Crypto Retirement: A February full of excitement in your retirement wallet

First, the attack of Russian troops by Vladimir Putin on Ukraine and the related declines on the stock exchanges, which resulted in a decline in the cryptocurrency exchange rate. And then sobering up and the fact that digital money turns out to be the surest investment and medium of exchange in such cases. In February, a lot happened in our retirement portfolio. Finally, we end the month with an increase in the value of the cryptocurrency by 9,34%.

Check it out: Crypto Retirement: January with a drop of 23,03% in the retirement portfolio

Crypto-retirement rules of the Forex Club Portal:

- we invest on Binance Stock Market, which is not only the largest in the world, but also - so far - the most stable,

- every month we devote 60 euros (this is the minimum deposit threshold in Binance),

- we want to invest approx. half of the funds in Bitcoin, as the "king of cryptocurrencies" and the indisputable flywheel of the entire market,

- in addition to BTC, we selected 3 other cryptocurrencies: LINK, ADA and BNB, in which we will invest at least until the end of the year,

- if it is possible, we pay cryptocurrencies on "deposits" in Binance,

- at the end of the year, we will decide whether the portfolio will include other cryptocurrencies, most recently CRV, SOL, SAND and AXS

- the investment horizon is at least 10 years.

Wallet changes - a better secure investment than uncertain air drop

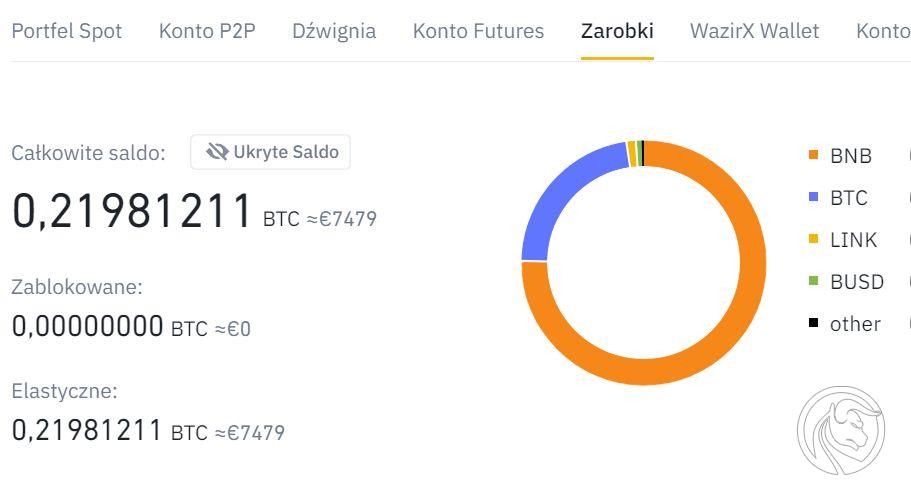

Let us remind you that after the last purchase for 60 euro, at the beginning of February 2022 our portfolio looked like this:

In February, however, we could not complain about boredom. First, there was uncertainty: as the Russians gathered more troops at the borders of Ukraine, lying that it was only a defense exercise, few expected war, but many feared it. Stock indices were falling, and with them more and more correlated with the traditional financial market, cryptocurrency prices. The culmination took place when the first air raids, missile fire and infantry attacks on Russian cities began.

However, when further sanctions were imposed on Russia - primarily economic - the activity on the cryptocurrency market increased significantly. The prices of the Russian ruble falling into the abyss, interest rates raised by the Russian central bank to the level of 20% and restrictions on the activities of banks made whoever could change the currency of less and less value into crypto-assets.

The Ukrainians did the same. It turned out that cryptocurrencies - which cannot be physically easily stolen, and also relatively easy to pay abroad - are one of the safest means of payment in the face of an armed conflict.

Declines from the precarious pre-war period were mostly made up for in just two days.

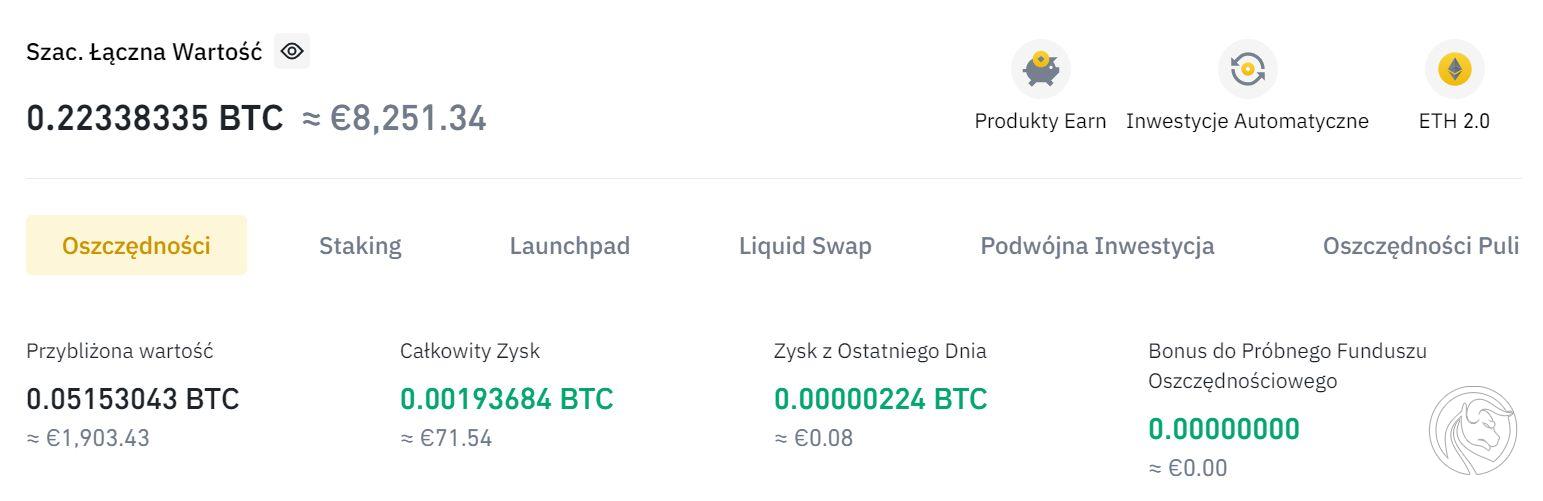

It is worth informing that we have also made some changes to our portfolio. We moved Binance Coin (BNB) from the account that allowed us to receive remuneration in new cryptocurrency projects, to an "ordinary" deposit. Thanks to this, we have a fixed interest rate of 6,53% per annum. This is much more than the current account where you could receive air drops - now its financial efficiency is calculated at just 0,35% per year, although of course it will be much better as soon as the next awards start. However, we decided to have a fixed interest rate on the accumulated funds.

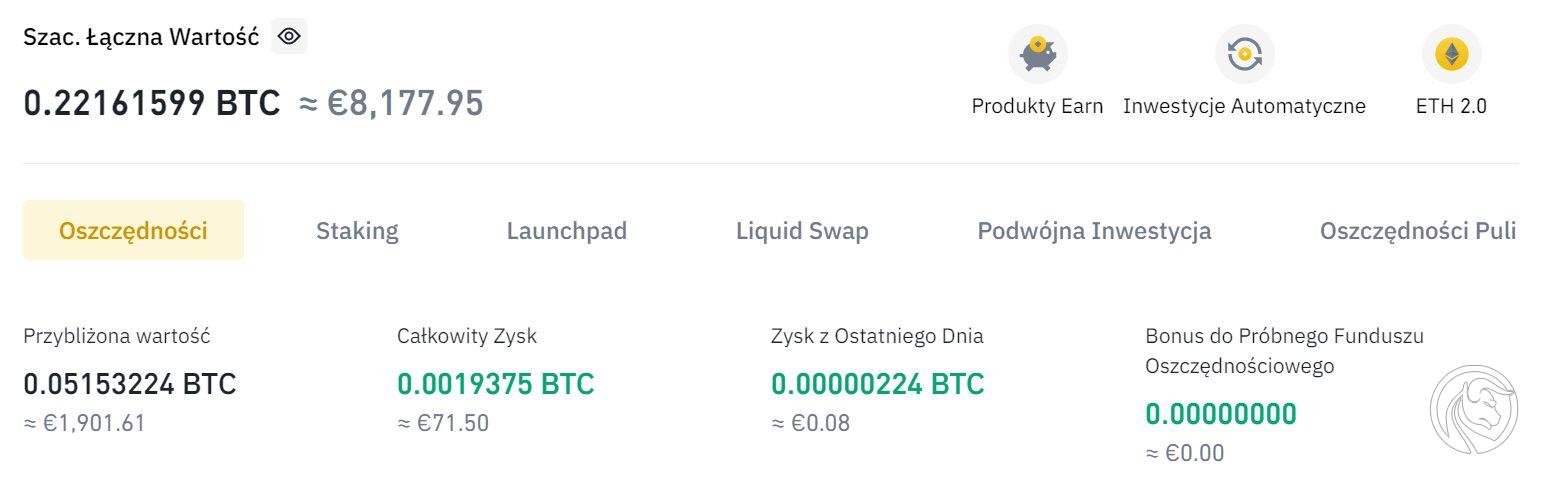

For this reason, we will present our balance a bit differently, because some cryptocurrencies are permanently stacked, and some have a flexible interest rate, which is why our wallet at the end of February 2022 looks like this:

The results of our major cryptocurrencies in January 2022:

- Bitcoin (BTC) + 13,92%

- Binance Coin (BNB) + 5,42%

- Axie Infinity (AXS) + 4,24%

- Solana (SOL) -0,54%

- Cardano (ADA) -9,91%

- ChainLink (LINK) -15,05%

- Sandbox (SAND) -20,11%

- Curve DAO Token (CRV) -22,33%

Crypto Retirement: A Summary

Recall: we made a deposit of EUR 25 60 times, so we invested EUR 1 in total. On March 500, 01.03.2022, the account balance is EUR 8.177,95. In 24 months, our portfolio increased by EUR 6.677,95, or 445,19%.

So we are investing another 60 euros. We chose the heavily discounted SAND in the last two months. The game is still very popular, the gaming trend is constant, and the discount was - in our opinion - mainly related to the turmoil in the entire market. Altcoins always react more dynamically than the movement of key cryptocurrencies, so we are also counting on a solid rebound.

Portfolio balance after 25 months: 8 177,95 euro (sum of payments: EUR 1500)

Profit in February: + 9,34 %

Profit after 24 months: + 455,19% (+ EUR 6 677,95)

Next summary in a month!

Learn more about selected cryptocurrencies:

- Bitcoin - all about the "king of cryptocurrencies"

- Link - a cryptocurrency that Intel has bet on

- ADA - a token created by scientists

- BNB - a token from the Binance exchange

- SAND - better than Minecraft because on blockchain and NFT

- SOL - still the cheapest blockchain platform on the market

- CRV - a platform for earning on stablecoins

- AXS - the gaming hit of recent years

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)