The title of "Best Forex Indicator" receives ...

"What's the best Forex indicator?" - such a question was asked by one of the novice traders recently. You can react quickly with a counter-question "Best for what?". But subconsciously we know well that it is about earning, and therefore indirectly about high efficiency in generating profitable transactional signals. A more experienced trader will react only with a smile, but somewhere deeply he knows that when he started, he also deluded (or still decides) that Holy Grail there.

Green crosses red… BUY!

Of course, this is just an example. However, many indicator systems are based on these assumptions. This is a dangerous trap for beginners. We see a description of the system with an exciting name "MaxProfit Forex Master"which already builds certain expectations for us. Then we look at the screenshots of the signals generated by the proprietary indicator - it looks great. He opens long holes, sells highs. Although we only see 5 sample transactions, we already know that this is IT.

Actually, we are not interested on what basis the indicator generates signals, or what are the foundations and weaknesses of the system. It is important that the entirety is legible, and according to the author - it has to earn. The green line crosses the red one at the bottom, we are supposed to buy. Similarly for sale. That's enough for us, we just want to earn money, not learn financial math and a whole bunch of other nonsense!

READ: Avoiding wrong signals - how to combine technical analysis indicators with each other

But with the application of the new invention, his image fades. It turns out that it is not as profitable as we thought. But we don't give up. We've finally read a few books on technical analysis so we'll be able to improve the lame system. So we go back to the roots - RSI indicators are moving, MACD, maybe a few MAs ... We want to filter only those bad signals. Over time, it turns out that the filter works, but it also filters out those good trades, and our result is still negative.

If you believe that there is a magical Forex indicator, or even a market rule that will generate the ideal entry and exit points for you, then wake up now.

But how? After all, we use the "magic indicator" and we support ourselves with a few known around the world. It should work! And then suddenly we are faced with gray reality. Therefore, I will write you the brutal truth now:

The best Forex indicator is… PRICE!

Exactly - the price. A trader can only be 100% sure of two things:

- What is the current price,

- What price was in the past.

All kinds technical analysis indicators is a price derivative, i.e. the price itself is only presented in a different format. It is the indicator user who hopes that he will be able to determine its behavior in the future based on the current or past price.

Good advice…

So another question arises. Since there is no best indicator… What / what should we use? The answer is simple (though probably unsatisfactory 🙂) - any. To be specific, certainly one that you will understand. If you decide to use a given tool, first learn about its strengths and weaknesses, what its mathematical formula is based on and how it actually transforms the price into the values displayed in the chart. Does what you get along with your system? Does it apply to the characteristics of the market on which you plan to use it? Become an expert on this indicator.

Are the indicators unhelpful?

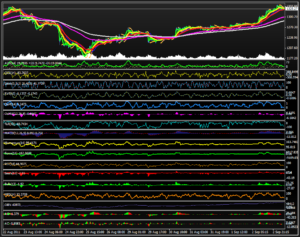

Not necessarily. Certainly, their excess is unfavorable, as in the picture below. The price has been transformed many times, until we have reached the point where we barely see what the current course of the instrument is. In addition, one signal is filtered by 10 other signals, which almost certainly do not interact with each other. This is a recipe for disaster.

However, there are people who use single indicators in their analyzes, who also very often mix different methods with each other technical analysis.

There is a tendency among traders to move away from the use of indicators. They decide to analyze the "clean" chart and the behavior of the price itself. This is where support, resistance, candlestick and bar patterns help them. Don't count, however, that this is a guaranteed method of success. This is just one of the many ways that can lead to it. More in the beginners section ...

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Tester 5 - combine for testing strategies [Review] forex tester 5](https://forexclub.pl/wp-content/uploads/2023/04/forex-tester-5-300x200.jpg?v=1679423429)

![4-5 and exit. Highly effective strategy [Video] Trading strategy: 4-5 and exit](https://forexclub.pl/wp-content/uploads/2022/06/4-5_i_wyjscie-300x200.jpg)