Jackson Hole: If you don't expect too much, you won't be disappointed

The symposium scheduled for this week may provide hints as to the commencement of the US's reduction of its bond purchase program Federal Reserve. However, it is unlikely that Fed chairman Jerome Powell will set the exact dates and details of this reduction. Debate is still ongoing on the macroeconomic effects of the Delta option and the related possibility of temporarily postponing the reduction of asset purchases to a later date. Our baseline scenario assumes that asset purchase constraints may start in November, provided the US pandemic turns out to be positive.

About the Author

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Limiting asset purchases is currently the consensus in the FOMC

Eleven members of the Federal Open Market Committee (FOMC) will decide the timing of this action. Most of them (i.e. Powell, vice president Richard Clarida, president of the Federal Reserve Bank of New York - John Williams, and president of the Federal Reserve Bank of Chicago - Charles Evans) seem to lean towards the end of 2021 / early 2022. Our baseline scenario is that the curtailment of asset purchases may begin in November and each month the reduction will apply to assets worth $ 10 billion, with an emphasis on mortgage-backed securities.

Arguments for limiting asset purchases

We believe this is the right time to start mitigating for the following reasons:

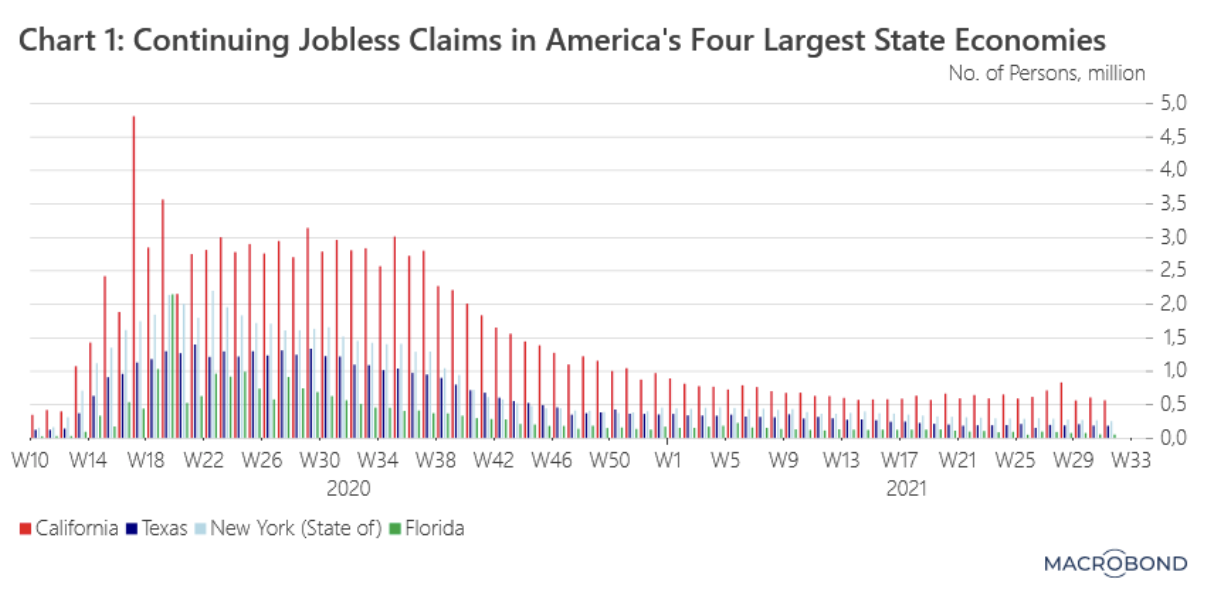

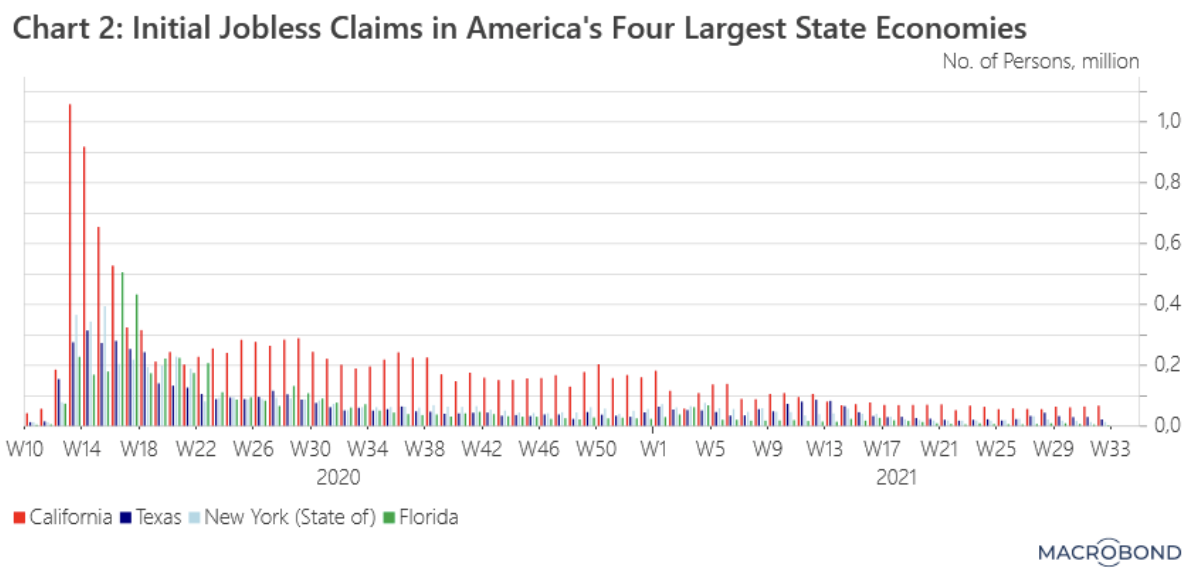

1. The recovery in the labor market proceeds at a fast pace (chart 1, chart 2).

In our opinion, this is the most important signal in favor of limiting asset purchases. The latest data on employment in the non-agricultural sector in July showed a broadly understood improvement. Employment in this sector increased by 943 during the month, and the data for May and June were revised upwards by a total of +120. Moreover, the unemployment rate is falling rapidly. The official U-3 rate, showing the number of people actively looking for work, fell to 5,4% in July. It is forecasted to amount to 5,2% in August. The U-6 total unemployment rate, which is a better indicator of the magnitude of labor underutilization and is therefore crucial for economists, also fell: in June it was 10,1% compared to the peak of the pandemic period (22,40% in August 2020). What may make the biggest impression, however, is that involuntary part-time employment - an indicator of the number of people who would like to work full-time but cannot work - has dropped to 4,48 million, below the long-term average of 5,4 million.

2. There is no reason to further warm up the economy.

According to the minutes of the last FOMC meeting in July, "majority" of participants believe that significant progress has been made towards meeting the inflation target. We suspect that behind the scenes concerns are being expressed about the inflation trajectory (see Figure 3). The data confirm the general view of the FOMC that the current elevated level of inflation is most likely of a temporary nature. However, there is a real risk that inflation will remain high for longer than the Fed and the market assume. Some of the factors behind the increase in inflation are cyclical (including all CPI categories affected by the re-opening of the economy, such as hotel accommodation prices and used car prices). Others, however, are of a structural nature (e.g. no investment in fossil fuels / energy from these fuels, which translates into import prices and core inflation). Increasing the scale of US inflationary pressures is a real threat to economic recovery.

3. Thanks to the expansionary fiscal policy, the Fed may slowly withdraw its support for the economy without much risk.

The size of the current US fiscal stimulus program is enormous. If approved in full, this program will amount to as much as $ 4,5 trillion ($ 1 trillion under the infrastructure package already adopted and $ 3,5 trillion under the partially approved social and environmental package). With greater inflow of funds to the economy in the coming years, it can be expected that economic activity in the United States will remain strong. In this context, the role of the Fed will be primarily to ensure that the overall financing conditions remain broadly accommodative.

We will wait for the details

Powell's speech is scheduled for August 27 at 14 p.m. Market expectations are high. What will be the pace of this reduction? If it is gradual, how long will it take? Will mortgage-backed securities or treasury bonds go first? And what if inflation continues to accelerate above the Fed's annual expectations of 00%? All these questions will remain unanswered. We do not expect Powell to break out of line on the FOMC, or to deviate too much from the minutes of the July meeting. The only real interesting aspect may be the issue of the Delta variant and its effects on the US economic recovery, and potentially the Fed's monetary policy. Last week, Dallas Federal Reserve Governor Robert Kaplan said he might withdraw support to start reducing asset purchases in October due to the Delta variant. This option has not had a significant impact on the mobility of Americans so far. According to the latest data published by Google, the number of people in shops and leisure centers - a reliable barometer of the economic impact of Covid-19 - has returned to pre-pandemic levels. However, there is still no answer to the question of the rate of immunization, particularly in the southern states. Were it not for the Delta variant, it would be almost certain that Powell would have officially announced a reduction in asset purchases in Jackson Hole.

Methodology: Inflation Surprise Index is a real-time model that analyzes the accuracy of Wall Street's inflation forecasts. The positive value of the index indicates that the latest inflation data exceed the expectations of all economists (consensus). A negative reading means that the data on inflation are lower than expected.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)