The Russian crisis of 1998 will not repeat itself

The last time Russia had such a significant impact on the financial markets in 1998, during "Russian crisis". However, its economic effects on the world economy were much more serious than they are today. Now the problems remain: global risk aversion i increase in the price of raw materials. However, the foundations of the world economy remain stable. The impact of the current situation on the stock exchanges is also limited and temporary.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

What is the future for us?

The Russian economy will plunge into chaos. The ruble exchange rate fell to a record low level on Monday. Moscow Stock Exchange remains closed. Banks are preparing to be excluded from the system SWIFT, and the Russians stand in long lines at ATMs. Some of them may resemble the Russian crisis of 1998, but this is only a sketchy analogy. Russia is now in a different place than it was in 1998, and the economic effects of the current situation will also be felt to a lesser extent globally.

The Russian crisis of 1998 was aggravated by the Asian crisis that had broken out a year earlier. In the face of the improvement in the economic situation of Russia in 1994–1997, it began to borrow large sums of money outside its borders, which resulted in a significant increase in its foreign debt. As commodity prices, which accounted for the most important part of Russia's income, fell, there was concern about its insolvency. The crisis resulted in the insolvency of Russia in terms of sovereign debt and a significant devaluation of the currency.

The situation is different

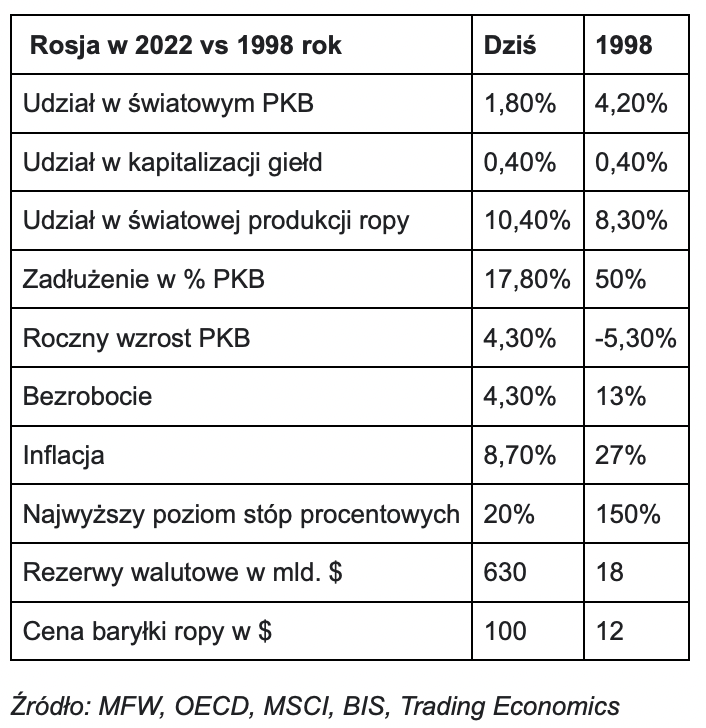

The depreciation of the ruble is what 2018 and 2022 have in common. But apart from that, Russia is in a different place today than it was then. In 1998, Russia's GDP was 4,2 percent. global, now it is only 1,8 percent. Within 24 years, the world economy developed much faster than the Russian economy. Russia, on the other hand, increased its share in world oil production from 8,3%. in 1998 to 10,4 percent. currently. It also accumulated foreign currency reserves of PLN 630 billion. dollars, while in 1998 its reserves were small.

Currently, the impact of the situation in Russia on the global economy is limited to two channels. First, the current situation causes increased risk aversion in the financial market. We can see it, for example, at the exchange rate of our currency, we currently pay PLN 4,80 for one euro. Poland is perceived as more risky, which causes an outflow of capital from our market and the depreciation of the currency. However, this is a temporary phenomenonand in the long run, risk aversion will fade away. Second, the current situation is pushing up commodity prices, which may largely limit the expected drops in inflation around the world.

However, apart from these two effects, it must be said that the fundamentals of the global economy are doing well. In 1998, the bankruptcy of Russia caused problems for many financial institutions around the world that owned Russian securities. The American bank Bankers Trust was acquired by Deutsche Bank, and the hedge fund Long-Term Capital Management was saved from bankruptcy with an amount of $ 3,6 billion to cover losses. Thanks to this, his problems did not spread to other financial institutions cooperating with him. In the present situation, there are no such threats.

The Russian capital market accounts for only 0,4 percent. global stock market capitalization. Global financial institutions today have little Russian debt and securities. Therefore, they will not be affected by the significant sell-off of Russian stocks. Although the Moscow stock exchange remains closed, some Russian companies are listed on other stock exchanges. The current situation is primarily increased risk aversion, growing volatility and pressure on valuations (which had already fallen as a result of the hawkish policy of the FED - C / E for companies from the S&P 500 index fell by 20 percent. up to a 5-year average) and an increase in the price of raw materials of which Russia is a significant producer.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)