Turkish Lira in disgrace. The overnight swap rate has reached ... 1050%

A day off in Turkey, the night and the sale of the dollar by state-owned banks - this made the Turkish lira exchange rate tremendously strengthened overnight. Over the past day, it has risen to over $ 7,1. Goldman Sachs analysts in London even say that Turkey's central bank sold as much as $ 65bn in July alone to bolster the lira.

We have been observing the weakening of the dollar in the global markets for several weeks. The American currency was losing in virtually all major pairs. It was cheaper against both the British pound, the euro and the Japanese yen. But you can say anything about the Turkish lyre in recent months, except that it is strong. However, she also started rallying against the US dollar. However, she needed help in this. And the Turkish central bank extended a helping hand.

Turkish Lira and powerful interventions

It's no secret that central banks are often large and important players in the financial markets. Not only do they invest huge amounts, but sometimes their opinion about the currency and the statement - even indirectly - that it is overvalued, and the market reacts immediately is enough. If we have real money "on the table", the effect is multiplied.

This is a normal practice not only in smaller countries, but also - and perhaps above all - in the largest players: the USA, Japan, Great Britain and Australia. So it is no surprise that Turkey, whose currency has been damaged for months, has started to react. However, the scale of the reaction may be surprising.

London-based Goldman Sachs analysts say the central bank sold $ 65bn to bolster the Turkish lira in July alone.

“It looks like another lira liquidity freeze in foreign markets. The mood of foreign investors towards the lira is unlikely to change that " - said Simon Harvey, currency market analyst at Monex Europe Ltd. in an interview with Bloomberg.

The Turkish lira against the dollar increased on August 06.08.2020, 2019 to the highest level since March 2,5. Only at night, after a public holiday in Turkey, as state banks began selling more dollars, the rate shot up. According to analysts, the market in Turkey has been flooded with currencies offered by government lenders for a week. They were supposed to sell a minimum of $ XNUMX billion a week!

USD / TRY chart, W1 interval. Source: xNUMX XTB.

The overnight rate jumps after currency intervention

The problem is that previously, foreign investors were essentially banned from borrowing from local banks - which was primarily intended to block large-scale short selling and further weaken the Turkish currency. So, if foreign investors do not have (and do not) Turkish lira, they have to borrow currency in a market where supply is limited, causing the exchange rate to rise as it exploded on Tuesday.

However, such action by the Turkish central bank is very costly for it. It would be cheaper to just raise interest rates or reduce the supply of credit. Instead, the Turkish central bank relies on cooperation with state banks by means of which it creates currency interventions. The most important thing for the Turkish authorities is that the lira does not exceed the psychological level of $ 7. Meanwhile, the Turkish currency is close to the never-recorded lows. The declines began practically in 2016 and since then the trend has not changed for more than a few weeks. Only the recent interventions of the central bank give hope that the sell-off will stop.

Last week, the rate on foreign markets was 30 percent. when the lira hit a record low against the euro. Now that's 1050%. One banker told Reuters that the lira market in London was "ultra-tight" after a long weekend in Turkey. Currently, the lira exchange rate against the euro is at a record high - it amounts to 8,46 and ... is constantly growing.

EUR / TRY chart, W1 interval. Source: xNUMX XTB.

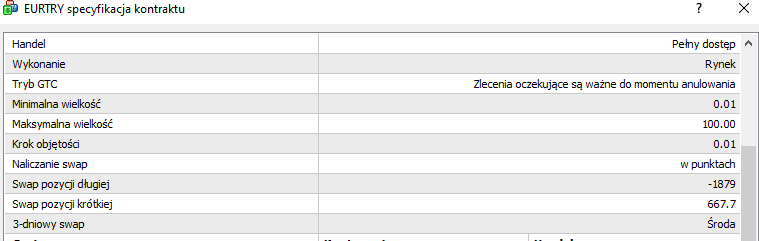

Turkish Lira - Swap Points

Reaction Forex brokers on market events was immediate. swaps on pairs with TRY have blasted into space! For example, at a broker Tickmill the value of swap points for the EUR / TRY pair reaches 700 points for a short position and almost -1900 for a long position.

EUR / TRY contract specification. Source: MetaTrader 4, Tickmill.

Be sure to read: Carry trade - Strategy for the long and medium term

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response