Maize - how to invest in maize? [Guide]

If you are wondering how you can invest in corn, this guide is for you. Corn is one of the most interesting and popular instruments from the class of agricultural products listed on financial markets. As wheat market, also corn is characterized by high volatility and interesting prospects in the assumption of a longer term (something for players speculating strictly in the long term). In this article, we will comprehensively discuss this market and present specific ways to invest in maize.

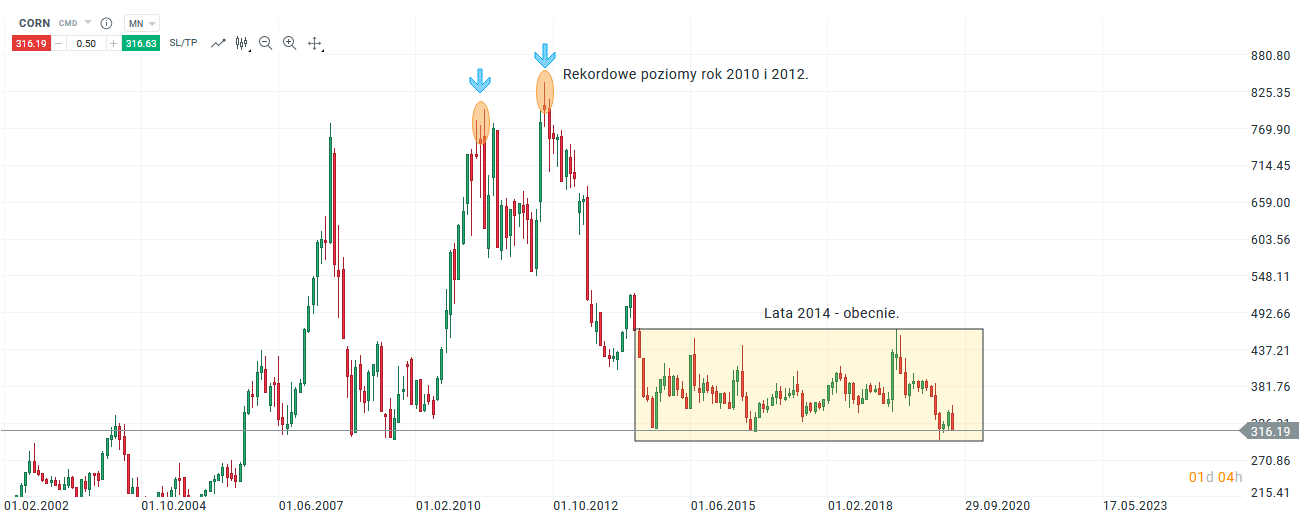

Chart - Corn

Corn - basic information

If you want to describe corn in one sentence, you can say that it is the most versatile and complex congregation in the world. It is one of the basic food commodities on Earth. In addition, it is used in a number of other industries, such as biofuels, production of animal feed or energy. The origin of maize goes back thousands of years BC. After the discovery of America, it was brought to other continents, including Asia and Europe.

It is estimated that maize production is about one billion tons per year. The largest producers are:

- United States,

- China,

- Brazil.

As with wheat, corn is priced in dollars per bushel. One bushel equals 27.216 kilograms.

Looking at the historical performance of this stock, you can notice several key periods and a certain sinusoid. The first was the 70s, the period from around 1971 to 1974. It was then that the first sharp increase in the rate took place, from $ 1.20 a bushel to $ 3.94 a bushel (the price more than tripled). Then there was a decline that lasted until 1977. Then there was a sharp increase again and the price hit an all-time high of more than $ 4 a bushel. Looking at the historical records, there were also periods of consolidation (2002-2006). From the buyers' point of view, by far the best periods were 2010 and 2012, where the price reached a record level of over $ 8. Looking at the quotes, now we can see that history likes to repeat itself. From 2014 until today, the trading price is between $ 4.60 and $ 3.10 a bushel during the consolidation period.

Corn chart, MN interval. Source: xNUMX XTB.

Corn in Poland and the EU

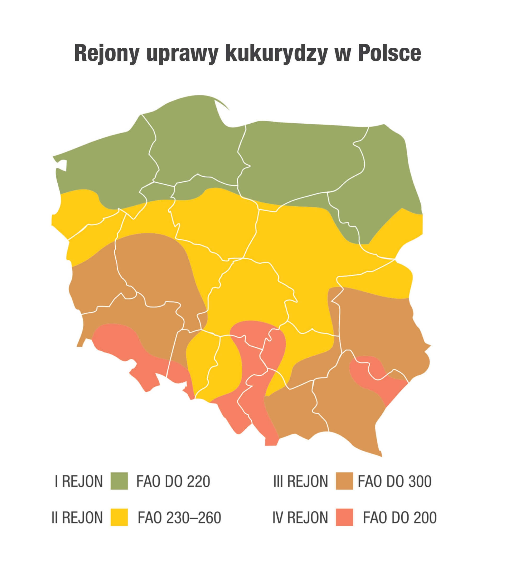

Looking at the cultivation areas in Poland, you can observe an interesting relationship with the division into the northern, central and southern parts. The central part definitely dominates in this respect.

Corn growing areas in Poland. Source agrolok.pl

It is also interesting that we are currently dealing with a significant increase in the import of maize in the EU. Based on the statistics, this is an increase to the level of approx. 19.4 million tonnes, which translates into an almost 35% increase compared to the previous 5 years.

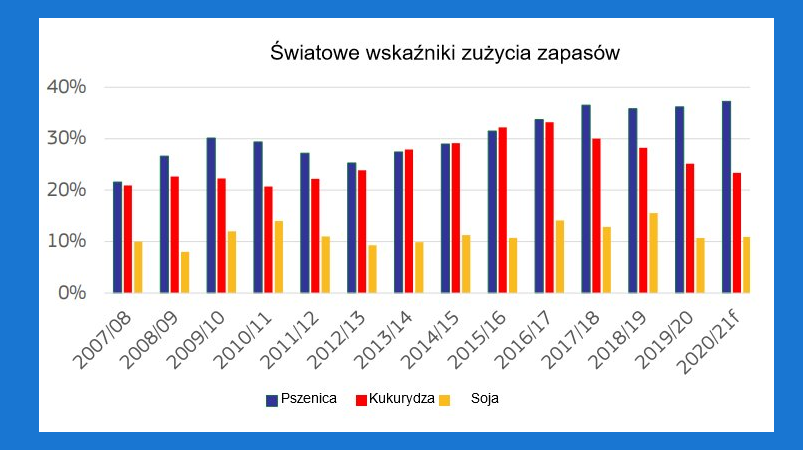

World consumption rates of corn stocks. Source: DG Agriculture and Rural Development, International Grains Council.

What affects the price of corn

The most important factors affecting the price of maize are:

- market supply expectations (especially in the months from March to September). The sown area and the expected yields, which are determined on the basis of the current weather and USDA reports, mainly affect the expectations. High volatility = dynamic prices.

- amount used to produce the biofuel. US Environmental Protection Agency, EPA (Environmental Protection Agency) requires that the amount of corn used to produce ethanol gradually increases. Depending on the harvest in a given year, this could have either a positive or a negative effect on prices.

- the amount of crops in a given year. If the achieved quantity is too low due to e.g. bad weather, the prices will automatically increase. The surplus of crops, in turn, leads to a decline. Investors should pay attention to the weather and its impact on crop performance.

How to invest in corn

As with the wheat market, there are several options to choose from when you want to invest in maize.

Futures contracts

They are standardized instruments and they are traded on individual exchanges (regulated markets). This means predetermined underlying instruments, execution dates and contract sizes. In the case of corn they expire monthly and are there 5000 bushels (which means that, unfortunately, the investment, due to the size of the contract, requires a lot of capital). Of course, we don't have to hold the contract until it expires. We can sell it at the current market price, if there is sufficient liquidity in the market. If there is no investor willing to buy it back, the position is closed at expiry at a predetermined price.

The futures market is intended for more experienced investors. The leverage on corn contracts is 1:10.

Corn options

An instrument giving its buyer the right to perform a specific operation. For maize, the conditions are exactly the same as for futures. Date the expiry date for options is one month and options are concluded are on 5000 bushels. We have buy and sell as well as Put and Call options. What is the difference? Here we still pay the so-called an option premium, i.e. a fee for purchasing a specific option. Another difference is that there is no obligation to exercise the option with regard to the contracts. In practice, if the rate goes in the opposite direction than we assume, we do not need to activate the option until it expires. The only cost we incur then is the aforementioned bonus.

CFDs

The easiest and undoubtedly the most popular way to invest in agricultural instruments. CFDs mimics the movement of the price of the underlying asset. The transaction takes place on the OTC market. One side of the transaction is the investor, the other side is the broker. To put it simply, if we have buy positions, the rate goes up, we earn on the increases. Short position, the rate is sliding down, we earn on declines. The leverage in the European Union is 1:10 in the case of CFDs on commodities - the same as on futures contracts. The difference, however, is the access to smaller transaction volumes, which means that we only need a smaller deposit for investment in the corn market.

The advantage is also that when the market is open, we can close the order at any time, there is no such thing as an expiry date. They do, however swap points.

How To Invest In Corn - Forex Brokers Offering Corn CFDs

Below is a list of offers from selected brokers offering the best conditions for trading corn (CFD).

| Broker |  |

|

|

| End | Poland | Australia, Mauritius, Cyprus | Denmark |

| Corn symbol | CORN | CORN | CORN |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

200 USD | 0 PLN / 0 EUR / 0 USD |

| Min. Lot value | price * 500 USD | - | b / d |

| Commission | - | - | - |

| Platform | xStation | MT4 / 5 | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summary: how to invest in corn

If we want to trade on agricultural commodities, we have a whole range of options to choose from. If you are wondering how to invest in corn, remember that it is worth taking into account the specifics of various instruments. Rather, long-term investments are recommended. The easiest way to invest in corn among retail investors is through CFDs. It is here that we will find "simplified" trading conditions, devoid of possible expiry of contracts and liquidity gaps, with simultaneous fast execution of transactions, low volume and transaction fees.

Before entering the agricultural market, it is definitely worth starting with a demo account where you can check how our deposit behaves in relation to changes in the price of wheat at a certain volume.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Maize - how to invest in maize? [Guide] how to invest in corn](https://forexclub.pl/wp-content/uploads/2020/07/jak-inwestowac-w-kukurydze.jpg?v=1596099807)

![Maize - how to invest in maize? [Guide] Bartłomiej Hamomka](https://forexclub.pl/wp-content/uploads/2020/07/bartlomiej-chomka-102x65.jpg?v=1596121436)

![Maize - how to invest in maize? [Guide] eToro - Marq Millions](https://forexclub.pl/wp-content/uploads/2020/08/etoro-marq-millions-102x65.jpg?v=1596441632)

Leave a Response