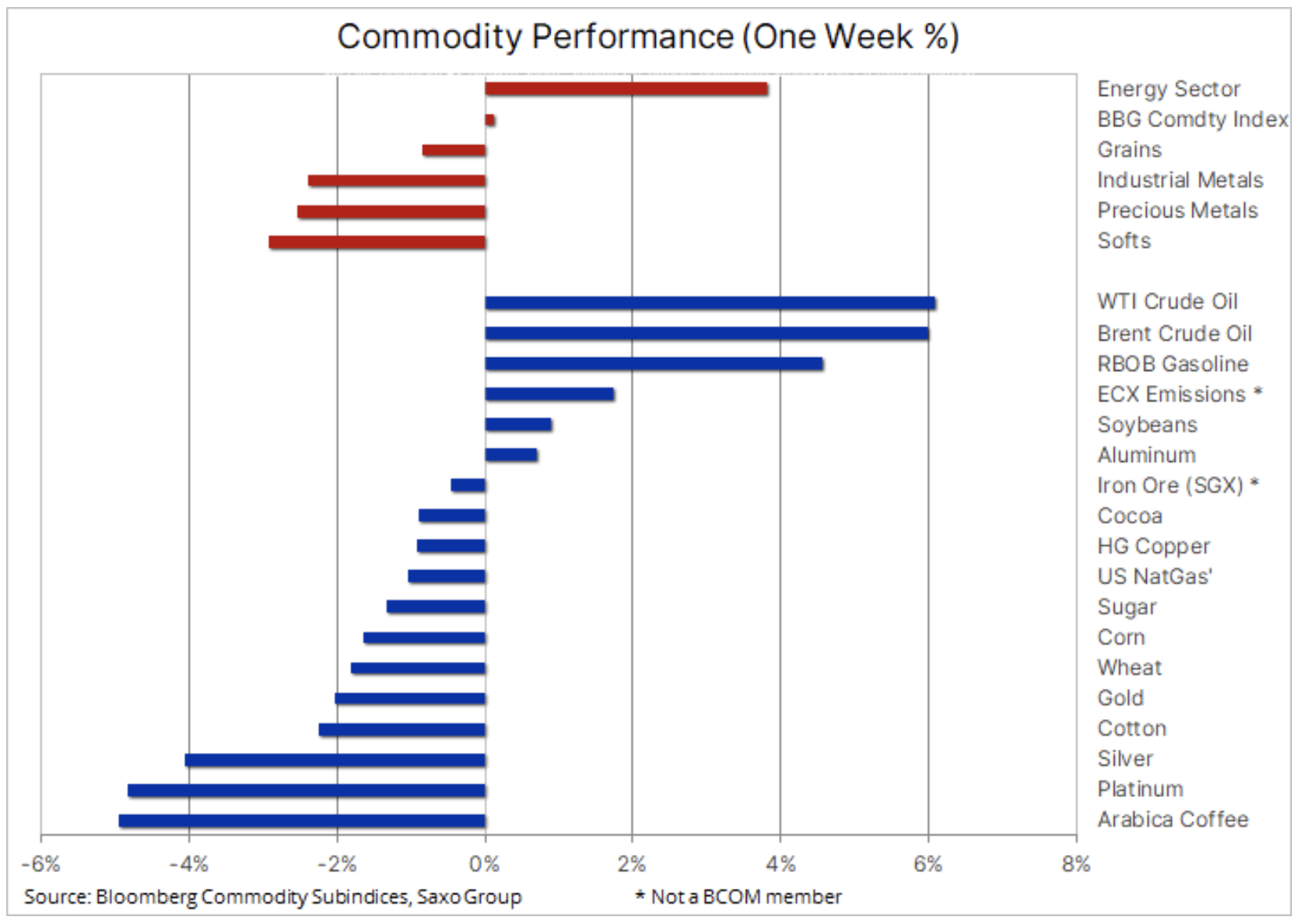

OPEC + raises the price of oil, most of the raw materials are nervous after the increase in profitability

The nearly synchronized boom in commodities markets observed in recent months continues to struggle with the steady rise in US bond yields, triggering risk aversion, as well as the strengthening of the dollar. Most metals, including copper, depreciated, while Saudi Arabia's push to raise prices pushed the price of oil to its highest level since last January.

The sharp surge in US bond yields on February 25 prompted us to warn recently that the commodities sector, especially precious metals, was facing a difficult period. This was not the result of an unexpected shift in the fundamental outlook, which is still favorable for all commodities, but rather the risk that higher yields could trigger a deleveraging period that would jeopardize the record long speculative position of hedge funds in energy, metals and agricultural products.

President Powell's speech from the Fed on Thursday, just one week after the first sharp rise, did not suggest any particular concern about higher yields, even though Powell insisted on keeping the reference rate temporarily low. Bond market he reacted with another attack of hysteria; as a result, long-term US bond yields peaked at the close of the current cycle on a daily basis. The appetite for risk went down sharply, and stock markets began to decline, while the dollar found new buyers, thus hindering the growth of numerous commodities sensitive to the currency exchange rate and the level of interest rates, including gold.

Copper

One of the most popular commodities during the monthly boom in commodity markets, due to the fundamentals pointing to declining supply as well as green transformation, it recorded a weekly loss for the first time in a long time. A few weeks ago, the sharp strengthening to the highest level in 10 years resulted, among others, from from the purchase of copper by a Chinese Leviathan with a total value of $ 1 billion in just four days. Such events, combined with the projected increase in the deficit, contributed to a significant increase in speculative positions on the stock exchanges from New York to London or Shanghai.

As a result, the market became exposed to the risk of short-term changes in the technical forecast. We saw results recently: Copper HG broke support at $ 4,04 / lb and fell to $ 3,84 / lb before finally returning above $ 4 / lb. As part of the unlikely, though possible, return to the upward trend of last March, copper HG could go back to $ 3,5 / lb, which is equivalent to $ 7 for LME copper.

Petroleum

Clothing Gained as much as 5% after OPEC + decided to further cut supply by delaying a planned increase in production, de facto assuming that US shale oil producers focus more on dividends than increasing production. In other words, they focus on pleasing speculative investors at the expense of the global consumer, thereby exacerbating the risk of rising inflation.

To defend the 80% increase that had sustained since the beginning of November, the group decided to postpone the discussed 0,5 million barrels / day increase in production by a month. In addition, Saudi Arabia extended its unilateral production cut by 1 million barrels per day, which runs the risk of unduly restricting supply in the market in the context of extinguishing the pandemic and increasing mobility. In reaction, a number of banks raised their Q75 price forecasts towards USD 80-XNUMX / b, and any short-term oil risk is now mainly related to the aforementioned deleveraging initiated in other markets.

The group's surprising decision to maintain the current levels of extraction could simply be justified by the fact that this is due to conflicting market signals. On the so-called On the paper market, the ever-increasing deportation of Brent and WTI futures contracts has been showing limited supply for several weeks now. This is in part due to buy orders from speculative investors focused on contracts in the coming months, the most liquid end of the curve.

In the physical market, however, the situation is much better: many traders argue that the availability of cargo is high, especially for delivery to Asia, which is the largest importer in the world. After analyzing the demand from refineries for April, the group may have concluded that it was not strong enough to justify an increase in production before May.

Gold & Silver

Gold hit its lowest price in nine months, under $ 1. This happened after the dollar appreciated in response to another Powell-induced hysteria in the bond market, when the president Fed it has refrained from intervening on the recent rise in profitability, in particular real yields, which, combined with the dollar, are the two most important indicators of demand for gold and precious metals as such. Simultaneously silver it went down even more in reaction to the aforementioned sale, which hit industrial metals such as copper and above all nickel, the price of which has dropped by as much as 20% from its peak in February.

From a long-term growth perspective, gold would have to stay above the key support area between $ 1 and $ 670, while a break above $ 1 would signal new appreciation and support. It is obvious that gold is unlikely to breathe a sigh of relief until yields and the dollar stabilize. The Fed is not prepared for this and it could lead to further complications until financial conditions force the Fed to react.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response