Microsoft - is it worth investing in the "old king"? [Guide]

Microsoft is one of the most famous companies in the world. Today, billions of people come into contact with devices or programs that belong to the "Microsoft stable" every day. Although most people associate Microsoft with the popular "window", "Windows" and Excel, this company is much bigger. Microsoft is one of the few companies in the world to whom capitalization exceeded $ 1 trillion (1 billion). It is a company that operates in such "hot" markets as cloud services or RPA (Robotic Process Automation). However, there are also allegations of monopoly practices that have cost the company many billions of dollars. At the end of June 000, the company employed approximately 2020 employees (full-time), including 163. in United States. In turn, one of the founders and the "face" of Microsoft - Bill Gates - is for some a visionary and philanthropist. For others, Gates is treated as a monopolistic entrepreneur.

In this article you will learn about:

- Bill Gates' youth;

- Microsoft's history;

- Shareholders and management board;

- Current Microsoft products;

- Financial results.

Chart - Microsoft stock

Bill Gates - founder and ex-CEO

When someone talks about Microsoft, Bill Gates is in front of their eyes. Likewise, Bill Gates is mainly known for his work - Microsoft. Although Gates has not been involved in the company's coordinated operations for many years, it is worth taking a closer look at the entrepreneur's youth.

Bill Gates in his youth.

When Bill Gates was a child, his parents wanted him to become a lawyer. At the age of 13, he began attending the prestigious private Lakeside School in Seattle, Washington. To this day, the school is at the forefront of schools in its category. In 2021, Lakeside was ranked by Niche as the best school of its kind in Washington state and the 23rd of its kind in the country. It was at this school that he wrote his first computer program that allowed users to play tic-tac-toe against the computer. Due to the fact that he was a very good student, he was awarded the National Merit Scholar.

At school, he could use a computer if time was paid. To get free access to the computer, young Bill found flaws in the software. At the age of 14, he and his friend Paul Allen founded Traf-o-Data to monitor traffic. Despite the fact that the contractors initially liked the product, the project did not work out when it turned out that the software was developed by teenagers. Nevertheless, he made $ 20 from this endeavor. At school, he created software for assigning students to specific study groups. He modified the code to assign it to groups with girls he liked.

On the SAT (Scholastic Aptitude Test) tests he achieved 1590 out of 1600 points. Thanks to this, in 1973 he entered Harvard College. He chose the law path, but attended maths and computer science classes. The following years are history. Bill Gates created one of the largest companies in the world that changed the world. Currently, he spends the main time overseeing and helping to develop charity projects.

It is worth mentioning the charity work carried out by the Bill and Millenda Gates Foundation. Projects include the fight against malaria, the creation of portable wastewater treatment plants and the fight against poverty. Since 2000, the foundation has donated more than $ 50 billion to charity. He and his ex-wife agreed to donate most of their property to charity (during or after their death). The Gates have three children, each of whom will inherit $ 10 million.

In March 2020, Bill Gates announced that he was leaving the board of Microsoft to focus on work for global health and education. Nada, however, remains a technology advisor to the current CEO.

Respectful to Microsoft, resignation from the board of directors does not in any way mean that you are completely leaving the company. Microsoft will always be an important part of my life's work and I will continue to work with Satya and management to help shape the vision and achieve the company's ambitious goals. - said Bill Gates.

Microsoft's history

The origins of Microsoft date back to the mid-seventies of the twentieth century. In 1975, Bill Gates and Paul Allen founded Microsoft, which was short for "microcomputer software". This year, the BASIC interpreter for the Altari 8800 was developed. At the end of 1978, Microsoft already employed 13 employees. He operated on the American and Japanese markets (he had his branch there). The company's revenues already amounted to $ 1 million.

One of the milestones was the cooperation with IMB and Apple Lossless Audio CODEC (ALAC),. The first big contract Microsoft signed with IBM (late 1980-1981) was for an operating system compatible with IBM personal computers. Bill Gates took the order ... although it had no operating system. Microsoft shortly afterwards acquired from the Seattle-based SPC computer company QDOS ("Quick and Dirty Operating System"), the name of which was sold as 86-DOS. It cost the company $ 50. Due to the fact that the system was not working very well, some corrections were needed. The finished MS-DOS product was installed on IBM computers, and at the same time Microsoft secured the possibility of selling the system independently. The operating system has been very well received by the market, many computer manufacturers have started using MS-DOS as the operating system.

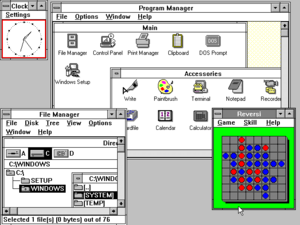

Apple, GUI and Windows 3.0

Steve Jobs, Bill Gates.

Another breakthrough was GUI introduction (Graphical User Interface). These solutions (a concept invented by Xerox in the 70's) made it possible to popularize home computers in society. In the early 80s, Microsoft and Apple signed an agreement. Created by Microsoft, Excel will be available exclusively on Mac for 2 years, in exchange Apple will buy a perpetual software license from Microsoft. At the same time, some of Apple's patents were transferred to Microsoft (including the window graphical interface). Thanks to the experience gained, Bill Gates and his team began to prepare his GUI. In 1985, Windows 1.0 was launched and 4 years later the famous Office suite appeared. However, the real breakthrough came in 1990, when Windows 3.0 was released. It was a real breakthrough. In the two years since its release, 10 million copies of this software have been sold. The following years strengthened Microsoft's position as the undisputed leader in the operating systems market. In 1998, over 90% of computers used Windows (including different generations).

Next years

After Windows 3.0 (and its subsequent versions), Microsoft continued to develop its main product. At the same time, new functionalities are constantly being added. An example is the search engine debuting on Windows 95 Internet Explorer. In the following years, new versions of the "flagship product" appeared, such as Windows XP, Windows Vista (2007), Windows 7 (2009), Windows 8 (2012) and Windows 10 (2015).

However, Microsoft is not only about computers. In 2001, the first Microsoft console was introduced - it was it Xbox. After the sales success of Xbox, the Xbox 2005 console made its debut in 360 (over 2014 million units were sold by June 84). The next consoles were Xbox One and the newest Xbox X and S. Xbox is one of the big three on the console market (along with PlayStation and Nintendo).

Microsoft also expanded its offer through acquisitions. In 2011, it acquired Skype Technologies for $ 8,5 billion, while in 2013, Microsoft acquired Nokia's smartphone business (without success). Three years later, the LinkedIn social network was purchased for $ 26 billion, the number of users of which has now exceeded 700 million. In 2018, GitHub was acquired for $ 7,5 billion.

The company also looked at the gaming market. In 2014, Mojang (producer of Minecraft) took over for $ 2,5 billion.. In turn, in 2020, ZeniMax was acquired for $ 7,5 billion, whose development studios released games such as Fallout, DOOM, Quake, Wolfenstein. This allowed Microsoft to strengthen itself on the PC and console gaming market. Thanks to these transactions, Microsoft is also becoming a content creator.

For many years, Microsoft has developed its database management systems (Microsoft SQL Server) and is developing its cloud service. Microsoft is among the top three cloud providers in the United States (along with AWS and Google).

Financial penalties

Microsoft's very strong position on the computer software market meant that the company was punished more than once for the use of illegal practices. In 2008 European Commission imposed a fine on Microsoft $ 1,35 billion for using monopolistic market power. In turn, in 2013, the European Commission also imposed on the company over € 560m fine for making it difficult to choose a web browser.

Management

In the XNUMXth century, Microsoft developed very dynamically. However, in the following years, the company began to turn into "Dividend company"which, instead of looking for opportunities to increase the scale of operations, lightly rested on its laurels. This was also evident in the share price, which was still below the 2014 peak in 2000. The situation started to change only after changing the position of CEO.

Satya Nadella was born in India in the city of Hyderabad in the state of Telengana. He was the son of an Indian official. After completing his education in India, he moved to the United States in the second half of the 80s. In the USA, he graduated in computer science from the University of Wisconsin-Milwaukee. In the early 90's he worked at Sun Microsystem, but in 1992 he joined Microsoft. In the years 2011 - 2014 he was the president of the Server and Tools branch. Under his term, cloud services revenues increased from $ 16,6 billion to $ 20,3 billion. From February 2014, he became the CEO of Microsoft. Under his rule, the company is trying to diversify its business more. This is especially true for gaming, RPA and cloud services.

Christopher Young from November 2020, he has been the Executive Vice President of Business Development. In the years 2017 - 2020 he was the CEO at McAfee. His previous position was SVP (Senior Vice President) in the Intel Security Group division (2014 - 2017). Previously, he worked, among others in Cisco, Vmware or AOL.

Amy Hood - since 2013 he has been the CFO (Chief Financial Officer) at Microsoft. He has been working for the company since 2002. Then she started working as the Investor Relations Director. In the following years, she climbed the career ladder. It is worth noting that in 2006-2009 she was General Manager in Strategy and Business Development. Before working at Microsoft in 1994-2002, she worked at Goldman Sachs in the Investment Banking and Equity Capital Markets department.

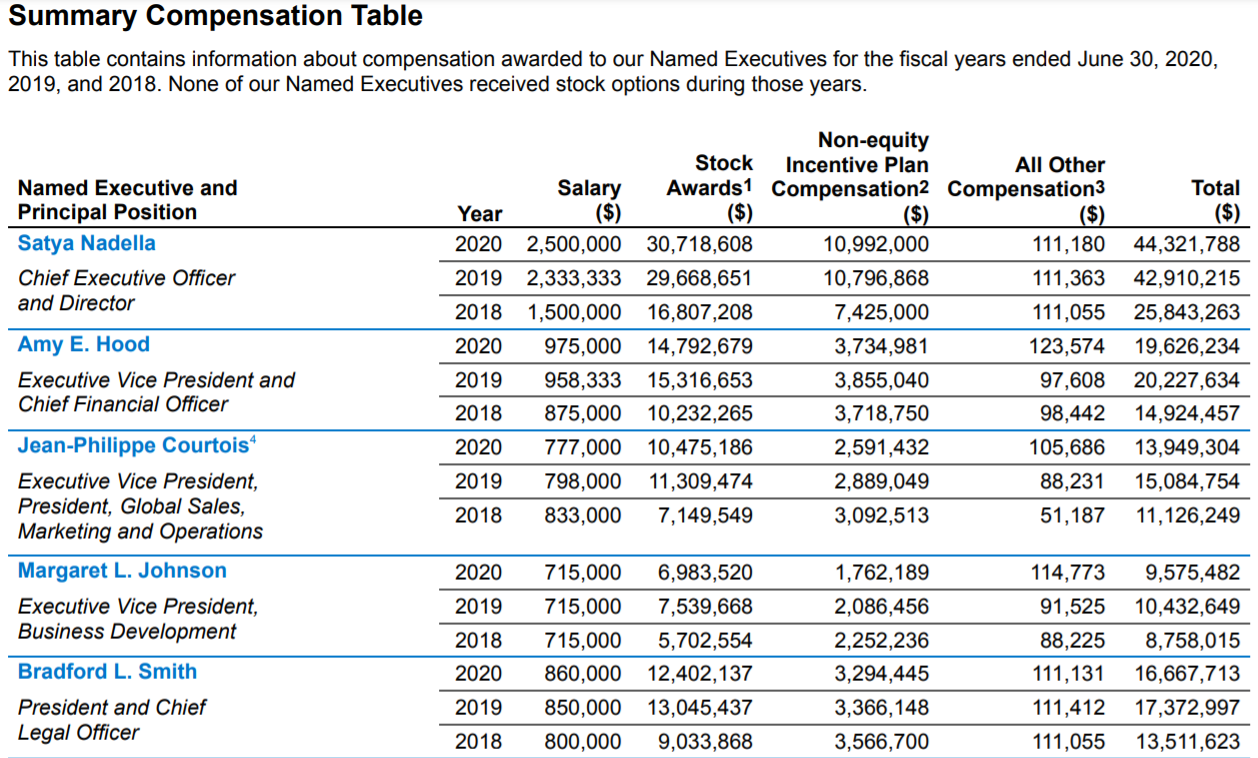

remuneration

As with most large corporations, the base salary is a small fraction of the total salary. In the case of a CEO, the basic salary is only 5,5% of the total salary. Awards for achieving short- and long-term goals for the company are dominant. Satya Nadella must meet three requirements (they all weigh the same): Product & Strategy, Customers & Stakeholders, and Culture & Organization Leadership. In the case of other Management members, goals are selected individually, depending on the department.

Shareholding

Financial entities dominate the shareholding structure. These include: Vanguard, Blackrock, State Street, FMR or T-Row. Only two shareholders exceed 5% of the shares in the company:

The fragmented shareholding structure means that the company may lack a long-term "ownership" view in the long term. In 2020, Bill Gates owned approximately 1% of the company's shares.

Business segments

Productivity and Business Processes

In Q2021 14,7 FY (financial year), the company generated $ 6,4 billion in revenues in this segment and achieved $ XNUMX billion in operating profit. The segment contains many products and services, which Microsoft divides into:

Commercial Office - this product group includes products such as Office 365 (subscriptions) and Office sold traditionally ("on-premises"). It also includes Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance and Skype for Business. The products are offered to companies both large and from the segment of small and medium-sized companies. Business growth depends on the monetization of existing and acquiring new users.

Office Consumer - this group of products is targeted at individual customers. As a rule, these are users of new devices who choose the subscription model instead of a lifetime license. The main product is Microsoft 365 Consumer (formerly Office 365 Consumer). At the end of Q2021 of the 365 fiscal year, the number of Microsoft 51,2 subscribers exceeds XNUMX million.

LinkedIn - this revenue includes premium subscriptions (LinkedIn Gold) and solutions related to talent management, science (courses), and marketing. LinkedIn is the largest social platform for professionals. Professional profiles are created there. LinkedIn is designed to speed up the time it takes to find the right candidate for a job. As with every social platform, the platform effect works (the more professionals, the more recruiters -> more recruiters, more job offers -> more job offers, more professionals). The current number of users exceeds 700 million people.

Dynamics business solutions - it is an offer that includes Dynamics 365 (subscription) and Dynamics ERP (on-premises) and Dynamics CRM (on - premises). The Dynamics 365 offer is a cloud-based solution combining CRM (Customer Relationship Management) and ERP (Enterprise Resource Planning) software. The offer is directed to small, medium and large organizations and branches of global companies.

IntelligentCloud

Intelligent Cloud offer includes public, private and hybrid cloud services. The offer includes, among others such services as Azure or SQL Server. The segment generated $ 2021 billion in revenues and $ 17,4 billion in operating profit in Q7,8 XNUMX FY. This segment includes:

Server products and cloud services - this group includes solutions such as Azure, SQL Server, Windows Server, Visual Studio and GitHub. It is worth taking a look at the first solution. Azure it is a comprehensive solution that allows developers and other professionals to easily create, develop and manage applications on any platform or device. Azure has over 200 additional solutions that allow for more efficient operation. These include Azure Cosmos DB (noSQL), or Azure Quantum is a full-stack, public ecosystem for quantum solutions. Microsoft boasts that 95% of Fortune 500 companies use the Azure solution.

Enterprise Services - it is an insignificant part of the business. It is part of the offer related to support and consulting services. Specialists employed by Microsoft conduct training courses and assist developers and IT specialists in their day-to-day work.

More Personal Computing

This offer includes devices, operating system sales and a gaming offer. The segment generated revenues of $ 2021 billion in Q14,1 4,9 FY and an operating profit of $ XNUMX billion. Microsoft divides this segment into the following revenue streams:

Windows

This is Microsoft's "flagship product". It is the most popular operating system in the world. The number of devices already sold with installed software depends on the revenues of this segment. The company sells licenses to device manufacturers (e.g. laptops, personal computers).

Devices

This revenue group includes Surface laptops and computer accessories. Surface laptop sales reached $ 1,5 billion in Q2021 XNUMX FY.

Gaming

Microsoft has a wide gaming offer. The company has its own content, community, cloud services and game devices (consoles). Development studios associated with Xbox Game Studios are responsible for creating the content. Through acquisitions, Microsoft is trying to expand its product offer. Thanks to this, the company can provide very good games to its subscription offer. The subscription product is Xbox Game Pass, which offers access to 100 games (own and external) on the console and computer in exchange for a monthly payment (in Poland PLN 40 per month in the subscription for the console).

Financial results

In terms of revenues, the best quarter for the company is Q2021 of each financial year (ends in June). In Q46,1 27 FY, the company generated $ 17,5 billion, which corresponded to 21% of revenues in the entire financial year. As you can see, there are no very visible sales cycles. In the entire financial year, revenues increased by 30%. In the last quarter, year-on-year growth was XNUMX%. In this quarter, cloud services sold very well (+ XNUMX% y / y) and Productivity and Business Processes segment (+ 25%). Over the past few years, the company has managed to simultaneously increase the scale of its operations and raise its operating profitability. It is also worth noting that the company managed to significantly improve the return on equity. Capital management is at a high level as ROIC (Return on Invested Capital) has been between 25% and 30% in the last three years.

| $ Million | 2018FY | 2019FY | 2020FY | 2021FY |

| Net revenues | 110 360 | 125 843 | 143 015 | 168 088 |

| operational profit | 35 058 | 42 959 | 52 959 | 69 916 |

| operating margin | Present in several = 31,77% | Present in several = 34,14% | Present in several = 37,03% | Present in several = 41,59% |

| net profit | 16 571 | 39 240 | 44 281 | 61 271 |

| equity capital | 82 718 | 102 330 | 118 304 | 141 988 |

| ROE | Present in several = 20,03% | Present in several = 38,35% | Present in several = 37,43% | Present in several = 43,15% |

source: own study based on the company's annual reports

Cash generated

Microsoft is a cash machine. In the past four years, it has generated over $ 233 billion in operating cash flow. After subtracting capital expenditures, the company generated FCF of approximately $ 172 billion. Free funds were allocated to acquisitions: ($ 14,7 billion), dividend payments ($ 58,2 billion) and share purchases ($ 80,6 billion). Despite the company's generosity and transferring less than $ 4 billion to shareholders in the last 140 years, Microsoft generated a surplus of cash during this time.

|

$ Million |

2018FY |

2019FY |

2020FY |

2021FY |

|

OCF * |

43 884 |

52 185 |

60 675 |

76 740 |

|

CAPEX ** |

11 632 |

13 925 |

15 441 |

20 622 |

|

FCF *** |

32 252 |

38 260 |

45 234 |

56 118 |

|

Net acquisitions (-) |

888 |

2 388 |

2 521 |

8 909 |

|

Dividend (-) |

12 699 |

13 811 |

15 137 |

16 521 |

|

Share buyback (-) |

10 721 |

19 543 |

22 968 |

27 385 |

source: own study based on the company's annual reports; * OCF - cash flows from operating activities; ** investment expenses; ***

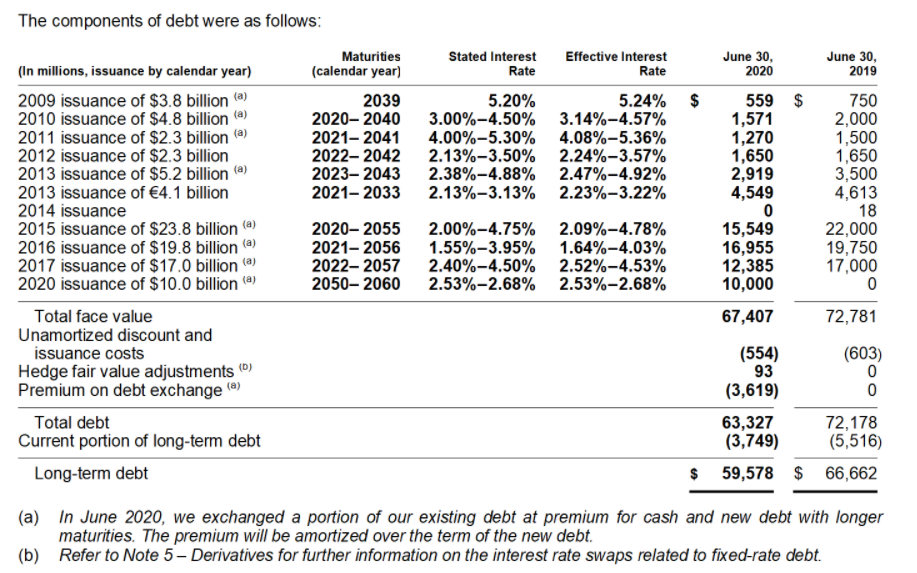

Debt structure

A year ago, Microsoft had approximately $ 59,6 billion in long-term interest debt. After a year, long-term debt fell to around $ 50 billion. Below is a list of bonds with information on interest rate, debt amount and maturity:

Microsoft is in a very good liquidity situation. The company has not had net debt for many years, i.e. financial liabilities less cash and cash equivalents. The COVID-19 period was not difficult for the company. The excess of liquidity over liabilities decreased by $ 5 billion.

| $ Million | 2018FY | 2019FY | 2020FY | 2021FY |

| net debt | -46 156 | -47 377 | -54 382 | -49 132 |

source: own study based on the company's annual reports

Competition

Due to the fact that the company operates on many markets, it is difficult to identify a company that competes with the company in all fields. In the case of cloud services, the biggest competition is Amazon (AWS) and Alphabet (Google Cloud). In the case of Skype, the competition is Slack or Zoom. In the case of the cyber security offer, ProofPoint or Symantec can be mentioned among the competitors. If you look at the Dynamics product, the competitor is, among others Salesforce or SAP. In turn, in the segment of gaming platforms (for consoles), Sony or Nintendo are the competitors. Below are some of the companies that compete with Microsoft in specific segments.

A

It is one of the most famous technology companies in the world. It is best known from the Google search engine, YouTube platform, Android system and the Google Play store. Although advertising revenue is the main source of revenue, the business diversifies with each passing year. A has a cloud segment (Google Cloud), in which it competes with Microsoft. It also offers free Office solutions (Google Excel etc.). Of course, among other projects can be mentioned Waymo (autonomous cars). The company's current capitalization exceeds $ 1 billion.

| Alphabet ($ million) | 2017 | 2018 | 2019 | 2020 |

| revenues | 110 855 | 136 819 | 161 857 | 182 527 |

| Operational profit | 28 914 | 32 595 | 36 482 | 41 244 |

| Operating margin | Present in several = 26,08% | Present in several = 23,82% | Present in several = 22,54% | Present in several = 22,60% |

| Net profit | 12 662 | 30 736 | 34 343 | 40 269 |

Alphabet chart (Google), interval W1. Source: xNUMX XTB.

Amazon

Amazon mainly associated with the marketplace, which has a dominant position in the United States and very strong in many countries in Europe (including Germany) and Asia (including South Korea, Japan). However, in addition to its core business, the company is also a leader in providing cloud services in the United States, Canada and the European Union. Its Amazon Web Services (AWS) has been a benchmark in this market for many years. Amazon is also present on the gaming market (Twitch platform) and offers video-on-demand services (Amazon Prime Video). Amazon also allocates a lot of money to the development of AI technology (including medicine). The current capitalization of the company is $ 1 billion.

| Amazon (million $) | 2017 | 2018 | 2019 | 2020 |

| revenues | 177 866 | 232 887 | 280 522 | 386 064 |

| Operational profit | 4 106 | 12 421 | 14 404 | 22 899 |

| Operating margin | Present in several = 2,31% | Present in several = 5,33% | Present in several = 5,13% | Present in several = 5,93% |

| Net profit | 3 033 | 10 073 | 11 588 | 21 331 |

Amazon chart, interval W1. Source: xNUMX XTB.

How can you invest in Microsoft?

The company is one of the components the S&P 500 index. Having a brokerage account with access to foreign markets, the investor can buy shares or use derivatives such as options or futures contracts. Another option is investing in an ETF giving exposure to Microsoft. An example would be Technology Select Sector SPDR (XLK)in which Microsoft has a 20,8% weight in the ETF.

CFD Chart on ETF Technology Select Sector SPDR (XLK), Interval W1. Source: xNUMX XTB.

Another option is to invest in iShares US Technology ETFwhich gives exposure to US technology companies. One of the companies that make up this ETF is Microsoft with a share of 17,4%.

How to Invest in Microsoft - ETFs and Stocks

An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

Microsoft has come a long way in its 45-year history. From a garage company to becoming a huge monopoly that has been on the radar of many state regulators. When it seemed that Microsoft would "devour the world", the company fell into apathy and became a dividend company. Even 9 years ago it seemed that Microsoft awaited the fate of other "technological giants" such as IBM or Xerox. However, after changing the position of CEO, the company caught the wind in its sails. Over the past 7 years, numerous acquisitions, the development of the cloud offer and product diversification have given the company a new lease of life, and despite revenues exceeding $ 180 billion, it can grow at a double-digit pace. Of course, years of previous neglect have meant that the company has a lot of catching up to do, and in many places Microsoft is one of the chasing competitors. This is e.g. on the cloud market (AWS is the leader) and in the RPA segment (Robotic Process Automation), where UiPath is one of the leaders.

Although the company has a lot of catching up to do, it is still able to generate an excellent operating margin from its flagship products and services. Most of the cash is spent on dividends and share purchases. While this is beneficial for shareholders in the short term, it can be detrimental in the long term. Since the company is able to generate 25% -30% profit (ROIC) from the invested capital, allocating several tens of billions annually to new projects could help the company quickly catch up with technological debt in many niche, but promising industries. However, apparently the management board does not see any space for such investments, or the main shareholders (investment funds) are satisfied with the current state of affairs.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Microsoft - is it worth investing in the "old king"? [Guide] how to invest in microsoft shares](https://forexclub.pl/wp-content/uploads/2021/08/jak-inwestowac-w-akcje-microsoft.jpg?v=1627892296)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Microsoft - is it worth investing in the "old king"? [Guide] Is Chinese Stocks an Opportunity](https://forexclub.pl/wp-content/uploads/2021/08/Czy-chinskie-akcje-to-okazja-102x65.jpg?v=1627898155)

![Microsoft - is it worth investing in the "old king"? [Guide] uses](https://forexclub.pl/wp-content/uploads/2021/08/dlug-usa-102x65.jpg?v=1627905068)

Leave a Response