The real killer of stocks is the recession, not inflation

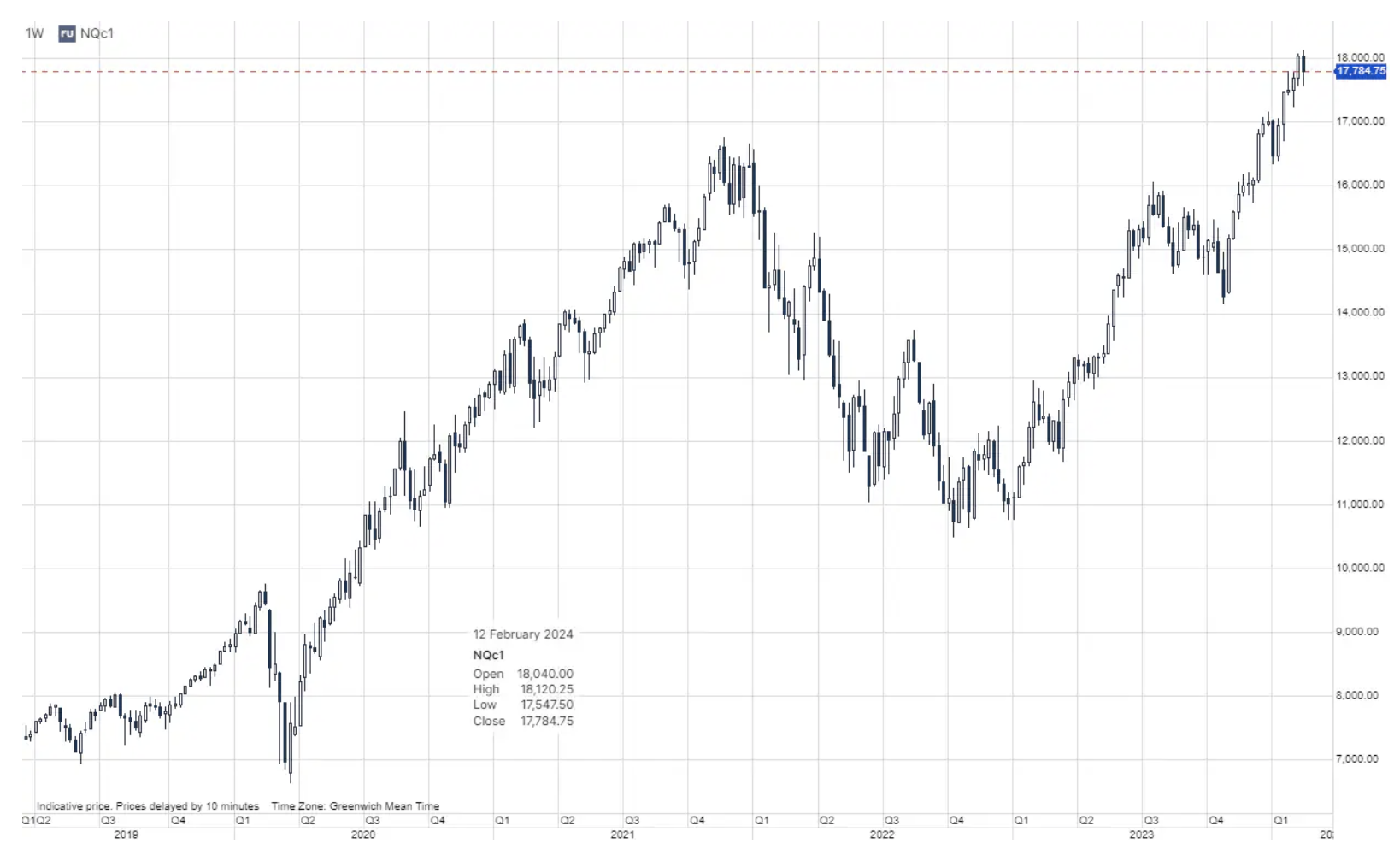

The recent U.S. inflation report came as a surprise, pushing stock markets, especially the Nasdaq, lower. Higher-than-expected inflation meant that expectations for interest rate cuts were pushed further into the calendar. A March interest rate cut is out of the question, the first cut will come in May or June, and we could see four cuts by December. This is a drastic change from the seven cuts expected earlier this year. What happened? Sticky core inflation in services, supported by wage dynamics, is not budging, and global manufacturing is showing signs of recovery. If the commodity economy adds to this already stubborn inflation, things could get interesting. Should stock investors be worried? As long as inflation remains below 4%, the recession becomes more significant. If the economy stays afloat, sentiment should remain positive. However, recent sky-high valuations could become a problem if companies are unable to meet earnings expectations.

Inflation dynamics are delaying market hopes for a reduction in interest rates

A surprise in the form of the January inflation report in the USA, which showed CPI y/y at 3,1% against the estimated 2,9% and core CPI y/y at 3,9% against the estimated 2,9%. 2,9% and core CPI y/y at 3,9% compared to the estimated 3,7%. That pushed stocks lower, with Nasdaq 100 futures leading the decline by 1,6%. However, futures on leading technology indexes rose 0.6% the next day, reflecting that this inflation surprise will derail the stock rally for now. Before we dive into what the inflation report means for stocks, it's worth observing market changes in the pricing of interest rate cuts Fed.

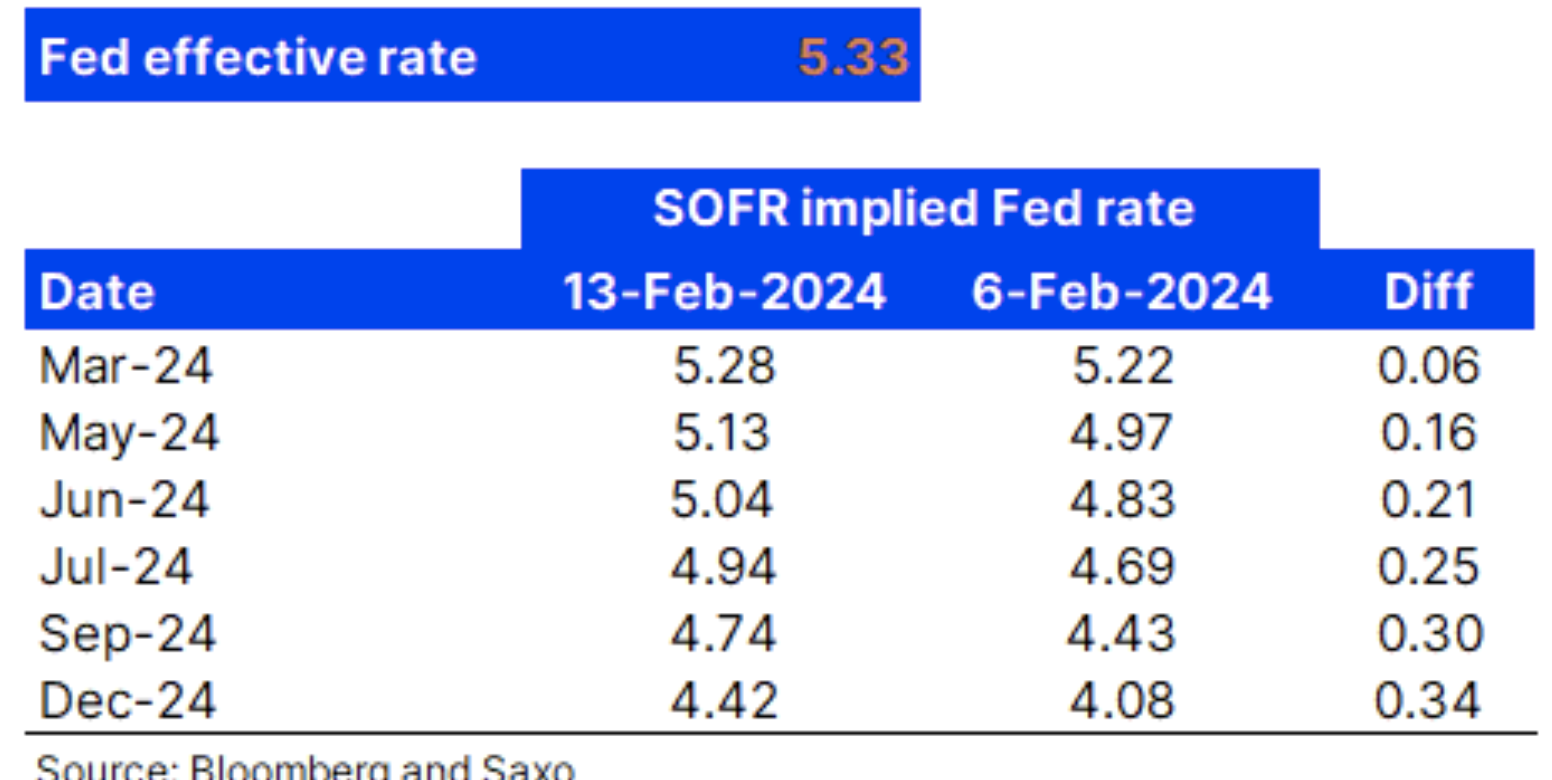

The table below shows that the current Fed effective interest rate is 5,33% and the Mar-3 24-month SOFR futures closed at an estimated Fed Funds Rate of 5,28, reflecting that the March rate cut has been fully priced in . The table also shows the estimated Fed Funds rates at various points in the future based on these SOFR futures contracts from a week ago and the difference. We see that compared to the situation a week ago, the market has removed the entire rate cut (25 basis points) by the July FOMC meeting. The current estimated Fed funds rate for the July meeting is currently 39 basis points below the current effective rate, suggesting the market is leaning toward two rate cuts by the July FOMC meeting, but the split is closer to 50/50. The table also shows that the market is pricing in four rate cuts (the Dec-24 contract puts the Fed funds rate 91 basis points below current levels) by the December meeting FOMC, which is a drastic change compared to the beginning of this year, when the market priced in seven interest rate cuts. So what has changed?

As we wrote in our article What are the Fed's possible considerations for rate cuts? on February 1, there were several factors that indicated that the Fed would refrain from cutting. Some of them include sticky core inflation in services, loose financial conditions, an upward trend in the US economy and a tightening labor market, as seen in the latest monthly observations. The latest inflation report showed exactly what we were talking about: wage growth is creating sticky core services inflation, which increased by 0,66% m/m, and on a year-over-year basis the 6-month average m/m was 5,6% year-over-year. The rise in inflation now looks like this. Base effects from lower energy prices are receding and the global manufacturing sector is showing green shoots, with PMI data pointing to the highest levels of activity since August 2022. Imagine the goods economy gaining momentum again on top of the current sticky services inflation.

Should stock investors be concerned about inflation dynamics and that the path to the Fed's estimated target funds rate is now likely to be longer? As long as headline inflation stays below 4%, we don't worry about stock returns from an inflation perspective. A recession, or lack thereof, means a lot more for stock returns, so until we see clear signs of an impending recession, we think equity market sentiment will remain positive. However, stock valuation levels are quite high and therefore pose risks should companies suddenly be unable to meet these expectations.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response