Crypto Retirement: December with a correction in the retirement portfolio

The 23,51% decrease in the value of the cryptocurrency wallet is the result of the cryptocurrency sell-off in December last year. However, the month of theoretical losses does not worry us at all. For two reasons: the first is the fact that we had the opportunity to buy cryptocurrencies at low prices, and the second is that after 22 months our wallet has already increased by 8109 euro.

Check it out: Crypto Retirement: Highest Portfolio Value Ever (+ 840%)

Crypto-retirement rules of the Forex Club Portal:

- we invest on Binance Stock Market, which is not only the largest in the world, but also - so far - the most stable,

- every month we devote 60 euros (this is the minimum deposit threshold in Binance),

- we want to invest approx. half of the funds in Bitcoin, as the "king of cryptocurrencies" and the indisputable flywheel of the entire market,

- in addition to BTC, we selected 3 other cryptocurrencies: LINK, ADA and BNB, in which we will invest at least until the end of the year,

- if it is possible, we pay cryptocurrencies on "deposits" in Binance,

- at the end of the year, we will decide whether the portfolio will include other cryptocurrencies, most recently CRV, SOL, SAND and AXS

- the investment horizon is at least 10 years.

December nervous, but not for everyone

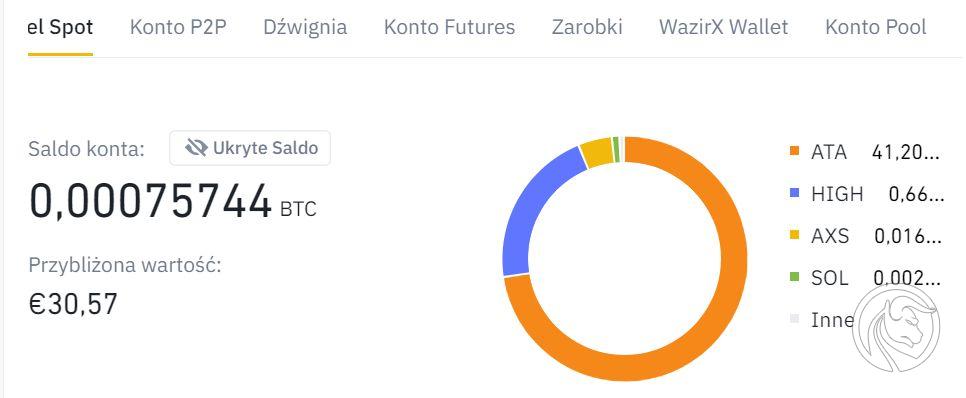

Let us remind you that after the last purchase for EUR 60, at the beginning of December 2021, our portfolio looked like this:

After a brilliant November, our cryptocurrency-based retirement portfolio recorded a record result - it was worth EUR 12.410, and we deposited a total of EUR 1320. Euphoric moods prevailed on the market, which was intensified by the fact that December was approaching, which - like the football derby - has its own rules. This is when investors expect the so-called St. Mikołaj, who years ago were arranged for us by investment funds, which, when extracting the valuation of assets at the end of the year, could boast a better result over the past 12 months.

Unfortunately, the St. Nicholas is not always a certainty, and with the development of financial markets - less and less. Similarly with the January effect, when allegedly new money was to hit the market. In recent years, probably also due to the pandemic, we have not observed this relationship.

We used this turbulent time to optimize the portfolio. It turned out that we kept some of the cryptocurrencies on flexible savings accounts, and during this time the Binance offer has grown a lot. Admittedly, it still remains a hit Axie Infinity (AXS)another month we stack at 104,32% per annum, but both SAND and SOL or LINK also have offers of up to 25%. But you have to be quick and check them regularly, because the best bites are sold out quickly. Despite this, it is possible to block even large cryptocurrencies at 8-12% without any problems. The exception is Bitcoin - continuously giving interest at the level of "only" 3% per annum, which, however, compared to bank deposits, is still an unprecedented result.

The results of our major cryptocurrencies in December 2021:

- DAO Token (CRV) curves + 65,49 %

- ChainLink (LINK) + 13,03%

- Cardano (ADA) -1,09%

- Bitcoin (BTC) - 1,56%

- Binance Coin (BNB) -3,32%

- Solana (SOL) -10,73%

- Sandbox (SAND) -11,69%

- Axie Infinity (AXS) -13,79%

Crypto Retirement: A Summary

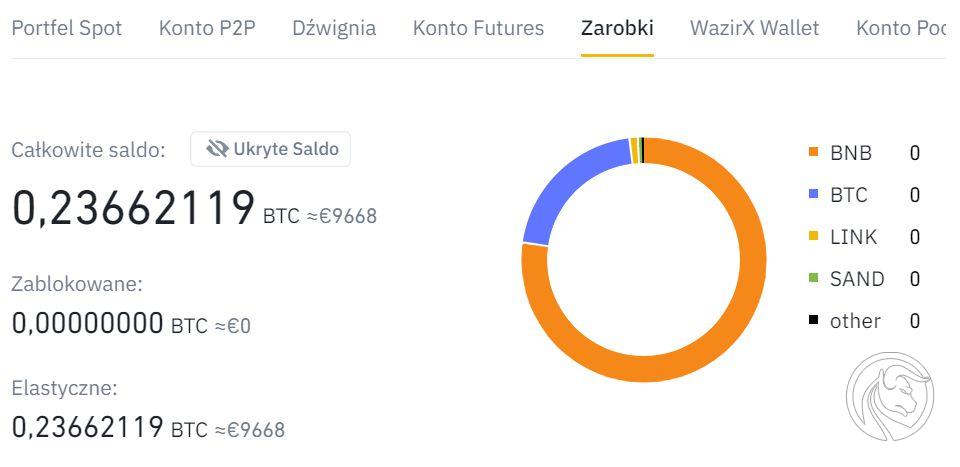

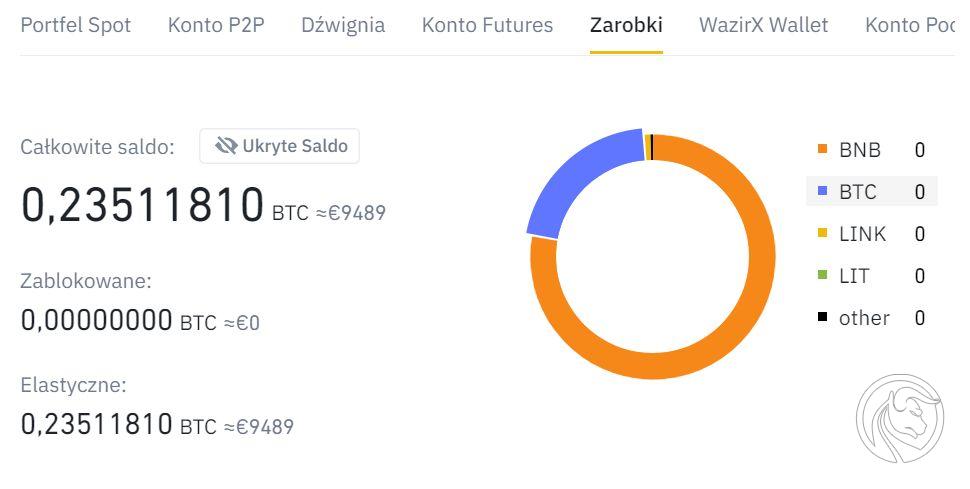

Recall: we made a payment 23 times for 60 euros, so we invested a total of 1 euros. On December 380, 31.12.2021, the account balance is EUR 9.489. Our portfolio increased by 22 euros in 8.109 months.

So we invest another 60 euros: in SAND. We believe that tokens from the broadly understood world of gaming and metaverse have a bright future ahead of them, and their price is also undergoing a correction, so it's a good time to buy.

We also still hold positions in the latest cryptocurrencies we received for staking BNB, but not all of them. If the airdrop ends up at the level of at least several dozen zlotys, we leave it in the wallet. However, if it is a dozen or so zlotys, then we assume that even with a high percentage of growth, there will be no coconuts and we exchange them for BNB - with a kind of perpetual motion in mind, i.e. receiving more tokens for a larger number of stacked BNB.

As of 31.12.2021/XNUMX/XNUMX, the spot portfolio looks like this:

Portfolio balance after 22 months: 9 489 euro (sum of payments: EUR 1380)

Loss in December: -23,51%

Profit after 21 months: + 587,60 %

Next summary in a month!

Learn more about selected cryptocurrencies:

- Bitcoin - all about the "king of cryptocurrencies"

- Link - a cryptocurrency that Intel has bet on

- ADA - a token created by scientists

- BNB - a token from the Binance exchange

- SAND - better than Minecraft because on blockchain and NFT

- SOL - still the cheapest blockchain platform on the market

- CRV - a platform for earning on stablecoins

- AXS - the gaming hit of recent years

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)