Investors are losing their appetite for vegan stocks and opting for meat

Investors have lost their appetite for so-called "vegan stocks" in the past 12 months, while stocks of traditional meat producers have fared much better.

In a nutshell:

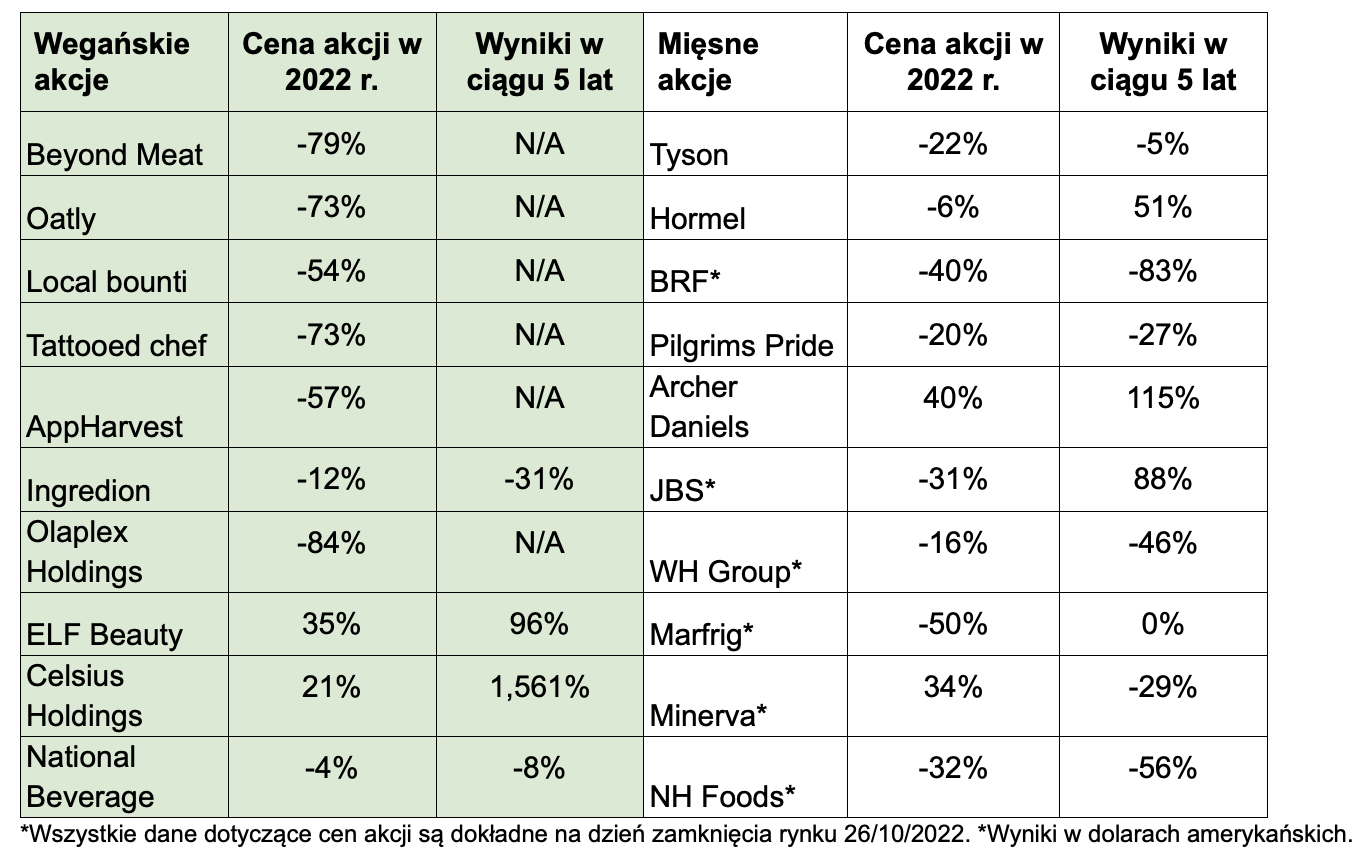

- eToro an analysis was undertaken to create vegan and meat "baskets" for listed shares

- Six of the vegan stocks in the basket are the recent IPOs, with an average of 77% decline in value since going public

- In two years, meat stocks returned 7% and vegan stocks lost 36%.

- Celsius Holdings, a producer of vegan-friendly drinks, is leading the category with phenomenal growth

Vegan actions are no longer fashionable

On World Vegan Day (November 1), eToro publishes data collected showing that a basket of the top 10 vegan stocks saw a 51% decline in value. in the last 12 months and by 36 percent. during the previous two years. Similarly, the basket of shares of the most famous meat-producing companies lost investors' interest by only 12%. over the last year and would gain 7 percent. during the last two years (converted into US dollars).

This is a reversal of the trend seen in previous years when vegan stock prices rose sharply. In the long run, a vegan basket would still be a better investment than a meat basket, bringing in 38 percent. vs -10 percent in a three-year period and 20 percent. vs 5 percent over a five-year period. This is solely due to the phenomenal growth of Celsius Holdings, a vegan beverage company, where the share price jumped more than 1500 percent. in five years.

In five years, none of the baskets overshadowed the Nasdaq profits, which increased 67%. However, both did much better over this period than the FTSE100which fell by 5 percent.

| Investing time | Meat stock basket | Vegan action basket | Nasdaq | FTSE100 | Meat vs vegan |

| 1 year | -12% | -51% | -28% | -3% | 39% |

| 2 years | 7% | -36% | -4% | 22% | 44% |

| 3 years | -10% | 38% | 35% | -3% | -47% |

| 5% | 20% | 67% | -5% | -15% |

Share price data taken at market close on 26/10/2022. The index performance is calculated in US dollars.

In addition to Celsius Holdings, the vegan basket contained well-known meat and dairy substitute companies such as Beyond Meat and Oatly, both of which saw stock prices plummet in 2022, shortly after entering the Nasdaq. The basket also consisted of vegan-focused brands in other sectors, such as the cosmetics company ELF Beauty. The meat stock basket included meat giants such as Brazil's JBS, the world's largest meat processing company, and US meat producer Tyson Foods.

Commenting on the data, Ben Laidler, eToro's Global Markets Strategist, He said:

Many of the so-called vegan stocks have risen sharply during the wider VC and technology boom over the past few years, but are now crashing to the ground amid tough market conditions, high interest rates, and the risk of a recession. Many of these stocks have had disastrous results after the relatively recent IPO, though successes such as Celsius show that there are certainly opportunities in this space.

In terms of what is driving recent trends, while vegan continues to grow, incumbent protein companies and established food giants are currently struggling to expand into new non-meat product lines by leveraging their scale and distribution advantages. Traditional meat stocks have been unhurriedly stable and these companies are now likely to take advantage of the fact that consumers are buying cheaper sources of protein in the face of the cost of living crisis, while investors are leaning more towards core value stocks in the current climate.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)