Forex Trading Down: Holiday Sentiment Diminished Volatility 10%

The holiday period is not the best time on the market. Despite the fact that stock exchange investors cannot complain about the lack of movements in financial instruments recently, August has certainly brought a lot of consolidation periods. The decline in activity for the average investor was perhaps not as noticeable as it was for liquidity providers. Traditionally, as every month, we will look at the volume reports published by selected financial institutions.

The trends from year to year are quite similar, if not repeatable. As a rule, the autumn months (September, October, November) are marked by a marked improvement in volatility. Therefore, August may probably be the last "falling" month. When analyzing the reports on turnover, we got used to the fact that the general tendency is not the rule, and also in this matter there will be "raisins", which recorded quite good, double-digit increases in m / m.

It can be good when it is bad

Let's start with the nicer things - first let's take a look at the reports he published GMO Click. When we say "nicer" we mean of course the growth. The Japanese broker, unlike foreign and most domestic competitors, fared quite well. In the recently published report it showed an increase in volume by 14,6%. Currency trading, which was very popular among August market participants, contributed particularly to this. Despite the fact that their influx is not as intense as during the first few weeks of the epidemic, GMO Click continues to record a steady influx of new customers (approx. 0,5% per month), which translated into 3 new accounts in August.

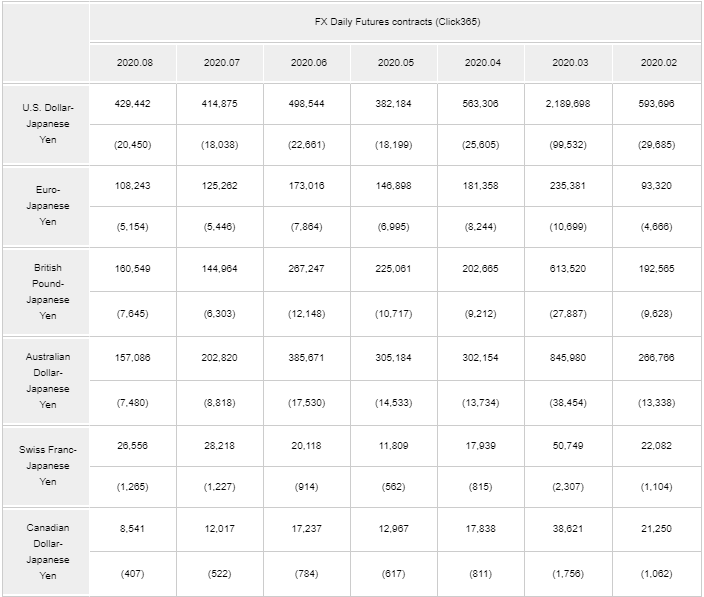

Considering the Click 365 platform itself, the broker was no longer as colorful as the entire GMO group. These are not extremely great values. The average daily trading of futures fell by less than 1% (approx. 0,7). Currency trading remained fairly good. We observed a decrease in the involvement of traders mainly in such currency pairs as EUR / JPY, AUD / JPY and CAD / JPY. The remaining currency pairs either increased trading volumes or remained at very similar levels.

Saxo Bank: Worst month since March

This honorable title, however, can be "proud" Saxo Bank. The decrease in the trading volume recorded on a monthly basis amounted to nearly 11% (more precisely 10,9). In absolute terms, the broker posted monthly turnover of $ 279,4 billion in August, compared to $ 307,1 billion published in July. As with most major brokers, the Saxo Bank turnover in March reached a record level of USD 496,8 billion (at Forex market USD 248,6 billion). However, the numbers have continued to drop drastically since then, and August has proven to be the worst period in terms of volume in 2020. Only January is slightly worse than him.

The bank's daily currency volumes fell to $ 5,9bn last month, compared to $ 6,3bn published in July, according to published data. The downward trend on a monthly basis can also be seen in the stock market, where monthly volumes of USD 83,7 billion fell from USD 115,4 billion in the previous month.

Euronext down 2,5%

In August, Euronext also joined the list of brokers and liquidity providers that showed a downward trend in the value of trading. In particular, the value of foreign exchange transactions decreased, and hence the decrease in involvement and activity in the Forex market. Euronext FX recorded a total trading volume of $ 397,8 Billion in August. Comparing this figure with the previous month when the monthly turnover was $ 407,9 billion, it is a decrease of approximately 2,5%. How do these results fare over the course of the year? For the same period last year, Forex trading volumes were $ 490,9 billion for August. As a result, the annual turnover result is weaker by approximately 19%. In August last year, the average daily trading volume was USD 22,3 billion.

Summation

The holiday period is usually a time of greater stagnation on the market and a decrease in investor involvement, and thus their activity and the turnover generated by it. It can be stated with a high degree of probability that the coming months, including September, will improve trading results. It is true that in the present day "covid" you can not be sure. Nevertheless, in the fall (more precisely in early November) we will face the US presidential election, which will certainly bring more volatility.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![VSTOXX - the European equivalent of the American VIX [Guide] Vstoxx index](https://forexclub.pl/wp-content/uploads/2022/10/Index-vstoxx-300x200.jpg?v=1666609979)

![VIX Index [Fear Index] - in search of market volatility [Video] vix fear index](https://forexclub.pl/wp-content/uploads/2021/12/vix-index-strachu-300x200.jpg?v=1638525622)