Asymmetrical deviation - or why brokers cheat, and we agree to it (?)

In the Polish environment of traders, it became loud about the enigmatic sounding matter " asymmetrical deviation ". What is this about? You can about it read in a separate article HERE. As a Forex Club, we fully support all initiatives to enforce justice for traders and unveil the backstage of the case, which in places is not very clear.

However, you can wonder why you only hear so much about the title deviation now and how it came about that brokers used it years ago, and the hype started in October 2019. To get to know the problem, it is worth starting with a "short" historical outline. We strongly encourage you to read.

Market Makers in disgrace since ...

More than a decade ago, retail traders only had access to Market Maker brokers - there were no other brokers, and when they appeared, they set excessive deposit requirements (eg Dukascopy Bank in 2010 wanted a minimum deposit of USD 50). At the same time, the regulated market was much less attractive to smaller speculators, mainly due to the relatively low leverage.

For Forex brokers there were attractive promotions, high leverage (1: 500 and more), opening an account from 5 $, interesting platforms, and the period with much more volatility on currencies than today. Revel soul, there is no hell. On the other hand, there was no protection against negative balances, each broker set the Stop-Out level where he wanted, and trader education was just crawling.

At that time, the retailer entered, consciously or more often less consciously (if he hadn't read the contract he accepted), a bit like into the mouth of a lion, agreeing to whatever was written in the contract. Yet he agreed to trade in the lion's yard, according to its rules. In practice, the regulations were long and not very interesting, in the case of foreign brokers only in English - everyone wanted to earn, and not spend time with a translator over PDF files. Hardly anyone was concerned about the open provision "Conflict of interest"that may have occurred. I performed. And there is no denying that it was this point in the regulations that was responsible for the lion's share of the profits of MM brokers.

Over time, traders became more creative, experienced, and educated, and it became more difficult for brokers to maintain their initial edge. There were voices about abuses and manipulations by MM brokers - the price and the platform - usually more in the form of rumors, individual complaints on forums, sometimes screenshots from platforms. Less often in the form of real conflicts in courts supported by appropriate documentation, or official messages issued by regulators. By the time. One of the biggest scandals that surfaced was the practices used by the largest Forex broker in the US - FXCM - in 2009-2014. More on this you can read in THIS article.

Due to suspicions of similar practices and fear of manipulation by other MM brokers, clients wanted to change.

ECN as a savior of traders?

A conflict-free order execution model was supposed to be what would solve all the problems of the retail and make traders start trading again without any problems. Over time, it turned out that the offered NDD, ECN or STP model works in a slightly limited formula and has its significant disadvantages. Of course, transparency increased, fees decreased, and order execution changed. Rapidly growing competition translated into an increase in the quality of services offered. What was once a large-scale standard suddenly ceased to be.

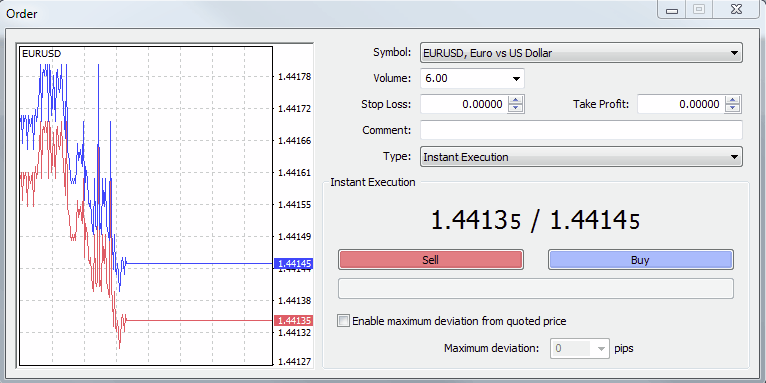

In the MM model, the biggest problem for traders was the so-called requotes, the ability to control spreads and execution time. Re-quotes allowed you to reject customer orders multiple times when between clicks "Buy / sell" and on the platform confirmation, the price on the broker server has changed.

While the execution went smoothly and the market was not raging, it was not a problem. With dynamic price change and "Free" (for various reasons) executions, there were bizarre situations where the price was slipping away before our eyes, and we were left out of position. Of course, the requotes only happened in one direction - when the course was going where we assumed :). Not with one broker - in everyone. That's just the mechanism. The only solution was to set the active parameter "Slippage", i.e. an acceptable maximum price slip, which eliminated requotes, but only to a certain level (probably max. 5.0 pips). While the price movement during the confirmation did not exceed the value of the slip that we accept, the transaction took place (of course with the slip).

In the ECN model, the greatest disadvantage was what was supposed to be a godsend - the execution of orders. With the rapidly changing market, we entered the position, but at a price different than expected. Our SL and TP also entered, but not always at the set levels. Spreads could go crazy on macro data or in the evening hours, sometimes to levels "Sky is the limit". Meanwhile, MMs often offered fixed value spreads (or fixed ranges) and execution of pending orders at a point, regardless of market conditions (sometimes even in the price gap!).

In practice, we could choose - execution of the order at the first market price with a slippage at ECN and an uncertain, market spread or re-quotation at MM and known in advance, although apparently higher, transaction costs. So bad and so bad :). It was then that it was discovered that this Market Maker is not always as bad as it is painted. That a good MM is better than a bad ECN. Ultimately, most preferred a substitute for the real market to the broker's artificial backyard. MMs had to adapt to this as much as possible in order not to go out of the market, which was successful and increased their quality of services. The requotes disappeared and order processing was made more flexible. But how would that help them gain the upper hand? This is how asymmetrical deviation was born.

Asymmetrical deviation and earning

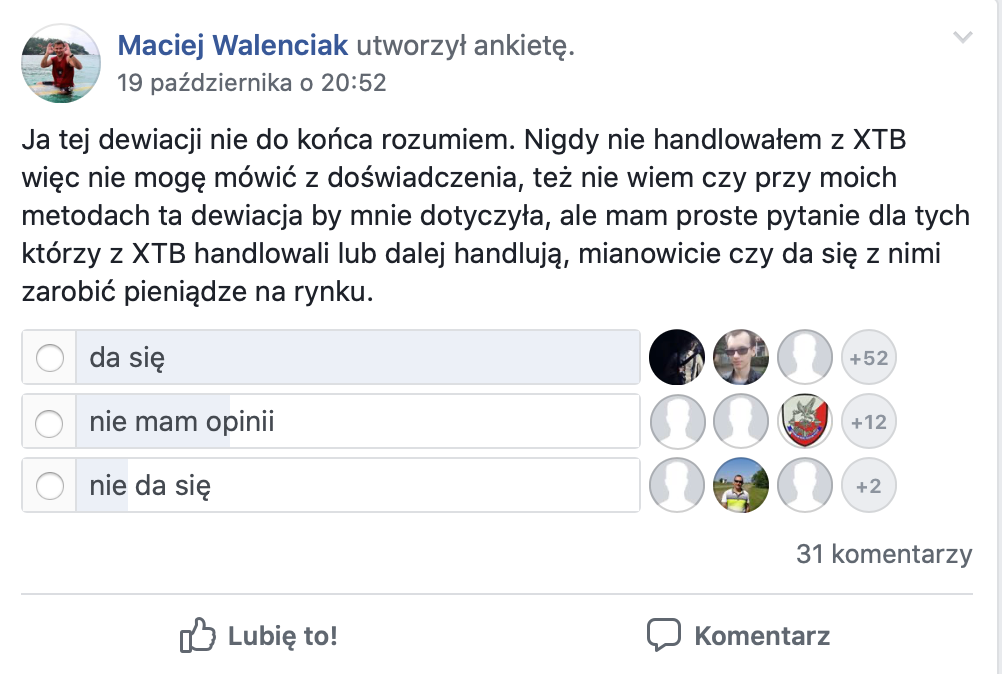

In the survey on the Facebook group TJS the question was asked whether the XTB broker, where in the years 2014-2015 was to be used asymmetrical deviation, you can earn. The vast majority answered in the affirmative.

Based on my own experience, I am able to agree with the overall result that a broker who uses (or used) such practices can be earned with some "but". It all depends on how you trade. If you trade long-term, even if the broker uses an asymmetrical deviation, you probably won't feel it. But the shorter and less profitable the transactions, the greater the potential negative impact on the financial result.

Some MM brokers decided to defend themselves by writing in the regulations, introducing a ban on scalping. Because there is no one general definition of this style of play, brokers interpreted it according to their own see-me-out, most often as transactions shorter than X minutes or with a profit less than Y pips (or both). But after all, the trader wants freedom, wants to earn as he wishes. I don't want restrictions. That is why brokers often gave it up (they only occasionally terminated contracts with scalpers).

The MM broker was somewhat forced to offer a substitute for the real market. Since he could not defend himself with re-quotes or the prohibition of scalping, he could execute orders "on the market", but in a limited way - instead of "Requotes" offered "Price slippage", but only in a way that is favorable to him. In another case, the order was carried out at a point, at the indicated price (I remind you that all the time we are only in his yard, which is stated in the contract).

Will you feel a 150.0 pips difference on the slippage earning 3.0 pips in position? Probably not. Will this also be the case when scalping at 2.0 pips? On the contrary. After some time, it will turn out that the system that was profitable for you now generates losses. In theory, nothing has changed. It is also not that asymmetric deviation causes losses - it can at best limit your potential profit, which in fact might not be there anyway (depending on market conditions).

Does MM broker have to cheat?

Statistics show that in the long term, they lose most of them without any help. Just wait for the trader to beat himself. But there is a certain risk that a profitable trader will be found :). In theory, the MM broker should hedge on the real market, e.g. wholesale on the difference in exposure of client orders. Does it do? It is already his inner decision. Common sense tells you to do so. If not… then there is a problem. It may also be the case that he would like to do it, but he does not always succeed - and the problem then is mainly quick, short transactions, especially those with larger volumes. Meanwhile, there are a lot of clients and the broker should ensure the fast execution of each of them.

Surely, you've seen in many Hollywood movies a scene where the casino client is "removable" by sad gentlemen when he is going too well. The casino doesn't want such customers. I don't want to because I lose them.

Wouldn't it be more honest to say simply "goodbye"? Certainly.

Does this mean that the MM broker is cheating on us? I have tested well over 100 FX / CFD brokers from around the world on my own funds. I have to objectively admit that there were worse and better companies. The quality of their services has also changed over time - perhaps due to financial conditions, changes in management, developing infrastructure, or increasing competition. Some have overtly manipulated the trading conditions on the platform (to a varying extent), but I certainly didn't feel it for everyone. So either they can deal with scalping, or they are less greedy than the rest, or they include such clients in their business plan. How is it actually? I do not know.

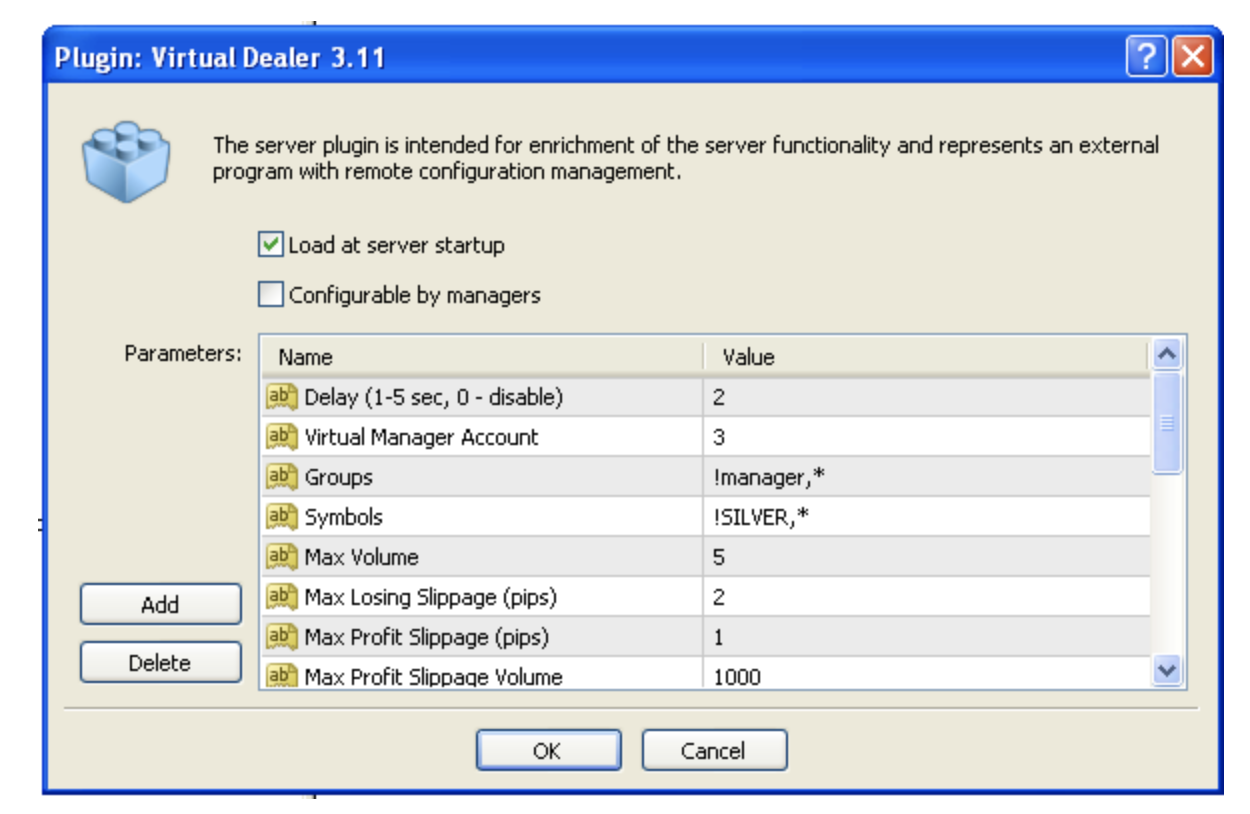

MetaTrader allows manipulation?

This is a rhetorical question, because it has long been known that yes. Although "Manipulations" it may be a wrong word. It might be more appropriate to say that "Allows for a wide range of configurations of mechanisms operating on the platform" :). The most famous tool is the Virtual Dealer plug-in.

The question arises - if MT allows such activities, does every broker use them? In total "Allow" it is not "Command". I know from experience that not everyone was bothered by scalpers, news traders and the rest of short-term traders. And another question - if MT has such options, does it mean that other platforms can also have them? It is not known, but it is likely to some extent.

Be sure to read: Dirty plays by brokers - TOP 5

"I trust but I check"

The rule is as old as the world. Is it enough? Maybe an even better solution would be "I do not trust and check"? Certainly, this approach will allow us to diagnose possible manipulations faster. Although it's better not to be paranoid. In my opinion, in the era of social media and the current level of investor awareness and regulatory knowledge, the chances of dirty brokers' activities have been greatly reduced. The broker will think carefully before trying something. In terms of service quality, the last 3 years are a real renaissance compared to the situation, e.g. in 2010 :-).

Why, despite finding the use of asymmetric deviation many years ago, traders still use MM brokers? There can be many answers - low entry threshold, leverage, availability of small volumes, no problems with liquidity, friendly platform, wide range of instruments, marketing ... Everyone can choose their own.

Insufficient control

If you made it to this place, I would like to bow my head and congratulate you on your persistence :-). We are a bit at a stalemate. On the one hand, retail traders agree that they do not want to tighten trading conditions and restrictions, on the other hand, they want leverage to be high, promotions available and freedom to increase. Sometimes our requirements become unrealistic - we want execution without a conflict of interest, but also with low spreads and express execution of orders, regardless of market conditions.

Why in the case of XTB does the audit only cover the period from January 2014 to June 2015? Why wasn't it checked what happened earlier and later? What is in the secret report of the Polish Financial Supervision Authority? Why aren't we hearing about audits of other brokerage houses?

It can be assumed that this is a consequence of determined actions of a client who used XTB services at that time and decided to take an independent fight, for which he had to allocate his own funds.

It is also highly doubtful that Commission officials would speculate on the Forex market on a daily basis. Therefore, the knowledge about the mechanisms working on the platform grows very slowly and comes mainly from ... traders. But did it really take them so many years to learn what is slippage on FX / CFD platforms?

The financial penalty for XTB, despite their cancellation, is a fact for now. The fact is also the lack of an order from the regulator to "regulate" the account against injured customers and the entire PLN 9,9 million will go only to the KNF account. It is not even said that customers really owe something. Is the only option to get your rights in the future with a possible conflict on the line trader - broker does it really have to be legal? How many of you have a transaction history from the platform for 2014 or still use the same account? How do we determine if we are actually entitled to any compensation and if so, in what amount and whether we have the right to obtain it from another Polish broker who he didn't stay inspected?

XTB has announced that it will publish an official announcement regarding the matter by October 27 this year.. We sincerely hope that this document will shed more light on the story.

Read: KNF announcement regarding price slips dated 25 April 2017.

update 24.10.2019

There has been an official position of the XTB Board regarding the whole matter, which has been published in a separate article here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-300x200.jpg?v=1708677291)