Passive investing in the mWIG 40 index - it's easier than you think [Guide]

For many years, the Polish capital market was not very open to the development of passive investment products that would give exposure to the market of Polish, medium-sized companies. Until recently, investing in companies included in mWIG 40 index were only possible through:

- purchase of participation units in investment funds,

- futures trading,

- individual selection of actions.

These ways of investing had their drawbacks. They were either expensive or required spending free time.

Investment funds

When investing in units of mutual funds, the investor entrusts his money to specialists, but he has to pay dearly for this service. The buyer of the fund's investment units often has to pay a distribution fee of up to several percent and a fund management fee. In theory, fund managers should generate a rate of return higher than the entire index (benchmark). However a small percentage of funds can beat the market in 5-10 years. They are the obstacles high feesthat lower your real return on investment.

Futures contracts

Trading futures is the second way to invest in the mid-market. This method seems to be extremely simple. It is enough to buy a futures contract, roll it up every quarter and you get it "Passive wallet" giving exposure to companies from the mWIG40 index.

However, the problems faced by such investors include:

- the indivisibility of a futures contract,

- low liquidity,

- the difference between the base price and the forward price.

The indivisibility of a futures contract is a problem for investors with a small investment portfolio. The nominal value of the mWIG40 futures contract was PLN 15 on November 56th. For an investor who wants to invest PLN 860, it is the mWIG10 futures contract is unacceptable. On the Polish stock exchange, it is not possible to take advantage of trading with fractions of futures contracts. For this reason, using mWIG40 futures is not a convenient solution.

Low liquidity is another problem that investors in mWIG40 contracts may encounter. Due to a small number of market participants, the spread between the bid and ask price is much higher than in the case of WIG20 futures. This increases the cost of setting up a position.

Another problem for an investor in futures contracts is the difference between the forward price and the spot price. Very often the forward price is significantly higher than the spot price. It occurs then contango effect, which significantly reduces the result, the rate of return on long positions on futures.

Individual action selection

Investing for your own account may seem very exciting at first glance. It is the investor who decides which strategy he wants to use. For example, it may invest based on fundamental or technical analysis. Individual selection of shares gives the investor flexibility. It is he who decides which company to buy, at what price and when to sell. However, the disadvantage of such a solution is amount of time spent what an investor has to spend on selecting companies for the portfolio. If the investor uses technical analysis, it is necessary to monitor the marketto open a position with a favorable reward / risk ratio. It takes your time. It is similar in applying fundamental analysis. The investor must read the financial statements (annual and quarterly reports) and examine the micro and macro environment of the company (e.g. relations with suppliers and recipients or barriers to entering the market).

Another problem self-employed investors have is without consequences. During a natural period of capital decline (asset value decline), investors try to adjust their strategy in order to improve their results. As a result, the investor "jumps" from strategy to strategy. Another type of inconsistency is not following your own strategy. This may apply to "bending" the times of opening and closing positions as well as the size of the transaction (too small or too large position).

Passive investing in mWIG40

The solution is very simple. Enough buy an ETFwhich gives exposure to Polish medium-sized companies. It seems simple, but for many years Polish investors have not been able to invest in this type of ETF. Beta Securities came to the rescue, introduced in September 2019 by Beta mWIG40 TR. Thanks to this, an investor, even with a small capital, can gain exposure to the market of Polish medium-sized companies. ETF is a dividend-reinvesting index, therefore it took the mWIG40 TR (Total Return) index as its benchmark.

MWIG 40 index

For many investors, large opportunities to achieve above-average rates of return are found among small and medium-sized companies. The flagship indices representing this market segment are sWIG80 (small companies) and mWIG40 (medium-sized companies). In the further part of the article, we will present the mWIG40 index and briefly describe selected components.

The index was introduced by Stock Exchange in Warsaw on September 21, 1998. The base date was introduced on December 31, 1997, where the base value was set at 1000 points. mWIG40 is a price index. Additionally, dividend income is not included in its calculation.

The index contains 40 components that meet the following criteria:

- Number of free float shares greater than 10%,

- The value of free-float shares exceeds EUR 1 million,

- At least one transaction must be concluded on the shares within the last 3 months,

- The company cannot be qualified for the Alert List,

- The component cannot be located in the "Low Liquidity Zone",

- It cannot be a foreign company (dual-listed), the capitalization of which is greater than the median of the WIG20 company.

The mWIG40 index includes 40 more (after WIG20) companies included in the ranking, which are determined based on data after the trading session on the third Friday of February, May, August and November.

It is worth adding that the share of one company in the index may not exceed 10%. Index shares of companies are calculated based on the number of free float shares and rounded to the nearest thousand. The adjustments in the index are made after the sessions on the third Friday of June, September and December. In turn, the annual revision takes place on the third Friday of March.

Below the top 10 components of the mWIG40 index as of November 17, 2021:

| Company name | Participation in the index |

| ING Bank Śląski | 10,88% |

| mBank | 8,67% |

| Kety | 7,11% |

| Kruk | 6,95% |

| Or | 6,55% |

| Millennium | 5,89% |

| Intercars | 4,55% |

| Kernel | 3,72% |

| Budimex | 3,63% |

| virtual Poland | 3,30% |

virtual Poland

The company operates in two segments: Online and TV. The largest segment is Online, which generates 95,8% of the company's revenues. The segment includes websites and e-mail services. Wirtualna Polska is the owner of such websites as Money.pl, WP, WP Sportowe Fakty. Wirtualna Polska also has a gaming website - Polygamia.pl. The remaining revenue is generated by the TV segment (Telewizja WP). Wirtualna Polska also offers WP Pilot, which allows you to receive traditional television online. TV can be watched via the website and the application. The company's capitalization is approximately PLN 4 billion.

| PLN million | 2017 | 2018 | 2019 | 2020 |

| revenues | 465,6 | 567,3 | 708,7 | 632,3 |

| operational profit | 78,6 | 107,3 | 129,9 | 121,7 |

| operating margin | 16,88% | 18,91% | 18,33% | 19,25% |

| net profit | 40,0 | 76,0 | 71,1 | 81,7 |

Wirtualna Polska chart, interval W1. Source: xNUMX XTB.

Budimex

The company is one of the largest companies in Poland operating on the construction and assembly services market. Budimex operates in the general contracting system. The Budimex Group deals, inter alia, with construction of national roads, railways or cubature buildings. Budimex's clients include General Directorate for National Roads and Motorways, MPWiK or PKP. The company also conducts real estate development, which generated PLN 2020 million in revenue in 673 (sale of 1672 apartments). As part of its activities, the Budimex Group also deals with municipal services, road maintenance and technical maintenance of buildings. Most of the company's revenues are generated in Poland (95,5% of sales). Other markets where the company operates are Germany, Lithuania and Norway. The company's capitalization is approximately PLN 6 billion.

| PLN million | 2017 | 2018 | 2019 | 2020 |

| revenues | 6 369 | 7 387 | 7 570 | 8 382 |

| operational profit | 588,3 | 417,0 | 318,4 | 638,6 |

| operating margin | 9,24% | 5,65% | 4,21% | 7,62% |

| net profit | 464,4 | 305,4 | 228,8 | 471,4 |

Budimex chart, interval W1. Source: xNUMX XTB.

amrest

He is the master franchisee of famous restaurants. It is one of the largest enterprises of this type in Europe. At the end of the third quarter of 2021, the company had 2 restaurants. According to the financial statements, the company owned 395 restaurants on its own account and franchised 1 to other entities. AmRest is the operator of such brands as KFC, PizzaHut, BurgerKing and Starbucks. The company operates in 892 countries. The largest markets for the company are Poland, Spain, Russia, France, Germany and the Czech Republic. The company's capitalization exceeds PLN 503 billion.

| PLN million | 2017 | 2018 | 2019 | 2020 |

| revenues | 5 266 | 6 652 | 8 353 | 7 028 |

| operational profit | 266,9 | 307,9 | 449,7 | -657,6 |

| operating margin | 5,07% | 4,63% | 5,38% | -9,36% |

| net profit | 181,3 | 177,6 | 284,9 | -847,7 |

Amrest chart, interval W1. Source: xNUMX XTB.

LiveChat

It is a company that produces online communication solutions for business. The company's most important service is LiveChat, which supports communication between the company and customers (online chat). The application generates approximately 94% of the company's revenues. The services are used by over 34000 clients, incl. Bosch, Samsung, Philips. The company operates in the SaaS model and over 40% of its revenues are generated in the United States. The current capitalization of the company exceeds PLN 3 billion.

| PLN million | 2017 | 2018 | 2019 | 2020 |

| revenues | 89,4 | 109,3 | 130,9 | 179,0 |

| operational profit | 61,3 | 70,8 | 81,9 | 107,1 |

| operating margin | 68,57% | 64,78% | 62,57% | 59,8% |

| net profit | 48,3 | 57,2 | 76,1 | 100,2 |

LiveChat chart, interval W1. Source: xNUMX XTB.

House Dvelopment

It is one of the largest residential developers in Poland. Dom Development operates on the Warsaw, Tri-City and Wrocław markets. In 2020, the company sold 3 apartments (+ 756% y / y). During the first 3 months of 9, Dom Development sold 2021 apartments (+ 2% y / y). In 972, the company sold over 13% of the apartments at a price in excess of PLN 2021 per apartment. For comparison, in 40 this percentage was 650%. The company was one of the beneficiaries of the boom on the Polish housing market. The current capitalization of the company is approximately PLN 000 billion.

| PLN million | 2017 | 2018 | 2019 | 2020 |

| revenues | 1 405 | 1 654 | 1 662 | 1 815 |

| operational profit | 235,4 | 282,0 | 320,7 | 386,3 |

| operating margin | 16,75% | 17,05% | 19,30% | 21,28% |

| net profit | 190,7 | 227,0 | 256,0 | 302,2 |

Dom Development company chart, interval W1. Source: xNUMX XTB.

Amica

It is one of the largest producers of household appliances in Europe. The company's offer includes, among others refrigerators, washing machines, dishwashers, ovens, microwave ovens and small household appliances. Amica generates most of its revenues on the markets of Western Europe. According to the report for the third quarter of 2021, 46% of revenues was sold to the west. The Polish market is responsible for approximately 24% of the group's revenues. The current capitalization of the company is approximately PLN 900 million.

| PLN million | 2017 | 2018 | 2019 | 2020 |

| revenues | 2 654 | 2 928 | 3 023 | 3 069 |

| operational profit | 143,5 | 152,0 | 167,2 | 200,5 |

| operating margin | 5,41% | 5,19% | 5,53% | 6,53% |

| net profit | 151,1 | 114,6 | 109,6 | 150,7 |

Amica company chart, interval W1. Source: xNUMX XTB.

Beta mWIG40 TR

For over two years, an individual investor has been able to acquire ETF units, which give exposure to the index of Polish medium-sized companies. The ETF started operating on July 31, 2019. The benchmark for the fund is WIG40 TR (Total Return). This means that the dividend collected from the index components is reinvested in the index again. It is a more tax-efficient solution because investors do not incur any additional capital gains tax on the dividend paid. The ETF replicates the index physically, which means that they physically purchase the stocks, do not engage in swap (synthetic) transactions. Beta mWIG40 TR management fee is 0,8% annually.

It is worth mentioning that the Polish ETF operates as a Portfolio Closed-End Investment Fund, which is listed on the stock exchange. The buyers of the certificates on the exchange do not pay any subscription fees. On the other hand, certificate holders do not pay a redemption fee if they sell their certificates through an exchange. According to the data published on the agiofunds.pl website, the assets under management amount to PLN 190 million.

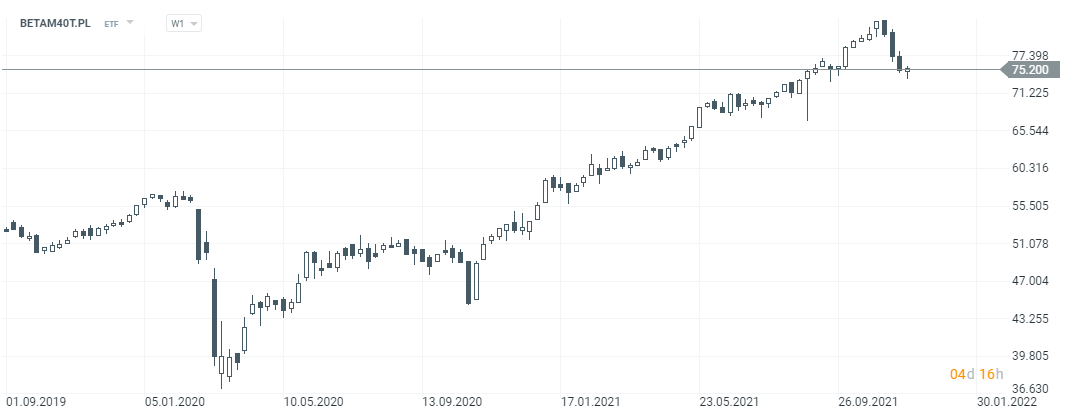

ETF Beta chart mWIG40 TR, interval W1. Source: xNUMX XTB.

Brokers offering stocks and ETFs

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

| Commission |

0% commission up to EUR 100 turnover / month | according to the price list |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Passive investing in the mWIG 40 index - it's easier than you think [Guide] mwig index 40](https://forexclub.pl/wp-content/uploads/2021/12/indeks-mwig-40.jpg?v=1638271626)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Passive investing in the mWIG 40 index - it's easier than you think [Guide] inflation in Poland November](https://forexclub.pl/wp-content/uploads/2021/11/inflacja-w-polsce-listopad-102x65.jpg?v=1638271097)

![Passive investing in the mWIG 40 index - it's easier than you think [Guide] oil becomes more expensive](https://forexclub.pl/wp-content/uploads/2020/04/ropa-naftowa-opec-102x65.png)