Coronavirus: More Questions Than Answers - Monthly Macro Outlook

At the end of 2019, the consensus for 2020 was that emerging market equities would perform well as the dollar index slumped, trade tensions softened and China's positive credit impulse continued to rise, while European stocks would continue to grow thanks to transparency Brexitu and hope for a Green New Deal. However, these predictions did not take into account the Covid-19 virus. Financial markets are overestimating the likelihood that the economic impact of the coronavirus will extend beyond Q2020 XNUMX and that further local outbreaks of infection will begin to emerge around the world, as is already the case in Italy and Spain, which will temporarily disrupt economic relations.

Before discussing the known and unknown consequences of coronavirus, we would like to highlight the achievements CSSE at Johns Hopkins University in monitoring new cases worldwide. It is a very useful tool for everyone, especially in financial markets who would like to better understand current events.

Many unanswered questions

First, we should be humble about the coronavirus crisis. This case raises more questions than answers, including:

- What is the actual level of infection at the global level? A recent study by the Center for Infectious Diseases at London's Imperial College estimates that "around two-thirds of Covid-19 infection in China has not yet been detected in the world in China."

- How do you explain this infection chain? Some of the patients were not in China and did not come across any virus carriers.

- What will be the response of the US and European governments if the coronavirus spreads even further? Will - like China - decide to close borders and introduce quarantine in the largest cities?

- Many unanswered questions also appear at the economic level:

- How much will Chinese GDP in QXNUMX suffer? Personally, I think this is a relatively insignificant question.

- The more important issue is the possibility of recovery in QXNUMX and its strength.

- What will be the consequences for travel, tourism and global supply chains, and moreover, when should we expect the situation to return to normal?

The latest hard data, especially from Europe, do not offer details in this regard. The coronavirus and the crisis associated with it have not yet destabilized Europe or the United States. We will certainly get more clarity on the macroeconomic impact of the virus after the March data release.

What do we know so far?

That said, we do not wander completely unknown territory and we begin to obtain information and data on the economic consequences of this crisis.

- Coronavirus and the Covid-19 epidemic are atypical for policymakers as they disrupt both supply and demand. The supply shock is related to the inability of companies to resume operations, in particular small and medium-sized enterprises in China, while the demand shock mainly focuses on Chinese consumers, but may also hit global demand as the virus spreads. Based on market expectations, there is a growing risk that the initial supply shock will be followed by an equally strong global demand shock. The graph below illustrates this: the demand curve shifts to the right. If this assumption proves to be correct, the main risk will not be associated with inflationary shock, but rather with deflationary shock, compounded even more by a strong dollar. In fact, it is consistent with current inflation expectations in the market.

- The euro area is less exposed to the effects of supply chain disruptions than the United States or Japan, because it is less dependent on China's direct contribution to its domestic production, it is, however, more sensitive to Chinese export demand and the inflow of tourists from Asia. We predict that the decline in travel and tourism demand in the coming months will negatively impact the service sector, in particular in countries such as France, where tourism has a significant share of GDP.

- A further decline in global investment spending is inevitable. Even in January, before the appearance of the coronavirus, for the third month in a row they recorded another deep decline. Japanese machine orders - a very old-fashioned business cycle indicator - confirm that we should be prepared to delay investment, perhaps cutting employment and falling investment expenditure.

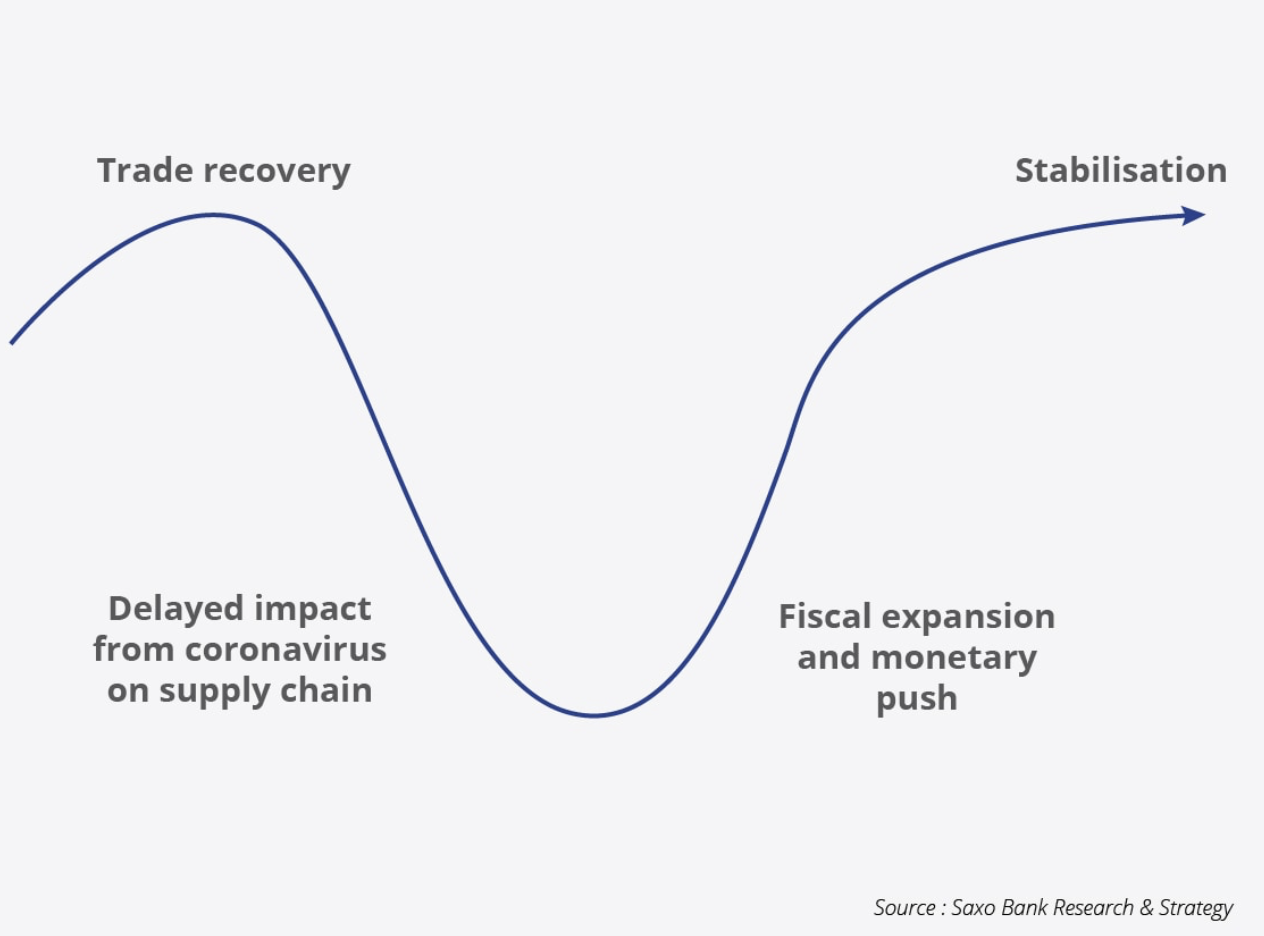

- Contrary to market opinion, the recovery may be U-shaped, not V-shaped. In other words, this means that in many areas of the world, recovery will be gradual and dependent on the speed of political responses. The main risk area is concentrated in the Asia-Pacific region, which accounts for 45% of global GDP. In these circumstances, the role of fiscal policy is to stimulate demand, including through direct cash injections, as is the case in Hong Kong, while the role of monetary policy is to ensure that we can avoid freezing the credit market and tightening financial conditions. Incorrect or too sluggish monetary policy response may increase the risk of a deflationary impulse, which emerging markets are clearly afraid of, as shown by my recent conversations with clients.

Source: Christopher Dembik, director of macroeconomic analysis at Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)