How to invest in futures on German bonds

The German capital market is a very important place for trading in bond derivatives. Thanks to this solution, the investor has easy access to a liquid instrument with exposure to the bond market. It can be an interesting idea to diversify your investment portfolio.

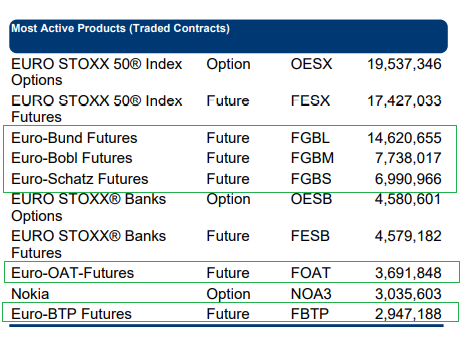

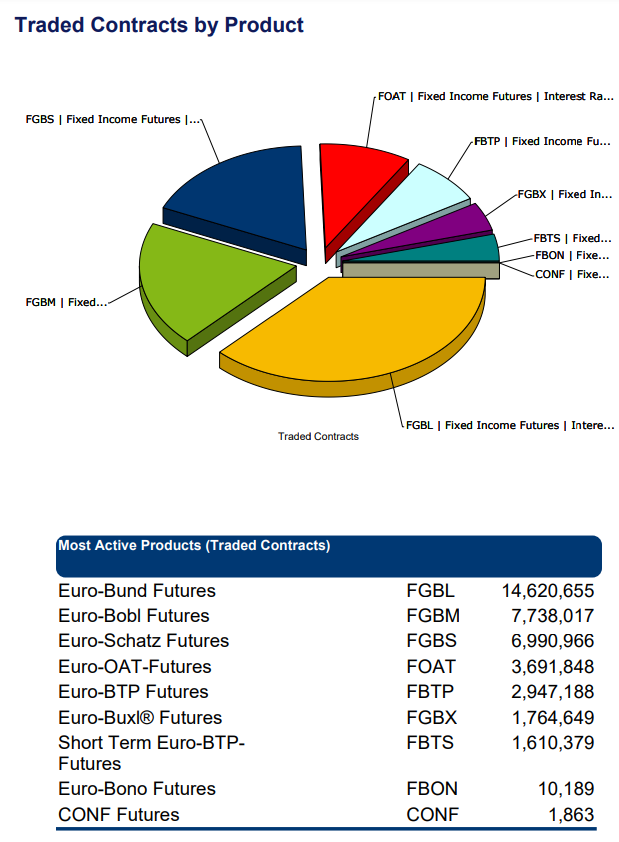

According to data provided by Eurex, bond futures were among the most used for derivative trading on the German stock exchange. Derivatives trading in January 2021 is listed below:

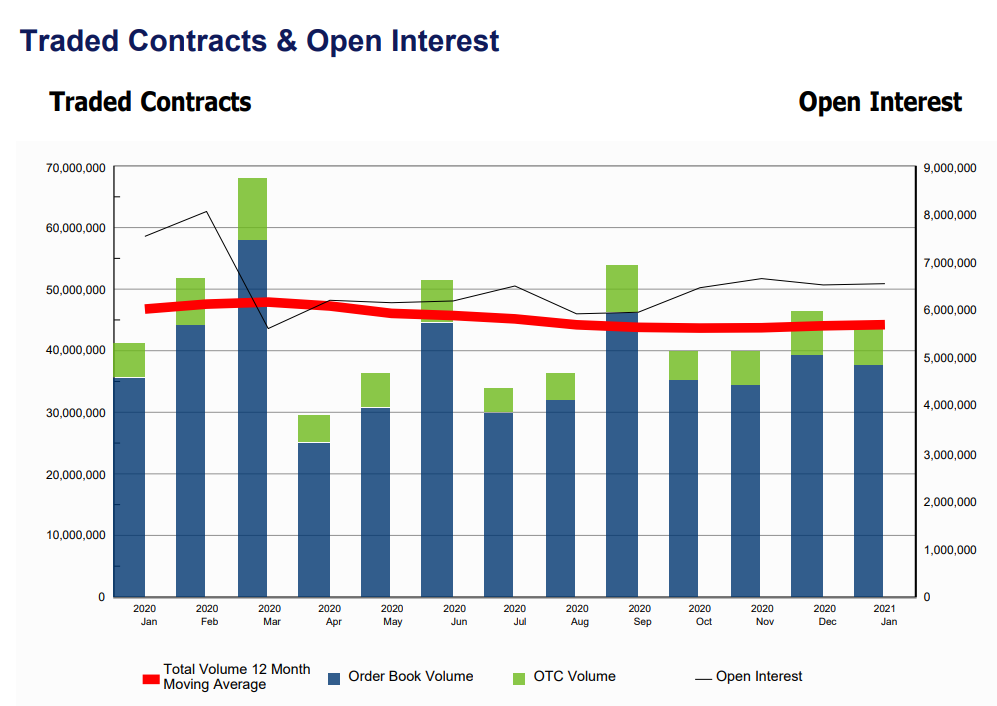

On the German market, the average monthly trading in derivative instruments in the last 12 months was around 45 million. In 2017-2020, the annual turnover in futures and bond options fluctuated between 528 and 628 million contracts. The futures contracts alone accounted for 484 million concluded contracts (91,7% of all contracts).

In January, the trading volume on the bond futures market was 39,4 million contracts (1,97 million per day). This meant a 7% increase year on year.

The largest volume of trading takes place on futures contracts on German long-term bonds (FGBL). In January 2021, this instrument accounted for approximately 37,1% of trading in bond futures on the German market. The second most popular instrument was German medium-term bond futures, which accounted for 19,7% of the turnover.

Euro-Bund futures

These are futures for long-term German government bonds (Bundesanleihe). Euro-Bund bonds must have a maturity of 8,5-10,5 years. It is the most liquid euro-zone futures contract. The contract has a nominal value of € 100. The minimum tick is 000 which means that the value of one tick step is € 0,01.

Contracts expire each quarter (i.e. March (H), June (M), September (U) and December (Z). Each month, trading is available on the next three series of quarterly contracts. The contract series is structured as follows: FGBL Q RR, where Q-is the expiry month of the contract and RR is the expiration year, therefore a futures contract expiring in March 2021 is FGBLH21 .

The delivery date of this futures contract is the 10th day of the month of the series (e.g. the tenth day of March 2021). If the 10th day of the month falls on a non-trading day, the delivery date is the next "trading" day. The last trading day for a given series is two sessions prior to delivery.

CFD chart on Euro-bund bonds, interval W1. Source: xNUMX XTB.

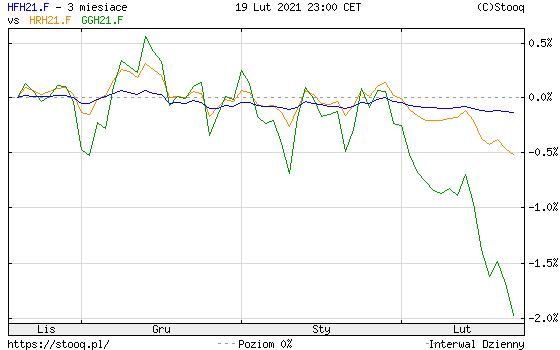

Long-term bonds are more "sensitive" to expectations of changes in the future interest rate. This is due to the way the bonds are valued (discounted). Below is a list of changes in the prices of futures contracts expiring in March 2021 for long-term bonds (green color) compared to short-term bonds (blue color) and medium-term (orange). A fall in bond yields raises their price (bonds become more expensive). In the event of an increase in bond yields, its price drops, the strongest being the bonds with the longest maturity.

Euro-Bobl futures

Euro-BOBL futures contracts are the second most liquid derivative instrument listed on the German stock exchange. These are "medium-term" bond futures. Bonds included in Euro-BOBL must have a maturity of 4,5-5,5 years. As with the Euro-Bunds, the notional value of the contract is € 100. As a result, one tick is worth € 000. The futures contract has an abbreviation FGBM. For example, futures for German government bonds (Bundesobligation) expiring in March 2021 have the abbreviation FGBMH21. Medium-term bonds are less sensitive to changes in expectations about interest rates than long-term bonds.

Euro-Schatz futures

The Euro-Schatz futures contracts are the third most liquid futures listed on the German stock exchange. These are derivatives on "short-term" bonds of the German government (Bundesschatzbrief). Euro-Schatz bonds must have a maturity of 1,75 - 2,25 years. As with the previous two futures, the contract has a notional value of € 100. The futures contract has an abbreviation FGBS. For example, the short-term German government bond futures expiring in March 2021 have the abbreviation FGBSH21. Short-term bonds are the least sensitive to changes in investor sentiment from the above-mentioned ones.

How to invest in derivatives on German bonds?

CFDs

The easiest way to invest in futures contracts on German bonds is to use the offer of brokers that provide trading on these derivatives. The problem for most retail investors is contract size. For this reason, you can take advantage of the offer of the forex brokers who are offering CFD on German government bonds.

| Broker |  |

|

| End | Poland | Denmark |

| Bond symbol | SCHATZ2Y BUND10Y |

21 bond contracts |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD |

| Min. Lot value | price * 1000 USD | b / d |

| Commission | - | - |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 74% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

ETF Funds

Another idea is investing in ETFs, which is based on German bond futures. One of them is Lyxor Bund Future Daily (-2x) Inverse UCITS. This ETF is an investment strategy to assume a double short position on a futures contract on long-term German government bonds. The base value of the ETF was set to 100 on January 4, 2010. Currently, the ETF value is below € 30. This is due to a significant increase in the value of long-term bonds (yield decline).

ETF Lyxor Bund Future Daily (-2x) Inverse UCITS ETF Chart, Interval W1. Source: xNUMX XTB.

Brokers offering ETFs

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain / Cyprus |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFDs on ETFs |

3000 - ETF 675 - ETF CFDs |

397 - ETF CFDs |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

Investing in bond futures can be an interesting solution for investors who are looking for a way to invest in debt market derivatives. However, you should be aware that, depending on the type of bond (long-, medium-, short-term), the price change varies. The most liquid futures contracts listed on the German stock exchange are Euro-Bund, Euro-Bobl and Euro-Schatz. Below is a brief summary of these bonds:

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)