Japan - capital market. How to invest in Japanese companies? (part II) [GUIDE]

TSE (Tokyo Stock Exchange) is one of the largest stock exchanges in the world and is the largest stock exchange in Asia. The history of the Tokyo Stock Exchange began in 1878 as Tokyo Kabushiki Torihikijo. In 1943, the exchange "absorbed" ten local exchanges creating the Nippon Shōken Torihikisho. The stock exchange was shut down after the Nagasaki atomic bomb exploded.

In 1949, the Tokyo Stock Exchange resumed operations. The 1983 - 1990 bubble meant that TSE capitalization accounted for 60% of the market capitalization of all exchanges in the world. After the bubble burst in the stock and real estate markets, the prestige of the Japanese stock exchange slightly dimmed.

Tokyo Stock Exchange - the leading Asian market

The stock exchange operator belongs to the Japan Exchange Group (JPX), which was formed as a result of the merger of the Tokyo Stock Exchange with the Osaka Stock Exchange. The aforementioned merger took place in 2012 after obtaining approval from the JFTC (Japan Fair Trade Commission). As a result of the merger, the JASDAQ market was included in the JPX group. The JPX Group also has its own clearing house and a goods trading segment.

READ NECESSARY: Japan - between tradition and modernity (part I)

The TSE exchange offers trading in shares, futures, bonds, ETFs and structured products. According to data from the World Bank, the capitalization of the Japanese stock exchange is over $ 5 billion. At the end of Q700 2020, over 2 companies (TESE650 / 1) and 2 companies listed on the JASDAQ were listed on the stock exchange. The Japanese stock exchange also offers broad market access to ETFs (700) and REITs (250).

Nikkei 225 - mostly old economy

Nikkei 225 is the main index of the Japanese stock exchange, which groups the largest and most liquid TSE companies (Section 1 Companies). It is a price-weighted index (similar to the Dow Jones). The index is priced in Japanese Yen. They are excluded from the Nikkei 225 ETFs and REITs.

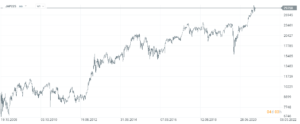

Nikkei 225 - this index was established in 1950. According to data collected by Nikkei, the company's average capitalization was JPY 1 billion. In turn, the median was JPY 862 billion. The index has provided a decent rate of return over the past 879 years. During the analyzed period, the average annual rate of return was around 5%.

Chart of the Nikkei 225 index, interval W1. Source: xNUMX XTB

The index is dominated by companies included in the technology companies sector (47,2%). Another component is companies operating in the consumer goods sector (26,8%). The representation of companies operating in the "materials" segment is also quite large (12,7%).

The range of companies included in the Nikkei index is very wide. There you can find the "Internet conglomerate" Rakuten, a stock exchange operator or a high-speed rail operator. Selected companies from the Nikkei 225 index are presented below:

M3.com (2413)

The company was founded in 2000. One of its main activities is the m3.com portal, which offers doctors and pharmacists a place to exchange medical information. It also offers access to an overview of medical articles in English. Another offer is internet services for pharmaceutical companies. They also offer recruitment and market research services. The company's capitalization exceeds JPY 5 billion.

| M3.com | 2017FY | 2018FY | 2019FY | 2020FY |

| revenues | 78 million JPY | 94 million JPY | 113 million JPY | 130 million JPY |

| Operational profit | 24 million JPY | 29 million JPY | 30 698 billion MXN | 34 million JPY |

| Operating margin | 31,76% | 31,42% | 27,15% | 26,30% |

| Net profit | 16 million JPY | 19 million JPY | 19 million JPY | 21 million JPY |

Source: own study

Japan Exchange Group (8697)

The company is the operator of one of the largest stock exchanges in the world. JPX offers access to Japanese companies listed on the Tokyo Stock Exchange. Additionally, it also offers access to the ETF and REIT market. Japan Exchange Group it also offers access to the derivatives market (indices, stocks, bonds and commodities). Another segment of activity is also the clearing house. The company's capitalization is JPY 1 billion.

| JPX | 2017FY | 2018FY | 2019FY | 2020FY |

| revenues | 108 million JPY | 120 million JPY | 121 million JPY | 124 million JPY |

| Operational profit | 57 million JPY | 70 million JPY | 67 million JPY | 66 million JPY |

| Operating margin | 53,54% | 57,91% | 55,38% | 48,19% |

| Net profit | 42 million JPY | 50 million JPY | 49 million JPY | 47 million JPY |

Source: own study

Central Japan Railway (9022)

The company was founded in 1987. It operates the Japanese high-speed railway (Tokaido Shinkansen), which connects the metropolitan areas of Tokyo, Nagoya and Osaka. It also deals with transport on 12 "conventional" railway lines (Nagoia, Shizuoka). The company's capitalization exceeds JPY 3 billion.

| Central Japan Railway | 2017FY | 2018FY | 2019FY | 2020FY |

| revenues | 1 billion JPY | 1 billion JPY | 1 billion JPY | 1 billion JPY |

| Operational profit | 619,6 billion JPY | 662,0 billion JPY | 709,8 billion JPY | 656,2 billion JPY |

| Operating margin | 35,27% | 36,33% | 37,79% | 35,57% |

| Net profit | 392,9 billion JPY | 395,5 billion JPY | 438,7 billion JPY | 397,9 billion JPY |

Source: own study

Rakuten Inc. (4755)

It is one of the largest technology companies in Japan. The company was founded in 1997. Rakuten is known, among others from the Rakuten Ichiba platform, which is the largest e-commerce platform in Japan (B2M model). The company operates, inter alia, in the fintech segment, having an online bank. Rakuten also owns Viber and is the 4th largest mobile operator in Japan. The company is often referred to as the "Japanese Amazon".

| Rakuten | 2017 | 2018 | 2019 |

| revenues | 944,5 billion JPY | 1 billion JPY | 1 billion JPY |

| Operational profit | 152,0 billion JPY | 170,4 billion JPY | 72,7 billion JPY |

| Operating margin | 16,09% | 15,47% | 5,75% |

| Net profit | 110,6 billion JPY | 142,3 billion JPY | -31,9 billion JPY |

Source: own study

Fast Retailing (9983)

The company was founded in 1949. Fast Retailing is a Japanese manufacturer and retailer of clothing and underwear. The main brand of the company is UNIQLO. At the end of 2019, the company boasted over 2 stores in the world. In addition to Japan, the company operates, among others on the Chinese, Indian and American markets. The company's capitalization exceeds JPY 250 billion.

| Fast Retailing | 2017FY | 2018FY | 2019FY | 2020FY |

| revenues | 1 billion JPY | 2 billion JPY | 2 billion JPY | 2 billion JPY |

| Operational profit | 176,4 billion JPY | 235,6 billion JPY | 257,1 billion JPY | 149,0 billion JPY |

| Operating margin | 50,70% | 51,57% | 55,52% | 52,23% |

| Net profit | 119,3 billion JPY | 154,8 billion JPY | 162,6 billion JPY | 90,4 billion JPY |

Source: own study

ETFs for the Japanese market

Thanks to the dynamic development of the ETF market, the investor does not have to buy individual companies to gain exposure to the selected market. After purchasing the appropriate ETF, the investor obtains indirect exposure to the market or segment. Buying an ETF solves another problem which is that not every broker offers trading on this market. This is important information as not all large Japanese companies are listed on other markets (e.g. the US). For this reason, you can take advantage of the offer of ETFs, which will facilitate the decision-making process.

The largest ETF enabling investments in Japanese companies is iShares MSCI Japan ETF. It has over $ 13,3 billion under management. The ETF was established in 1996 and its benchmark is the MSCI Japan Index. The management fee is 0,51% per annum. The average spread is at 0,01%. Companies from the industrial and consumer goods sectors dominate, with over 44% of the weight in the ETF. Top 5 as of February 05:

| Company | Sector | Weight |

| toyota motors | Telecommunication | 3,95% |

| SoftBank Group | Consumer goods | 3,61% |

| Sony Corporation | Consumer goods | 3,10% |

| Keyence Corporation | Finances | 2,03% |

| Mitsubishi UFJ | Materials | 1,65% |

Source: own study

MSCI Japan ETF. Source: xNUMX XTB

You can also invest in ETFs, in which Japanese companies have a large share. Examples include:

Vanguard FTSE Pacific ETF

-

- Issuer: Vanguard

- Annual fees: 0,08%

- Average Spread: 0,19%

READ ALSO: Vanguard - one of the "big three" of the ETF market

The fund invests in Japanese, Australian, Korean, Hong Kong and Singapore companies. The ETF consists of 2 companies. The largest share is held by Japanese (approx. 412%), Australian (approx. 57,6%) and Korean (16,7%) companies. Assets under management (AUM) at the end of March 14,4, $ 12 billion. The benchmark for the fund is the FTSE Developed APAC All Cap Index.

Japanese market - where to invest?

Forex brokers have a wide range of shares, CFDs on shares and ETFs in their offer.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

Japan is a developed country with a large representation of technologically advanced companies. The economy is very closely related to Asian markets. The main Nikkei 225 index is dominated by industrial, financial and technology companies. The stock exchange lists companies from the automotive sector (Toyota), well-known brands from the household appliances / electronics segment (Panasonic, Sony). Technologically advanced companies (Rakuten) are also present on the Japanese stock exchange.

The Japanese stock exchange is an interesting idea for an investor looking for exposure to the Asian market. However, one should bear in mind the currency, political and macroeconomic risks associated with investing in foreign markets.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Japan - capital market. How to invest in Japanese companies? (part II) [GUIDE] JPX, Tokyo Stock Exchange (TSE)](https://forexclub.pl/wp-content/uploads/2021/03/jpx-tokyo-stock-exchange.jpg?v=1615972001)

![Japan - capital market. How to invest in Japanese companies? (part II) [GUIDE] price compression strategy](https://forexclub.pl/wp-content/uploads/2021/03/strategia-kompresji-ceny-102x65.jpg?v=1615827116)

![Japan - capital market. How to invest in Japanese companies? (part II) [GUIDE] covered call option strategy](https://forexclub.pl/wp-content/uploads/2021/03/strategia-opcyjna-covered-call-102x65.jpg?v=1616143060)

Leave a Response