Commodity Sector: The Hossa Stalled - Short Term Drop?

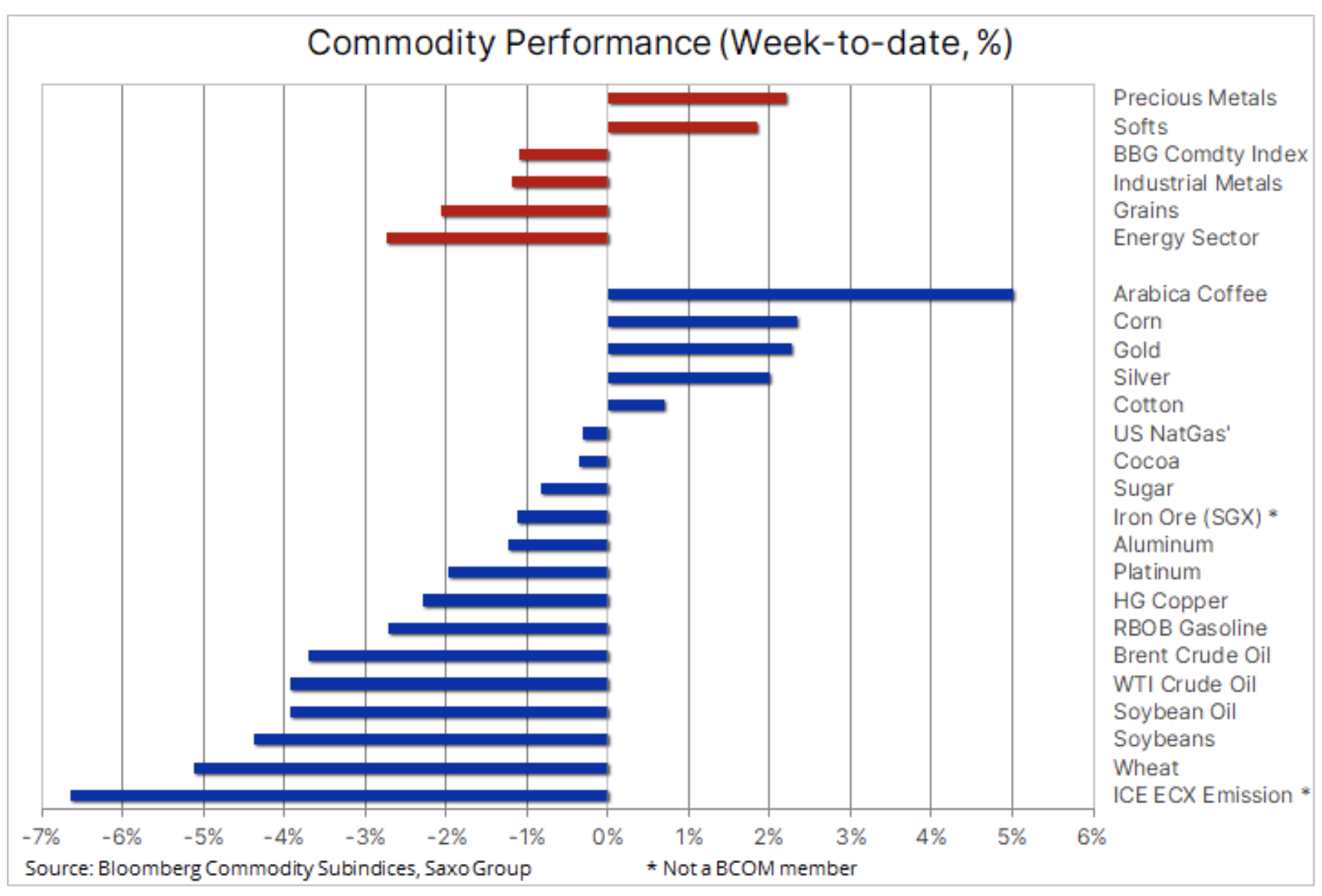

The commodities sector fell for the second consecutive week, and the risk of a correction is increasing more and more after a sharp rise in April. The main loser was crude oil, which depreciated in anticipation of an increase in Iranian supplies due to progress in lifting sanctions. Industrial metals also suffered losses after the Chinese government announced its efforts to reduce inflation in this sector. In the agricultural sector, the situation was mixed with wheat and soybeans depreciated on improving US weather conditions, while coffee appreciated on drought fears in Brazil.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Overall, the Bloomberg commodity index fell 1,1%, contributing to the decline in US inflation expectations, and the ten-year above break-even yields fell 10 basis points to 2,45%. As a result of these events, there was a quick reversal of the dollar boom, initiated by the publication of the minutes of the FOMC meeting, and the EUR / USD pair reached the highest level since January. The situation in the commodity sector was also influenced by the risk aversion caused by the Wednesday collapse on the cryptocurrency market; The notable exception here is gold, which saw a wave of purchases from investors who found the excessive volatility of bitcoin and other cryptocurrencies too problematic for them.

The overall forecast assuming an increase in commodity prices has not changed, and although the energy sector may slow down while the Iran reports are analyzed and the coronavirus outbreak is resolved, the industrial and precious metals sectors - for completely different fundamental reasons - are likely to continue to receive adequate support .

The fatigue with buy transactions among speculative investors started to be visible even before the last weakening. Report Commitments of Traders in the week ending May 11, when the "hottest" raw materials, such as copper or maizehave reached new highs, showed that hedge funds made the decision to cut their exposure rather than prolong the boom by adding more long positions. So far, the reductions have been limited, but indicate that a given sector may enter a period of consolidation.

Highly ranked industrial metals went down; HG copper had a well-deserved breath after the last almost vertical strengthening. While the baseline fundamentals are still very strong, especially for copper, due to the pressure on 'green metals' needed to drive global decarbonisation, some investors realized gains, while others were concerned about the world's largest consumer trying to reduce commodity prices. China. This fear is related to the recent announcements by the Chinese authorities that they intend to strengthen the management of the demand and supply of raw materials in order to limit "unjustified" price increases.

After more than double the increase since the low from 2020, copper can "afford" a correction of 15% without breaking the annual upward trend. In our view, a correction of this order is not possible with short-term support focusing on the area between $ 4,30 and $ 4,37, reflecting an additional 6% decline.

Petroleum

On Friday Petroleum made an attempt to stabilize after the largest weekly loss since March due to reports of a potential recovery on the Iran nuclear deal. By then, Brent crude oil had hit the $ 70 level, though it had yet to beat it once again as the lack of a synchronized global recovery in demand temporarily limits Brent's ability to strengthen. Despite the strong increase in fuel demand in the United States and Europe, further coronavirus outbreaks in Asia will continue to negatively impact the short-term outlook, including the recovery in aviation fuel demand, a process that seems extremely slow due to protracted restrictions and a lack of interest in intercontinental flights.

Oil prices were also affected by a general correction in commodity markets following a warning from China that it intends to introduce measures to contain the rise in commodity prices. The Brent oil price spread has declined, showing the lowest deportation this year, suggesting that supply in the market is starting to pick up. Given the potential return of Iranian crude oil supplies and OPEC + already started to increase production, the price of Brent crude oil is likely to remain in the $ 65-70 range and the short-term risk will decline until the demand situation discussed above improves.

Precious metals

The market has been booming for six weeks gold and in addition to the increase in momentum after breaching the 1-day moving average, the support is currently at $ 845 and the downtrend line from August's high. The main drivers of the price of gold were the stable yields on US Treasury bonds and the weakening of the dollar, as well as the very high volatility in the cryptocurrency market, as a result of which this new sector has lost its attractiveness as a method of value storage. This was underlined by JPMorgan's comment that as concerns about inflation intensify, the largest investors they started to give up Bitcoin for traditional gold investment.

Silver it has defeated gold since its early April low, and has supported gold at numerous critical moments during the recent boom in breaking through key resistance levels. However, after the gold-silver ratio dropped from over 70 ounces of silver to one ounce of gold in early April to a minimum of 65,50, as well as the cryptocurrency market crash on Wednesday and profits on the industrial metals market, this relationship strengthened to about 67,5. This highlighted the new demand for gold from investors seeking hedging against market uncertainty and rising inflationary pressures.

For the gold rally to move beyond current levels, US economic data should continue to follow a downward trajectory. Although this would not reduce the inflationary pressures favorable to gold, a period of US data correction would help to keep the yields on US government bonds stable and at the same time put downward pressure on the dollar.

The key level to consider for the break above $ 1876 is $ 1922, a 61,8% retracement from the August-April correction line. Support is at $ 1 (two-hundred-day moving average) followed by $ 845 (twenty-one-day moving average).

Agricultural commodities

On the market of agricultural products, last week was varied: soybean lost about 4% after easing the downturn in the upward momentum due to the rapid pace of seeding in the United States, while wheat more than 11% was the result of heavy rainfall in Kansas, the main crop-growing state, that increased the chances of a record yield. The price of maize rose due to limited supply, mainly due to unprecedented purchasing of this product by China, as well as increased demand from the renewable fuels industry.

"Soft" products gained in value - it was at the top of the table last week arabica coffee after an increase of 5% to a nearly four-year maximum. Persisting drought in Brazil negatively affects crops at a key stage of their development; Moreover, in the years 2020-2021 the droughts were so strong that they contributed to the reduction of the number of new nodes on trees, which will reduce the yields in 2022. Due to the above factors, there may be a change in the context of the synchronized boom that supported the sector in recent months agricultural, in a more selective direction based on individual events.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)