Strong drop in inflation in Poland rather without impact on the Monetary Policy Council (and the zloty)

The year 2024 began with a strong decline in inflation in Poland. However, this should not have a significant impact on future decisions of the Monetary Policy Council, and therefore on the zloty quotations.

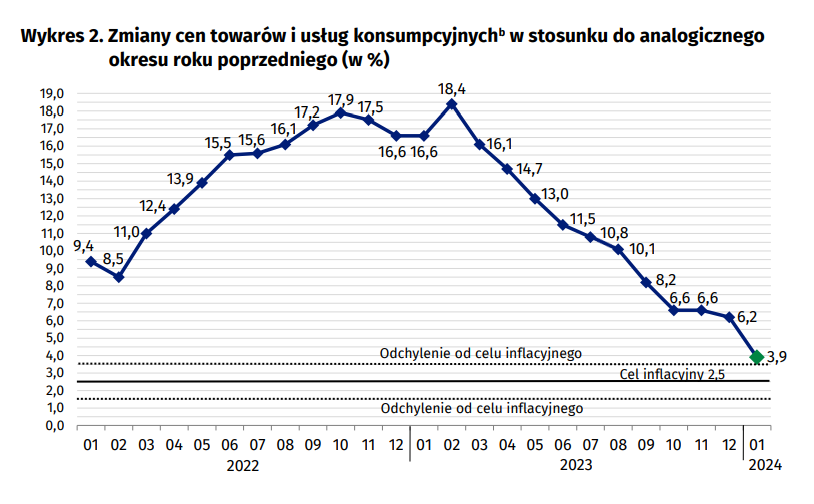

Inflation drop in Poland to 3,9%

January brought a strong acceleration of disinflationary processes in Poland. According to data published today by the Central Statistical Office (GUS), consumer inflation (CPI) decreased to 3,9%. year-to-year (Y/Y) from 6,2%. in December and it was significantly lower than the market consensus of 4,1%. (forecasts ranged between 3,8% and 5,2%). These data may suggest that inflation will drop to 2,5% in the first quarter. R/R.

Inflation in Poland. Source: Central Statistical Office

January also looks good when it comes to month-to-month price changes. These increased on average by only 0,4%, which is the smallest increase since 2019 and a much smaller increase than in recent years. For comparison, in January 2023, prices increased by as much as 2,5%. month-to-month, and in January 2022 they increased by 1,9%. compared to December 2021.

Why the lack of reaction on the zloty?

However, the published data do not cause a major market reaction on the currency market. Investors are aware that the Monetary Policy Council (MPC) has recently clearly stiffened its position and become more "hawk", which means that the focus is not on current inflation readings, but on inflation in the second half of the year, when all anti-inflation shields will be abolished and the VAT rate will return to normal levels. Hence, the chances that interest rates in Poland will be reduced this year remain relatively small. Alternatively, if they could be reduced, it would probably be symbolic and one-off. The market invariably assumes that cutting interest rates in Poland is only a matter of 2025.

Due to the lack of a potential reaction of the Council to the currently observed decline in inflation in Poland, the Polish zloty also remains insensitive to these data. This means that in the near future the domestic currency will react primarily to the changing moods on global markets and the resulting fluctuations in quotations. EUR / USD. In the longer term, the zloty should remain strong, supported by the Polish economy slowly returning to the growth path, as well as by more "hawkish" monetary policy in Poland in relation to other countries.

EUR / PLN daily chart. Source: Tickmill

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)