Shares are still expensive after the turmoil in May

In this stock market analysis, we focus on May, which was a real rollercoaster - there was a sharp decline at the beginning, and then a rebound that resulted in MSCI World index for this month have not changed. As a result, equities are still priced dearly given financial conditions, so we remain defensive on equity. Among our thematic baskets, the best results were achieved by small giants from China, semiconductor manufacturers and the energy storage industry. We also discuss the recently published Salesforce Profit Report.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

The outlook for shares remains weak

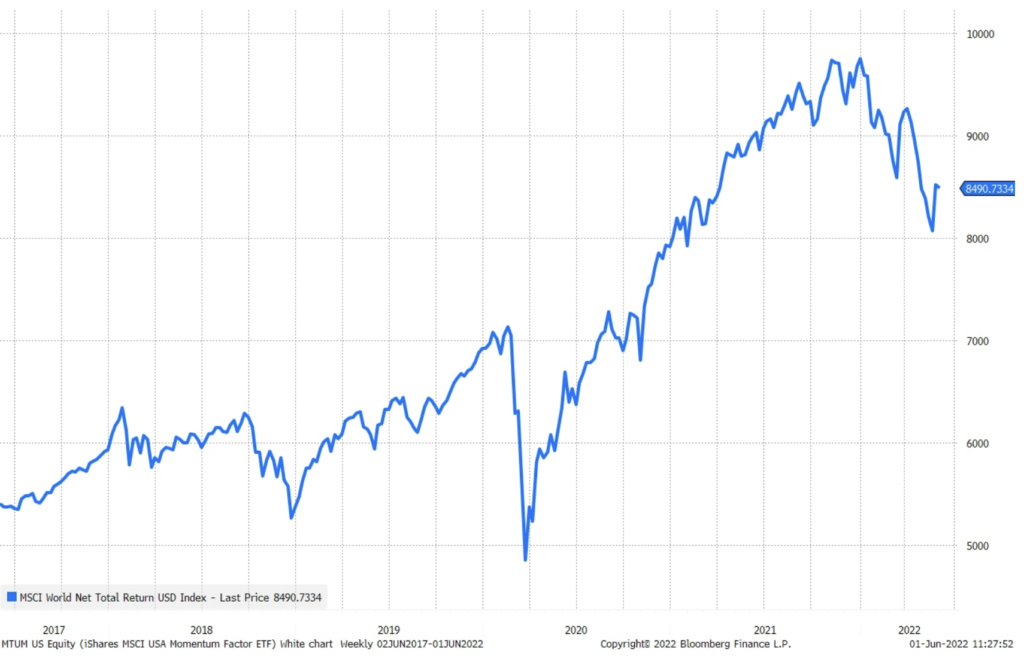

Global stocks as measured by the MSCI World Index Total Return USD index in May were unchanged after a 5,5% drop in the month as market sentiment shifted last week and there were signals on Friday that inflationary pressures may already have reached their value peak. However, Christopher Waller, representative of the Board of Governors FedHe started this week with the remark that he is ready to aggressively fight inflation, cutting interest rates by 50 basis points at each subsequent meeting until he sees signs of cooling inflation. Moreover, Holzmann z EBC he said yesterday that due to record core inflation in Europe it will be necessary to raise rates by as much as 50 basis points. In addition, the situation in the energy and food markets continues to deteriorate, increasing fears that inflation will persist.

In fact, nothing has changed and our take on equities remains negative with the expected tightening in financial conditions, rising interest rates, sustained inflation fueled by the deepening energy and food crisis, and potentially more lockdowns in China this year due to low vaccination coverage and zero Covid policy.

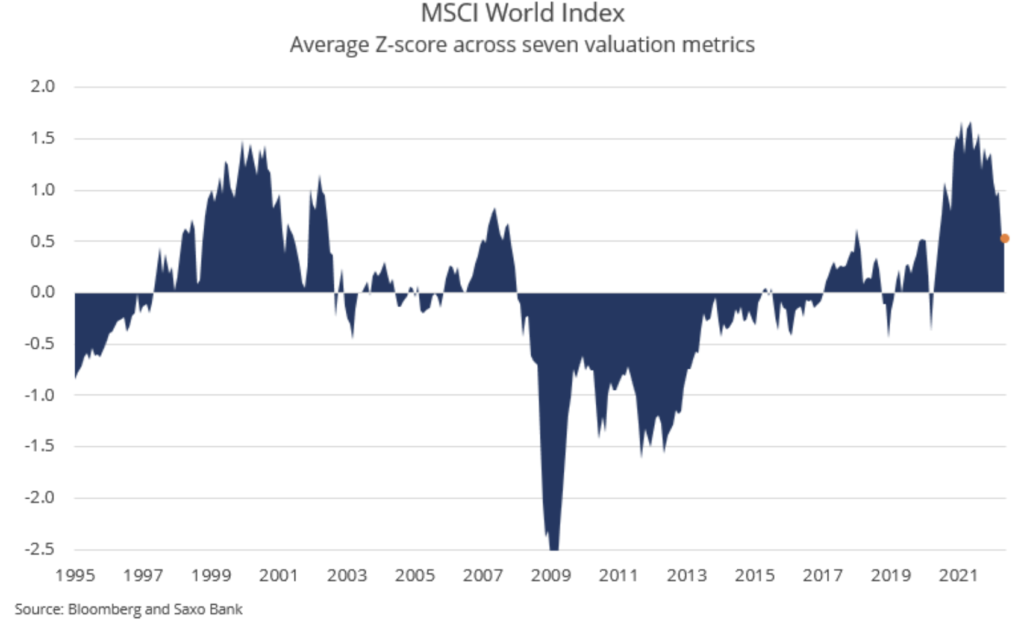

Our MSCI World valuation model is based on seven different valuation indicators that measure specific aspects such as revenues, profits, cash flow and dividends and continues to show that global equities are half the standard deviation above the average valuation since 1995. In our opinion, global equities they should be valued around the average, taking into account the current circumstances and the trajectory of financial conditions.

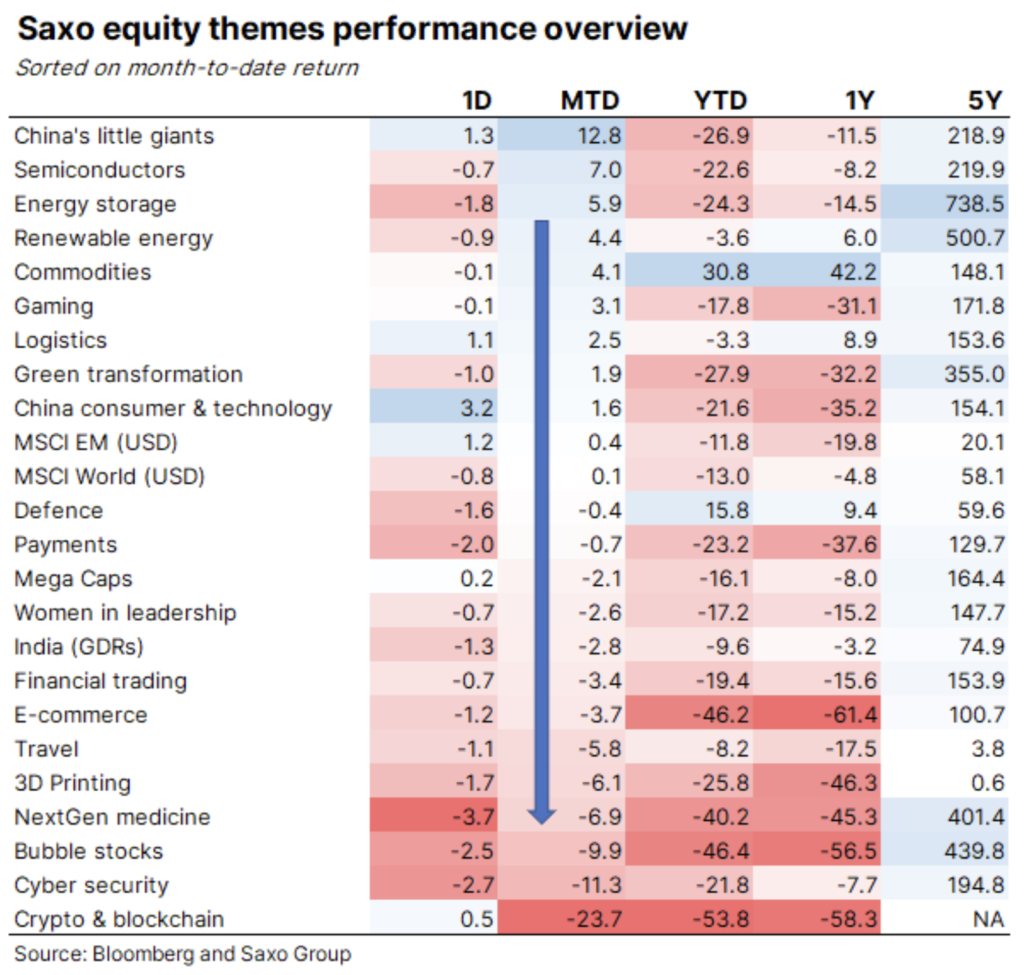

With regard to our thematic baskets, in May we observed a large discrepancy in results: the best results were achieved by small Chinese giants, semiconductor producers and the energy storage industry, which was the result of a direct policy of the Middle Kingdom to stimulate economic growth, as well as a continuous inflow of funds to the energy storage sector, which is crucial to the green transition. The weakest ones were the thematic baskets including "bubble actions", cybersecurity (one of our favorite long-term topics) and kryptowaluty i blockchain technology due to further compression of valuations of highly valued technology companies.

Salesforce's stock price response illustrates the current reward mechanism

Investors were delighted with the announcement of Salesforce profits, in which the forecast for revenues for the current fiscal year was slightly lowered, but at the same time the forecasted profits were slightly increased. The company's shares surged in OTC trading, highlighting a significant shift in the corporate reward mechanism over the past six months. Companies are no longer rewarded for lightning-fast revenue growth at any cost, but for cost discipline, higher return on invested capital and margin maintenance.

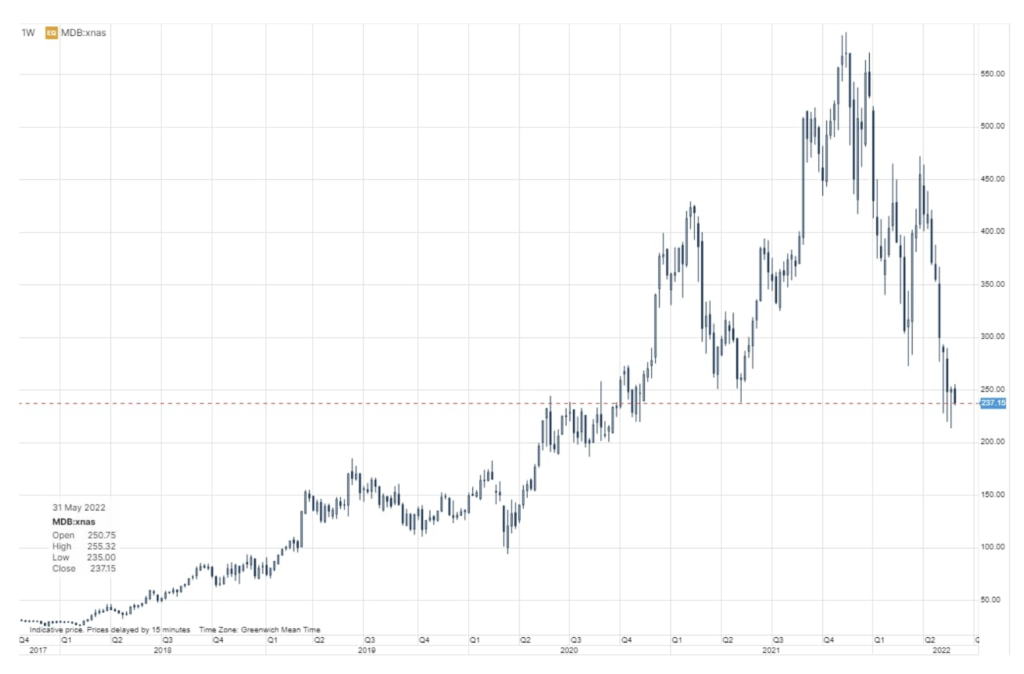

As we highlighted in yesterday podcast, the reaction to Salesforce profits provided an interesting prelude to the profit release MongoDB. This company has been in our thematic basket for over a year, the so-called "Bubble shares", and with a 13,1-month future value-for-sale ratio of 50x, despite a share price drop of more than XNUMX% from last November's peak, the company could face disappointment with margins and cash flow generation.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)