from the previous quarter, with Tesla, Amazon and Apple being the most-owned companies on the platform.

Paweł Majtkowski adds: By keeping their faith in tech titans like Amazon and Microsoft, retail investors are increasingly focusing on corporate profits and cash flow today rather than on the promises of riskier growth driven by tomorrow's technology. It's clear that the tech giants with high profit margins and balance sheet claims can survive any recession. This is a very reasonable approach with high global inflation, worsening economic growth and increasingly ruthless markets.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)