How to invest is only in the States. Facts and myths about the US economy

Each industry is characterized by certain beliefs or stereotypes associated with it. This trend also affects investments. Many myths have arisen among her, and one that I want to write more about today concerns the allocation of capital in the USA. There is a belief (certainly to a large extent justified) that the American stock exchange will always give you money, no matter how overvalued it is. It is worth bearing in mind that there is a grain of truth in every myth. In our case there may be many more of these seeds and I may be tempted to say that sometimes they are 100% true. In today's text we will check whether investing in the US is already a kind of obsolete, or whether myths attached to the American stock exchange are in fact such.

The key is interpretation

Let's start with the elementary thing, i.e. data interpretation. This is where the whole adventure begins with all the economic myths that are often created on the interpretation of one publication, taking it out of the macroeconomic context. We still operate in the world of economic models that set a certain framework for a "healthy" economy. When I say healthy, I mean stable - where economic growth is moderate and unemployment i inflation remain at a low level with no upward or downward peaks (which we observed, for example, in March 2020 for obvious reasons).

Eyes on debt

The day-to-day debt of the United States could be said to be history. We can read about its astronomical levels on every investment portal. What is its impact on the markets? Does the more heavily indebted economy, the greater the risk of recession? Not necessarily. We need to look at the whole situation again in an economic and purely market context. First, let's take a look at the debt in the US.

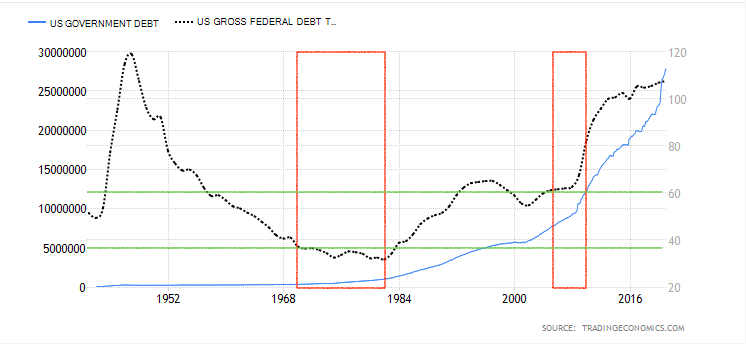

In the chart above, we have two variables - the blue one, which represents the nominal debt in the United States (the value of government debt expressed in USD), and the other, the black variable, which represents this debt compared to GDP (economic growth). I also marked the sites of the recent major recessions (red rectangles) and the percentage levels of debt to GDP (green, horizontal lines). Is there a greater correlation between them? As you can see, not necessarily. The last recession in 2008 was “indebted” at 60% of GDP, while the crises of the 70s and 80s ranged from 30% to 35% of GDP. What conclusions can be drawn from this? Above all, do not jump to conclusions on the high level of debt to GDP. The level of 107,6% means that the debt exceeds the level of economic growth. When talking about debt, it is necessary to mention the factor that has a huge impact on it - the interest rate.

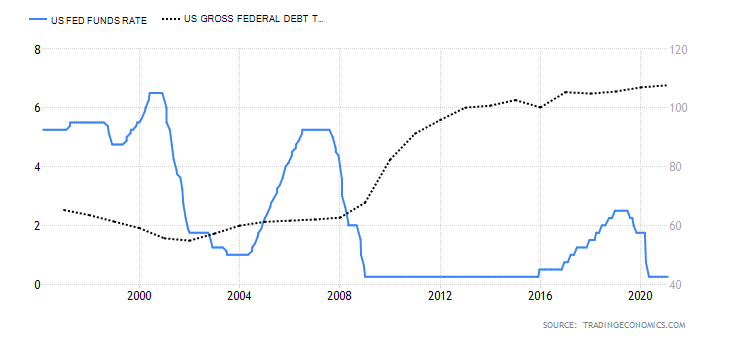

A low interest rate means cheaper debt service. It is hardly surprising, then, that the United States has been so eager to get into debt in recent years. Moreover, we are now dealing with almost zero interest rates as well. Thanks to low yields on safe assets, capital flows to more risky assets, which are shares. So we have a beautiful boom in the indices that we are currently observing. So, can a high level of indebtedness even indicate the necessity of a recession? Not necessarily. It is worth looking at the structure of this debt and the money that creates inflation on risky assets. So is there any regularity in American public debt worth considering? In a broad economic context, yes. However, apart from that, the US debt under the proverbial traffic jam (we are talking about nominal growth) does not prove anything yet.

The market has been growing for too long

There is a lot to talk about re-evaluation when the indices break historical peaks. They grow too often, too fast, too intensely… and there is no surprise either. The breaking of equity baskets to new levels is not a sign of recession at all. Of course, the risk of a correction increases (part of the market will want to take profits), which may lead to a slight sell-off in the short term, but nevertheless, taking into account the long-term horizon, they will continue to gain. Why? First of all, we have low interest rates, and therefore the% return on shares is much better than keeping funds in deposits or bonds. Secondly, solid fiscal packages that keep adding money to the market. There are many more factors, including the mere interest in the stock exchange. So where to look for the first signs of a recession?

Shares and bonds

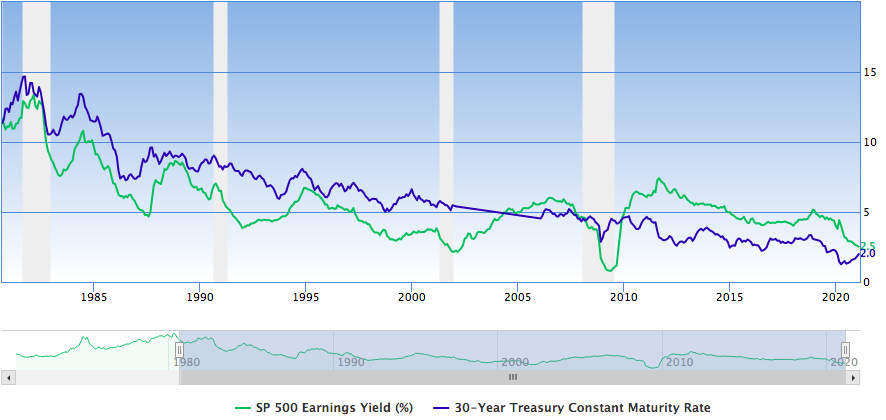

Until recently, a good indicator of a recession was the intersection of the yield of the US index and the return on 30-year government bonds. Why? This is related to the flow of capital from risky to safe assets and risk aversion. Of course, the opposite is true when it comes to the beginning of the recovery phase.

Source: Focus Guru

So let's look at 2008 and the periods closer to 2010. These are the two situations described above, where the profitability of investing in equities flooded and shifted to bonds and vice versa. You could say that we are approaching the current level again. However, it should be cautious. Equities still generate better yields than bonds, which does not change the fact that we are currently seeing a slowdown between the two factors. How long will it take? A month as well, maybe another five years. I am not trying to predict this. Suggestions from comparing the profitability of investing in stocks and bonds make sense only when these processes take place impulsively (e.g. March 2020). At present, however, we can only conclude that there is a slight cooling down process (the profitability of investing in equities has decreased), which does not mean that the new reprinting will not bring about a greater rebound in the corporate securities market. Moreover, keeping these indicators at their current levels, with slight upward or downward revisions, may well continue for the next several years. Can it be said then that the American market is overvalued? One can speak, but what is its coverage in reality? The price of a share in the market itself is the result of several components. Some investors value them fundamentally, some technically, and yet another fraction buys them because of recommendations. A huge part of the market consists of investment funds which, even if there is a bad market situation, must (in line with the strategy from their prospectuses) maintain exposure to shares in their portfolio.

Therefore, it is hard to believe in the myth about the overvalued economy in the US, which is put forward only on the basis of observing the price of indices and individual shares. They are still an interesting alternative (and perhaps one of the only ones) for various types of investors (at the moment mainly individual). The capitalization of the entire US stock exchange is practically 50% higher than GDP. Of course, in order to assess the actual overvaluation, we would have to adjust for non-US generated income.

So what is this economy like?

Looking through the prism of the US indices only, it can be said that they are at "too high" levels. Nevertheless, this statement is far from the truth. While in selected sectors one can talk or reflect on their upcoming sell-off, looking at the broad market, it seems to react "in a healthy" manner to the factors provided to it. What threats must occur for this to change? First of all, maybe not the extremely reverse, but at least limited factors of the current growth. It could be:

- increasing interest rates

- significant reduction of cash overprint

These are two of the simplest and most effective factors that can suck capital out of the stock market. However, leaving these deliberations aside, we should ask ourselves, why would anyone do this? Current activities Federal Reserve continue to show the opposite trend and aim to maintain higher inflation and low interest rates, which have a positive effect on the day-to-day debt service. There are, of course, a whole host of economic parameters that we have not taken into account here (industrial production, procurement, etc.).

Summation

The economy in the US, despite being well indebted, remains a tasty morsel for investors (especially long-term investors). Looking through the prism of previous recessions and the current situation of households and their indebtedness, the recession, even if it were to come, would not be as solid as the previous one, and the "dragging" of the discount that would take place would take much less time than in 2008. an additional factor that actually significantly changed the macroeconomic environment. In fact, drawing conclusions about the state of the US economy solely on the basis of out of context indicators does not make much sense. In the short term, there may actually be corrections of even a few percent, but they will be more the result of profit taking and uncertainty related to the current pandemic situation than the beginning of an unprecedented recession.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)