Pin bar - entry and exit techniques

There is no doubt that pin bar in various forms appears on the market extremely often. So since it is an inseparable part of the market and appears in such large quantities, why not use it to play interesting setups? One key question immediately arises: How to define the techniques of entering and exiting a position based on pin bars? In this article we will try to answer this question and present specific methods on the basis of which you can play candles of this type.

Entry Techniques

There are two main ways to enter the transaction after the pin bar. Both have their advantages as well as disadvantages and depend primarily on the trader and prevailing market conditions.

Technique # 1

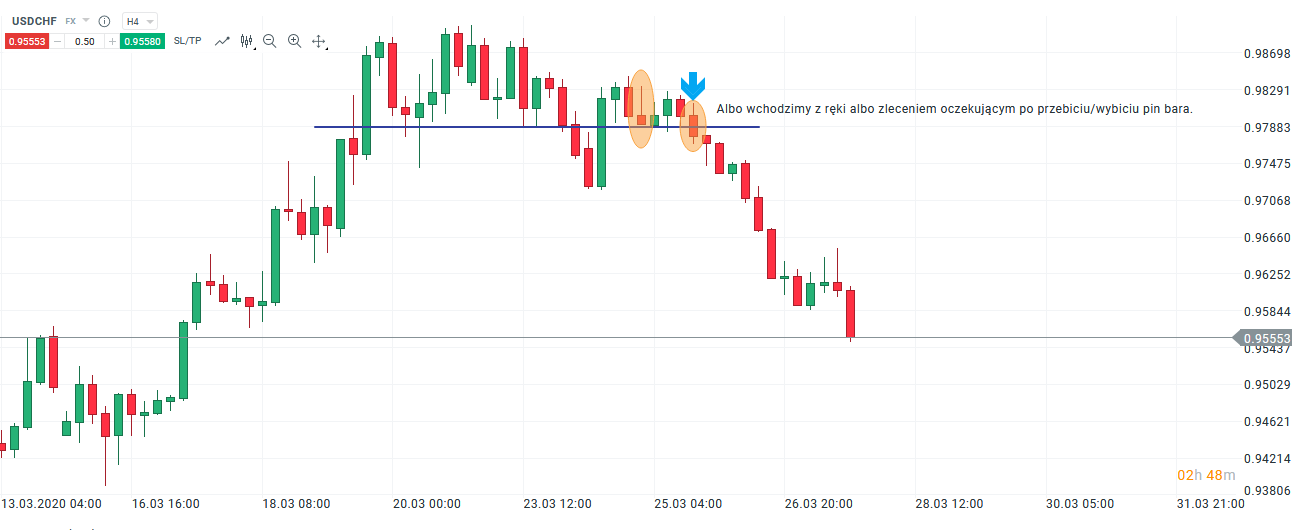

The first technique is called entry after breaking the pin bar extremes. Is the most widely used and conservative way to take position after the pin bar. It consists in placing a pending order, or opening a position from your hand, just behind its top or by analogy the hole. If we decide on a pending order, the distance at which we place the order should always depend on personal preferences and the given currency pair. In addition, it is always worth leaving some space in case the breakout is false.

Entrance after breaking the extreme. Chart USD / CHF, H4 interval. Source: xNUMX XTB xStation

Technique # 2

The second technique is to enter a 50% pin bar lift. It often allows for a favorable profit / risk ratio, which is why it is preferred by many traders. For a potential trade, e.g. 2R, using this entry method after the break you can potentially get 3R, or even more when entering a 50% retracement in exactly the same setup. If the method is used correctly, it can have a very positive effect on our trading in the long run. To get the pin bar entry level using the 50% retract rule, drag the Fibo Levels tool from the top of the wick to the lows of the candle. Likewise, if you're measuring a bullish pin bar, drag from the low to the high of the candle. When discussing this technique, it must also be said that it is not without flaws. While entering a 50% retracement can provide some really nice results, in some cases the market will unfortunately fail to clear 50% of the pattern range leaving orders unactivated. This means that if you find a setup and choose this entry strategy, there is a chance that your order will not be filled and you will colloquially speak out of the market.

Entry technique for 50% lifting of the pin bar. Chart EUR / GBP, H4 interval. Source: xNUMX XTB xStation

Exit techniques

It doesn't matter what technique we use. In the forex market, we should always have a specific plan for where to leave the position. Pin bar based transactions are no exception. Always remember to "Trade according to plan".

We can distinguish two basic ways of output:

- at a loss,

- for profit.

What I wrote is obvious, but it's worth focusing on other points. How to set stop loss? In fact, it can depend on whether the position will ultimately be profitable or lossy. So how do we plan the potential loss after pin bar setup? Here he may write another "banality" and obviousness, but this method works amazingly well in everyday trade. It is best to set the stop a certain distance above or below the wick of the candle.

Summation

When using pin bars in trading, always remember about:

- think of every transaction in terms of multiples of R: R,

- always try to keep a minimum profit to risk ratio of 2x,

- if possible, use a 50% lift entry strategy to maximize R: R,

- placing your foot remember to keep a proper distance from end of the candle wick,

- always take into account the potential loss before considering the potential profit (not only for pin bars),

- if you have a problem determining your take profit target, you can use local support and resistance as confirmation.

Be sure to read: Profit order, i.e. where and how to set up Take Profit

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Wyckoff's three laws on current charts - Mieczysław Siudek [Video] Wyckoff's three laws on current graphs](https://forexclub.pl/wp-content/uploads/2023/05/Trzy-prawa-Wyckoffa-na-aktualnych-wykresach-300x200.jpg?v=1684310083)

![Grzegorz Moscow - Ichimoku is not everything. On trader evolution and market analysis [Interview] gregory moscow ichimoku interview](https://forexclub.pl/wp-content/uploads/2022/12/grzegorz-moskwa-ichimoku-wywiad-300x200.jpg?v=1671102708)