How deep the bear market could be

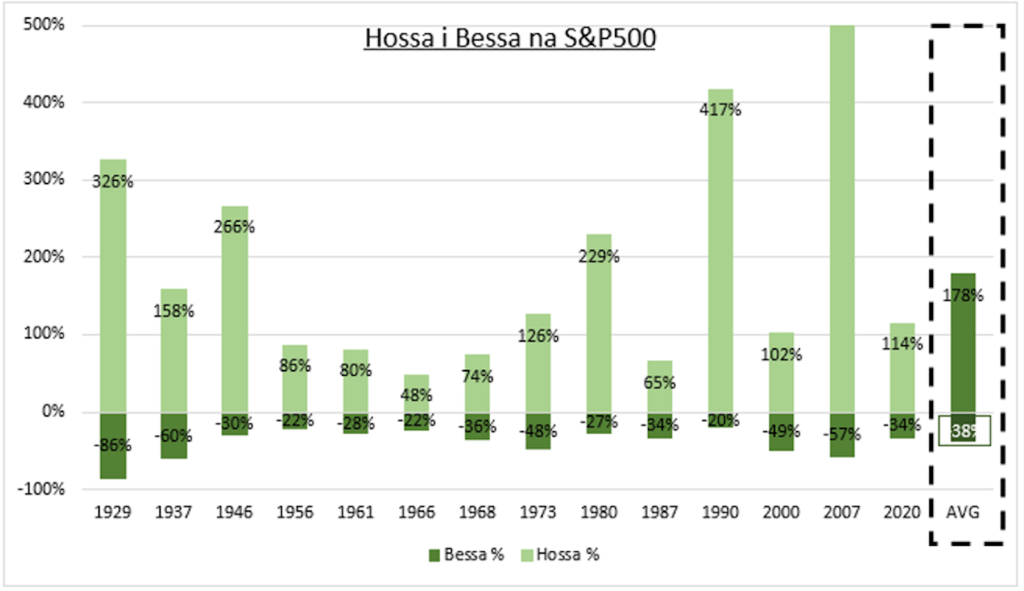

On Monday, a bear market began in the US, the declines in the last five months exceeded 20%. On average, a bear market represents a 38% decline lasting 19 months. Then, however, usually comes a bull market, which lasts 4 times longer and on average brings an increase of 180%. We will have to wait for the boom, while tomorrow we will have another rate hike in the US.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

The chances of an end to declines are small

On Monday, the fall of the American S & P500 index exceeded 20 percent, which means the beginning of a bear market. This may not be the end of declines, however, the risk of a global recession is becoming more and more real. And we may be waiting another 20 percent. decline as average bear market on the S & P500, although rare, lasted 19 months and closed with a decrease of 38%. (see diagram). Currently, we are dealing with a discount of 21 percent. within 5 months. In this situation, the gradual recovery of the economy (U-shaped) remains the baseline investment scenario. However, we should invest defensively to cope well with rising risks.

Recession possible, but not certain

The risk of a recession is increasing, but not yet so high that it is inevitable. So far, economic growth in the US has remained resilient, consumers are saving big and companies have record margins. However, the longer inflation remains high, the higher the risk of a recession. The current sell-off on the market was mainly related to the revaluation of companies that were perceived as too expensive. Currently, the US P / E ratio has dropped to almost 16x, which is below the 10-year average. The situation on the American labor market, where wages have been rising since the beginning of the year, is also not indicative of a recession. Usually, in the event of a recession, they drop by 20%.

In the US, rates will go up tomorrow

Tomorrow we will see a decision on US interest rates, which will most probably be raised by 50 bp. Friday's data on rising inflation in the US are encouraging FED to raise rates faster and to a higher level than previously expected. Soon we will also see the first interest rate hike in the euro zone, where the rates have not been raised yet. Rising rates will reduce growth in Europe. It seems that China, recovering from the pandemic, may be the only growth engine in the world for the time being. Against the backdrop of higher inflation and higher interest rates, the yield on 10-year US government bonds rose to over 3,3%. The growing cost of capital affects financial flows in companies, and this particularly affects the technology sector. Clothing remains expensive, and as the supply of this commodity is limited in the current situation, the market does not pay attention to the possible prospects of a decline in demand as a result of the recession.

However, it is worth remembering what the long-term forecast of a bear and bull market looks like. As mentioned above, while the average S & P500 bear market lasts 19 months, the average bear market is 60 months. During this period, prices increase by an average of 180 percent. It is the bear market that builds the economic foundations for the boom, lowering valuations and forcing companies to operate more efficiently. This is what is happening now, valuations have already plummeted, the financial conditions of companies are tightening, and central banks are raising rates to fight persistently rising inflation.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)