More arguments for the end of QE - announcement of the US employment report

Today's employment report will be significant given the emphasis on such data by Fed chairman Jerome Powell and other officials and its implications for limiting quantitative easing in monetary policy. It is also the last hiring report to come before Powell's scheduled speech Jackson Hole in August, which may give some hints on what to do next Fed in the field of monetary policy.

About the Author

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. Is a global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

The situation on the US labor market

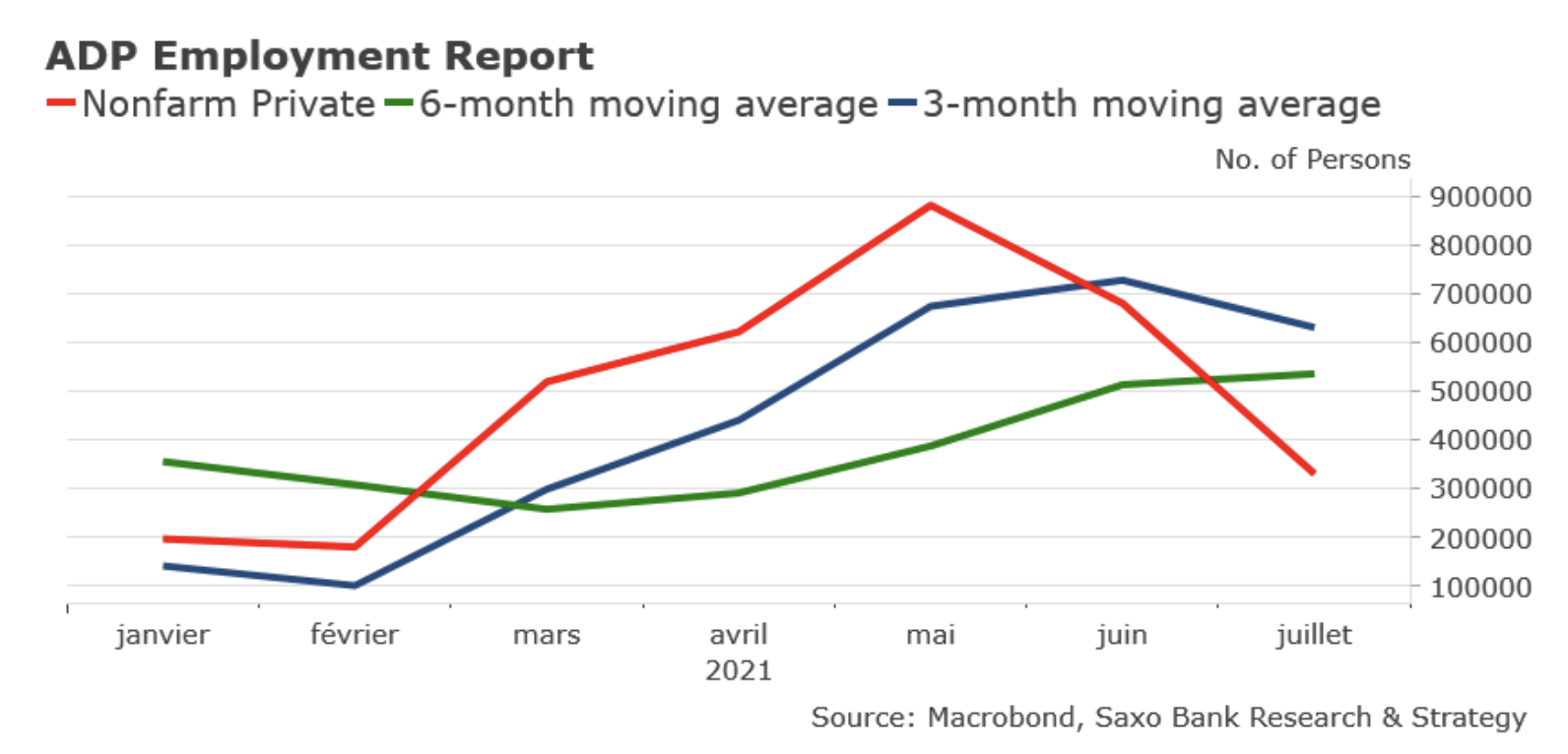

According to the results of the published July ADP report about employment, 330 thousand jobs were added this month. new jobs, which is significantly below the expected level of 650 thousand. These results may raise concerns about the outlook for economic growth. However, we believe that investors should not overreact to this data. Since the outbreak of the pandemic, tracking jobs has been quite a challenge for ADP as the number of new hires and layoffs fluctuated rapidly.

However, we expect a better result in today's report. Employment is forecast to increase by 900. jobs compared to previously assumed 850 thousand. This, in turn, would mean a drop in the unemployment rate to the lowest post -andemic level of 5,7%. Some economists even forecast an increase of +1 million jobs. If their predictions came true, it would be the fastest employment growth since last August. It should be noted that July is a poor month in terms of employment growth. However, in the current situation, anything can happen.

On the other hand, the chances of reversing the trend in professional activity are still slim. The employment rate is expected to remain around 61%. The labor shortage reflects both cyclical factors (the sustained impact of increased unemployment benefits, fears of return to work and sickness, and school closings) and structural factors (the negative impact of an aging population). This situation is closely monitored by the FOMC. However, in our opinion, it is unlikely that this will have a significant impact on the introduction of restrictions in QE policy.

Given the volatility of data and the unprecedented economic situation, it is not surprising that Fed officials have very different views on the tapering and outlook for the US economy. This, however, will lead to greater market volatility, at least in the near term. Statements from Chairman Powell, Vice Chairman Richard Clarida and newly appointed Fed Governor Christopher Waller in recent days have been relatively inconsistent. Powell mentioned that "the labor market still has a lot to do" and that an unemployment rate of 5,9% reduces the problem of the employment deficit. This suggests Powell is ready to wait before quitting QE. Clarida, in turn, suggested that rates could rise in 2023, thus confirming that the FOMC is heavily divided on introducing increases interest rates. According to quarterly forecasts released at the FOMC meeting on June 15-16, 13 out of 18 Fed officials are currently considering a rate hike in 2023, and seven are already considering a rate hike next year. Waller said that if employment growth in July and August remained as high as in June (850 jobs), it is quite possible that tapering will start as early as October and could be higher than previously forecasted $ 10 billion. monthly.

There is no doubt that week by week we are closer to announcing the end of quantitative easing in monetary policy. First, however, we face a period of even greater uncertainty, at least in the near term. The US central bank, relying heavily on data, takes weeks, maybe even months, before deciding on the exact timing of tapping. Let's get ready for the market turmoil.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)