Crypto Retirement: May Great Correction. Portfolio value decreased by -40,99%

The last month was marked by a sharp decline in the entire cryptocurrency market. The value of our portfolio also decreased - by -40,99%. However, if someone thinks that it is a drama, a bubble burst and the like, it is worth bearing in mind that despite these drops, after 15 months, we have achieved a rate of return of 582,05%.

Check it out: Crypto Retirement: April with + 52% Capital Increase

Crypto-retirement rules of the Forex Club Portal:

- we invest on Binance Stock Market, which is not only the largest in the world, but also - so far - the most stable,

- every month we devote 60 euros (this is the minimum deposit threshold in Binance),

- we want to invest approx. half of the funds in Bitcoin, as the "king of cryptocurrencies" and the indisputable flywheel of the entire market,

- in addition to BTC, we selected 3 other cryptocurrencies: LINK, ADA and BNB, in which we will invest at least until the end of the year,

- if it is possible, we pay cryptocurrencies on "deposits" in Binance,

- at the end of the year we will decide if there are other cryptocurrencies in the portfolio,

- the investment horizon is at least 10 years.

Black (red?) May in the cryptocurrency market

In May, there was as much happening in the cryptocurrency market as in many other markets not even for a year. The author of the script was an eccentric billionaire Elon Musk, who first supported cryptocurrencies, bought Bitcoin for himself and his electric car company, but then decided that it would not be possible to pay in BTC for Tesla because the tokens consume too much energy and are not ecological.

Although experts quickly ridiculed him, showing specific calculations and comparisons with the gold or bank transfer market, which are much more energy-consuming, it was too late: the dynamic correction was already underway, and China added its three cents, announcing restrictions on the purchase and mining of cryptocurrencies on their territory (which does not prevent them from promoting the digital yuan…).

Be sure to read: Why are we all going to buy Bitcoin?

From our portfolio, only the Cardano (ADA) token increased in May, by as much as 31,11%. However, it does not constitute a large part of our portfolio. Most of them are Binance Coin (BNB), which lost 42,98% in the last month, which is practically the entire increase from the brilliant April. The second pillar of our retirement portfolio, Bitcoin (BTC), also decreased by 35,03%.

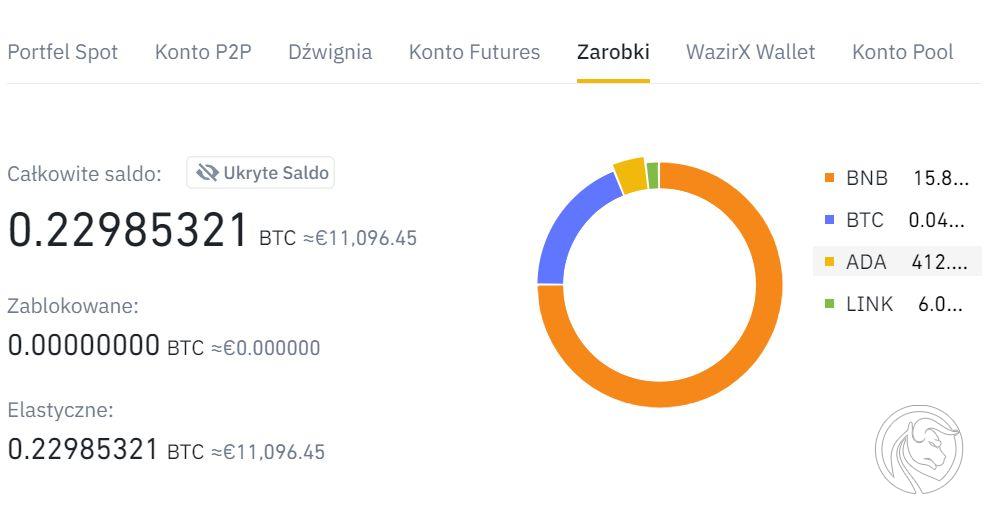

Let us remind you that after buying BTC for 60 euro on May 1, 2021, our portfolio looked like this:

The declines in the cryptocurrency market turned EUR 11 into EUR 096,45 in just 30 days. Its value in relation to the fiat currency decreased by 6%, which translated into a decrease in value by EUR 547,77 40,99.

The results of our cryptocurrencies in March 2021:

- Cardano (ADA) + 31,11%

- ChainLink (LINK) -22,02%

- Bitcoin (BTC) -35,03%

- Binance Coin (BNB) + 42,98%

Crypto Retirement: A Summary

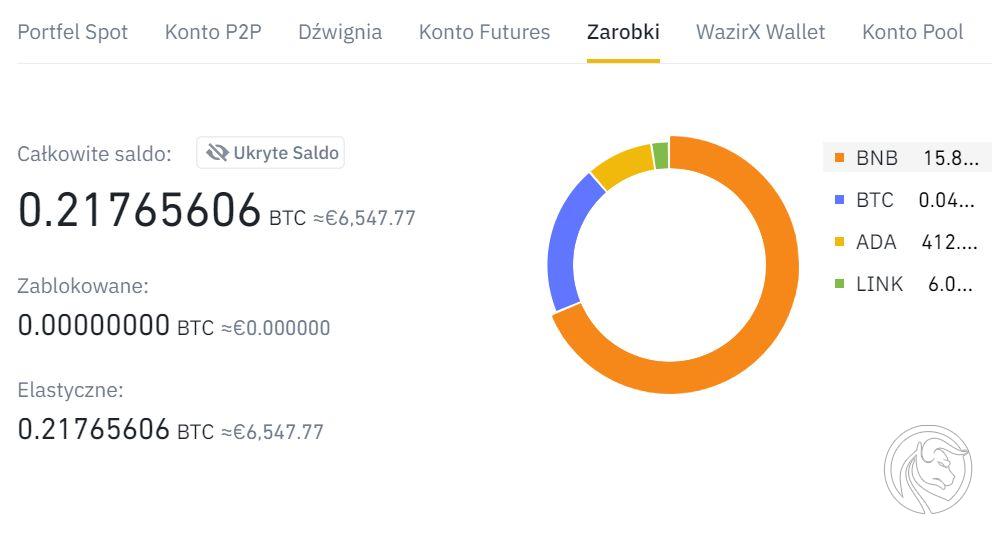

Recall: we deposited 16 times for 60 euros, so we invested a total of 960 euros. On March 01.06.2021, 6, the account balance is EUR 547,77. Our portfolio increased by EUR 15 in 5 months.

We still try to approach it with great calm, because - let us remind you - our investment horizon is 10 years. So we invest another 60 euro and, as usual, we put all cryptocurrencies on interest-bearing deposits using the automatic subscription function.

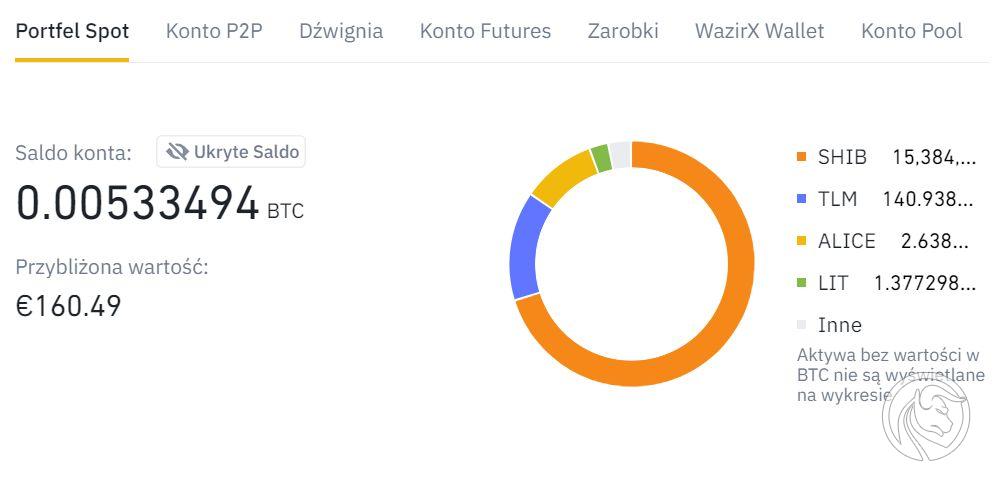

We still do not exchange new cryptocurrencies that we receive for stacking previously selected ones. The Binance cryptocurrency exchange rewards its users with tokens that are given away and added to the wallet - this is an additional profit, in addition to interest on deposits. Previously, we exchanged them for BNB, but from January 2021 we keep them on a separate wallet and wait if any of them will become a new star of the crypto scene.

As of 01.06.2021/XNUMX/XNUMX, the spot portfolio looks like this:

We do not include its value in the total crypto-retirement investment. For now - after four months, we have cryptocurrencies worth over EUR 160 on it. This is where our last purchase is located, which - even for the cryptocurrency market - was quite crazy. We have invested in highly speculative token Shiba Inu. It's a joke, a cryptocurrency created to show that Dogecoin, which was supposed to be a pin for everyone who laughed at blockchain technology, is still not enough. What are we counting on when buying SHIB units? What can I say: a miracle, because great increases are already behind it, but we have time to wait for - perhaps - an absurdly high valuation that will translate into profit in our portfolio.

Portfolio balance after 16 months: 6 547,77 euro

Profit after 16 months: + 582,05 %

Next summary in a month!

Learn more about selected cryptocurrencies:

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)