Jim Simons - a mathematician who beat the capital market

Jim Simons is certainly one of the richest mathematicians in the world. According to Bloomberg, he is the 66th richest man, with a net worth of more than $ 25 billion. However, he did not make his fortune thanks to a scientific career, but thanks to the use of mathematics in the financial market. He was one of the advocates of investing based on quantitative analysis and the application of the momentum strategy. In today's article, we will present the history of this one of the most outstanding investors in history. Jim Simons is one of the top earners in the financial industry. He earned around $ 2020 billion in 2,6. In turn, between 2005 and 2007, he earned a total of $ 6 billion.

In 2019, the magazine Forbes named Simons one of the highest-paid hedge fund managers and traders in history. Jim is also the hero of the book: The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution, by Gregory Zuckerman.

In 2019, the magazine Forbes named Simons one of the highest-paid hedge fund managers and traders in history. Jim is also the hero of the book: The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution, by Gregory Zuckerman.

There are very few people who can beat the market over the decades. Very often, Wall Street “stars” start to achieve worse results after several years of spectacular gains. However, there are some exceptions. The most famous are such investors as Warren Buffett, Ed Seykota, Ray Dailo, Peter Lynch or George Soros.

However, this type of investor can be called "traditional". Some of them used fundamental analysis, others technical analysis or market intuition. However, there is also a person who rejected market dogmas and built a "dream team" of high-class mathematicians, physicists and data analysts. Thanks to the algorithms developed by a team of specialists, the fund generated stunning rates of return. In 1988-2018, the Medallion fund achieved an average annual rate of return of 39% after deduction of fees. The fees were astronomical, 5% a year for management, + 44% of the profit earned by the fund.

For comparison, Warren Buffett's investment vehicle - Berkshire Hathaway generated an average annual profit of 1965% in the years 2018 - 21. The results generated by Medallion are therefore phenomenal. It can therefore be considered that Jim Simons is one of the best investors in the history of financial markets.

Childhood, education, career beginnings

James Harris Simons was born on April 25, 1938 in Brooklyn. James's parents were Americans of Jewish descent. James's ancestors emigrated to the United States in the 20th century from the Russian Empire. James Simons did not complain of poverty because his father owned a shoe factory. Parents placed great emphasis on the education of their children. Young James Simons showed an interest in mathematics. Due to good results in the earlier stages of education, at the age of 23 he entered the Massachusetts Institute of Technology, where he studied mathematics. After graduating from MIT, he enrolled in PhD studies at the University of California, Berkeley. He obtained his PhD title very young, at the age of XNUMX.

During his studies, Simons developed the Chern-Simons form, which was later used in topological quantum field theory. His talent for mathematics was noticed by the US military. In 1964 he was employed at IDA (Institute for Defense Analyzes). At that time, he was responsible, inter alia, for breaking codes during the Vietnam War. After four years, Jim Simons returned to civilian life. He began teaching maths at MIT and at Harvard. The young mathematician began to be encouraged to start working in corporations. The queue of applicants was very large, he was approached by, among others IBM, which at that time was for many a "dream workplace".

During his studies, Simons developed the Chern-Simons form, which was later used in topological quantum field theory. His talent for mathematics was noticed by the US military. In 1964 he was employed at IDA (Institute for Defense Analyzes). At that time, he was responsible, inter alia, for breaking codes during the Vietnam War. After four years, Jim Simons returned to civilian life. He began teaching maths at MIT and at Harvard. The young mathematician began to be encouraged to start working in corporations. The queue of applicants was very large, he was approached by, among others IBM, which at that time was for many a "dream workplace".

The beginning of the adventure with the financial market

In 1978, James Simons founded a hedge fund Monetimetrics. The beginning of the adventure with finance was not accidental. Young Jim invested in the capital market for many years. Initially, the fund's focus was on investing in the foreign exchange market. Contrary to appearances, initially the fund operated in a "classic" way. After a while, however, Jim saw the potential of analyzing big data. The said data was used to test investment strategies and search for market patterns and anomalies that could generate profitable trades.

Simons knew he did not have enough time alone to devise strategies, collect data, and test investment ideas. He decided he needed help. But instead of hiring seasoned Wall Street analysts, he chose another source of talent. Jim chose the world of scientists because he believed that gifted mathematicians would bring a new perspective to the financial market. The first transfer was the employment of Leonard Baum, who was a cryptographer at the IDA military institute. Leonard was the co-author of the Baum-Welch algorithm. Another employee was an outstanding mathematician, James Ax. The work of outstanding scientists resulted in the construction of a huge database and the development of advanced mathematical models that tested "investment ideas" or correlations between instruments. It should be noted that it was the first fund to apply a scientific approach to the market on a large scale. As a result, fund employees were able to detect market anomalies or correlations faster and profit from market inefficiencies. At the same time, they were not content with short-term successes, trying to constantly improve their algorithms. James Simons tried not to hire people after working in the financial industry, because he was afraid that their developed habits would have a negative impact on the quality of the algorithms. The only possible exception was financial professionals with exceptional big data analytics skills.

Establishment of the Medallion Fund

Elwyn Berlekamp, source: itsoc.org

In 1988, the legendary Medallion fund was established. It used models built by Baum and Ax. The start wasn't very good. The fund under management recorded a 30% decrease in equity. Ax thought it was normal and true to the model. Simons, on the other hand, decided to investigate the situation and make sure that all the algorithms were working properly. He turned to a professor at the University of California - Elwyn Berlekamp - for help in running the Medallion.

Work on improving the algorithm took several months. In 1990, the first visible effect of work appeared - the fund generated a profit, net of fees at the level of 55,9%. A year later, Elwyn sold his shares and returned to teaching math. His role was taken by Sandor Straus. The following years also brought very good results. In 1991, the fund's profit was 39%, a year later investors earned 34%, after fees. Since 1993, due to its successes, the fund has aroused increasing interest among investors. As a result, the fund managers decided that the fund would become closed to outside investors. From that moment on, only its employees or their families can become members of the fund.

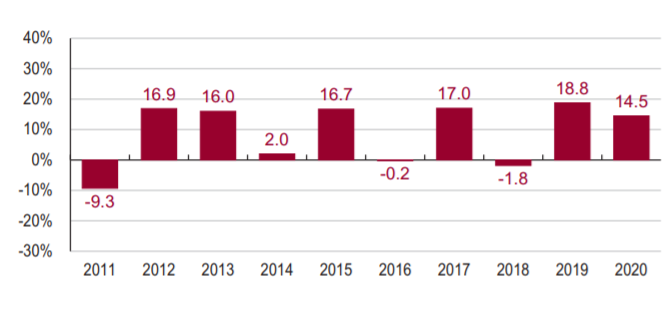

Over the years, the fund has generated very stable profits. Between 1993 and 2004, the fund had a monthly loss for only 17 months. In turn, looking at the quarterly results, the Medallion fund was "on the line" only for three quarters. James Simson retired in 2009. Despite this, the fund continued to provide investors with above-average returns. For the first thirty years of the fund's existence, gross return was 66%, followed by 39% after fees. As a result, it generated over $ 100 billion in profit for its investors.

Renaissance Institutional Equities Fund (REIF), RIDA, RIDGEF

In addition to its flagship project, Renaissance Tecnologies also owns three other funds:

- Renaissance Institutional Equities Fund (REIF),

- Renaissance Institutional Diversified Alpha (RIDA),

- Renaissance Institutional Diversified Global Equity Fund (RIDGEF).

In the case of the REIF fund, at the beginning of December 2021 it had over $ 1,6 billion in assets under management. The fund invests in the global stock market (outside the United States). According to data prepared by the fund, it invests mainly in the Japanese (20%) and Swiss (15%) markets.

Family life

Jim Simons has been married twice. The first wife was Barbara Simons, with whom the relationship lasted 15 years. The marriage broke up in 1974. Marilyn Hawrys Simons became the second partner. Despite the market successes, life did not spare Simons. In 1996, one of his sons - Paul Simons - was fatally hit by a car. Paul Simons was 34 years old at the time of his death. The second son - Nocholas - drowned while on vacation in Bali. It is worth mentioning, however, that one of his sons - Nat Simons - followed in his father's footsteps and developed a career in the financial market.

Jim Simons: Controversy and Punishments

The fantastic results generated by the Medallion fund were one of the complaints made by clients who invested in funds open to outside investors. One of the scandals started in the spring of 2009. Investors in the RIEF open fund lost 2018% in 16. In turn, the Medallion fund, closed to investors from outside, published a profit of around 80% in the same year.

Renaissance Technologies is on the radar of the American tax office (IRS). The tax office believed the fund undeservedly benefited from a lower tax rate, avoiding taxation of several billion dollars. Renaissance Techenologies classified short-term profits (including from option transactions) as long-term investments. In the US tax system, long-term investments are taxed less than short-term investments. In 2014, the IRS estimated these unfair reliefs at $ 6,8 billion. The legal battle lasted for seven years. Ultimately, in September 2021, the company reached a settlement and the tax office. Renaissance Technologies agreed to pay $ 7 billion in back taxes and IRS penalties.

Philanthropy

Jim Simons, like many billionaires, donates a portion of his fortune to charity. To date, it has allocated over $ 2,5 billion to various forms of aid. In 1994, Jim and his wife Marilyn founded the Simons Foundation. The aforementioned foundation supports projects related to education, health or supporting scientific projects. In 2003, the SFARI (Simons Foundation Autism Research) foundation was established. Its aim is to raise awareness about the disease and to improve diagnostics.

Jim Simons used a portion of his fortune to fund universities to improve the teaching of mathematics and new technologies. For example, in 2012, the Simons Foundation allocated $ 60 million to found the Simons Institute for the Theory of Computing. The aim of the institute is to support research in computer science. After eight years, Simons funded the operation of the institute with $ 35 million.

Simons also spent a lot of money on the development of Stony Brook University. Over the past 15 years, it has provided over $ 230 million in grants. With these funds, the Simons Center for Geometry and Physics was founded in Stony Brook. Part of the money was allocated to the development of medical science.

Investment strategy

The Medallion fund did not conclude transactions based on classic technical or fundamental analysis. He concentrated on testing investment ideas by processing huge amounts of data. Initially, analysts processed data from session opening and closing. Only after many years of work did they start processing session data. In time, one of the first began to analyze the market on tick chart. The fund's employees tried to develop systems that had the potential to generate a market advantage. The system did not need to have a high percentage of successful transactions, it just had to generate a positive expectation value. Many different systems were tested, such as the effectiveness of transactions on certain days of the week or buying when the opening is much lower than the closing of the previous session. However, when developing investment strategies, analysts faced a number of problems:

- the system operated on historical data and made losses in the real environment. In such a situation, the problem could be price slippages or too low liquidity of the instrument,

- in the code written by the programmers there could be errors that no one noticed during the testing phase,

- during a series of capital slips, it was necessary to determine whether the correlations had expired or whether the loss generation period was natural for the systems.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-300x200.jpg?v=1709558918)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-300x200.jpg?v=1711601376)