Joel Greenblatt - Do you want to beat the market? Think differently!

Joel Greenblatt is one of the most famous investors who have managed to beat the market for many years. As one of the few successful investors, he likes to share his knowledge. He is also the author of very popular books aimed at educating individual investors. He believes that self-employed investing requires discipline, patience and a clear investment strategy. As Warren Buffett is an advocate of value investing.

Joel Greenblatt was born on December 13, 1957 in Great Neck, New York. His parents provided him with a good education. In 1979 he graduated with honors (summa cun laude) from the Wharton School at the University of Pennsylvania. In 1980, he earned an MBA. While studying at Wharton, he wrote an article, "How Small Investors Can Beat the Market," which was published in The Journal of Portfolio Management. After graduating from Wharton, Joel began studying law at Stanford, but dropped out of his education after a year and focused on pursuing a career in finance.

Founding of Gotham

A career development in finance allowed him to gain the confidence that allowed Joel to start his investment firm. Greenblatt launched a hedge fund under the name Gotham City. The share capital was $ 7 million, most of which came from Michael Millen. It is worth mentioning that Milken was hailed in the XNUMXs "King of junk bonds". The very etymology of the name of the fund is very interesting. Gotham is the name best known from the Batman comics and movies. However, few people know that in the nineteenth century it was one of the words of New York.

The fund began operating in 1985, and four years later Robert Goldstein joined the team, who still works with Greenblatt. Gotham focused its attention on "special market situations" that might not be very clear to investors at first glance. This concerned, among others, the separation of companies from the organization (spinoff) or the restructuring of companies. The fund sought to determine the intrinsic value of the acquired company and buy it at a lower price. The results were amazing. Between 1985 and 1994, the fund earned an annual average of 50% (gross). Along with the fantastic results, there was an inflow of capital from investors. Due to the fact that larger capital is difficult to manage, in the years 1995 - 2009 payments from external investors were not accepted.

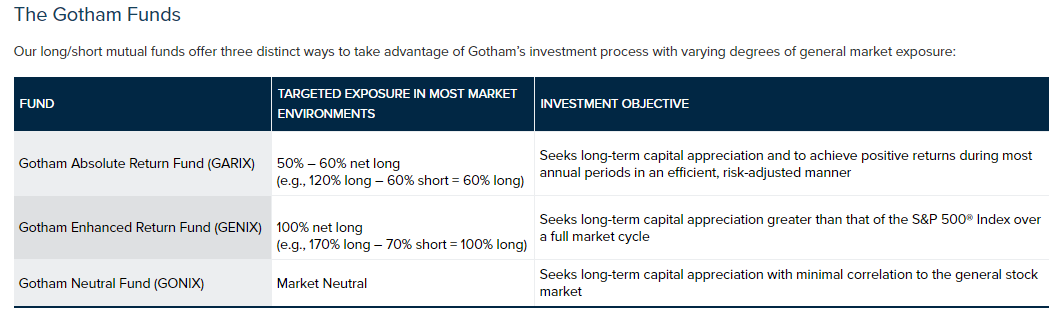

In 2008, Gotham Capital changed its name to Gotham Asset Management. Two years later, Gotham introduced "regular" mutual funds to its offering. New funds have become very popular. In 2014, new funds had approximately $ 5 billion under management.

Cooperation with Scion Capital

In 2000, Gotham Capital helped Michael Burr (one of the heroes of Big Short) in creating a hedge fund - Scion Capital. Gotham put $ 1 million into the fund. With the fund performing well, Gotham started putting in more capital. In October 2006, Gotham had $ 100 million in Scion Capital. The cooperation was exemplary until Michael Burry decided to play against the American housing market. For this purpose, Scion Capital used illiquid derivatives as they were CDSs (Credit Default Swap). Initially, the investment brought losses, and some clients, disagreeing with Burry's views, wanted to withdraw their money. However, this would result in Scion not having enough cash to maintain its CDS positions. Michael Burry made use of a point in his prospectus that allowed for the holding of withdrawals from the fund (the so-called side pocket). It wasn't until August 2007 that Burry began making withdrawals from the fund. Scion made over 100% of the deal, but that didn't convince Gotham to stay with Scion. After removing the side pocket, Gotham withdrawn all funds invested in Scion Capital.

Investment philosophy

Greenblatt uses fundamental analysis in its Gotham funds. Joel is a long-short trader. This means that it buys undervalued companies and sells overvalued companies. It focuses mainly on US large and medium-sized companies. Depending on the fund, "net long" ranges from 50% - 100%. This means that Gotham funds are always on the long side of the market. For example, in a fund GARIX (Gotham Absolute Return Fund) For every $ 100 in capital, Gotham buys $ 120 stocks and sells short stocks for $ 60.

Joel Greenblatt believes that to beat indices you have to think differently from the market. He believes that market valuations are moving around the fundamental value of the index, but sometimes they overestimate the value of the company, other times the company is underestimated. Therefore, those still investing in value have a chance to acquire companies below their fundamental value. Joel believes that if the company is indeed undervalued the "market" will eventually accept it. It is not known whether it will be in a week or 5 years. For those interested, a link to the video with Greenblatt.

Value Investors Club

This is another of Greenblatt's initiatives. The club is not an open association. You can join it only after going through the application process. The maximum number of club members is 250. Value Investors Club's task is to share recommendations that are to generate above-average rates of return. Authors of the best investment advice are awarded a prize of $ 5000.

Philanthropy

Like many rich people, Greenblatt spends some of its fortune on charity. In 2002, he donated $ 2,5 million to a primary school in Queens, where students were children of immigrants from South America and South Asia. In 2008 it was awarded Gotham Prize for Cancer Research worth $ 1 million. The winner of the award was Aleksandr Warszawskij for his attempt to find a sensitive feature of a cancer cell that will not change during the development of the disease.

The magic formula

Joel Greenblatt is also the author of the "magic formula" which he outlined in his 2005 book, "The Little Book That Takes the Market." It is a set of formulas to help find companies that manage capital very well and are affordable. The investment method is easy to understand and use. The aforementioned magic formula teaches investors to approach investments methodically and without emotions. The formula is based on investing in value. According to the data presented in the "Little book .." the annualized rate of return on the strategy was 30%.

One of the key elements of the formula is the profitability of capital, which should exceed its cost. Only under this condition can the enterprise generate value for the investor. Rather than analyzing each company in depth, Greenblatt recommends using a scanner and selecting the top 20-30 companies that meet the investment criteria.

Według "Magic formula" before selecting companies, a selection should be made:

- Select companies above the capitalization of $ 100 million,

- exclude companies from the financial and public utilities sectors,

- reject companies listed via ADR (American Depository Receipts),

- calculate the company's profitability calculated as EBIT (Earnings Before Income and Taxes) divided by EV (Enterprise Value),

- estimate the return on capital calculated as EBIT divided by the sum of net fixed assets and working capital,

- rank companies according to the highest profitability and return on capital,

- buy 2-3 companies a month from the top 20 companies in the ranking,

- rebalance the portfolio at the end of the year,

- repeat the process over the next years.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-300x200.jpg?v=1709558918)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-300x200.jpg?v=1711601376)