The reckless energy policy of the European Union

The European Union was heading towards energy crisis for many years. In the last month of 2021, prices reached record levels. Currently in Europe natural gas is more expensive than Petroleum. The sad reality of the EU's green transition is that instead of COP26 carbon-blanking, the use of coal is de facto bigger. As weather conditions improve from March / April, energy prices are likely to start falling, but that does not mean the crisis will end. Energy prices are expected to rise again next winter. The EU's energy targets included lower consumption, lower final payments and less pollution. So far, consumption has remained the same, we are paying much more and the pollution level is increasing.

About the Author

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Christopher Dembik - French economist of Polish origin. He is global head of macroeconomic research at a Danish investment bank Saxo Bank (a subsidiary of the Chinese company Geely serving 860 HNW customers around the world). He is also an advisor to French parliamentarians and a member of the Polish think tank CASE, which took first place in the economic think tank in Central and Eastern Europe according to a report Global Go to Think Tank Index. As a global head of macroeconomic research, he supports branches, providing analysis of global monetary policy and macroeconomic developments to institutional and HNW clients in Europe and MENA. He is a regular commentator in international media (CNBC, Reuters, FT, BFM TV, France 2, etc.) and a speaker at international events (COP22, MENA Investment Congress, Paris Global Conference, etc.).

Political failure

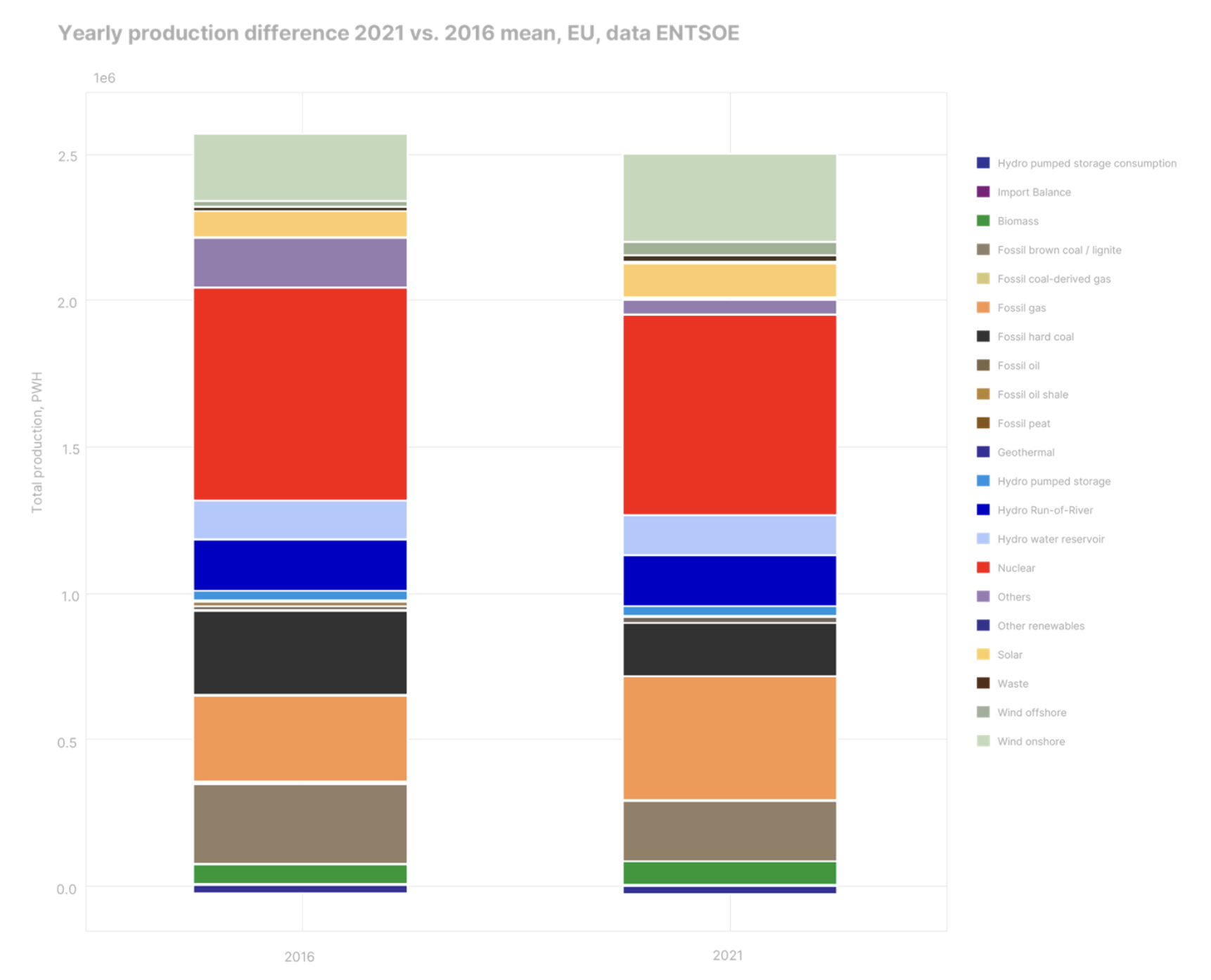

Over the past years, the EU has actively promoted renewable energy sources that are unable to ensure continuity of supply, while seeking to shut down nuclear reactors - one of the cornerstones of the EU's low-carbon baseload. These are the two original sins of the EU's green transition policy, which is why consumers are now paying much higher energy bills. Instead of moving away from fossil fuels, Europe is increasingly dependent on imported natural gas and the maintenance of coal-fired power plants, and has made little progress in decarbonising. The chart below shows the evolution of electricity production in the EU by source in 2016-2021. Natural gas (+120 TWh) has replaced hard coal and lignite (-170 TWh), while wind energy has increased by 100 TWh. However, nuclear and hydro energy remained unchanged. So far, natural gas is the main winner of the green transformation in the European Union. A number of countries are even satisfied with this, incl. Belgium, Germany or Poland.

Case studies

Germany and Belgium are perfect examples of what not to do. About 20 years ago, Germany adopted a plan to shut down nuclear power plants. This process was accelerated by the Fukushima disaster (March 2011) - as part of the automatic response, the service life extension of the seven oldest reactors was suspended. The closure of nuclear power plants has forced Germany to become increasingly dependent on fossil energy, including lignite which generates significant pollution. To prevent energy shortages, Germany will have no choice but to build a significant number of gas-fired power plants by 2030. The lowest estimate is to build at least 50 new gas-fired plants; the highest are as many as 140. This goal will be difficult to achieve and is, of course, incompatible with the goal of carbon neutrality by 2045. By contrast, Belgium is in a class of its own within the EU. It is the only Member State with a plan to increase the share of fossil fuels in its energy mix. The Belgian government is opposed to nuclear energy for ideological reasons. By 2025, it plans to close all domestic nuclear reactors, which generate almost half of the electricity. To compensate for the shortage caused by the closure of these plants, the government envisages the opening of new gas plants (even if they will take many years to fully start up) and an increase in electricity imports. All of this will result in a sharp increase in greenhouse gas emissions and the risk of shortages. This is complete nonsense.

Some hopes

Even though the situation is critical, not all is lost yet. During the Christmas break, the European Commission published a proposed taxonomy, a classification system that establishes a list of environmentally sustainable economic activities. Both natural gas and nuclear energy have been classified as green energy sources - under certain conditions. The inclusion of nuclear energy is, of course, a smart decision. The European Parliament and the Council will now have four months to thoroughly analyze it and to put forward any objections. Countries reluctant to nuclear energy (Austria, Germany and the Netherlands) protested against the inclusion of nuclear power, but do not have a qualified majority enabling them to reject this project in the Council; such a majority requires at least 20 Member States representing at least 65% of the EU population. Opposition by Parliament may be more likely as it only requires a simple majority. We should know the result by July; hopefully nuclear energy will remain in the taxonomy.

Macroeconomic implications

The energy component (9,5% of the Harmonized Index of Consumer Prices (HICP)) was one of the main drivers of inflation growth in 2021. This is partly explained by the EU's flawed green transition policy, low production reserves and a lack of investment in fossil energy infrastructure. Energy prices (especially natural gas) have fallen in recent weeks. However, demonstrations in Kazakhstan, which is a net exporter of gas (15 bcm3 in 2020) could affect local production and push up European gas prices again in the short term. We expect the energy component to lose importance from March / April as weather conditions improve. That said, we believe euro area inflation will remain, on average, uncomfortably high this year. In our opinion, the risk of another winter energy crisis is high.

Geopolitical implications

The EU is already structurally dependent on energy supplies from Russia. Currently, for example, it imports almost 40% of natural gas from the Russian Federation, and the situation will worsen even more. When Norway - the second largest gas supplier to the EU - reaches its peak of production at the end of the decade, this dependence will only increase. It is unlikely that Algeria - the third largest gas importer to the EU - would be able to significantly increase its production in the coming years. As a result, the EU will remain at the mercy of the President of the Russian Federation. Europe will remain a political dwarf in the international arena, and its influence outside the Community will be small (e.g. in Ukraine or Belarus).

Political implications

EU citizens will not be pleased in the coming months when they get higher energy bills. Several Member States have already taken temporary measures to mitigate the impact of this situation on consumers. For example, France has announced inflation compensation in the amount of EUR 100 for citizens earning less than EUR 2 per monthwhile Spain temporarily lowered VAT on electricity; other countries are discussing the introduction of their own measures. Germany's new ruling coalition is considering heating compensation to alleviate painful increases in energy prices through energy vouchers or tax cuts. Overall, the energy crisis hit hardest for over 36 million Europeans in the poorest quintile. All these actions are useful in the short term, but this does not have to translate into the situation in the long term. If the energy crisis continues - and we believe it is possible - it will also have profound political implications. The risk of the "yellow vest movement" spreading throughout Europe is low. Very few European countries have a tradition of protest as strong as France. However, anger about energy prices and declining living standards can cause, among other things, an increase in populism, a reluctance to vote, political extremism and an even greater distrust of the EU and the political elite. Ultimately, this leads to even greater social divisions.

In our opinion The closure of nuclear power plants in the EU was a serious historical mistake. In Asia and Africa, there are over 150 projects with a deadline for implementation by 2030. At this point, the EU is in a losing position; Consumers will pay the bill for ill-considered political choices. Including nuclear energy as a green investment in the taxonomy would be the best possible decision. However, building nuclear power plants takes years, with an average of more than 6. Until then, energy prices will remain high, pollution from fossil fuels will rise, and Europe will become poorer.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)