Options: Theta - meaning time is money

In previous articles on options, we mentioned delta and gamma. However, other factors also affect the option price. One of the most important is Time. An option is a derivative with an expiry date. It should be taken into account that the probability of the option exercise has a very significant influence on the option price "In money". The greater the probability, the greater the delta. However, assuming that the price is moving normally, the shorter the time to expiry of the option, the smaller the chance of a positive scenario in the case of the deep OTM option (except for money). The lapse of time is particularly important in the case of options with a significant share of the time premium in the option price. This is therefore the case for OTM, ATM and slightly ITM options. If the other factors are unchanged, then the option price will fall after one day. The Greek Theta coefficient informs about the size of the decrease. However, the effect of time on the option price is not linear.

READ NECESSARY: WHAT ARE THE OPTIONS? INTRODUCTION

When taking a position, remember about theta

Any seasoned options trader knows that time is the enemy of long holders of this derivative. On the other hand, it is an "ally" for traders issuing call or put options. Thety value is expressed as negative values. If theta is -0,12, it means that after one day it will lose 0,12 points. However, it is worth remembering that theta for call and put options with the same strike price may have different values.

If an investor takes a short position in the options market (eg by creating a covered call strategy), he earns money on the passing time every day. The risk for the investor is then a change in the price of the underlying instrument or an increase in volatility. Due to the fact that the closer the option expires, the faster the “price erosion” accelerates, it is worth looking at the possibility of issuing options with a short expiry date (less than 30 days). What type of options to trade depends on your risk aversion. ATM options have the highest value of the time premium (potential profit for the issuer due to the passage of time).

Theta is a Greek factor that has a consistently negative effect on the price of an option. So it is the "enemy" of every option holder. However, the effect of theta will vary depending on:

- the distance between the option exercise price and the market price,

- time until the option expires,

- volatility of options.

Theta and Time To Do

Another important issue is the non-linearity of the elapse of the time premium. The less time until the option expires, the greater the percentage of the time premium is taken by thete. In professional nomenclature, it has its own term - time decay. For short-term options (e.g. weekly), the passage of time can have a devastating effect on the pricing of options, especially options that are close to the market price (ATM). For long-term options (LEAPS) the passage of one day does not have a significant impact on the value of the time bonus. For this reason, theta of such an option is close to zero.

An example is the stock options of the SAP company. On March 16, 2022, the price per share was approximately € 104. As you can easily guess, the closer the time to the option expiry, the lower the time premium. At the same time, theta level rises. This is justified, because in the case of the option expiring in two days (March 18), the entire time premium must "disappear" within several dozen hours. In the case of an option with a longer time to expiry, theta is less of an erosion of the option price. The tables below are to confirm the mentioned dependencies.

Call (ask) price depending on the expiry date:

| call options | 18.03.2022 | 14.03.2022 | 16.09.2022 | 16.12.2022 |

| 95 | 7,95 | 9,05 | 12,55 | 13,98 |

| 100 | 4,02 | 5,40 | 9,45 | 10,60 |

| 105 | 0,80 | 2,77 | 6,50 | 8,45 |

| 110 | 0,16 | 1,41 | 4,85 | 6,40 |

As you can see, as the option gets closer to expiry, the market price of the option drops. This is because the probability of a sharp change in prices is reduced. As a result, investors do not want to overpay for options. This causes the time value of the option to decrease. In the case of an OTM option with an exercise price of € 110, the value of the option expiring on March 18 is only 2,5% of the value of the call option expiring on December 16.

Theta call option (ask) depending on the expiration date:

| call options | 18.03.2022 | 14.03.2022 | 16.09.2022 | 16.12.2022 |

| 95 | -0,03 | -0,049 | -0,025 | -0,019 |

| 100 | -0,233 | -0,07 | -0,025 | -0,019 |

| 105 | -0,334 | -0,065 | -0,024 | -0,018 |

| 110 | -0,077 | -0,057 | -0,021 | -0,017 |

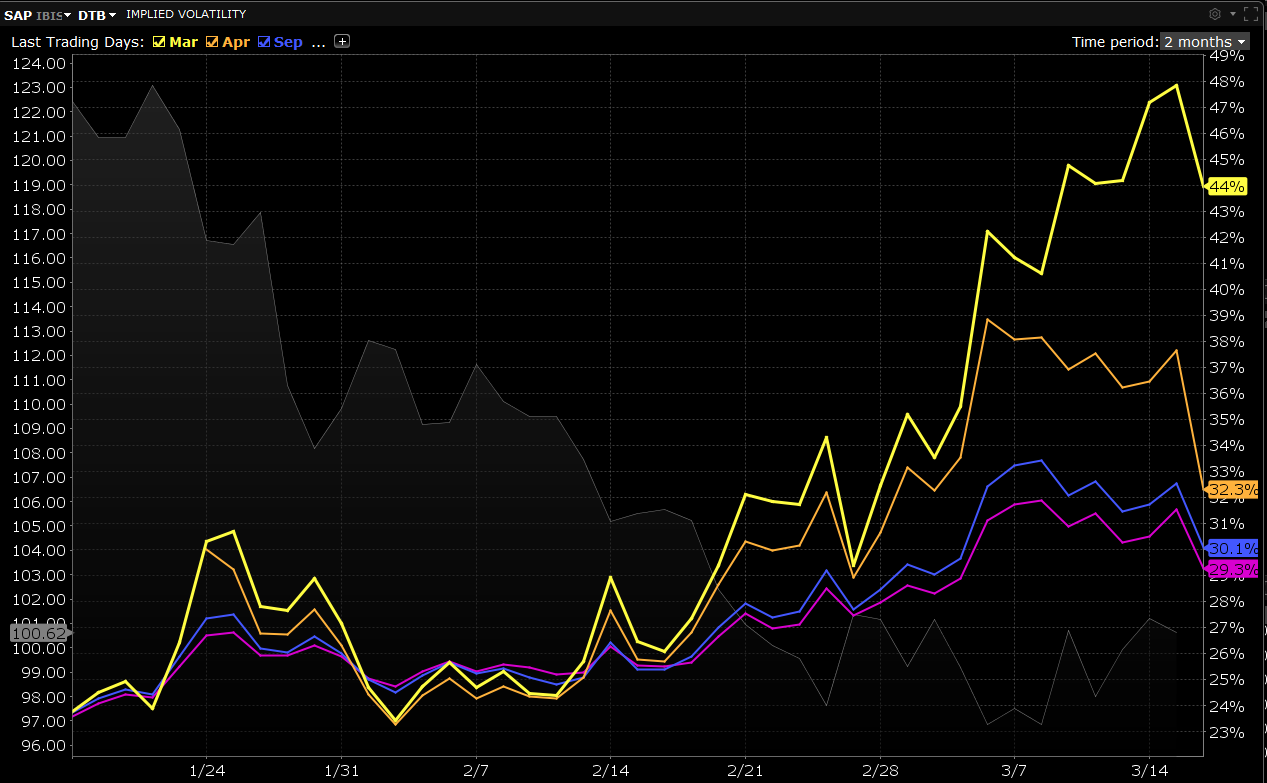

The closer the option is to expiry, the more theta (in absolute terms) grows. The greatest change concerns the options closest to the option strike price. This is due to the largest time premium (the difference between the market price of the option and its intrinsic value). For the series expiring on March 18, there are only two days until the expiration date. If the price does not change then 0,8 points must disappear in the next two days because the option will expire worthless. An additional factor influencing the price difference is the implied volatility. In this case, the March series has the highest implied volatility, as evidenced in the chart below.

As previously mentioned, the passage of time does not affect the option price linearly. For this reason, thety effect is minimal for long-term options. However, this factor plays a significant role in the last 30 days of the option's life. It is worth remembering this, especially during short-term speculation on weekly options.

This preview figure is about the "average" time value loss path of the option. In the case of the ATM type option, the drawing clearly illustrates the influence of the passage of time on the value of the option. However, for options that are deep ITM, the loss in time value appears to be close to linear. On the other hand, for the OTM and DOTM options, they lose most of their time value much earlier than in the last weeks. These types of options lose most of their time premium in the 60 to 30 days to expiry period.

Theta and volatility

In addition, option volatility is a very important factor influencing the size of the theta. If the implied volatility goes up, option prices go up as well. This translates into a time premium, which is the difference between the market price of the option and the intrinsic value of the option. It is worth remembering that high implied volatility increases both “in money” (ITM) and “out of money” (OTM) options. For investors who bought options with a monthly exercise date, the implied volatility of which is high, has a negative effect time lapse (theta) and the risk increases decline in volatility (vega).

Therefore, in periods of increased volatility, it is worth looking for a place to take a short position on call or put options. Thanks to this, the daily profit for the passage of time and the decrease in volatility for OTM and ATM options can be really large.

Theta and investment strategies

It is worth remembering that theta also affects type spreads debit i credit. An example is building a bull spread from call options on SAP stocks expiring on September 16, 2022. By purchasing a call option with an strike price of 95 and by issuing a call option with an strike price of 110, a bull spread is created. The theta of such a strategy as of March 16 was -0,004. This is because the ITM theta was -0,025 and the OTM theta (€ 110) was +0,021 (going short gives a synthetic "positive" theta). This means that each day the trader will be losing part of the value of the position due to the negative thety.

| call options | 18.03.2022 | 14.03.2022 | 16.09.2022 | 16.12.2022 |

| 95 | -0,03 | -0,049 | -0,025 | -0,019 |

| 100 | -0,233 | -0,07 | -0,025 | -0,019 |

| 105 | -0,334 | -0,065 | -0,024 | -0,018 |

| 110 | -0,077 | -0,057 | -0,021 | -0,017 |

The reverse is the case when building a bull spread from the put option. Then the theta of the put option is higher than the theta of the put option bought. It can therefore be concluded that credit strategies generate positive theta and debit strategies have negative theta (negative influence of time on the strategy's outcome).

Summation

Theta is an important Greek factor that many investors forget about. The value of the theta is influenced by a number of factors such as time to expiry, option type (OTM, ATM, ITM), counterparty and implied volatility. Understanding the interdependencies between the "Greeks" will allow you to build a better investment strategy and avoid the pitfalls.

Do you know that…?

Saxo Bank is one of the few Forex brokers that offers vanilla options. The investor has a total of over 1200 options at his disposal (currencies, stocks, indices, interest rates, raw materials). CHECK

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-300x200.jpg?v=1709558918)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-300x200.jpg?v=1711601376)