Investing in ETFs - what are the downsides?

Passive Investing is becoming more and more popular. It is often mentioned that ETF it is an excellent financial instrument for an individual investor. Nothing could be more wrong. Of course, investing in ETFs has its huge advantages, but there are no perfect products. ETFs also have disadvantages that are often forgotten. The article presents the weak points of this instrument.

You buy both good and bad companies

One of the greatest "Hidden flaws" ETFs that give exposure to a particular stock market are too diversified. Of course, they will be there soon "Allegations"that diversification is a good solution as it minimizes the specific risk. However, the greater the diversification, the lower the chance of generating a return better than the index. Diversification in the case of many ETFs is moved to the extreme variant. For example, the iShares S&P 500 ETF maps the index S & P 500. As a result, it consists of 500 components. Since all index components are purchased, there is no chance of returning a return other than the index.

By buying the entire "index", an investor buys both good quality companies and companies that have trouble generating shareholder value. For example, by purchasing shares in an ETF on the CAC 40 index, an investor in the portfolio has exposure to both Renault shares, whose shares have fallen by more than 5% over 50 years, and LVHM shares (owner of luxury clothing, perfume or alcohol brands) .

When purchasing an ETF, an investor cannot individually select companies with greater growth prospects and better management, he must accept the "mass" nature of this instrument. When buying an ETF, the investor agrees to buy a basket of shares, which includes both the shares of the best companies from a given index and outsiders. The investor must be aware that a portion of the capital allocated to the acquisition of an ETF will be written off as a result of acquiring shares in poor quality companies. Of course, the advantage of this solution is saving time and not worrying about who will be "Next Amazon". By acquiring exposure to the entire market, the investor will invest some capital in another stock market success. However, the final rate of return on invested capital will be slightly below the benchmark.

A "guarantee" of a result worse than the index

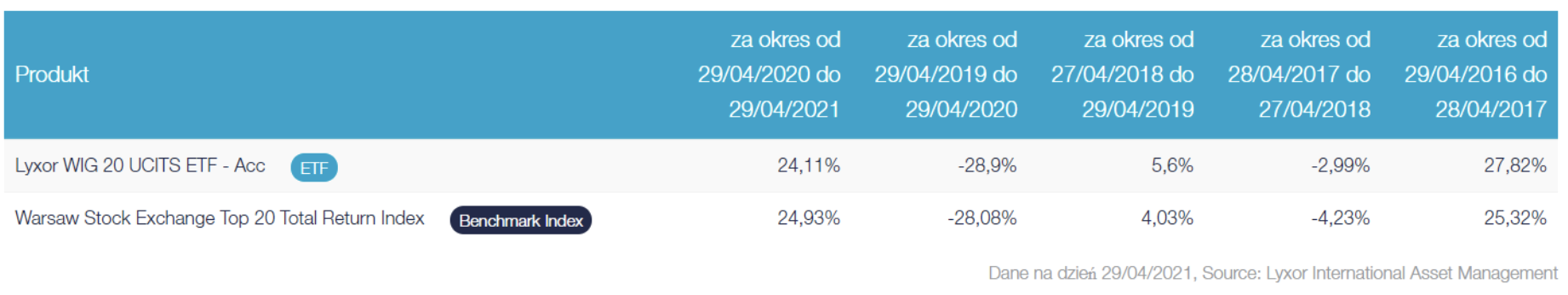

The ETF does not provide a better rate of return than the index. In the long term, it is impossible for the ETF to break the index. Since the ETF mimics the index and charges a management fee, it generates a lower rate of return than the index.

Another problem that is not seen with ETFs is the bear market. While active strategies may try to "use" the moments of the bear market to select shares that have been overestimated, in the case of ETFs such a strategy is not possible (the entire index is bought). This was evident from the last year. From the beginning of May 2020 to the end of April 2021, Saber shares gained over 100% in value. During this time, the price of the S&P 500 increased by "only" 40%. The corporation is also worth mentioning Awhich increased by about 80% during the year.

Investing with ETFs is not a get-rich-quick scheme. It is therefore a product that is best suited for investors with long-term plans who prefer to invest their funds "passively" rather than actively.

Currency risk

Another aspect that an investor must take into account is the currency in which the ETF is quoted. For example, if an investor buys iShares MSCI Brazil ETF (EWZ), he has exposure to Brazilian companies that are mostly valued in Brazilian Real (e.g. on the B3 exchange). At the same time, the ETF itself is quoted in US dollars. For this reason, the investor is exposed to foreign exchange risk, because the achieved rate of return expressed in Polish zlotys will be different from the rate of return of the ETF (valued in US dollars). The investor must be aware of this.

On the other hand, currency risk can be an advantage, as an investor diversifies his currency basket and reduces the influence of his assets on the policy of one central bank.

Tracking error (swap ETFs)

With some ETFs, the investor does not buy the stocks of companies included in the index, but an "approximation" of it. This is especially true for ETFs with exposure to less liquid markets. The worse the mapping the ETF manager is, the greater the difference between the benchmark (index) and the ETF's return. This situation is called a "tracking error".

An interesting example is ETFs with synthetic index replication. An example is the Lyxor WIG 20 UCITS ETF - Acc, which has in its portfolio such shares as Amazon (9,5%), Apple (9,2%) or 10X Genomics INC (9,1%). At the same time Lyxor signed a contract with Société Générale on a swap agreement. Lyxor communicates the rate of return on its portfolio by receiving the rate of return on the WIG 20 index. The ETF fee applies to both the managed fee and the cost of maintaining the swap.

Source: lyxoretf.pl

Popular reasons that contribute to a "replication failure" include:

Conducting a revision of the index

The indexes are revised at specific intervals (quarterly, annually). As a rule, stock indices are weighted with market capitalization after taking into account the free float factor. In the case of large debuts, an extraordinary adjustment of the index is made. At the same time, during market mergers, some companies are removed from the index and another company is replaced. The portfolio manager should track the index promptly. However, sometimes when the index consists of illiquid assets, the demand of an ETF can cause the stock price to rise. As a result, the ETF may acquire shares of such a company well above the intrinsic value.

Reinvesting dividends

ETFs with a "built-in dividend reinvestment function" may have a lower return than the total return index. This may be because the ETF is reinvesting the funds raised from dividends later than shown in the total return calculation.

ETF management costs

Although the fund management costs are much lower than in the case of active funds, they are not zero. These costs are reflected in the management costs (TER). This causes the ETF to achieve a lower rate of return than the index.

Valuation and ETFs

ETFs also have the disadvantage of being "insensitive" to valuations. The ETF is designed to map the index regardless of market circumstances. The influx of funds to the ETF requires the manager to acquire assets according to the component weights in the index. ETF managers do not pay attention to whether the purchased assets are "expensive" or "cheap". As a result, during the market mania the ETF has to follow it. Regardless of whether it makes financial sense or not. This has consequences in the times of the "bubble".

While nowadays the leading indices are close to their historical peaks, there were periods when the indices were in a downward trend for many years. An example is the Nasdaq Composite index, which broke the 2000 peak only after 15 years. When purchasing a hypothetical ETF with exposure to this index, he had to wait many years to "earn" on a passive investment. Another example is the WIG 20 TR (total return - including dividend reinvestment), which at the end of 2021 is lower than at the 2007 peak. As you can see, investing in ETFs is not a "guarantee" of profits.

"Special ETFs" (leveraged, short) - "nuances" that translate into the rate of return

With the development of the ETF market, their specialization increased. As a result, there was a "flood" of ETFs with different investment strategies. This has led to the creation of ETFs with different characteristics. You can mention, among others Leveraged ETFs based on VIX volatility index, short VIX or covered call strategies.

Some of these "specialist ETFs" do not perform well as a long-term investmentbecause it is aimed at actively investing. An example would be the Lyxor Daily ShortDAX x2 UCITS ETF - Acc, which is a leveraged fund (earning against declines). Since 2010, the ETF has depreciated over 96% of its value.

For this reason, the investor should check the "specification" of this instrument before buying an ETF. This will save you from an unwise investment.

Investing in ETFs - Rare Risks

Sometimes investing in an ETF carries very low probability risks. However, they are not null. This applies, inter alia, to changes in the benchmark, the risk of a counterparty or "being pulled from the stock exchange".

The risk of changing the benchmark arises when the ETF issuer decides to change the index to which it corresponds. It can only be a change of a specific index (eg from MSCI to S&P). However, sometimes an ETF may decide to change its investment policy which may be contrary to the investor's expectations. As a result, the assets are invested differently and a different benchmark is created as a benchmark.

An example is the Tierra XP Latin America Real Estate ETF, which in the second half of 2017 changed its investment policy by creating ETFMG Alternative Harvest ETF (MJ), which was the first ETF with exposure to the marijuana market. Of course, such a risk most often applies to unpopular ETFs that have little assets under management (AUM).

Counterparty risk (counterparty risk) applies to ETFs that use synthetic replication. This risk is related to the possibility of default on swap contracts with the ETF manager.

Delisting risk - This is the situation where the ETF manager decides to wind it up. This may be due to insufficient assets. In such a situation, the ETF does not build an appropriate "critical mass". As a result, the management fee revenue generated does not cover the ETF maintenance costs. This makes keeping the ETF "alive" financially unprofitable. The liquidation of the fund entails the need to delist it and buy the participation title from clients. In such a situation, the investor may be forced to sell the ETF at a loss.

Summation

ETFs have revolutionized the asset management industry. ETFs, despite the fact that they are a very interesting financial instrument, have a number of disadvantages that are unacceptable for many investors.

- One of them is too much diversification, which causes the ETF to acquire both the companies that are industry leaders and the stocks of companies that are in declining phase.

- Another "disadvantage" is the "guarantee" of achieving a worse result than the benchmark. Of course, it should be remembered that most actively managed funds cannot beat the market in the long term.

- For some ETFs, the investment policy may not be clear to the investor. An example would be instruments that invest in volatility index futures (buying or selling), the misunderstanding of which may have a negative impact on the achieved rate of return.

Of course, the aforementioned drawbacks are intended to illustrate that investing in ETFs is not an ideal solution. However, despite their disadvantages, they are still a financial instrument that offers cheap exposure to many interesting market segments. Another plus of ETFs is that they offer diversified assets with low management costs. You can read more about investing in ETFs in the section GUIDES.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)