A strong start to the year fuels speculation about a supercycle

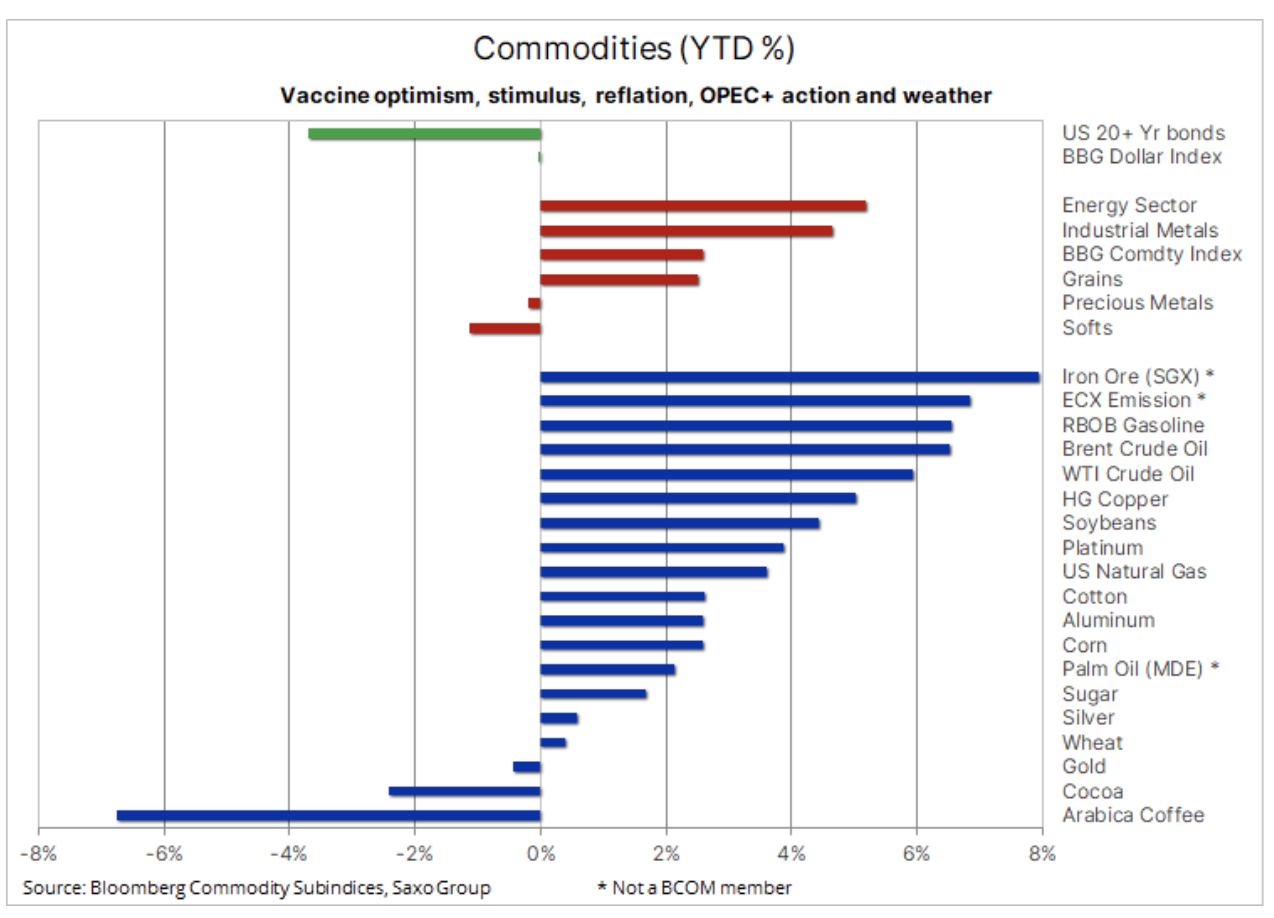

We anticipate that the general boom in commodity markets, as a result of which the Bloomberg commodity index gained 10% in the last quarter, will also continue in 2021. As a result of numerous positive impulses caused by a decrease in supply, the world market was flooded with cash, which intensified speculation in all markets and increased the demand for hedging against inflation. In addition, the prospect of a weakening dollar, a recovery in global demand over the vaccine, and new fears about the weather mean that elements of another super-cycle in the commodity market are already visible.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

At the same time, many countries are still facing the pandemic, particularly in the now winter regions of the Northern Hemisphere, and prospects for improvement, with the vaccine or otherwise, are slim until warming in March and April. As the bull market may hold back until the vaccine program gains momentum, the market remains hopeful that continued investment demand will prove strong enough to support markets in the coming months, when the negative effects of lockdowns and mobility constraints will be greatest.

Demand for investments was clearly visible in the first completed week of trading: the US stock market rose sharply, reaching a new record, mainly the so-called Tech bubble stocks and green stocks after Democrats won a majority in Congress. Bitcoin value, another bubble candidate, surpassed $ 40 as this alternative instrument gains popularity in response to rising institutional demand.

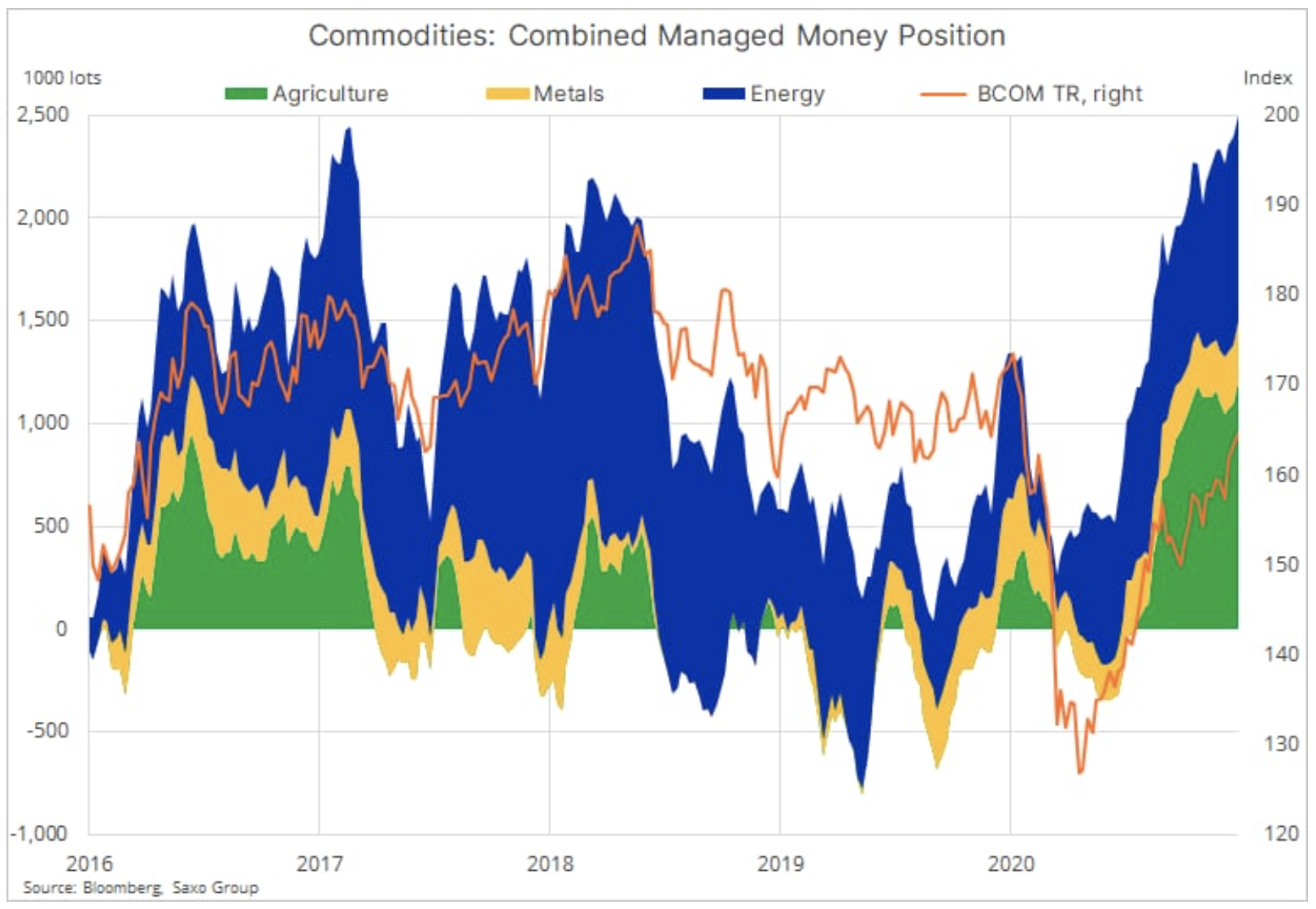

Speculative investors have reacted strongly to the improvement in sentiment over the past six months and had a cumulative net long position in 2021 major commodity futures of 24 million lots in early 2,5, corresponding to a face value of $ 125 billion. While the oil market dominated the previous two peaks of 2017 and 2018, the chart below shows that bulls traded more evenly across the three main sectors - energy, metals and agricultural products.

Overall, the largest orders are for crude oil, with both WTI and Brent crude oil long positioning totaling € 614k. lots, which corresponds to a face value of USD 30 billion, gold - long position is 137 thousand. flights worth $ 26 billion, as well as soybeans and its products - a long net position in soybeans, soybean meal and soybean oil reached 399. lots, i.e. a nominal value of USD 19 billion. The long net position in crude oil and gold, the two largest contracts in terms of exposure, remains well below its previous peaks of March 1,1 for crude 2018 million and 292 for crude oil. flights from September 2019 in the case of gold.

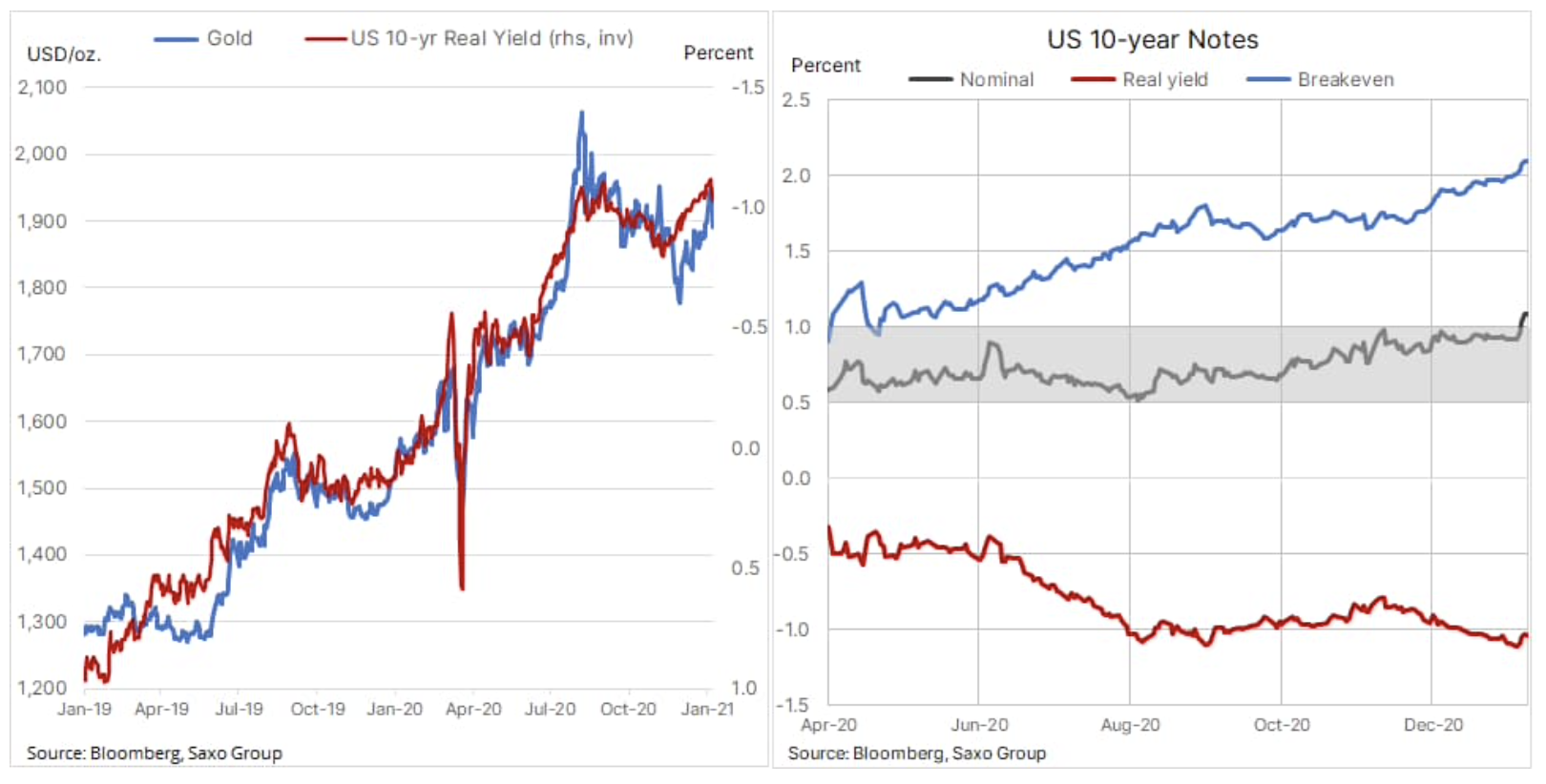

The number of transactions involving reflation has also increased, and thus the need to protect wallets from rising inflation, following the double victory of the Democratic Party in the Georgia Senate elections. The Democrats in effect gained a majority in the Senate, enabling President-elect Biden to plan additional fiscal stimulus and spending to support a pandemic-weakened economy and unite a uniquely divided nation. This led to an undesirable increase in US Treasury yields in the context of precious metals. An increase in 1-year US bond yields above 2020%, the ceiling recorded throughout the second half of XNUMX, contributed to the reduction of previous gains gold i silver, because the dollar has in effect attracted investors covering short positions to allow for further growth.

Precious metals

For metals, this is true of paragraph 22 as higher inflation expectations automatically push the dollar to strengthen in response to rising yields, which could hurt the gold's short-term outlook. Nevertheless, we remain optimistic and based on our forecast that the gold price will reach $ 2 / oz, the high beta silver should support further solid performance, and the gold / silver ratio in 200 will be in the lower 2021-60 range, thanks to so the price of silver could be around $ 69 / oz.

Meanwhile copper HG after rolling from a solid position in December, it had its best week since July 2020 driven by reflatory speculation and physical demand. China, the world's largest consumer of this metal, was the main contributor to the 75% boom in the March low. the global vaccine recovery is expected to translate into increased demand in other countries as well. This is mainly due to the fact that the departure from coal will accelerate the electrification process, thereby increasing the demand for copper due to its use as a heat and current conductor. After breaking HG copper above $ 3,65 / lb, there is no significant resistance up to $ 4,0 / lb.

Petroleum

Impressive bull market oil Since the first vaccinations were announced in early November, it also extended into the first trading week, with the price of Brent crude exceeding $ 55 / b for the first time since February. This came after OPEC +, amidst uncertain short-term demand forecasts, decided to hold current production levels until March. The surprise was the announcement of a unilateral reduction in production by Saudi Arabia, which is increasingly seen as the guardian of the oil market. The Saudis have likely concluded that the current weakening in fuel demand in the West over the next few months will also extend to Asia, where the number of infected people is growing rapidly.

Given this, from the current fundamental perspective, we remain skeptical about the ability of oil to break even much higher at this stage. However, as the momentum is still strong, the price of oil can easily reach levels that could not otherwise be justified at this stage of the recovery. We forecast Brent crude oil price to exceed $ 60 / b at a later date as global fuel demand picks up more and OPEC and non-OPEC production reserves now exceed 7 million barrels a day will begin to decline as OPEC + continues to increase production.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response