The pandemic continues. With what mood are we entering the next quarter?

The saying "in March like a pot", even in relation to markets, takes on a very literal meaning. The third month of the year brought us a large dose of volatility, for which investors (using the opportunity to play for a short time) certainly at least partially used. Of course, greater market turnover and speculative sentiment are given to us in connection with the dynamic global situation. We are strongly stuck in the problem of the coronavirus epidemic and despite the fact that this situation has been simplified to a large extent since mid-December (in Europe a little later), its end is difficult to see. The Old Continent, however, hopes to get rid of the pandemic faster. The number of cases is still increasing, while the speed with which the infected arrive is decreasing. However, this cannot be said for the United States. A very large number of cases cannot be optimistic. The indices scored huge declines from historical peaks and then rebounded a solid several percent up. You can get little consternation in this situation.

There will be no fireworks?

Saving economies by numerous central banks lowering interest rates and massive amounts of aid packages will certainly not go indifferently through the markets. The United States and Germany sent the largest of them. A large amount of cash in the economy will not only support "local" liquidity, but above all can negatively affect (weaken) national currencies. This scenario is louder and bolder in speculation in the context of the dollar.

Rather, we should not expect similar steps (our proverbial "fireworks") in the upcoming month that were used in March. These activities would be highly ineffective. Although the market has not reacted in any way to interest rate cuts, the impact on the economy will certainly have, but not as strong as in "normal" conditions. The current global situation is certainly unique. The actions of central banks and institutions that are responsible for broadly understood international markets should focus on hedging short-term fluctuations. It is highly doubtful that we will receive a series of further reductions in April. It is more likely to launch new or recapitalize existing aid packages.

Sunrise is overwhelming

April will definitely bring us some refreshment and revival of the situation in China. The country coped well with the epidemic and is recovering from its coronavirus order quite quickly. Generally speaking, macroeconomic data are above expectations and are closer to slowing than recessions. This is one of the positive reasons for normalizing the global economic situation. Eastern stock exchanges are a good mood creator for sessions in Europe and the USA. Therefore, recent increases in the stock market, although still slightly uncertain, may bring some optimism to our "backyard". However, high volatility throughout the day advises caution. It finds its justification in the nervousness of market movements and the uncertainty that accompanies them. As you know, the opportunity makes a speculator, therefore it is not surprising that we are dealing with so mixed moods and strongly changing sentiments on the market. It is worth noting, however, that despite spectacular reflections, March ends with a major downside for most indices. It will certainly take some time before we approach the historic peaks again. However, being of good cheer, we look forward to quickly ending the struggle against the epidemic and re-pouring enthusiasm and market demand.

April and the second wave of falls

Overpriced assets (especially stock markets) are an opportunity for decent purchases for many. Greed is the worst advisor, and relative optimism encourages the acquisition of cheap shares. It can be said with great probability that there is still a lot of space ahead of us and many reasons for these drops to hit the market again. One of the reasons that somewhat confirms the above assumption is the US credit market. The increase in investment products containing corporate bonds is almost avalanche, as is the increase in the value of liabilities in this respect. One looks at it with a wink. Federal Reserve perhaps it will be "unknowingly" used for this because of its provisions. As a reminder, the FED undertook to buy as much debt as needed to maintain liquidity on the market. It is true that the purchased debt is in the majority of government bonds, and the above-mentioned corporate bonds constitute only a small part of the whole.

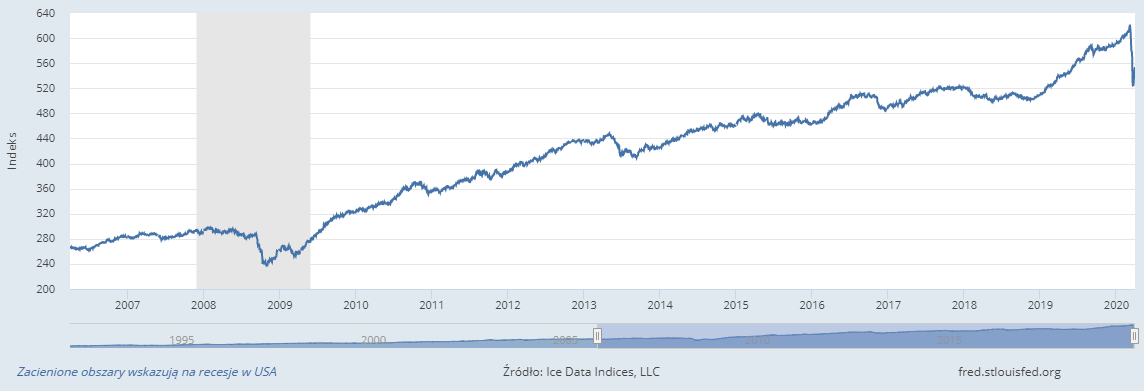

ICE BofA. Source: https://fred.stlouisfed.org/series/BAMLCC4A0710YTRIV

The chart above shows the results of an investment debt denominated in US dollars. Is issued publicly on the US domestic market. This collection includes all securities with a remaining maturity of at least 7 years and less than 10 years. It is not hard to see that the profitability of long-term corporate debt is not fantastic at present.

In view of the above, it can be expected that stronger supply pressure will return to the markets in the near future. To a large extent, concerns about the decline in value of most assets and the onset of a second wave of sales are associated with the second wave of virus outbreaks.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)