Inflation, the highest in 20 years, opens the door to the strengthening of the zloty

Shock and disbelief. In August, inflation in Poland unexpectedly soared to 5,4 percent. on an annual basis, significantly exceeding market forecasts. Road to 6 percent is opened. At the same time, the door to strong zloty appreciation is wide open.

Inflation in Poland exceeded 5%

In August inflation in Poland fired to 5,4% YoY from 5% in July and was the highest since June 2001. It is probably also the highest inflation in Europe. Meanwhile, in February the inflation rate was at the level of 2,4%.

The data surprised a lot. The market forecasts were at the level of 5,2 percent. R / R. Inflation is also well above the upper range of the NBP's inflation target (3,5%), which opens up a path to speculation about possible earlier interest rate hikes by the Monetary Policy Council. Especially that this is not the end of inflation increases. All indications are that inflation will reach 6% y / y this year.

The prospect of earlier than previously assumed increases interest rates in Poland, water to the mill of the future zloty strengthening. This process has already begun.

Analysis of the zloty market

The zloty reacted with a clear strengthening to the inflation data. At 14:13 PM the EUR / PLN exchange rate was at the level of PLN 4,5295, and the USD / PLN rate was PLN 3,8271. Recently, the euro was so cheap until the zloty on July 8, and the dollar on August 4.

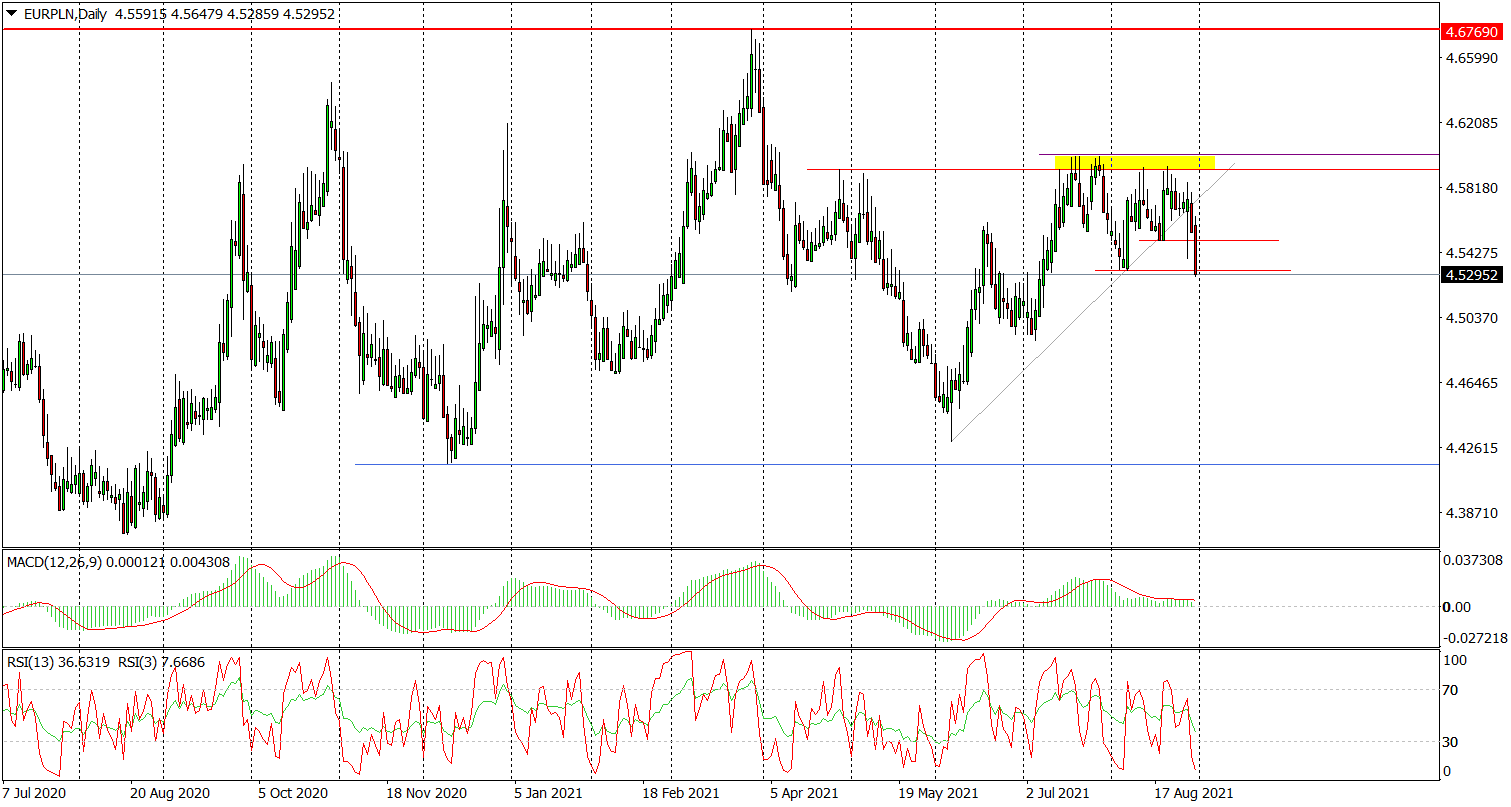

EUR / PLN daily chart. Source: Tickmill

The situation on the EUR / PLN and USD / PLN daily charts suggests that this is just the beginning of the zloty appreciation. Defeated 3-month uptrend lines, negative divergences, sell signals on indicators and broken or broken important supports all suggest that one has to take into account the decline of the euro and the dollar at least 10 cents in the coming weeks.

USD / PLN daily chart. Source: Tickmill

Such expectations are also justified if we look at the zloty through the prism of a potential change in bias RPP to monetary policy. Recently, when the market was playing against earlier interest rate hikes in Poland, the EUR / PLN rate tested around PLN 4,44. He should go back there now.

Of course, if the Council continues to stubbornly ignore the highest inflation in 20 years, the strengthening of the zloty will be delayed. The market will not play against the Council. Another threat to the zloty is politics. Exactly this risk is the suspension by the European Union of disbursement of funds under the Reconstruction Fund.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)