The end of the year is marked by the omicron and volatility on the EU energy market

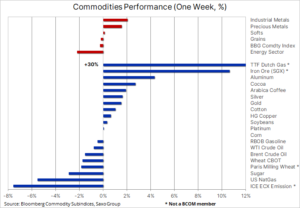

Commodity prices varied during the week in which the US broadcast FOMC as expected, it turned out to be more aggressive in connection with further efforts to combat dynamic inflation growth. However, after the prospect of three rate hikes in 2022 and 2023 was presented to the market, there was a sharp shift in risk appetite, as a result of which the value of the euro and other major currencies exceeded the price of the US dollar, which in turn contributed to the strengthening of some commodities that had been in place before the FOMC meeting. under the pressure.

US Treasury bonds, a key direction indicator for investment metals, also reacted surprisingly to the FOMC meeting. The very next day, after the tightening of the rhetoric in the form of another series of stronger forecasts about the economy, inflation and Fed policy, yields fell along the entire length of the curve. Aside from the rally to gain in-depth understanding of the central bank's reasoning, the further rapid spread of the coronavirus omicron variant was also likely contributing to this response, causing a surge in infections worldwide.

Despite support from a weaker dollar, the crude oil market underperformed and short-term demand concerns about the omicron variant confirmed the International Energy Agency's prediction of market oversupply in the first months of 2022. Natural gas prices continued to stagger - mild winter weather in The United States brought prices down to levels normally seen in the summer months, while in Europe a perfect and price-favorable storm pushed gas and electricity prices up to new record levels.

These developments resulted in a relatively neutral week on the Bloomberg Commodity Index, monitoring a basket of the most important commodities evenly broken down into energy, metals and agricultural products. Thus, this index has consolidated its very good result for 2021, currently amounting to 24%, which is the largest year-on-year increase since 2001.

Precious metals

Precious metals received a positive impulse after the FOMC meeting confirmed the expected policy tightening. Both metals have been under pressure since the surprisingly hawkish comments from CEO Powell and Fed vice president Brainard on November 22. As most of the announced measures were already priced in ahead of the meeting, both metals took the opportunity to recoup some of the recent losses. As 1-year real yields returned to pre-FOMC levels below -XNUMX% and the dollar recorded the biggest drop since October, gold managed to break above the XNUMX-day moving average, the level that had been a resistance in the run-up to the meeting.

The forecast for 2022 remains problematic and most of the downward forecasts for gold are due to expectations of a sharp rise in real yields. Real yields in the last few years showed a high degree of inverse correlation with the zloty and it is the risk that aggressive Fed policy will increase yields that currently worries the market.

However, with three interest rate hikes already priced in for 2022 and 2023, and gold trading at levels that appear to be about 0,25% too cheap relative to ten-year real yields, downside risks should be contained unless the Fed in the coming weeks and months it will sharpen the rhetoric and signal a more aggressive pace of rate hikes.

It should also be borne in mind that an increase in interest rates will most likely lead to an increase in risk in the stock market as many of the high growth non-profit equities may be subject to a major revaluation. Moreover, the factors that may offset the negative effects of the increase in bond yields include concerns about the persisting levels of government and private debt, increased asset purchases by central banks and the strengthening of the dollar in the coming months.

Gold

Gold, which broke above resistance turned into support at $ 1, will find support from short-term buyers, but for this new appreciation to go beyond this level, long-term investors must emerge, and so far the overall investment of gold-backed funds will not shows no signs of improvement. Perhaps this is due to the time of the year when only significant investment cases are reacted, while others are postponed until January.

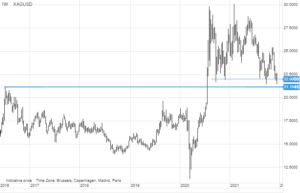

Silver

Silver also deserves attention after once again finding support, with buyers four times below $ 22 since September, preventing it from slipping down to $ 21,15 - the key 2016 support. potentially signaling a significant minimum, but for now the metal needs support from both gold and industrial metals to force a significant change of direction.

Industrial metals

Industrial metals, like precious metals, received a positive impulse after the FOMC meeting, but only after preventing another attempt to decline, in which the price of copper temporarily fell to a two-month low. The recovery was supported by information that Chinese aluminum production slowed down in November due to continued energy constraints, which resulted in increased demand for inventories in warehouses monitored by the LME. At the same time, copper found support after one of the largest Peruvian mines began to cut production over public protests that hindered mining.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Annual price forecasts and projections from leading commodity banks have started to flow in, and while the outlook for energy and agricultural products is broadly positive and negative for precious metals due to the expected hike in US short-term rates and long-term profitability. at the end of the yield curve, for industrial metals they vary. Despite the predictions that the energy transition towards less dependence on coal in the future will generate strong and steadily growing demand for many key metals, the outlook for China, in particular for copper, is a big unknown at present, as the real estate market is responsible for a significant part of Chinese demand. .

Given the scarce supply of mined metals, we believe that the current negative macroeconomic factors related to the slowdown in the real estate market in China will begin to weaken in early 2022, and with both copper and aluminum inventories already low, this could cause that prices will return to or even surpass their all-time highs from the beginning of this year. The months-long sideline has reduced the speculative long position to an almost neutral level, thereby increasing the prospects for attracting new buyers as soon as the technical forecast improves.

Petroleum

Petroleum it slightly depreciated on Friday, resulting in a weekly decline as the omicron variant continues to impact short-term demand outlook. The weaker dollar has been offset by a monetary tightening that could further soften the outlook for economic growth in 2022. While Europe is struggling with a deepening energy crisis, milder-than-usual Asian weather has led to a reduction in demand for fuel products used to generate electricity and heating. Due to the problematic forecast, we expect that most of the turnover ahead of the New Year will be the result of short-term technical strategies.

Because the International Energy Agency as well OPEC forecast market equilibrium in the first months of 2022, the risk of price increases may be delayed, but not eliminated. We maintain a long-term positive outlook on the oil market as it faces long years of potential underinvestment - major players are losing their appetite for large ventures, partly due to an uncertain long-term outlook for oil demand, but also increasingly due to constraints lending to banks and investors due to ESG (environmental, social and corporate governance) issues and the emphasis on green transition.

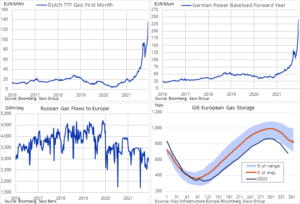

Gas and electricity

The EU gas and electricity market hit a new record high on Thursday, then fell on Friday after Gazprom had reserved some of the pipeline's capacity. Previously, the Dutch benchmark TTF gas contract closed above EUR 140 / MWh or USD 45 / MMBtu, more than nine times the long-term average, while the German electricity futures contract was more than six times the long-term average at EUR 245 / MWh.

Temporary shutdowns of French nuclear power plants due to detected pipe faults, frosts expected next week and low flows from Russia continue to reduce the already low stocks. Added to this is US pressure to impose sanctions on Russia over Ukraine and the announcement by German regulators that the Nord Stream 2 gas pipeline may not be approved by July.

The market is clearly fueled by concerns about the gas shortage in February and will therefore continue to focus intensely on short-term weather developments as well as on any signs of increased supplies from Russia. Improving both these factors could cause a sharp correction in prices as the current levels hold back economic growth, increase inflation and contribute to the creation of local areas of energy poverty across Europe.

More analyzes of commodity markets are available here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response