A strong decrease in NatGas, an increase in copper prices due to coronavirus

A strong decrease in NatGas, an increase in copper prices due to coronavirus

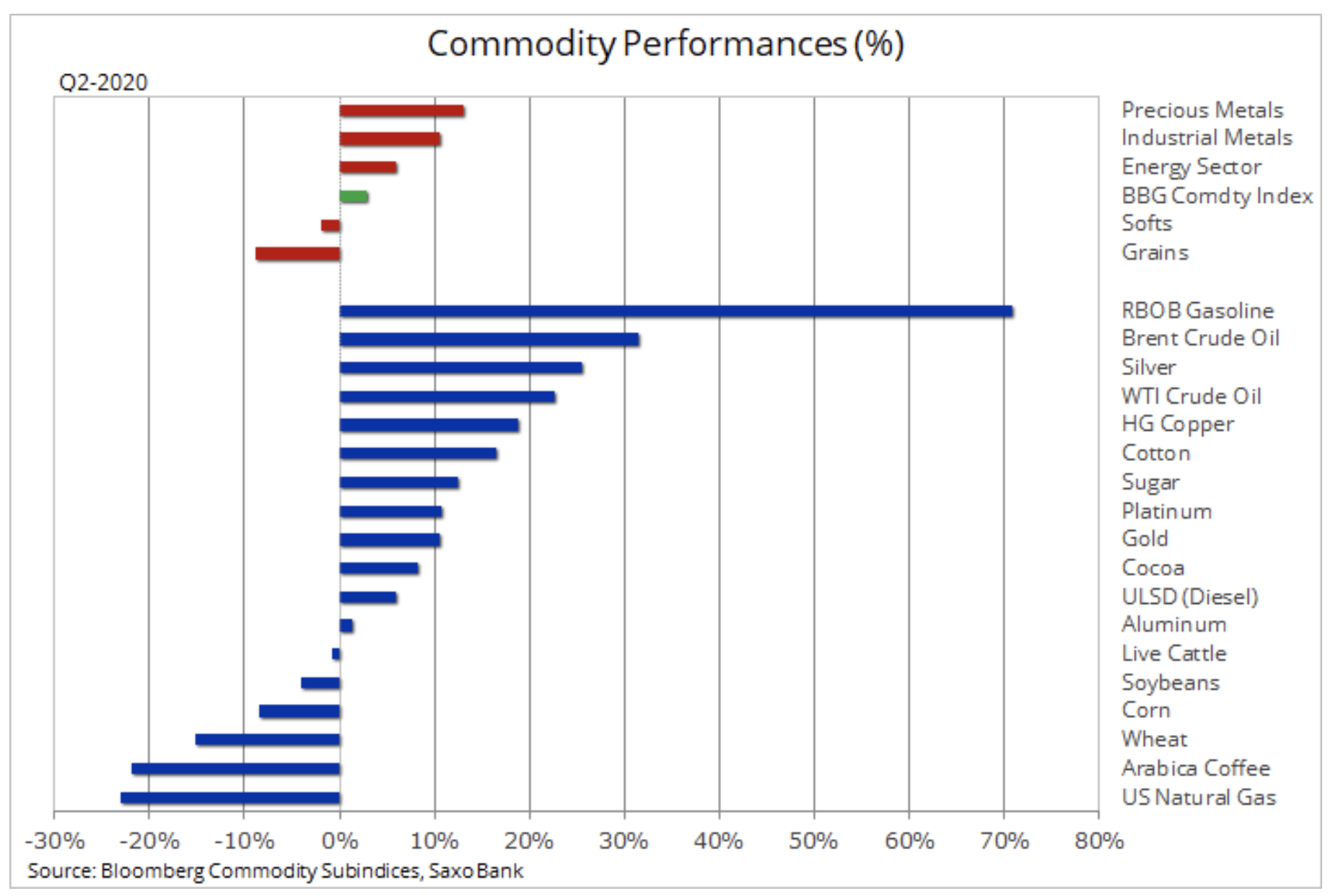

The commodity market seems determined to end the second quarter, i.e. the recovery quarter, with strong gains in the energy and metal sectors. Overall, however, the Bloomberg Commodity Index, based on a basket of futures for key commodities, managed to record only a small profit compared to other markets. This index pulls down agricultural products, some of which are losing because of significant inventories and falling consumer demand during the isolation period.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

As we end the extremely volatile and sometimes disturbing first half of the year, which has been marked by the worst global growth pandemic collapse since World War II, forecasts for the second half give some reason for concern. In many regions of the world, the pandemic has still not been overcome, and the new rise in the United States and the recent panic in Beijing highlight the risks associated with this "invisible enemy."

More forward-looking assets, such as shares, some of which have returned to pre-pandemic levels, may ignore short-term risk, taking into account the economic recovery based on the wall of central bank money. Raw materials, however, do not have such a luxurious position, because they are "instant" assets, depending on demand and supply. This means that financial investors can control the price for some time, but if the foundations do not improve, one should take into account the risk of a reverse course.

Selected raw materials, such as natgas or oil or fuel products, have just reached levels where price may need support in the form of continuous improvement of foundations to grow. However, due to the further increase in COVID-19 infections, problems may arise that limit the growth potential.

NatGas (natural gas)

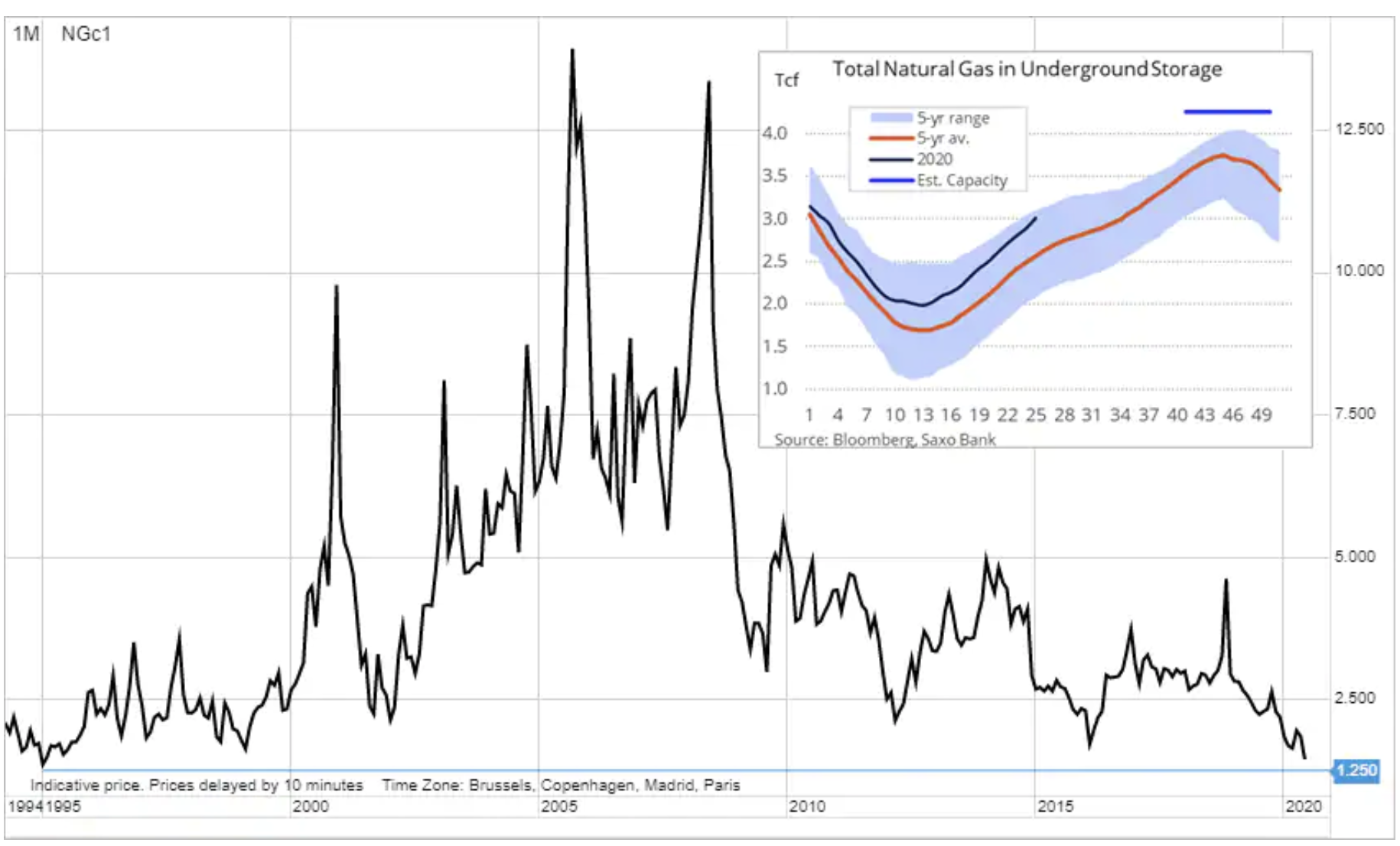

Natgas fell to its lowest level in 25 years after the US Energy Information Administration (EIA) reported a more-than-expected weekly jump in inventory levels in the United States. The dynamics of the latest decline partly resemble the factors that led to the sharp fall in oil prices in March. World natural gas prices have fallen sharply in recent months, first as a result of a mild winter, which has left too much gas in storage, followed by a pandemic that has further reduced demand from industrial users.

The biggest threat is the possibility of filling underground tanks before the return of winter demand, which will reduce the level of stocks. If things continue in this direction, prices may fall even further in the coming weeks, and eventually the only solution may be top-down production cuts, as was the case recently for US shale oil producers.

Natgas and its low world prices, reflected in benchmarks in both Europe (Dutch TTF) and Asia (Japan / South Korea), have limited the earning potential of exporters, including transport and liquefaction. As a result, exports from the United States decreased by half compared to the peak value at the end of December last year.

Petroleum

Petroleum until recently, it had recorded the highest prices since March 8, when Saudi Arabia launched a short-lived price war, but this boom has just stopped. Instead of focusing on effective OPEC + efforts to support the market by reducing supply, the market has temporarily focused on the risk that a new rise in COVID-19 may slow down further recovery in global demand.

In particular, this applies to the United States, where a number of states, including Texas - the center of the US oil industry - halted the process of opening the economy after an increase in the number of infections, and authorities in Houston said that ICUs have reached full occupancy. At the same time, US oil reserves continue to grow; recently recorded a record level of 541 million barrels, to which should be added 19 million barrels temporarily deposited in government magazines.

Whether this situation changes will depend on US gasoline demand during the summer, from July to September. Usually, oil reserves decrease during this period due to the increase in refinery demand. The recent increase in incidence may have an even more negative impact on the number of kilometers driven than the 15% year-on-year decline forecast by the American Automobile Association.

Producers from OPEC + exceptionally effectively limit production, which is illustrated by the decrease in exports from Western Russian ports forecast for next month. However, for this agreement to be successful further, OPEC + must also see the light in the tunnel in the context of unscrewing the taps again. Although we do not anticipate a repeat of earlier draconian isolation methods, the increase in morbidity may further delay the moment of increasing production, which may upset the group's decisions.

We maintain the view, which will be expressed in the soon-published Q35 forecast, that Brent oil in the coming weeks, and maybe months, will fall in the range from 45 to XNUMX.

Gold

Gold wthe rest managed to break into the new eight-year maximum of USD 1 / oz, thus approaching another key area around USD 780 / oz. In 1-800, this area was a veritable battlefield, in which the losers ultimately turned out to be bulls after a year-long decline toward USD 2011 / oz.

Despite the complications, gold did not come close to support at 1 745 USD / oz. A weekly closing above USD 1 / oz and an increase in the involvement of hedge funds in the context of long positions (in recent months the funds have reduced long positions by 765%) may be a positive technical signal.

The current forecast is still definitely favorable for gold, which also explains why the rate of this metal is unlikely to be linear. Rather, it will be a source of frustration and even influence the decisions of many traders using short-term strategies. However, our positive opinion about gold is well known, and in recent updates we have provided arguments to support our position.

Let's examine why the recent attempt began to get complicated just after the break. The inability of silver to break above USD 18 / oz despite support from gold led to some weakening of both metals from sellers of the latest long positions, in particular in silver. The ratio of gold to silver rose again sharply above 101, while platinum, another metal that often uses gold support, recorded a record discount against gold of USD 970 / oz. In order for this bull market to have arms and legs, we must wait for a possible revival of demand for smaller metals.

Copper

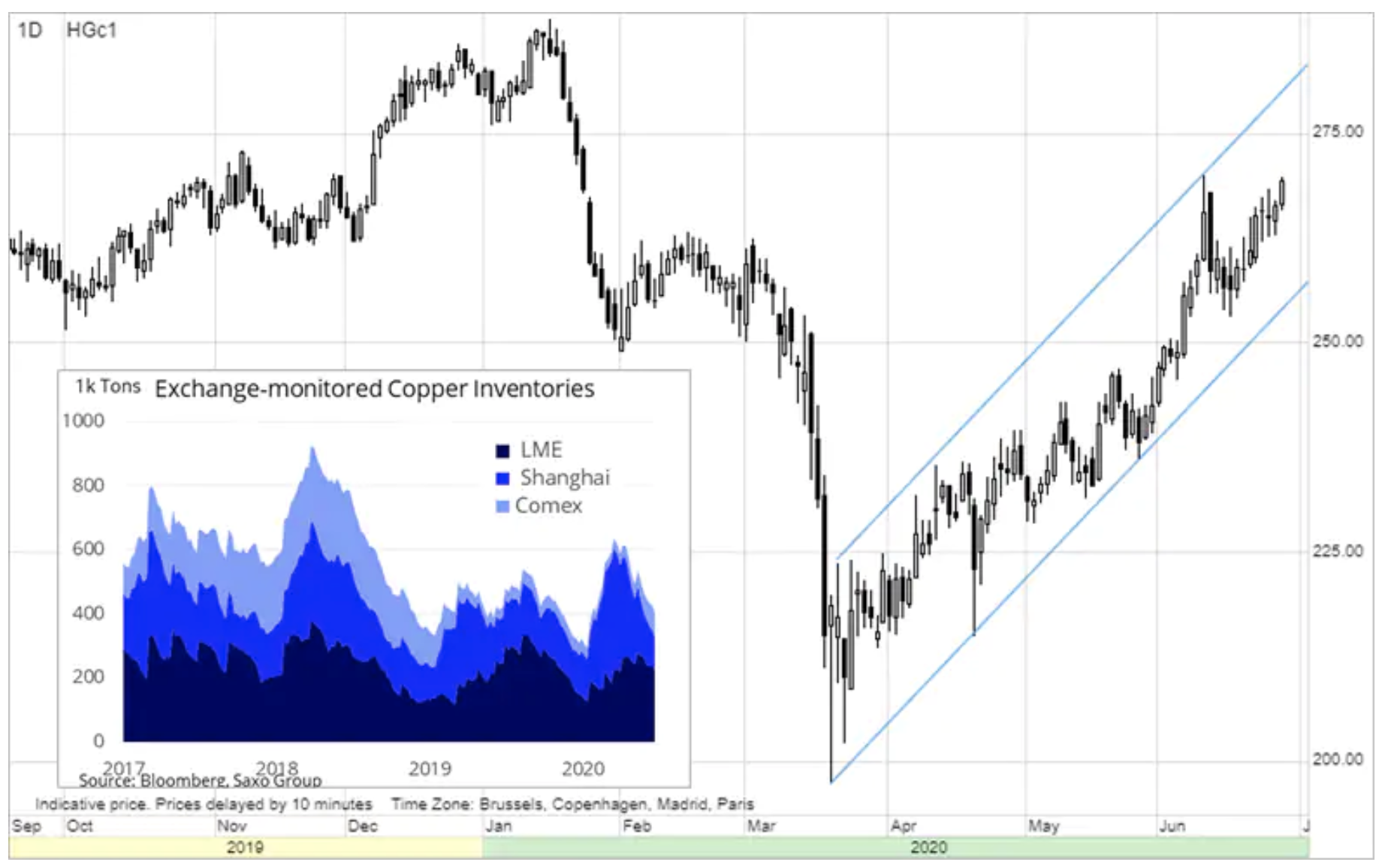

Copper is an example of a metal that initially suffered losses and then strongly strengthened as a result of virus-related events. The market went down in March, when demand fell due to a worldwide pandemic. Since then, global stimuli, ventures and higher demand in China - the country's main copper consumer - have contributed to price support.

Recently, the attention of investors is increasingly attracted by the supply side - many mines in South America work with only a basic cast due to the pandemic.

As a result, the price of HG copper on Friday approached a four-month maximum, while LME copper reached a psychologically important level of USD 6 / t. Both contracts have already managed to recover over 000% of the losses from January to March, and further growth is not excluded, given that governments are looking for ventures to support the economy.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)