The KNF imposes PLN X million on XTB for abuses from before 9,9 years

The Polish Financial Supervision Authority decided to impose a fine on X-Trade Brokers Dom Maklerski SA in the amount of PLN 9,9 million - such a decision was made at a meeting of the Polish Financial Supervision Authority on September 18, 2018. This is due to irregularities in the execution of clients' orders from three years ago. This is the first such high financial penalty imposed on a Forex broker in Poland.

A fine of PLN 9,9 million for asymmetrical slides and ...

The case is not new. The official indictments of the KNF directed towards XTB have already appeared in November last year, which we wrote about here. The Supervision's reservations related to the manner of execution of broker's clients' orders in the period from January 2014 to May 2015. They mainly related to asymmetrical order slippage (the so-called "deviation" parameter) in the execution model Instant, where the traders were losing on the way of implementation.

Fragment of the KNF communication:

"Ww. the entity monitored price deviations, ensuring that transaction prices do not differ significantly from the prices of the underlying instruments. X-TRADE BROKERS used in the transaction systems an asymmetrical setting of the deviation parameter, introducing a price deviation limitation from the moment of placing the order from the price at the moment of order execution, in the case of a change in the price favorable for the client, while leaving the price of the order unlimited if the price of a given item changes, to the detriment of the customer. "

Customer losses were estimated at the level from 8 to 23,5 million. Such a large discrepancy in estimates may result from the problem of determining what kind of slips would be recorded in reality (eg what positive slippage would occur if it were allowed).

Slips are not the only thing that Polish supervisors had reservations about. As the message content indicates, the broker also had to use the parameter delay, responsible for deliberately delaying the execution of client orders.

The Polish Financial Supervision Authority writes:

"Moreover, in relation to a specific category of clients subject to observation by the Trading Department, as a tool for additional price verification in the orders placed by them, X-TRADE BROKERS used the so-called set on one of the transaction platforms. delay parameter, causing in practice stopping the execution of orders of such clients for a definite period with this parameter expressed in milliseconds "

Last year, a representative of the XTB Management Board refuted the allegations:

“We disagree with the KNF's comments. We submitted extensive substantive and legal reservations as well as detailed analyzes to the Commission, pointing to the groundlessness of the remarks in the protocol after the inspection. We implemented all the recommendations of the Commission immediately, while maintaining in full our objections to the report after the KNF inspection. "

Full text of the KNF communication

X-Trade Brokers position

In response to the Communiqué of the 404th meeting of the Polish Financial Supervision Authority, the Management Board of XTB fully upholds its previous position and claims that there are no grounds for objections regarding the company's operations. Additionally, it announces that it will appeal against the supervisor's decision.

The official XTB position:

During the proceedings before the KNF, the Management Board provided the supervisor with extensive explanations as well as legal and quantitative expert opinions of independent entities that confirm that XTB's use of the asymmetric deviant mechanism did not violate the principle of acting in the best interests of clients and did not affect the clients' transaction results. The KNF's remarks to XTB regarding the application of this mechanism concern the activities from January 2014 until May 2015 The guideline on the necessity to use symmetrical deviation was issued by the PFSA in May 2016, almost a year after the company independently changed its IT systems.

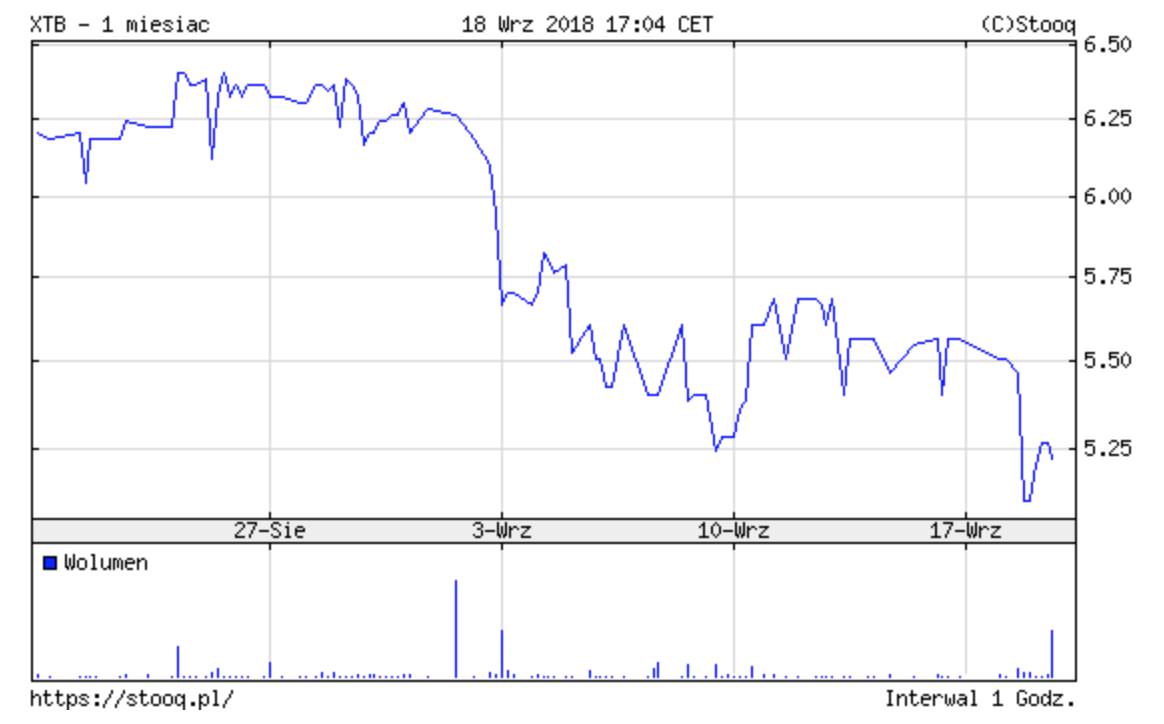

Shares down by 5%

X-Trade Brokers is a joint stock company listed on the Polish stock exchange. Today investors reacted with the sale of shares, which consequently led to a drop of the share price by slightly more than 5%. It's hard to talk about a wave of sell-offs - has the market to some extent discounted the potential for a financial penalty earlier?

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)