Once a dove, once a hawk - won't Adam Glapiński fly too far?

We will certainly remember the last year in terms of monetary policy in Poland and in the world for a long time. Perhaps only the golden thoughts shared by the president during press conferences will survive longer than these memories NBP - Adam Glapiński. In the abyss of the Internet, we will find quotes and life advice from the chairman of the Monetary Policy Council that are detached from reality, rather than specifics regarding monetary policy. It is, of course, funny when during the speech there are (I will quote later) flowery comparisons about horses, dogs, books or love. However, it becomes less funny when we realize that the Council's decisions regarding interest rates may be in a similar tone. I decided to summarize the tightening cycle and the current decisions of the NBP in this article, referring to the recent stand-ups organized at conferences by President Adam Glapiński. I will also try to answer the question what (a dove or a hawk) will the chairman of the MPC turn into at the next meetings.

"I appear before you as a hawk"

The revelation of Glapiński as a hawk occurred quite early, which does not mean that it was correct. Let us outline here an outline of not so long ago history. Most central banks – FED, EBC, BoE and NBP - more or less from the end of 2021, it began to indicate a problematic increase in prices. In several comments from that period, I pointed out the problem of deferred post-Covid demand, which was in fact true. However, this demand would not be so "dangerous" if not for the ocean of money that surrounded it and systematically flooded it. Let's look at some numbers.

- FED introduced from May 2020 to January 2022 - $4,7 trillion;

- ECB from March 2020 to June 2022 – €4 trillion;

- NBP from March 2020 to September 2022 introduced PLN 400 billion.

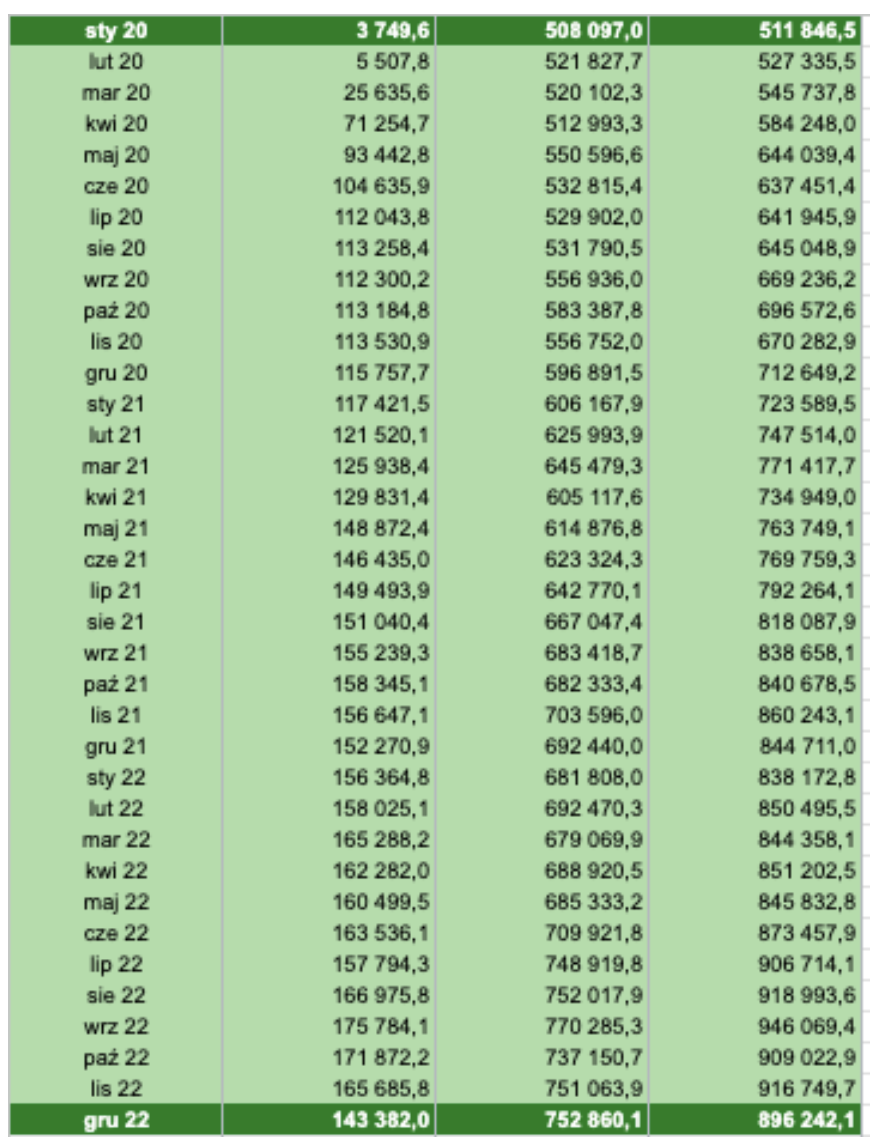

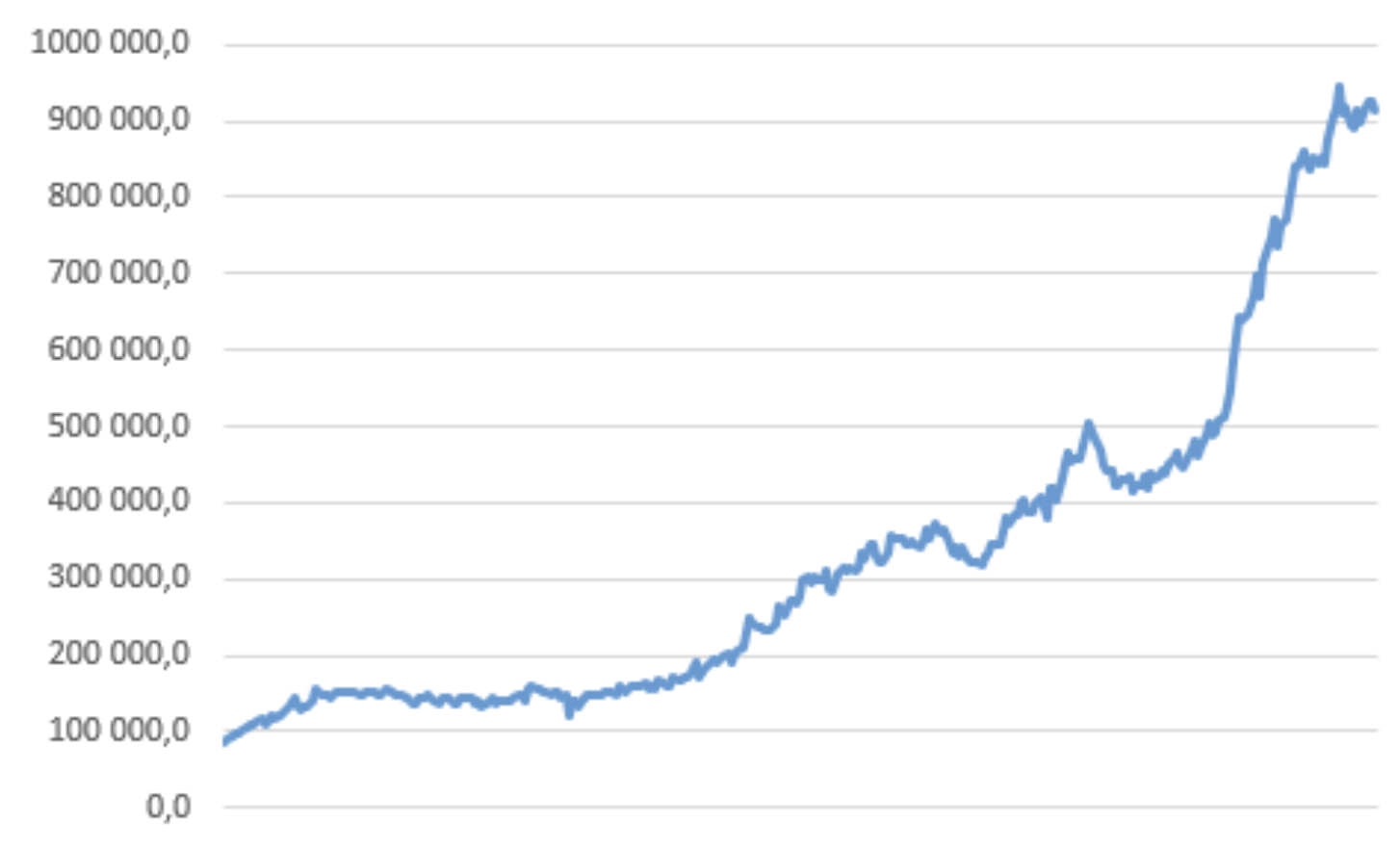

Nominally, this can be seen in the statistics that the National Bank of Poland makes available on its website. In the graphic above, I chose a slightly wider (and also more optimistic) time range from the beginning of 2020 to the end of 2022. However, looking at the numbers from the above calculation - March 2020 is 545 billion of the balance sheet increase, while September 734,8 is 2022 billion. In practice, this means an almost 73,35% increase in less than two years. As Adam Glapiński says:

“In an economy, when it goes up, it goes down, when it goes down, it goes up.”

So let's ask the key question - how much has it grown in this case? To illustrate these sums more spatially, dear readers:

- in the years 1996 – 2019, the sum of the NBP balance sheet increased by 423 billion;

- in the period analyzed above in 2,5 we had an increase of slightly over 40 billion/

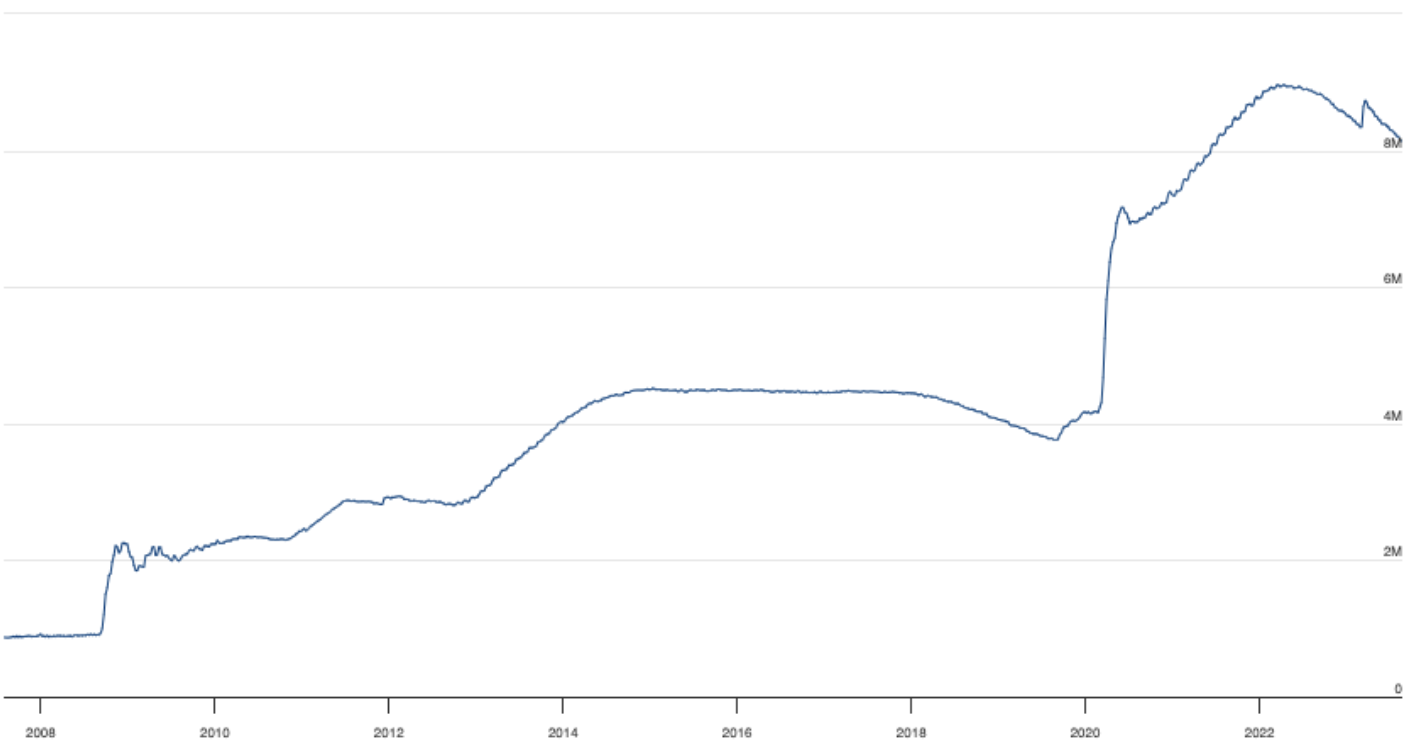

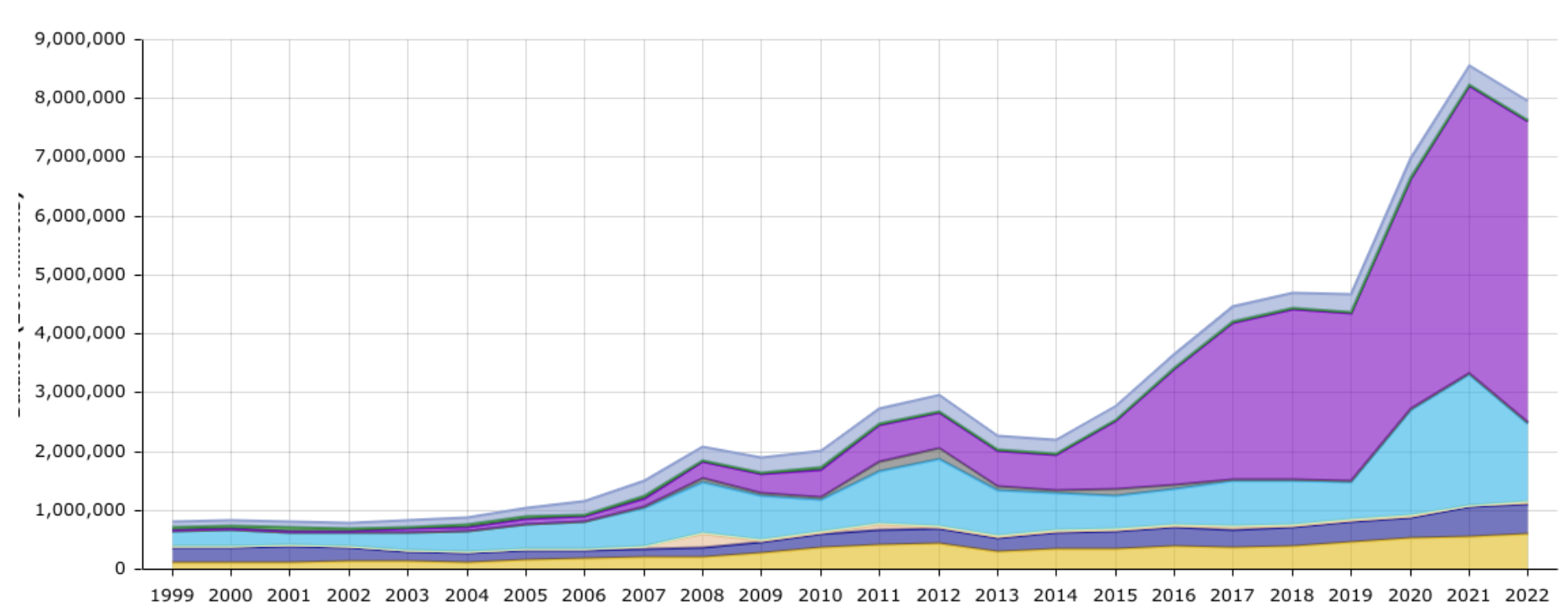

There is only one conclusion. Within two and a half years, the National Bank of Poland managed to add more or less as much to the market as in the last 23 years. On the one hand, we see how a huge injection of cash was injected during Covid, but on the other hand, everything bad is blamed solely on delayed demand and then the situation in Ukraine (which was announced by banners displayed by the National Bank of Poland). Meanwhile, an additional PLN 400 billion is floating freely in the economy. President Glapiński's inner pigeon soared to truly astronomical levels. But it's time to be a hawk – those to whom he declared himself at one of the meetings in 2022. Interestingly (I will present this path in a moment), about a month before the tightening, Adam Glapiński and his team insisted that there would be no hikes and no inflation. Most central banks, in addition to raising interest rates, used an additional tool in the form of reducing the balance sheet. Which allows you to act "with the other leg" in the fight against inflation. In other words, downsizing has the opposite effect to asset purchase programs. The reduction of the balance sheet is intended to “pull” cash out of the market. Below I present the balance sheets of the FED, ECB and NBP.

Fed balance sheet. Source: Fed

ECB balance sheet. Source: ECB

NBP balance sheet. Source: own study

As you can see, our chart has only reached a slight plateau. As the president of the NBP says:

“If someone walks in the Tatra Mountains, they know what a plateau is.”

Also, whether it is on the chart above or not, I leave to your judgment. People walking in the Tatra Mountains can give feedback to other readers so that we know if this phenomenon is really happening.

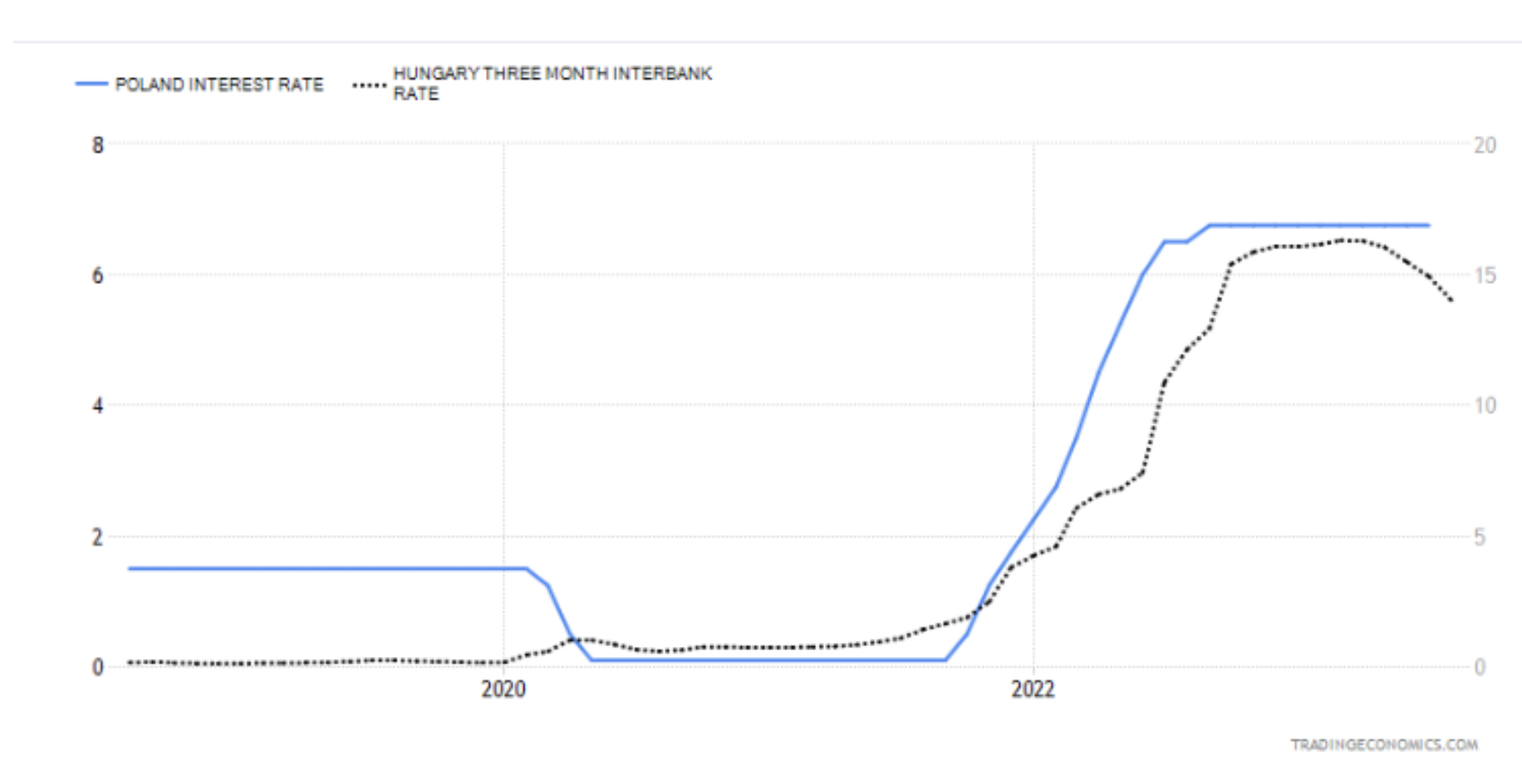

However, the data are not fully updated on the NBP side and there are no subsequent readings. In all this, I would like to compare, apart from major central banks (ECB and FED), institutions that are more economically similar to NBP. We will take a closer look at the Czech and Hungarian central banks. Here we will focus on Hungary, where interest rates were cut by 100bp recently. In my opinion, this is an announcement of a similar step on the part of the NBP, but I will talk about it later. The two graphics below present a comparison of the Polish interest rate level to the Hungarian and Czech ones. The Hungarians in the entire ranking took an even further step, as their balance sheet shows the first signs of a reduction / natural expiry of the maturity of some debt securities, which also causes its decline. The policy of the central bank in Hungary is more dynamic. The local president tries to flexibly adapt to market conditions and, as he himself says, not to steer the bank's decisions on autopilot. The other side of the coin of these activities is the crisis that hangs over Budapest. Does it also hang over Poland? From the viewpoint of technical recession yes – the first two quarters of 2023 closed in the red.

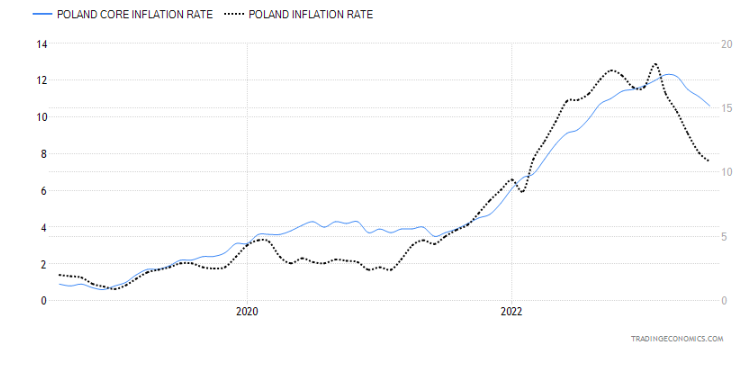

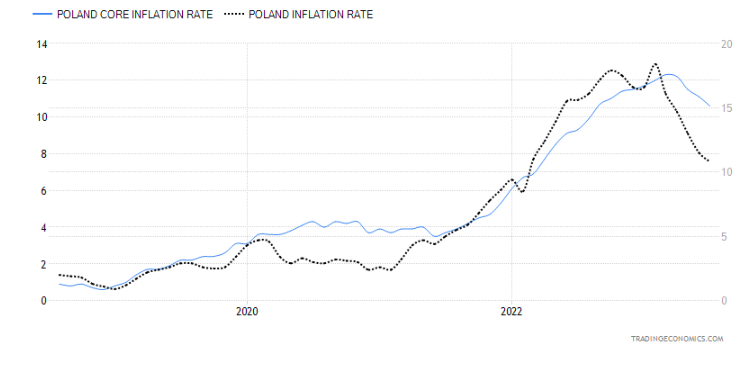

Without dwelling on the signs of a crisis, let's take a look at a short track of speeches about inflation and its dangers. After analyzing this thread, the anecdotes of the MPC president will become less and less funny, and the lack of clear communication on the part of the bank becomes more and more visible, which affects the overall economic disorientation. I think that by getting to know the NBP communication presented on the chart with inflation and numbers, we will answer the question whether the sopot treaty and rate cut ahead of the upcoming elections will not mean that the inflation move towards 10% will not be only the beginning of the road to the top. It would seem that both the FED and the ECB treated the subject loosely at the beginning of the inflation increase. They called its breakout only temporary, but after admitting their mistake, communication is still very hawkish, and the vision of sitting on high interest rates seems to provide a buffer between a quick return of inflation. It is true that we will not be ahead of the Hungarians in cutting rates, but in my opinion the key question is whether we will not do it too soon.

- There were no and will not be expensive prices, the economic miracle continues.

- Interest rates will not go up, inflation is low and will remain low.

- We will not make nervous moves because of inflation.

- Inflation will remain very low.

- Higher inflation is temporary.

- There is no recession. PLet me make an additional comment here: in June 2020, NBP purchased bonds worth nearly PLN 100 billion.

- Further reductions in interest rates are possible.

- Inflation will not exceed the NBP target, there is zero probability of hikes.

- Inflation is because we do well; this is probably its peak.

- Raising rates would be unwise, it would be a schoolboy's mistake.

- Inflation is slightly elevated, you can take a loan, everything indicates that from January there will be no need to raise interest rates.

- Inflation is on the rise, and it is a phenomenon that occurs all over the world.

- The fight against inflation is taking place at an optimal pace.

The next story is quite modern. Adam Glapiński only pointed to a faster pace of increases than in other central banks. Communication began to be based more on mouth watering, explaining that the NBP president is not to blame for the increase in inflation and that a significant part of the price increase came from abroad. Analyzing the rate of inflation, which has made a significant downward move (looking at its astronomical levels), one can conclude that there has been a calming "foreign inflation". Much more problematic and alarming is what is happening with its base index, which excludes food and energy prices (i.e. it best illustrates the impact of interest rates). In this case, the decline is not as promising as the inflation rate's descent from the Tatra plateaus.

In my opinion, the NBP itself contributed to a large extent to inflation. I am not inclined to condemn the actions during Covid - most banks behaved in a similar way, because it was an unknown and crisis situation, while the lack of clarity in the communication of the MPC - consumers / enterprises / households largely contributed to its growth. The moment when the central bank does not present any plan or idea for inflation leaves enormous waiting area for her. Expecting that it will grow and come with greater force, entrepreneurs start to raise prices, as if preparing for worse, future times. It may look similar from the demand side - since inflation will increase and prices will go up, it is better to make your purchasing decisions as soon as possible.

“You don't kick a horse, and when it rains you have to take an umbrella”

From recent speeches, it is impossible to deduce how long the NBP intends to keep interest rates at the current level. However, the president's humor is impeccable. Let's try to briefly analyze what horse we might be kicking when it comes to interest rate cuts too early.

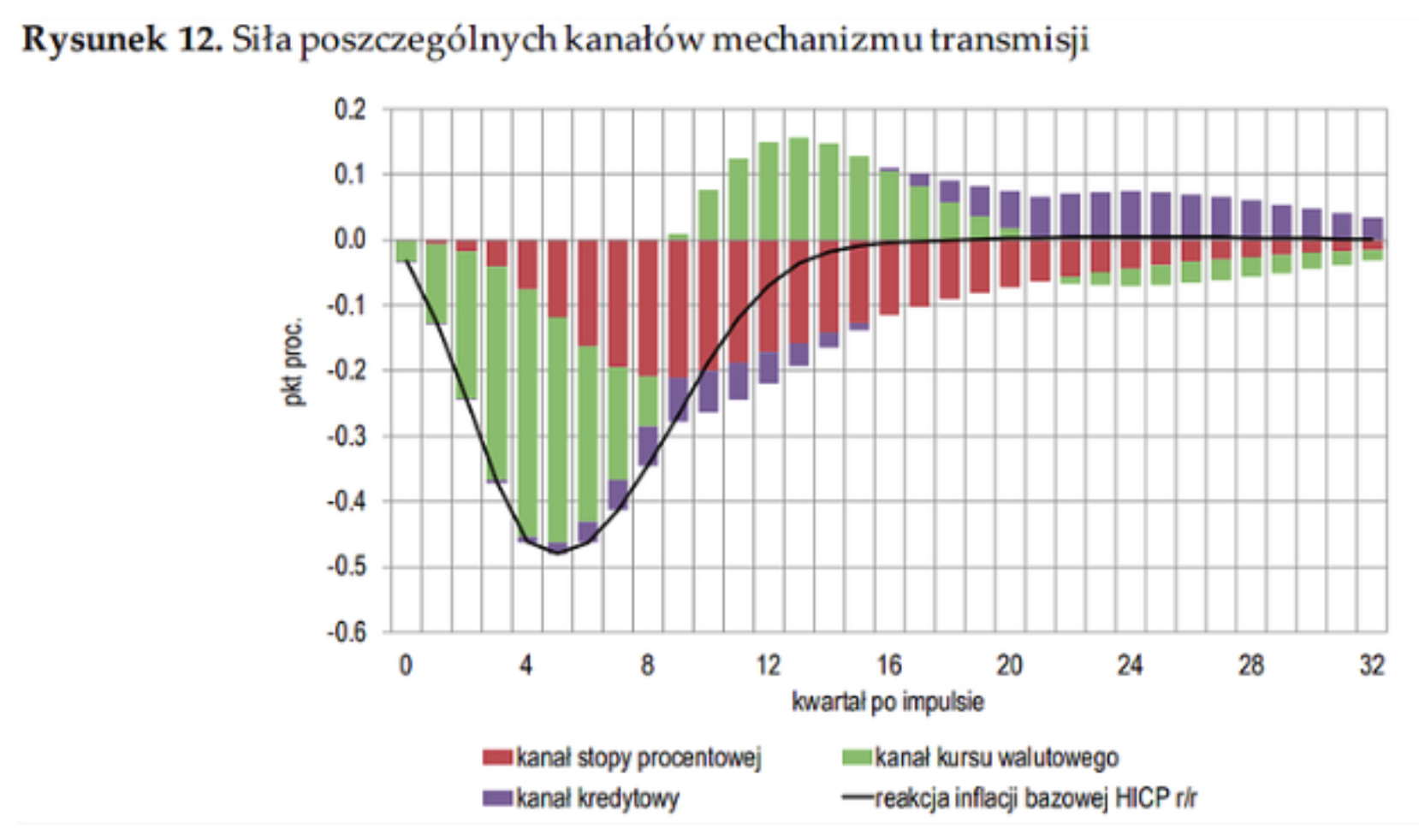

At this point, it is important to start with an explanation of how quickly the effect of monetary tightening can be noticed in the economy. Based on estimates from recent inflation spikes, a fall in GDP is noticed faster at the beginning than inflation. It's much slower in that respect. Interest rates directly affect the demand for loans and bank deposits. They somehow force households to postpone purchasing decisions, increase the demand for saving (increase in the interest rate on deposits) and reduce "free money", because increased loan installments absorb a larger part of cash surpluses. I would also like to remind you that all recent forecasts of the National Bank of Poland regarding inflation and GDP assumed (from approximately June) the condition of no further increases. Inflation expectations are extremely fluid, so it is not possible to precisely calculate how deep rates need to be raised. Therefore, most central banks, after reaching the final (target) rates, consider maintaining them for some time (probably 2 quarters for now) to see how they work in the economy. However, it is very doubtful that at the first signs of a decline in inflation (primarily core), banks would immediately consider cuts. So the question arises: Does the National Bank of Poland intend to fold its umbrella even when it rains? It looks.

The graphic above, when analyzing core inflation and the inflation rate, is very reliable. It shows the scale of the paradox when interest rates cut in September. The Polish model of monetary policy transmission to inflation is obvious. Inflation expectations, core inflation index and effective exchange rate are elements directly related to increases. On the other hand, the general inflation index, which the MPC likes to show, includes food and energy prices, which have fallen in recent months. In addition, if you want to look at the savings rate of Poles in 2020, it was 11,77% - one of the highest values in the EU, while in 2021 we went down to one of the lowest levels - 2,77%. The range of consumption and its size are perfectly illustrated by these numbers.

“Somewhere up to level six, nine let's say”

So let's say where. President Adam Glapiński often pointed to foreign factors determining the huge increase in inflation - it is enough to go back to the paragraph above to understand that the only inflation that does not want to fall too much is that in the hands of the NBP (base).

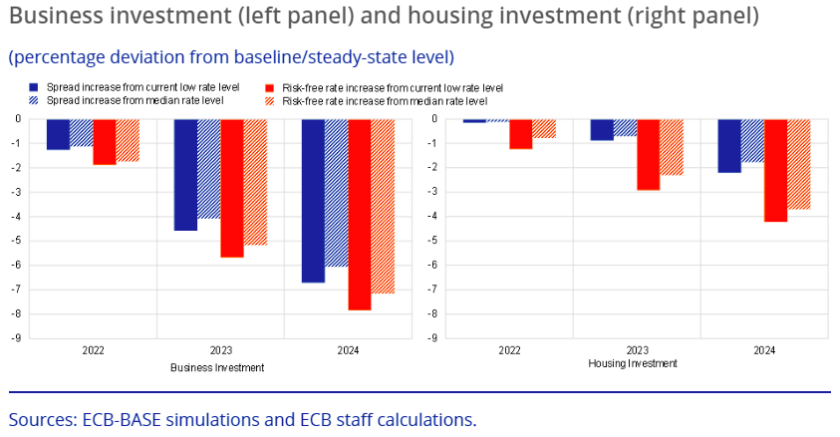

The current tightening cycle that we have endured is largely an anomaly-driven cycle. We started (like most central banks) with virtually zero interest rates and quickly raised them to historic levels. We will not miss the effects of such an undertaking. What are these effects? ECB economists undertook to compile a list of impacts based on the semi-structural ECB-BASE model. Without going into the details of this model, they noticed that interest rate increases cause a stronger decline in investment (consumption) if their initial level was low.

I presented data on savings on accounts above. This level started to drop, but it is worth noting here created buffer These savings meant that the initial level from which we started with price increases was quite high. Simply put, rates work but to a lesser extent, their more effective effect being spread over a longer period of time when savings levels are low. I treat the data I am presenting to you in general terms, but if we start delving into the details (which we may do in the next article), the level of threat from too rapid rate cuts may be downright terrifying.

The impact of interest rates on the economy is perfectly demonstrated by T. Chmielewski's model, which clearly shows that an increase of 100 bps on average starts to be effective after 6 quarters.

PLN not as green as German asparagus

Despite a series of increases on the part of the National Bank of Poland and Glapiński's flowery conferences, we managed to break the EUR/PLN record. Green was also not on the WIG, which, of course, we can connect to Covid first, and then war perturbations in Ukraine.

History has already shown several times that a too rapid drop in interest rates leads to a return to monetary tightening. Stronger, of course. It would therefore seem that the interest rate cut that is on the September horizon would be an inflationary shot in the foot. So I can see three scenarios at the moment:

- interest rate cuts only before the elections – subsequent communication about the need to stay on your feet and in the event of a further decrease in inflation, appropriate reductions,

- start of the cycle of interest rate cuts,

- a saving scenario – President Adam Glapiński decides that it is not the time and it is not the time yet.

One of the MPC members Joanna Tyrowicz – she indicated on her LinkedIn profile that in her opinion this is a colossal mistake. As in this article, she sees the consequences of cutting too quickly in creating even more problems with runaway prices than before. In addition, she pointed out a very important element that will appear as a side effect of the activities already carried out - increase in costs in the form of an increase in the number of unemployed people and a general slowdown in wage growth. Unfortunately, the sad thing about all this is that the majority of the MPC nods to the rhythm of the chairman's nods (6 members out of 9). Therefore, potential hasty decisions and announcements have a high chance of being implemented.

Summation

In my opinion, one of them most important problems at the moment it is no clear communication. Most of Mr. Glapiński's conferences bring absolutely nothing, and the central bank itself seems to be totally unprepared for the consequences of its actions. At least that's what he looks like. There are no specifics, and the laconic NBP reports do not project a future that could be referred to in any way. Additionally, we experienced something of a kind “monetary shock” and we may experience a very similar one when rates begin to drop rapidly. The fact that we are dealing with global inflation does not help in operating monetary policy with a large margin of error.

We could summarize our considerations as follows:

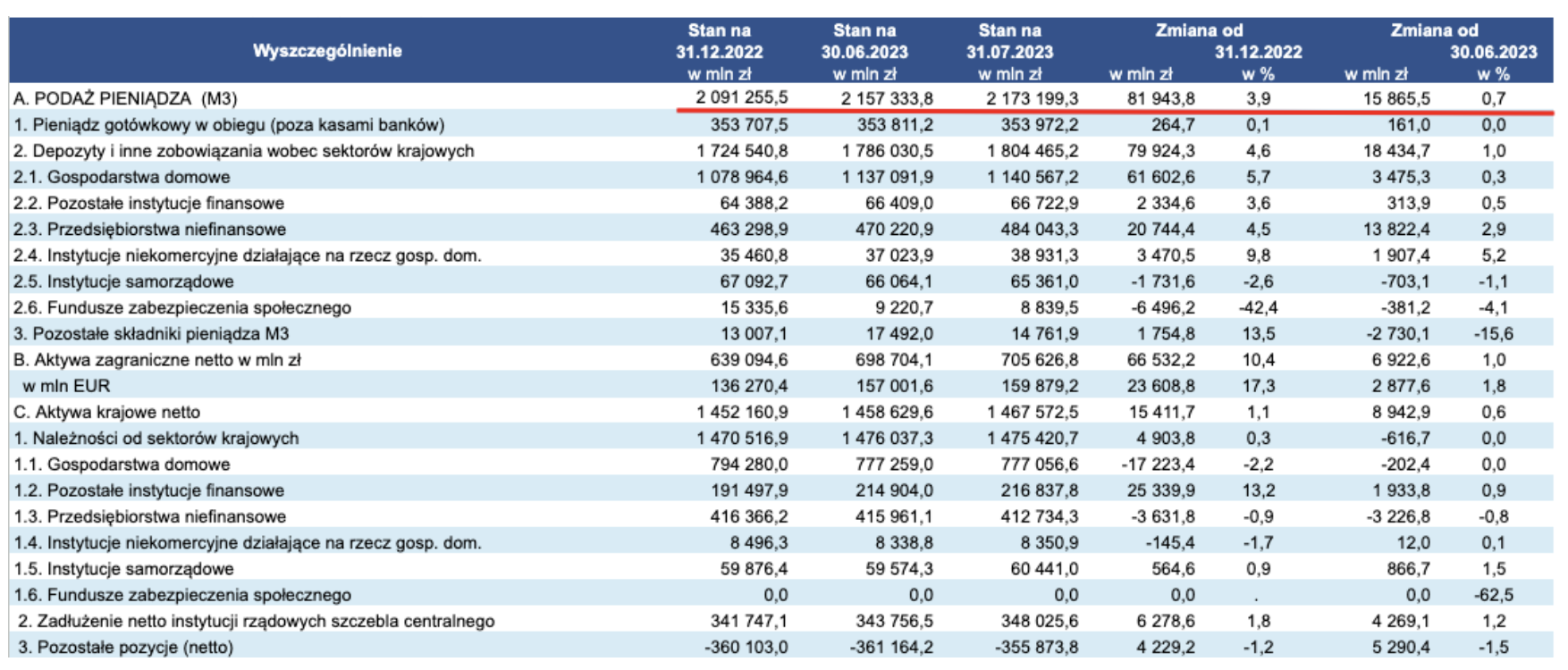

1. Interest rates currently have the most intensive impact on the supply of money - this is clearly visible in the aggregates (especially the largest M3) and the decline in the demand for loans. Only the percentage change that occurred from the end of last year to June 30 this year, where the supply increased by nearly 3,9%, may be worrying. It is also worth adding that despite the stricter policy (compared to other EU countries), it also had a significant impact KNF in reducing the demand for credit.

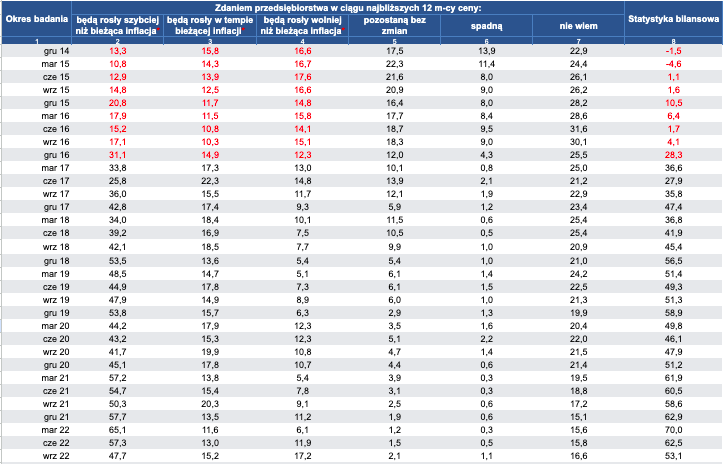

2. Inflation expectationswhich are hardly measurable for us - we are unable to fully assess the impact "stock consumption", i.e. consumption that is afraid of inflation and is carried out here and now. Households may be counterproductive and expect inflation to rise in the near future - even though indicators show a decline. Therefore, we do not have control over this factor - although it would certainly be more predictable if communication between the central bank and society were based on a professional level. On the one hand, the NBP mocks journalists and economists, on the other hand it assumes that every citizen knows how inflation works. Meanwhile, its rate, which is displayed on TV screens (as research shows) is often perceived as inflation, which increases monthly (month by month), not annually. That's why so many surveys show that Poles believe that the inflation rate is nearly over 30%. Below are corporate inflation expectations. They remained at a huge level throughout 2022, only at the turn of March/June 2023 did they decline.

3. Labor market – In my opinion, this is where the key battle will be played, which will allow us to assess progress in the fight against inflation. We are currently dealing with a decline in wages in enterprises, but this significant deterioration in employment conditions will play a key role in limiting demand. The current economic situation has begun to turn very strongly towards recession and there is a very fine line between the choice: lowering rates and protecting against inflation at all costs, and keeping rates at the same level at the expense of employment, but a faster decline in inflation.

Therefore, let us impatiently await what the near future will bring and the actions of the MPC.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)