KNF asks for the opinion of individual investors regarding the Forex market

The Polish Financial Supervision Authority wants to learn, among other things, what level of leverage would be optimal for the Polish investor, or if the leverage has moved to non-EU countries, to benefit from greater leverage and if ESMA's intervention has influenced it to invest in other financial instruments. The survey will be available on the KNF website 22 April 2019 year.

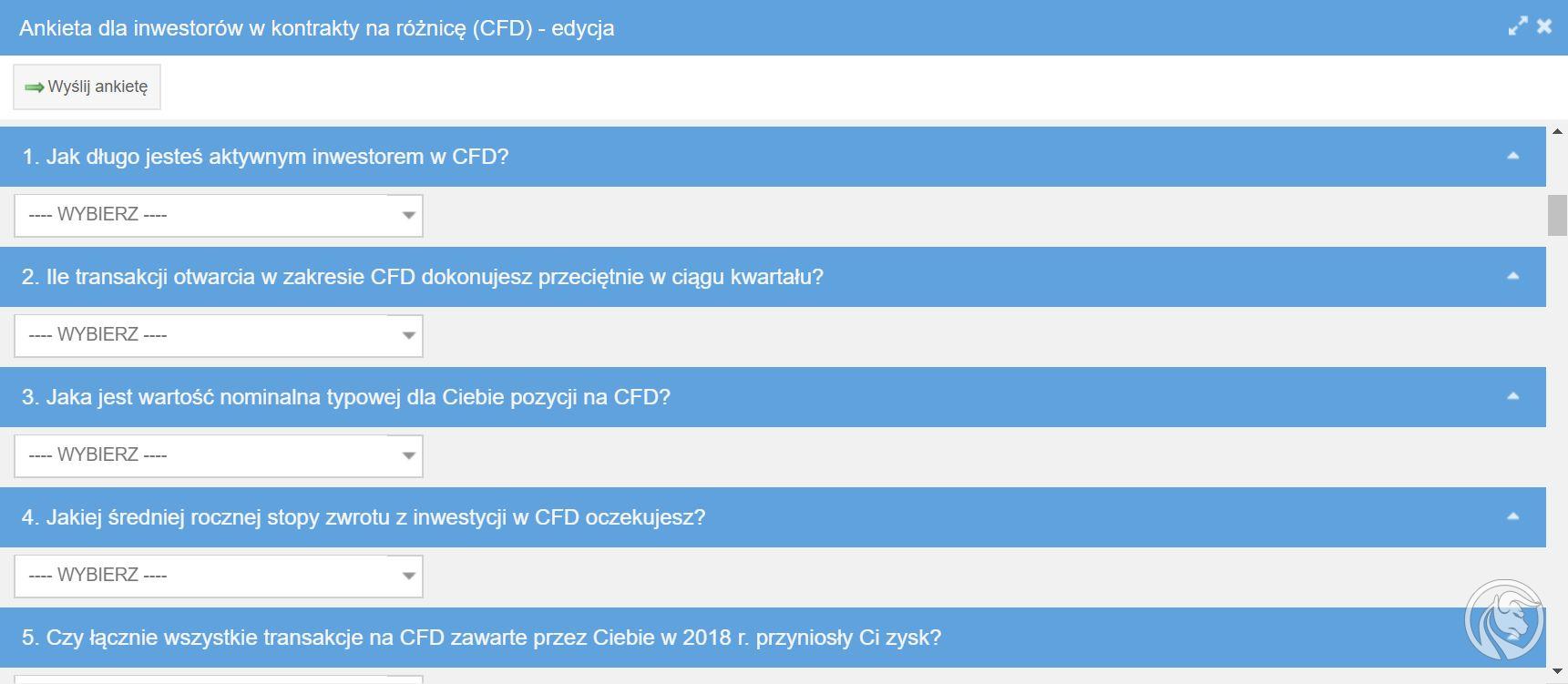

The questionnaire has appeared on the website of the Polish Financial Supervision Authority and can be completed by any investor. Regardless of how long he has been on the market, what capital he trades and with which broker his account is - it is important for the Polish Financial Supervision Authority, because he wants to know the opinion of all investors, including those who conclude transactions via platforms outside Poland.

The survey was published in connection with the fact that the Polish Financial Supervision Authority is still carrying out work that will probably result in product intervention in the CFD and Forex market. One of the elements of preparing the intervention is to consult investors. The questions are to examine the preferences of Polish investors, regardless of whether they are present on the financial market through the intermediation of domestic brokers or use the services of foreign companies. Regardless of whether they have a retail or professional account.

An investor on the CFD market, or who?

The survey will also help to create a profile of a Polish investor. That's why there are also classic questions about theoretical preparation for investing or speculation on financial markets. The KNF is interested not only in education, but also in the type of work performed and the position in the company. There is also a detailed question about the certificates and permissions held, related to the financial market, investment risk or individual financial instruments.

Be sure to read: The KNF publishes the report. 21,1% of traders recorded a profit in the 2018 year

There are also questions about 2018 - did it end with a profit, loss and in what amount. We also mark how many transactions we make in a quarter, what is their average size, and what level of risk / loss is acceptable for the investor.

How big should the lever be?

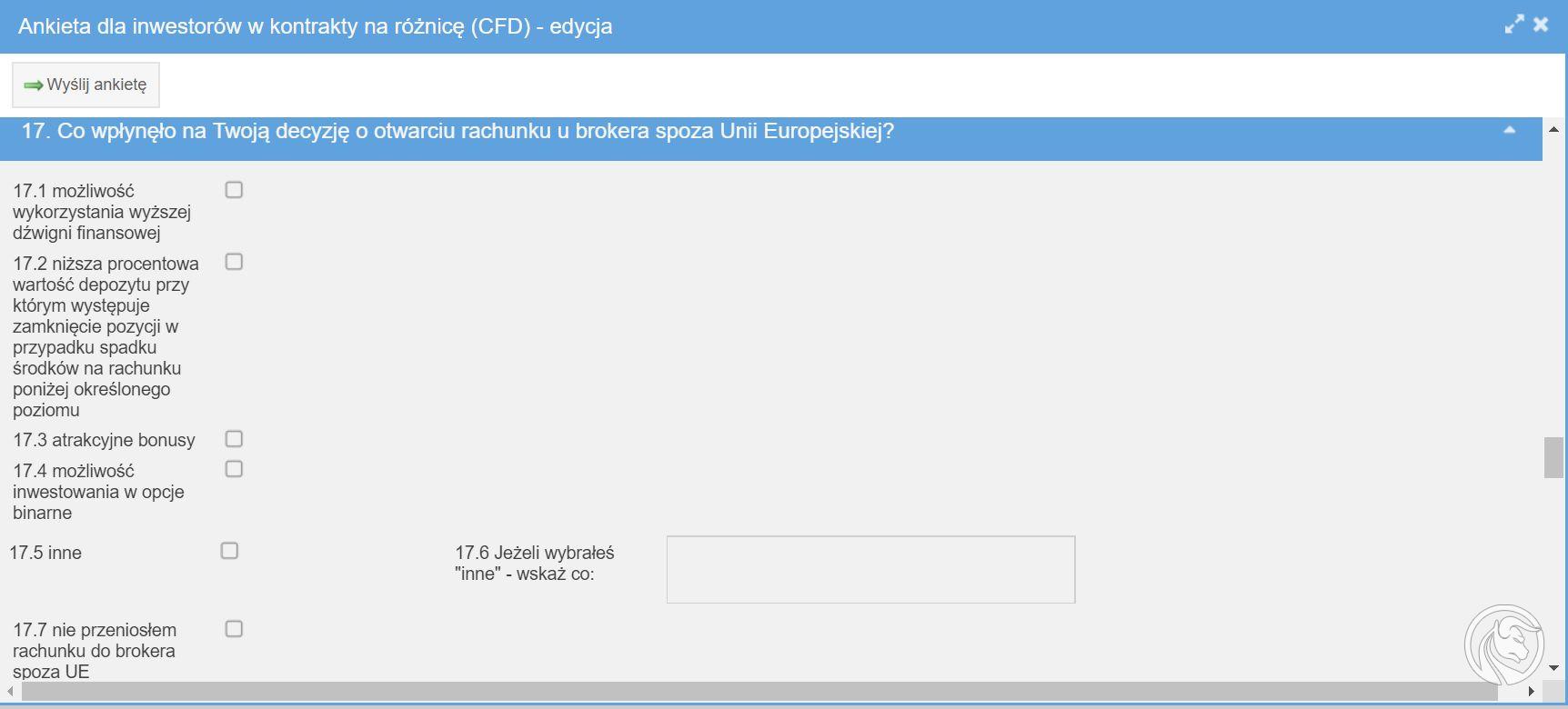

The quintessence of the survey is, however, preparing the answer to the question what leverage level is optimal for the Polish investor on the CFD market. The Polish Financial Supervision Authority also asks whether, as a result of the intervention, you started investing in instruments other than CFDs: from cryptocurrencies, for contracts or shares. He is also interested in whether the changes had an impact on the transfer of the account to a broker operating outside the European Union (where the lever is bigger) or whether you even consider a change that will allow for greater leverage of investments.

The key is, however, the question as to what maximum leverage level at the broker would be optimal. If the opinions are confirmed, which can be read even on many discussion groups concerning the Forex market, it may turn out that most of the answers will not mean the regulator, because many investors do not want too much restrictions in this field, accepting the risk resulting from high leverage, also, of course, affecting the opportunity to earn more by controlling a larger position.

Rate the quality of the broker's services

Some of the questions in the survey also concern how we evaluate the services provided by the broker. The assessment is issued on a six-point school scale. You can review both Polish brokers and their competitors from outside the European Union. Not only the basic factors such as the transaction platform, security of funds or protection against negative balances were taken under the microscope, but also access to the high level training offer and organized competitions for traders.

The cost of training is also compared with brokers from the European Union and from outside the EU, as well as their usefulness and substantive content.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

Leave a Response