Industrial metal price rebound depending on the situation in China

The raw materials sector, led by industrial metals, is currently undergoing a correction. After the record-breaking first quarter, it was long awaited, with China being the main factor behind its zero-tolerance policy for Covid-19. Moreover, the militant American central bank contributing to the increase in financing costs, the significant strengthening of the dollar, as well as signs of a global economic slowdown due to inflation at the highest level in several decades raised some doubts about the outlook for demand. In this article, we discuss the situation on the copper market in more detail and explain why we are maintaining a positive outlook for prices.

Correction in the raw materials sector

The commodity sector is currently undergoing a correction, after a record increase in the first quarter, it has been expected for a long time. China and its zero-tolerance policy for Covid-19 were undoubtedly the main factor behind the weakening - long lockdowns were introduced in response to the outbreaks in Shanghai and Beijing, damaging economic growth and creating significant bottlenecks in global supply chains.

Moreover, the militant American central bank contributing to the increase in financing costs, the significant strengthening of the dollar, as well as signs of a global economic slowdown due to inflation at the highest level in several decades raised some doubts about the outlook for demand. In recent analyzes and webinars, we have highlighted the need to focus not only on demand but also on the supply side when trying to formulate a forecast for the commodity sector.

While demand may show signs of weakening, the supply side is equally problematic for a range of key raw materials, from energy to industrial metals and agricultural products. In our opinion, this could prevent a much-needed deep price correction, which would ease the global price pressure.

Example: WisdomTree Industrial Metals is a publicly traded fund (ETC) that complies with the EU's collective investment criteria, and monitors the Bloomberg Industrial Metals Total Return Index.

As already mentioned, in the context of the slowdown in economic growth, the market has largely focused on China, the world's largest importer and consumer of raw materials, especially after an initial failed attempt to contain the virus from spreading to parts of Shanghai in late March. Six weeks later, the Covid outbreaks in China and restrictions to contain them indirectly increased operating costs, making it difficult for factories to maintain production, source raw materials, and ship finished goods.

Industrial metals index

As a result, industrial metals, China's most dependent commodity sector, suffered the hardest - the Bloomberg industrial metals index plunged almost 25% from its record high on March 7. Other sectors, such as precious metals (-12%), energy (-10%), grains (-5%) and 'soft' agricultural products (-6%), saw smaller declines compared to the latest highs. As the industrial metals sector has almost recovered to early-year levels, the question remains, what could support the final minimum prices in this market? The answer is simple: China.

A major investor in Hong Kong recently described the current situation in China as the worst in 30 years as Beijing's increasingly restrictive zero-Covid policy slows economic growth while causing public discontent. As a result, global supply chains remain under threat and congestion in Chinese ports is worsening, while demand for key commodities, from oil to industrial metals, has declined markedly. One consequence is that the government needs to implement significant incentives to support the recovery of economic growth, which is currently well below the 5,5% target. Such initiatives are likely to support the industrial metals sector given the emphasis on infrastructure and energy transition; therefore we hold the view that, after the recent weakening, the minimum prices will soon be reached.

Limited supply forecast

The renewed rise in industrial metal demand from China will once again show a dangerously low level of stocks available. If we add to this the government-backed energy transition, particularly in Europe, where the main goal has become independence from Russian energy supplies, the market may soon stop focusing on demand and focus on limited supply instead. Stocks of key industrial metals - from aluminum material and copper to nickel and cynk - Stocks monitored by exchanges are at their lowest level in many years, and when additional supply is difficult to provide, a forecast of limited supply can help the sector set minimum prices and start growth.

For example, the recent decline in momentum and the focus on China brought the HG copper contract down to the lower end of its annual range, and as part of this process, speculative investors moved back to a net short position for the first time in two years. A rebound from current levels, without undermining the key support at $ 4 per pound, could cause the initial coverage of recently established short positions.

Our positive outlook on industrial metals has not changed, but given the risk of weaker economic growth in the future, we do not expect prices to rise again soaringly. Instead, we anticipate a gradual increase in prices as a result of constrained supply, China's economic growth initiatives, and the green energy transition.

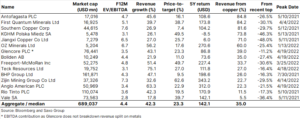

The table below presents some of the most important mining companies involved in the production of copper. The top six generate more than 60% of their revenues from copper, and the recent correction, due to a general weakness in the stock market and lower copper prices, has led to a decline in the stock of 25% to 48%.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

More analyzes of commodity markets are available here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)