Market shortages and calls for margins are fueling price increases

As a result of the West's decision to impose sanctions on Russia, markets have experienced extensive self-sanctioning, and we are therefore observing increasing discrepancies between the prices of raw materials produced in Russia "offline" and the prices of raw materials obtained from other producers. These changes bring us into another, increasingly dangerous phase, in which sanctions against the world's largest producer of raw materials may threaten financial stability.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

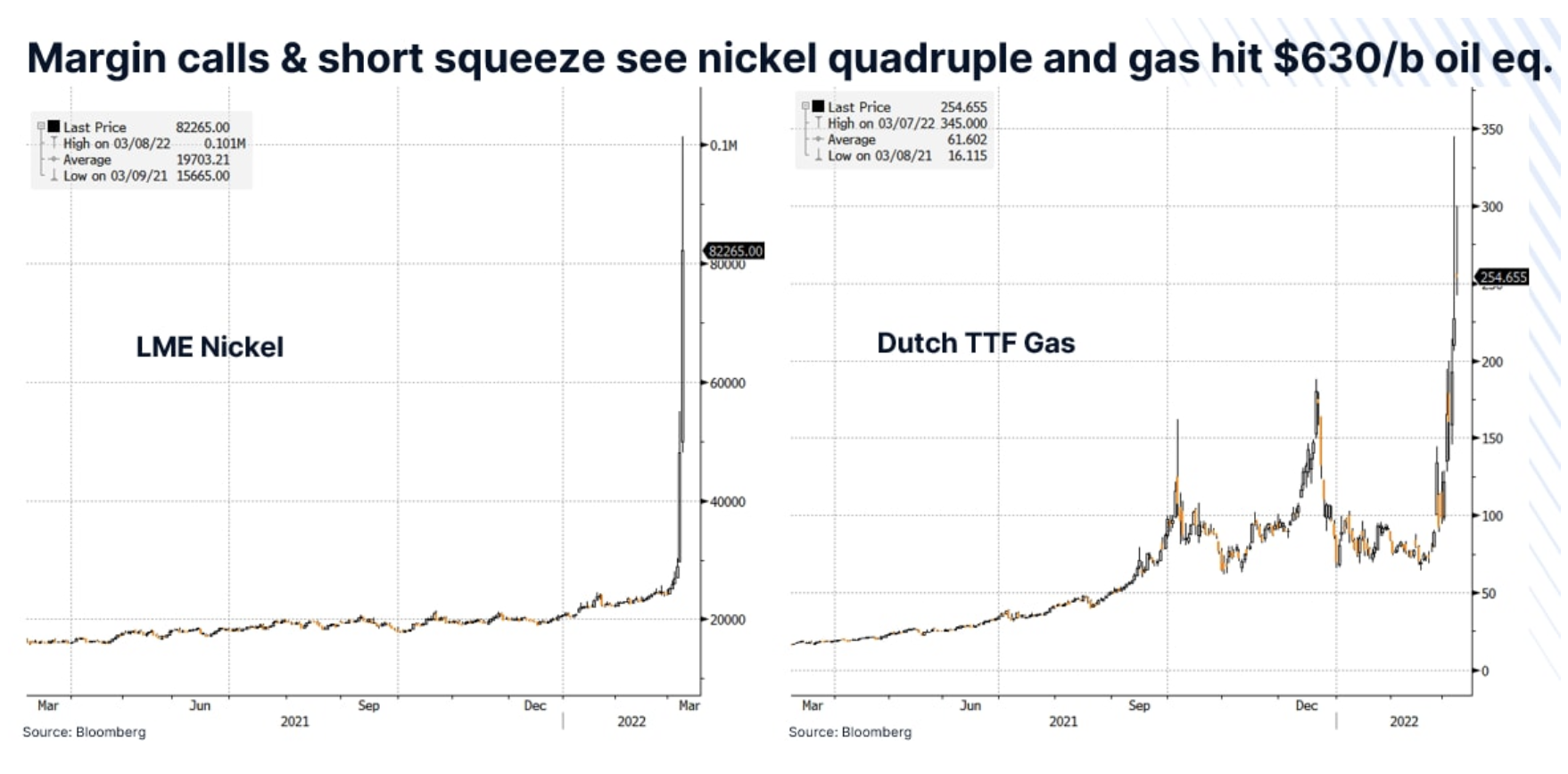

London Metal Exchange (LME) made the unprecedented decision to cancel all nickel transactions carried out yesterday. According to the LME data, one entity controls 50% to 80% of the nickel stocks on the LME, and the fight between one very large long position and numerous large short positions is brutal.

Huge volatility in the commodity market

There is chaos in the markets following Russia's unprovoked invasion of Ukraine, in particular in the raw materials sector, where stricter US and European sanctions, causing the so-called self-sanctioning, increasingly cutting off supplies from Russia, thereby affecting the prices of a range of key commodities, from gas and oil to industrial metals and basic agricultural commodities such as wheat. Often referred to as Europe's granary for its vast fertile lands that are naturally suitable for grain production, Ukraine has collapsed supply chains and closed ports prevented the export of key food products such as wheat, barley and corn.

Due to the phenomenon of self-sanctioning, we observe more and more often that raw materials produced in Russia are treated as toxic and are being avoided by a wide margin. The most recent example of this was Shell's announcement today that it will no longer buy Russian crude oil at spot prices. The decision is a reaction to the outcry following Friday's decision to purchase Russian oil at a large discount.

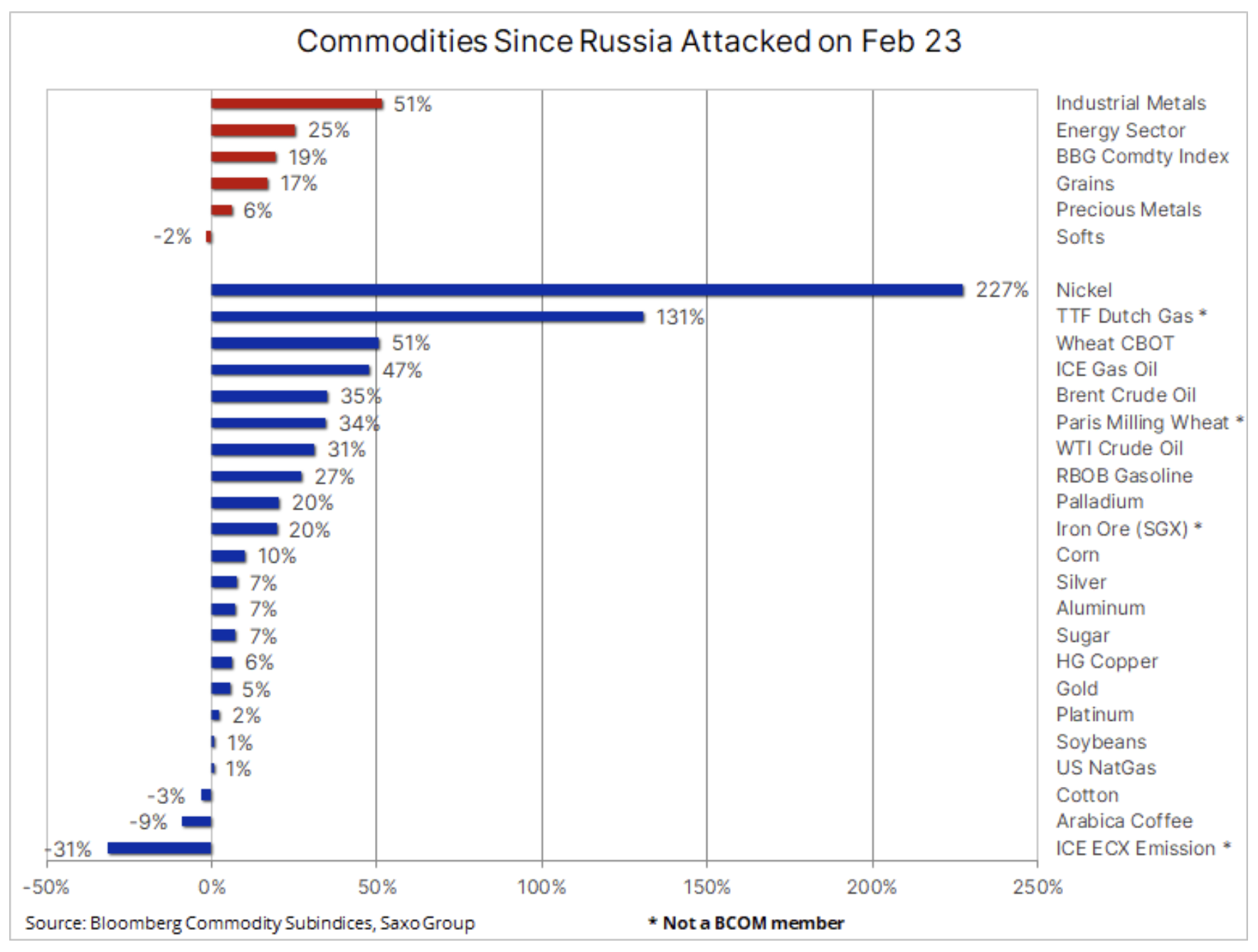

As a result, increases in the prices of individual raw materials take extreme values, as shown in the table below.

As a result of the West's decision to impose sanctions on Russia, the markets underwent extensive self-sanctioning, inter alia, of on oil and gas markets, which were not covered by these sanctions, and therefore we observe an increasing discrepancy between the prices of raw materials produced in Russia "offline" and the prices of raw materials obtained from other producers. These changes bring us into another, increasingly dangerous phase, in which sanctions against the world's largest producer of raw materials may threaten financial stability.

As Zoltan Pozsar put it in a recent Credit Suisse report:

“The aggressor in the geopolitical arena is punished with sanctions, and the movements in commodity prices caused by the sanctions threaten financial stability in the West. Is there sufficient security for the margin? Is there a sufficiently high credit line for a margin? What will happen to the commodity exchanges if players fail? ”.

This is where we are now, and whether we hold long positions in Russian or non-Russian commodities, any short position in futures on these commodities will require the ability to post a margin to cover the exposure. Trade in commodities is usually relatively calm, and price fluctuations depend on the outlook for supply and demand as well as the interest in particular commodities on the part of speculative investors.

Margin call + short squeeze

Movements such as those we have witnessed over the past few weeks have disrupted markets and unexpectedly, producers who hedged themselves, i.e. sold futures contracts to cover future metal, energy and agricultural production, increasingly find themselves in a difficult situation. situation as commodity exchanges demand higher and higher collaterals to keep short positions from closing.

Most likely, it was this mechanic that in recent days made gas prices in Europe reached at some point the price of USD 630 per barrel of equivalent oil, nickel prices it quadrupled to $ 101 per tonne before trading on the London Metal Exchange was suspended, and CBOT was subject to a "limit up" cap for wheat for five consecutive days.

In other words, these dramatic moves are unlikely to be driven by speculative investors; rather, they were insiders who tried to manage their revenues through futures in order to counterbalance price fluctuations and lock in profits from future production. Others, like nickel, could buy the metal from a Russian company and then hedge the price risk with futures. Not only have they now been subject to an Emergency Margin Call, they may also not receive the physical metal that triggered the sale in the first place.

Overall, as Zoltan mentioned, this situation could pose a threat to financial stability in the West. Already there are headlines about heavy losses from replenishment calls at highly profitable companies and this situation, until resolved, will keep volatility across the market at a very high level.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response