Taxation of Forex Income - Part 4. What about cryptocurrencies?

In Poland, cryptocurrency trading is still unflagging. Contrary to appearances, it is very profitable and allows you to earn substantial sums. However, it cannot be denied that accounting for cryptocurrency-based business is a huge challenge for both amateurs and experienced entrepreneurs. So let's know what laws regulate their sales and how to account for your revenues related to virtual currency.

How to account for trading on cryptocurrencies?

When exchanging any cryptocurrency for legal means of payment in Poland, our citizens must bear in mind that tax will have to be paid on the due. The judgment in Skateverket v. Hedqvist of the EU Court pointed out that the cryptocurrency acts as a means of payment and, as a result, it is exempt from the value added tax paid.

Until recently, Polish laws and regulations did not explicitly specify the rules for taxation of revenues from trade on cryptocurrencies, which is why tax authorities presented their own interpretations. According to them, income from cryptocurrencies should have been accounted for as income from the sale of property rights, added them to other revenues and sources of income, and taxed on the basis of general principles. Such treatment of the subject forced the interested parties to pay also tax on civil law transactions. However, on December 20, 2019, the ordinance concerning the abandonment of tax collection tax was updated to June 30, 2020. Eventually, his conscription was abandoned.

"In order to ensure continuity in not charging the tax on civil law transactions for sale and conversion of virtual currencies, it is proposed that the provisions of the act enter into force on January 1, 2020." - we read in the justification of the Ministry of Finance.

Tax office, cryptocurrencies and Polish law

Until 2018, cryptocurrencies did not have any regulation in legal regulations. In principle, there was no authority or institution that would oversee them, and Polish law clearly articulated the view that cryptocurrencies cannot be treated on an equal footing with legal means of payment, and therefore they are not legal means of payment.

There was no doubt, however, that when the virtual currency is exchanged for the national or foreign currency, or if it is purchased for real means of payment, then income is generated which is subject to income tax. And this principle has finally been defined in art. 17 clause 1f of the pit act:

"The sale of a virtual currency for consideration means the exchange of a virtual currency for a legal tender, good, service or property right other than virtual currency or settlement of other liabilities with a virtual currency."

Cryptocurrency settlement in practice

Since 2019, cryptocurrency settlement is carried out on a different basis than in previous years. At PIT 2019 (for 2018), we calculated cryptocurrency revenues on PIT-36. So 18% tax was charged on them (after exceeding the tax threshold - 32%). In addition, cryptocurrency income could be combined with other income. PIT-36 settlement also provided access to a significant number of concessions.

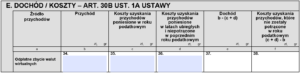

From 2020, the grouping of revenues to tax sources, as well as the principles of cost settlement, have changed significantly. Both of these categories have found their place and are accounted for in PIT-38 in the source of funds, where a new line has been added for the specification of income from cryptocurrencies - 'Paid sale of virtual currencies' and in PIT Z / G (section C3, items 34-35 ).

In 2020, we will pay 19% tax on cryptocurrency income, so similar to when settling income from the currency market. However, this income cannot be combined with income from other sources, and this means that losses on the stock exchange, currency market or other financial instruments cannot be compensated with income from cryptocurrency trading, or vice versa. The taxpayer settling on PIT-38 is entitled only to IKZE relief and foreign relief.

NOTE: The above accounting policy applies only to the physical exchange of cryptocurrencies. In the case of cryptocurrency contracts, we settle transactions as for foreign currencies (settlement of exchange differences).

Any exchange of cryptocurrency for physical currency (fiat) and all other activities that generate revenue are subject to taxation. In practice, therefore payment for pizza in bitcoins also will be an indirect exchange of cryptocurrency and the tax should be paid as much as possible.

We calculate the revenue from the sale of cryptocurrencies in the case of conversion into foreign currency as in the case of exchange rate differences - the transaction is converted into PLN at the average exchange rate of the National Bank of Poland on the day preceding the exchange day.

Finally, it should be noted that provisions in this area still have a gap. Professional cryptocurrency trading forces you to run a business, which is important, however, income from cryptocurrencies in this form of business cannot be settled in PIT-36L and in PIT-38, even if we prove that purchases and transactions using cryptocurrencies were part of its business ( the only exception are exchanges and exchange offices).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)